BalkansCat/iStock Editorial via Getty Images

Performance Review

Nikon (OTCPK:NINOY) (OTCPK:NINOF) showed substantial improvement in profitability in terms of operating profits over the past fiscal year.

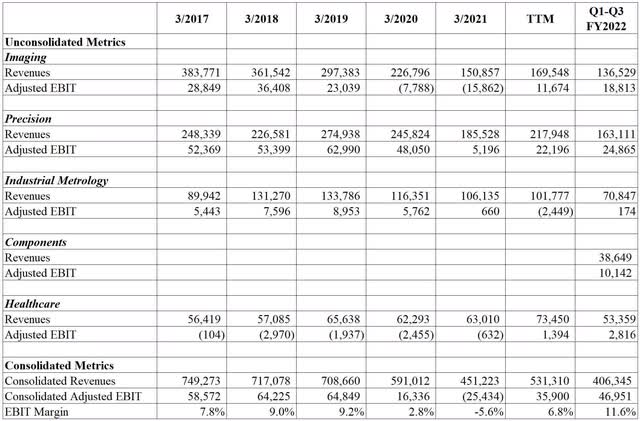

Table 1. Nikon‘s profitability (in millions of yen)

Source: Company‘s financial statements. Adjusted EBIT numbers add back restructuring and impairment losses.

Especially notable is Nikon‘s progress in restoring profitability of its underperforming imaging segment. While revenues plunged, Nikon was able to pull off a dramatic increase in profits. Although the trailing twelve-month, or TTM. period shows relative underperformance in absolute terms, the profitability that the imaging segment shows is very strong, especially for the Q1-Q3 FY 2022 period with close to 13.8% operating margin. This margin improvement was achieved partially thanks to restructuring and consolidation of manufacturing around Thailand.

Overall, the camera market is on a recovery category judging from the Japan CIPA numbers:

Table 2. Camera Market

Source: Japan CIPA. Units shipped in 1,000 units; shipment values are in ¥ millions; average unit prices are in ¥ thousands.

As I expected, the trend towards higher unit prices picked up, which is especially notable among the mirrorless category. Despite very low unit growth rate for mirrorless cameras, the average unit price shot up from ¥84.2 thousand in 2020 to ¥104.5 thousand in 2021, producing an all-time high sales figure. This reflects the fact that not only overall cameras are getting more expensive, but that professional photographers are increasingly the ones propping up the camera market.

Based on the value of sales in yen, Nikon‘s market share stood at 20.4% in the calendar year of 2021. This is a significant reduction since my last calculation of Nikon‘s market share of 25.4% for FY2020. This could be partially explained by an anticipated release of the new flagship camera Z9, but unfortunately to a very limited extent. This is so since Z9 camera is very expensive and appeals to a very small niche of professional photographers. Another reason for this drop can be explained by a lack of new releases of Z-series camera models that are relatively less expensive and would appeal to a wider audience. Or it could be that the industry dynamics are such that Nikon partially lost its competitiveness with the current camera/lenses lineup. For now, this 5% market share decrease is a worrisome trend for Nikon‘s imaging department despite strong improvement in its profitability.

FY 2021 was a very sluggish year for Nikon‘s precision business. Due to restrictions on business travel, it was very difficult to sell, install and service new lithography equipment, especially in China. However, as business travel restrictions are being gradually lifted, sales of flat panel display and semiconductor lithography equipment picked up. Overall, I continue considering precision business as the most promising for Nikon‘s value going forward.

In 2021, Nikon also separated and began disclosing the components business segment, which sells various opto-electronics and precision equipment technology related to semiconductors and robotics. In particular, this unit supplies many optical parts to manufacturers of automation equipment, such as industrial robots. Nikon rightfully views this segment as a strong growth area in the future, as it releases optics for other manufacturers.

As for the other segments, the healthcare business demonstrated positive operating profit for the TTM period for the first time since its inception, though for now its profitability remains relatively insignificant for the company‘s overall bottom line. At the same time, Nikon‘s industrial metrology and other segment‘s revenue decreased due to a separation of the components segment. Industrial metrology largely continues assisting the precision segment by generating almost half of its business from intersegment sales.

At the same time, Nikon continued amassing a large cash balance of ¥367.4 billion as of December 31, 2021, while the total debt stayed relatively flat at ¥144.2 billion.

What is Next for Nikon?

In the short- to medium-term, imaging and precision segments will continue playing a dominant role in Nikon‘s value. However, it is quite possible that going forward the components business will demonstrate strong growth due to a steady secular trend of automation in manufacturing worldwide.

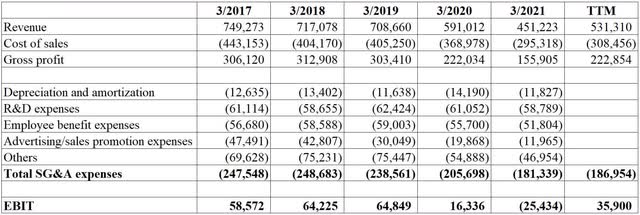

The imaging business is likely to be constrained this year or possibly even next year due to supply chain issues, as various electronic components that go into the production of lenses and cameras remain in short supply. Overall, it is not certain when and where the imaging market stabilizes and where Nikon will stand in terms of the market share. The recent recovery in the camera market‘s sales values is an encouraging sign, but it could reverse again on the downward trajectory, as more people continue switching to using their phones as cameras. At the same time, I find it worrisome that Nikon drastically cut its advertising and sales promotion expenses leading up to Covid-19. Likely, these expenses mostly go towards promoting the imaging segment products.

Table 3. Operating Profits (in millions of yen)

Source: Company

At some point, Nikon will need to up its game to promote new imaging products, which means that such low advertising expenses are below norm in historical comparison, even as a percent of revenues, either total or from the imaging segment.

While the precision segment is very likely to continue showing strong performance, there are certain idiosyncratic risks that can jeopardize future sales. First, there is build-up of chip manufacturing capacity among major chipmakers, which likely means that the current upcycle will last only so long. Second, as Robert Castellano noted in his article titled “3 Headwinds Facing ASML’s Non-EUV Business In China”, China is attempting to build its own lithography equipment. While it remains to be seen, successful development of lithography equipment by China can significantly undermine Nikon‘s precision business. Lastly, since 2021 there is growing pressure on the U.S. government to block the sales of ArF immersion lithography equipment, which are the most expensive machines that Nikon sells, especially to its Chinese customers. Because Nikon sources some of the critical components for ArF machines from U.S. companies, such sanctions will inevitably affect the company‘s precision sales to China. While this remains a tail risk, it should be considered as a possible adverse event.

Reflecting on a higher cash balance, improved profitability of the imaging segment, my valuation analysis shows that Nikon potentially has about 30% upside from the current stock price of ¥1,320. This valuation is based on similar assumptions I used for the initial investment in Nikon at my article titled “Nikon: Not Only A Camera Company With An Upside Of 50%+” with a few updates such as possibly a 3% higher operating margin for the imaging segment, updated cash and debt balances and updated Japan‘s government yield. If you continue holding Nikon‘s stock, please consider reducing your exposure.

If you bought Nikon stock at a price of ¥870 on July 8, 2020 when I wrote my initial article, you could have potentially earned a total return consisting of about 52% in capital appreciation and about 2% in dividends on a constant currency basis. Japanese yen depreciation would reduce this return by about 3%. If instead you bought Nikon‘s stock at a price of ¥659 on November 3, 2020 when my second article titled “Nikon: Why I Am Still Bullish Despite Gloomy Sentiment” came out, you would have earned a total capital appreciation return of 100% on a constant currency basis. Japanese yen depreciation would subtract about 5%-6% from your total return.

Personally, I recently sold my Nikon‘s position, as the margin of safety has been greatly reduced and I came across a much more attractive opportunity. If you are interested in learning more, please consider reading my top idea article on Yamato Holdings (OTCPK:YATRY) titled “Yamato Holdings: Diversify Your Portfolio With 50%-70% Upside From Dominant Japanese Logistics Company”.

Be the first to comment