Andy Feng

NIO Inc. (NYSE:NIO), a Chinese electric-vehicle firm, is facing significant problems, which could worsen in 2022. Despite profiting from a delivery bounce in June, NIO is dealing with decreasing delivery growth prospects in China and may supply fewer electric-vehicles this year than last.

The Securities and Exchange Commission recently short-listed NIO as a potential de-listing contender.

Given the current macro background and growth constraints, I believe NIO is overvalued and that the company has a reasonable value of no more than $10.

Reasons For NIO’s Terrible Performance

As I mentioned in my previous post ‘NIO: Losing The EV Race – Part II‘, NIO’s growth has slowed significantly in 2022, and NIO’s second quarter delivery milestones haven’t helped matters.

NIO has underperformed in terms of both delivery growth and stock price performance in 2022. With increased hurdles in the electric-vehicle market such as increasing competition, suggestions to slash electric-vehicle subsidies in China by up to 30%, Covid-19 outbreaks, and supply-chain problems, NIO’s outlook for setting a new delivery record in 2022 has drastically deteriorated.

NIO’s output volumes dropped significantly in the first and second quarters due to supply-chain difficulties and Covid-19 outbreaks. As a result, NIO has underperformed both its electric-vehicle peers and market expectations.

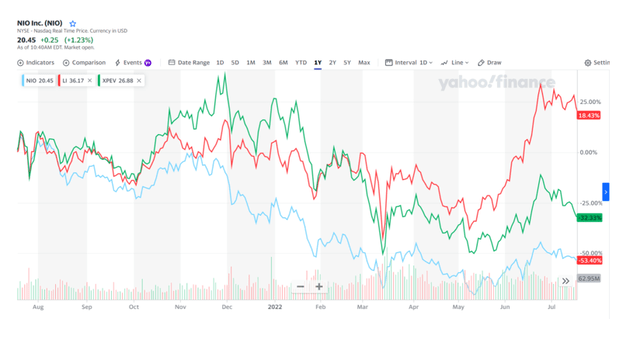

An investment in NIO made a year ago resulted in a valuation haircut of 53% of its value, while peers such as XPeng (XPEV) and Li (LI) fared far better. A year ago, for example, an investment in Li yielded 18%.

Share Price Comparison (Yahoo Finance)

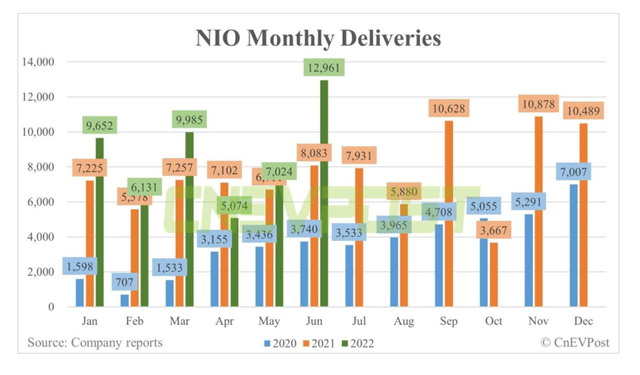

NIO delivered 5,074 and 7,024 electric-vehicles in April and May, respectively, while growth slowed to 5% YoY in May. In the same period last year, the growth rate was 95%, indicating a significant decrease.

Even if NIO’s growth accelerated in June, with deliveries of 12,961 electric-vehicles, the question is how sustainable this rate of development will be in the future.

NIO delivered 25,059 electric-vehicles in the three months ending June 2022, representing a pitiful 14% YoY growth rate. In the three months ending June 2021, NIO delivered about the same number of electric-vehicles, 21,896, while increasing deliveries by 111.9% YoY. The significant decrease in NIO’s growth rate from 111.9% to 14.4% indicates that last year’s optimistic growth forecasts were overstated.

The inference is that NIO’s delivery growth is falling short of forecasts, pointing to further difficulties for NIO’s stock. At the present delivery rate, NIO may be content with delivering 100,000 electric-vehicles in 2022, and there is a strong potential that NIO may fall short of exceeding its 2021 deliveries.

NIO delivered 91,429 electric-vehicles in 2021, representing a 109.1% increase YoY. All it takes for NIO to disappoint here is another surge in Covid infections and supply-chain issues to persist for a little longer.

Investors Still Ignoring De-Listing Risks

As if NIO’s slowing delivery growth wasn’t enough of a concern to justify the company’s value, the Securities and Exchange Commission named NIO in the second quarter as one of 80 firms that potentially risk de-listing of their ADR shares under the Holding Foreign Companies Accountable Act. As a result, NIO listed its Class A ordinary shares on the Singapore Stock Exchange.

Under the Holding Foreign Companies Accountable Act, the Securities and Exchange Commission can prohibit the trading of ADR shares of a company that has been audited, but whose working material cannot be audited by the Public Company Accounting Oversight Board. This issue appears to be mainly neglected by U.S. investors.

NIO’s Fair Value Is $10

Even with generosity, I struggle to see a fair value much greater than $10. China is slashing electric-vehicle subsidies, which might slow demand and dampen NIO’s delivery prospects in the future.

NIO’s current sales multiple is unsustainable in light of a significant slowdown in deliveries and sales, and the stock is overpriced in my opinion. Despite risk factors that fundamentally weaken trust in NIO’s capacity to continue its U.S. ADR de-listing and decreasing delivery prospects, investors value NIO’s electric-vehicle growth at 5.5 times sales.

If there is evidence that the supply-chain scenario will deteriorate more in 2022 or 2023, NIO’s valuation would fall again.

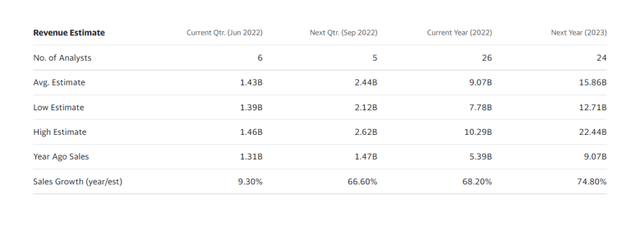

The market expects NIO to earn $15.9 billion in revenue next year. With a market capitalization of $35 billion, NIO has a sales multiple of 2.2x based on forward sales.

Considering that NIO is experiencing a significant slowdown in its operations, as well as production difficulties and supply-chain issues, NIO may just barely exceed 2021 deliveries.

At 2.2x revenue, I believe NIO is still significantly overvalued. Given that the corporation is dealing with so many various risks at the same time, paying 1.0-1.1x seems more appropriate. Based on a 1.1x sales multiple, NIO’s stock is worth closer to $10 than $20.

Why NIO Could See A Higher Valuation

Markets constantly revise their assessment of a company’s fundamental worth. And the prognosis for electric-vehicle companies can shift very fast, depending on what topic of the day makes the news.

NIO’s stock price has fluctuated from $11.67 – $47.38 in the previous year, and the stock will continue to be volatile. The investment thesis shifts if electric-vehicle manufacturers solve their production obstacles, which necessitates a supply-chain solution. An increase in NIO’s sales would also be a positive sign that the stock is about to exit its downtrend.

My Conclusion

Given the current market environment and decreasing growth, NIO’s prospects are expensive, and the company could face an even lower sales multiple, especially if investors begin to accept only a modest rise in deliveries relative to 2021.

The risks are far bigger than the market currently represents, implying that NIO’s stock might fall by 50%. Given the current risk-reward scenario, I don’t believe NIO has a higher fair value than $10.

Be the first to comment