Scharfsinn86

Nikola (NASDAQ:NKLA) may be about to enter a significant growth phase; they have an excellent product in the Nikola Tre Battery Electric Vehicle (BEV), a class 8 truck with 350 Miles of range and a 2-hour charge time. Nikola has completed phase 1 construction of their U.S. manufacturing site, giving them a capacity for 2,500 vehicles a year. A joint venture with IVECO will enable Nikola to manufacture and sell its trucks in Europe. Nikola is the first company to get its BEV class 8 truck into volume production and is guiding towards 300 truck deliveries this year. I expect revenue to reach $2 billion by 2025 and the share price to double. Nikola has a great product, an excellent business plan, and some great partners helping to build out its re-charging infrastructure. I rate Nikola a solid Buy and have taken the largest position my trading plan allows. I have been analyzing the companies trying to decarbonize heavy-duty trucking for some time; you can read my previous articles on Hyzon (HYZN) and Hyliion (HYLN), both of which I did not buy. I will continue this series of articles with more companies in the coming weeks

History: Fake it until you make it?

In 2020 I was caught off guard when Hindenburg Research released a short seller report calling Nikola an ‘intricate Fraud’; the video of a Nikola truck cruising along an interstate was just a truck rolling down a hill (it had me fooled). The shares took an immediate hit (before the release, they were at $90; currently, they are below $7), and my holding took a bath. It was the most significant single loss I suffered that year by a considerable margin.

Nikola did settle with the SEC in December 2021 without admitting or denying the charges they agreed to pay a penalty of $125 million. The founder and CEO from that time is currently the subject of criminal fraud charges and will go to trial later this year, several class action lawsuits continue and the U.S attorney’s office for New York continues to investigate the company. The legal proceedings from this time continue to rumble on and probably will for some time.

Having previously “faked” an electric truck video (by filming one rolling down a hill and publishing it on their website, plus saying it was fully functioning), Nikola has now made an electric truck, and the company may have turned the corner toward a profitable future.

Q1 2022, No Scandals, but a real business arrives

Q1 2022 was crucial for Nikola; they delivered the final 10 of the planned 40 pre-production BEV trucks used for demos, pilot programs, and R&D. They completed two more pilot programs, Univsar and TTSI, with other programs continuing.

On March 21st, Nikola began serial production of its trucks; the first production Nikola Tre BEV’s rolled off the production line in Coolidge, Arizona. Phase 1 of the development of the Coolidge site is now complete; it can build 2,500 trucks per year. Phase 2 of the site is under construction and will give a maximum capacity of 20,000 trucks per annum.

The first 11 trucks were delivered in April (these can go uphill and downhill). Even though revenue for these was not booked in the quarter, they reported a gross profit of $0.43. Gross profit for Q2 was -$29 (in millions)

The Business Strategy going forward

Nikola intends to manufacture both Battery and Fuel cell electric trucks in the U.S. and Europe. It has a plan to build the trucks and the fuelling infrastructure for both types of vehicles and has signed MOU with industry leaders to help make its vision a reality.

1. The Nikola Tre

Following on from the Nikola One and the Nikola Two, Nikola Tre is the production truck’s name and will be available with both fuel types. The Truck is built on the IVECO S-Way platform, the drive train, control, and infotainment systems are developed by Nikola and integrated into the chassis. In April 2020, Nikola and Iveco established a joint venture Nikola Iveco Europe GmbH which will manufacture the Nikola Tre in Ulm Germany. The port of Hamburg will take the first 25 trucks produced at this site. It is a 50/50 joint venture and covers the European and North American markets; the strength of this agreement is essential; unlike some of the other E.V. companies who buy components from suppliers or have an MOU, Nikola has a joint venture agreement with a major truck manufacturer. U.S. readers may not recognize the IVECO brand; they have 25,000 employees and operate in 160 countries with 5,000 service outlets and 2,000 sales outlets. IVECO has 27 production plants in 16 countries concentrated in Europe, China, Africa, and Latin America. In my view, the tie-up with IVECO being a complete joint venture significantly increases the chances of success for Nikola as it sidesteps many of the problems that other entrants will face in the marketplace. Nikola will gain de facto reliability and quality reputation.

As of April 30th Nikola reported 134 purchase orders for Nikola Tre’s in the U.S.

During Q2 Nikola produced 50 Nikola Tre BEVs and delivered 48 to dealers. In the Q2 conference call, they repeated guidance of 300- 500 Trucks for 2022 but suggested it will be at the lower end of this when questioned by analysts.

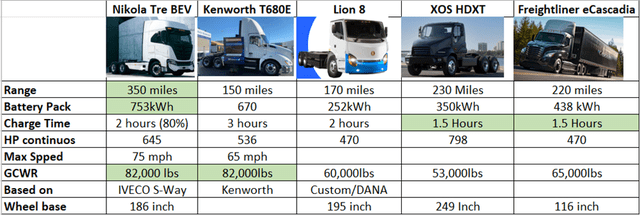

A comparison of the Tre BEV with some main competitors is below. The Nikola Truck is a very competitive package and is available for volume delivery, unlike any of its competitors. My trading strategy is all about looking at the company’s products compared to its competition. It is a good strategy and often gets me into the right company. See this research article highlighting Innoviz as the lidar company likely to make the best progress. (Innoviz jumped 54% last week but is still only halfway to my price target)

Electric truck comparison (author, info from company websites)

The Nikola Tre BEV has been approved for the $185,000 truck voucher in New York and the CARB zero emission incentive in California.

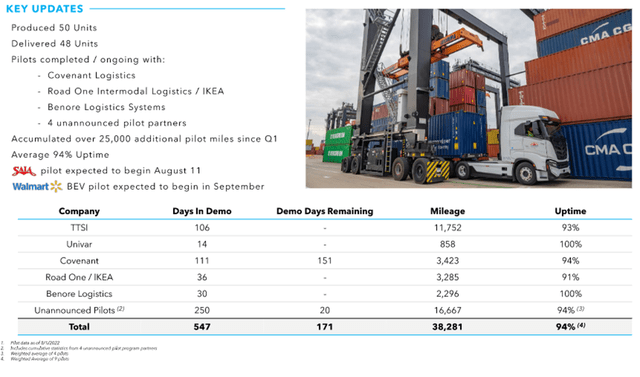

At the Q2 conference call, this graphic was shared,

Nikola Key updates (Q2 conference call)

94% uptime is outstanding, the number of demo days very impressive, and the companies testing these trucks have the potential to buy significant numbers of vehicles. The Nikola Tre is leading the field at the moment, it is showing excellent reliability over large numbers of miles, and to the best of my knowledge, it is the longest-range truck currently in serial production.

2. Nikola TRE FCEV

The Fuel Cell version is the same Truck with a Fuel Cell creating the electricity rather than re-charging batteries. The FCEV is not yet in serial production. However, in the Q2 earnings call, we heard that it had completed pilot testing with Anheuser-Busch (BUD) in California. Nikola plans to build 6 beta test trucks in 2022 and follow that with two batches of 5 and 8 trucks for beta testing during 2023. Serial production is planned for the end of 2023.

In 2020 Nikola signed an MOU with General Motors (GM). Nikola intended to integrate G.M.’s Hydrotec fuel cell into its trucks. This was a non-binding MOU and appeared to have been replaced in 2021 with an agreement with Bosch. The Bosch agreement is for fuel-cell components to be assembled into power modules by Nikola. The Bosch tie-up is a good one; they have an excellent reputation in the supply of power trains and a global presence, of course, they are a German company that fits very well with the IVECO joint venture and manufacturing site. Bosch has licensed much of its automotive fuel-cell technology from Powercell (PCELL) in Sweden and Ceres (CWR) in the UK. I have previously invested in both of these companies believing their technology to be superior.

Q2 updates included news that the Tre FCEV Alpha testing trucks have completed 3,800 miles and that Walmart (WMT) is expected to begin testing shortly.

3. The Nikola Energy Business

We are all aware that these zero-emission vehicles’ charging and refueling infrastructure is not yet in place. Nikola is developing a fuel supply business simultaneously with their trucks.

Pabloi Koziner is president of Nikola energy. In a recent press release, he said

Nikola plans to build a complete hydrogen ecosystem of production, distribution and dispensing and site-specific use case consultation on BEV charging solutions that will support zero-emissions commercial vehicles across the country,

The long-haul trucking industry is the target for fuel cell trucks, but there is minimal Hydrogen refueling infrastructure currently in place. Nikola has signed an MOU with T.C. energy (TRP) to develop “Hydrogen Hubs,” large-scale Hydrogen production sites throughout North America. T.C. energy is an energy company with 93,000KM of Natural gas pipeline delivering 25% of the natural gas used in North America. T.C. Energy has signed a similar MOU with Hyzon Motors I wrote about Hyzon recently. T.C energy has the scale to produce hydrogen and the pipelines to move it around the country.

Nikola has also signed an MOU with OPAL fuels. I will be writing about them in depth shortly. OPAL joined the Nasdaq in July via a SPAC deal merging with ArcLight (ACTD); the combined company is called OPAL Fuels inc (OPAL). OPAL operates fueling stations for renewable natural gas (RNG); they produce RNG by capturing methane at the source and build, own, and operate custom-designed RNG fueling stations for fleets. They currently have 350 fueling stations across the U.S. and fuel more than 5,000 class 8 trucks daily.

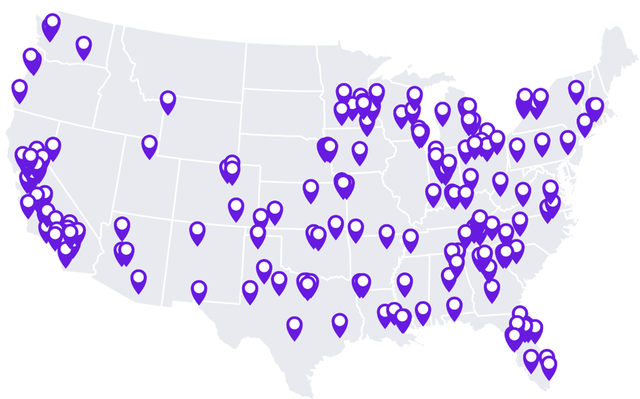

Opal refueling sites, (OPAL website)

This image shows the current fueling systems operated by OPAL and is taken from their website.

The agreement will concentrate initially on “behind the fence” refueling stations (owned by and available to specific fleets).

A third MOU signed in 2021 with TravelCemters of America (T.A.) to develop Hydrogen fueling at T.A. sites was confirmed recently with the location of the first site given as Ontario (California). The TA deal was to include two sites initially, this could be another great deal as T.A. are the largest operator of full service travel centers in the U.S.

The two agreements have the potential to provide a nationwide Hydrogen refueling operation and allow Nikola to offer the promised fleet leasing deal, which will include Trucks, Maintenance, and Hydrogen fuel supply

Q2 updates included news that Nikola has executed the definitive agreement with TravelCenters of America and that key equipment has been ordered. Land has been leased in California to build a new Hydrogen fueling station and a second lease is in negotiation at Long Beach.

Q2 2022 Nikola delivered another four Mobile Charging Trailers, these trailers accounted for the sales revenue of $1.9 million in Q1. The Mobile charging station is a temporary solution that fleets can use as they transition to more permanent charging infrastructure. It is simple to implement, does not require permits and will allow fleets to begin to move towards E.V. use without having to make the major capital investment required of permanent charging stations.

Nikola Financials

At the end of 2021 Nikola did not have enough cash to deliver on the business plan, the balance sheet can be summarized as follows.

|

Item |

Full Yr 2021 in $ Millions |

|

Cash and equivalents |

497 |

|

Current Liabilities |

181 |

|

Net Cash provided by Operations |

-307 |

During the Q2 conference call the CFO Kim Brady discussed the fact that $200 million had been raised through a private agreement and $50 million with a promissory note. A further $300 million is available in untouched credit lines. Mark said they now have enough cash for the next 12 months but will “opportunistically” raise capital as appropriate.

Just this month Nikola shareholders approved an increase in the outstanding share count from 600 million to 800 million. This had been a battle, they had to reconvene the shareholder’s meeting several times to get approval. The former CEO Trevor Milton was against the plan and he still owns a significant number of shares, Mr Milton’s legal fees are being paid by Nikola as he fights his criminal trials. The CFO said that these new shares will be used to raise capital when needed.

Nikola recently announced the acquisition of Romeo power, Nikola is Romeo’s largest customer, and the purchase gives Nikola control of its crucial battery pack supply chain. The takeover will be all stock and values Romeo at $144 million. In the Q2 call we learned that production had been halted for two weeks at the Nikola plant due to a shortage of product from Romeo and that Nikola engineers had been based at Romeo for some time providing support. Nikola has agreed to help with Romeo’s funding problems by agreeing on a temporary price increase and providing $20 million of cash. Nikola will provide guidance for the Romeo deal and how it impacts the balance sheet at the end of Q3.

Romeo lost $80 million in Q1 2022 on a turnover of $12 million; at the end of the quarter, it had $67 million of cash and equivalents on its balance sheet. Romeo was clearly in need of cash and needed to do the deal. Nikola said in the press announcement that the acquisition would bring about cost savings of $350 million over the next four years.

At the Q2 call Nikola guided the following:

Positive margin on the BEV end of 2023

Positive margin on the FCEV end of 2024

Positive EBITDA end of 2024.

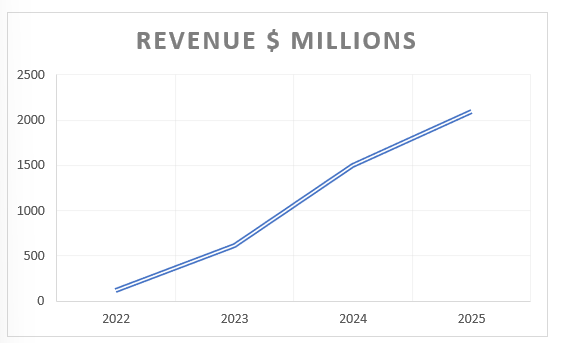

I believe that Nikola is entering a significant growth stage, perhaps the growth stage for this company that will become a major international supplier of heavy-duty trucks, and forecast the following revenue figures:

Forecast Revenue based on Company guidance (Author)

Conclusion

Having looked at several companies vying to provide Heavy Duty zero-emission Trucks, I have decided to invest in Nikola.

They are one of the first to market, have the longest range vehicle, a list of high-quality customers, a promising Joint venture with IVECO, and a burgeoning Hydrogen supply operation.

Nikola has developed a good truck and they can now manufacture it at scale, they have shored up their battery supply with the acquisition of Romeo and have strengthened their balance sheet somewhat.

These pre-profit companies are risky investments, and Nikola has the added problem of ongoing legal issues. I still think Nikola will need to raise more money and shareholder dilution will happen this year.

Be the first to comment