Justin Sullivan/Getty Images News

Main thesis

2022 was the second full year of Nike’s (NYSE:NKE) Direct Consumer Acceleration strategy. The company’s new policy is to reduce its presence among wholesale partners and focus on developing its own DTC sales. The company plans to achieve a unified and improved customer experience, which should ultimately materialize in the form of accelerated growth, increased efficiency, and responsiveness to customer needs.

Nike has made incredible strides in these two years, leveraging its strengths to deliver on its strategy.

Consumer Direct Acceleration

In 2020, Nike has taken a fresh look at its old Consumer Direct Offense strategy a fresh look and set new goals, while emphasizing the importance of better communication with customers. Nike has increased its focus on its own channels, which in the long run should strengthen the company’s brand and, as a result, consumer loyalty.

The transition to a new stage of the strategy was marked by a change in the CEO. Mark Parker gave way to John Donahoe, the former CEO of eBay (EBAY). The change in management highlighted the need to improve online channels as well as the physical store experience. This will unify and improve the shopping experience. For the most part, organizational and managerial changes aimed at increasing efficiency, which led to staff reductions, have been completed.

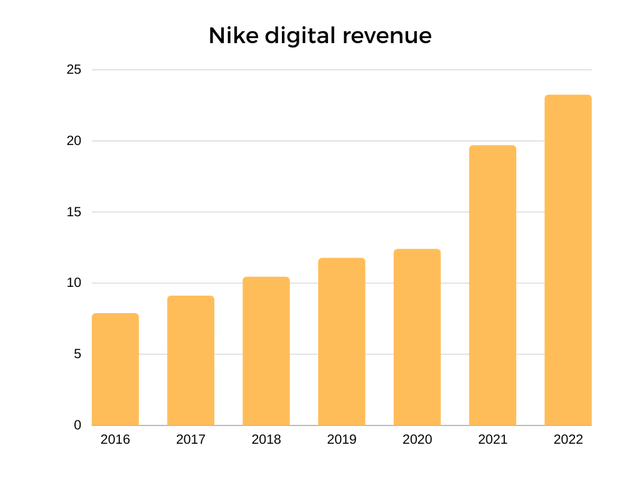

One of the key components of the strategy is to improve overall operational efficiency by investing in end-to-end digital transformation, investments in data analytics, demand forecasting, and inventory management. Nike has made several acquisitions in this area. In 2019, the company acquired Datalogue and Celect to improve raw data processing.

Switching focus to DTC

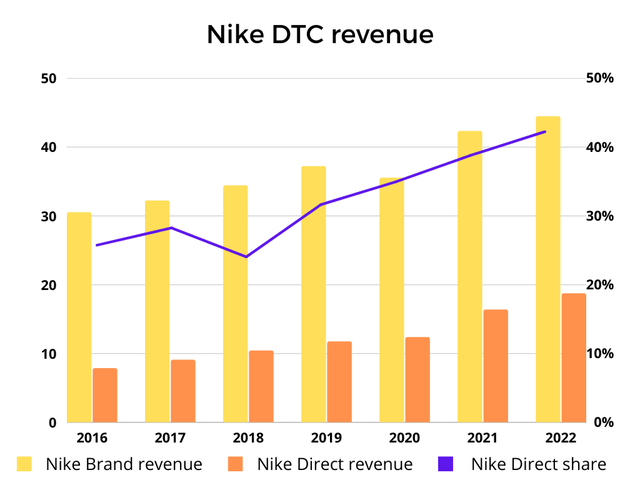

Consumer Direct Acceleration is fueled by the increase of Direct to Consumer sales. In just 5 years, the company reduced the number of wholesale partners by 50%. Nike has excluded retailers such as Macy’s (M), Urban Outfitters (URBN), DSW, Dillard’s (DDS), Zappos, and even Amazon (AMZN) from its list of long-term strategic partners. On the other hand, Nike has taken relationships with retailers like DICK’s Sporting Goods (DKS) to the next level. The ability to sell the company’s sneakers in stores with the same volume is now a privilege, not a right.

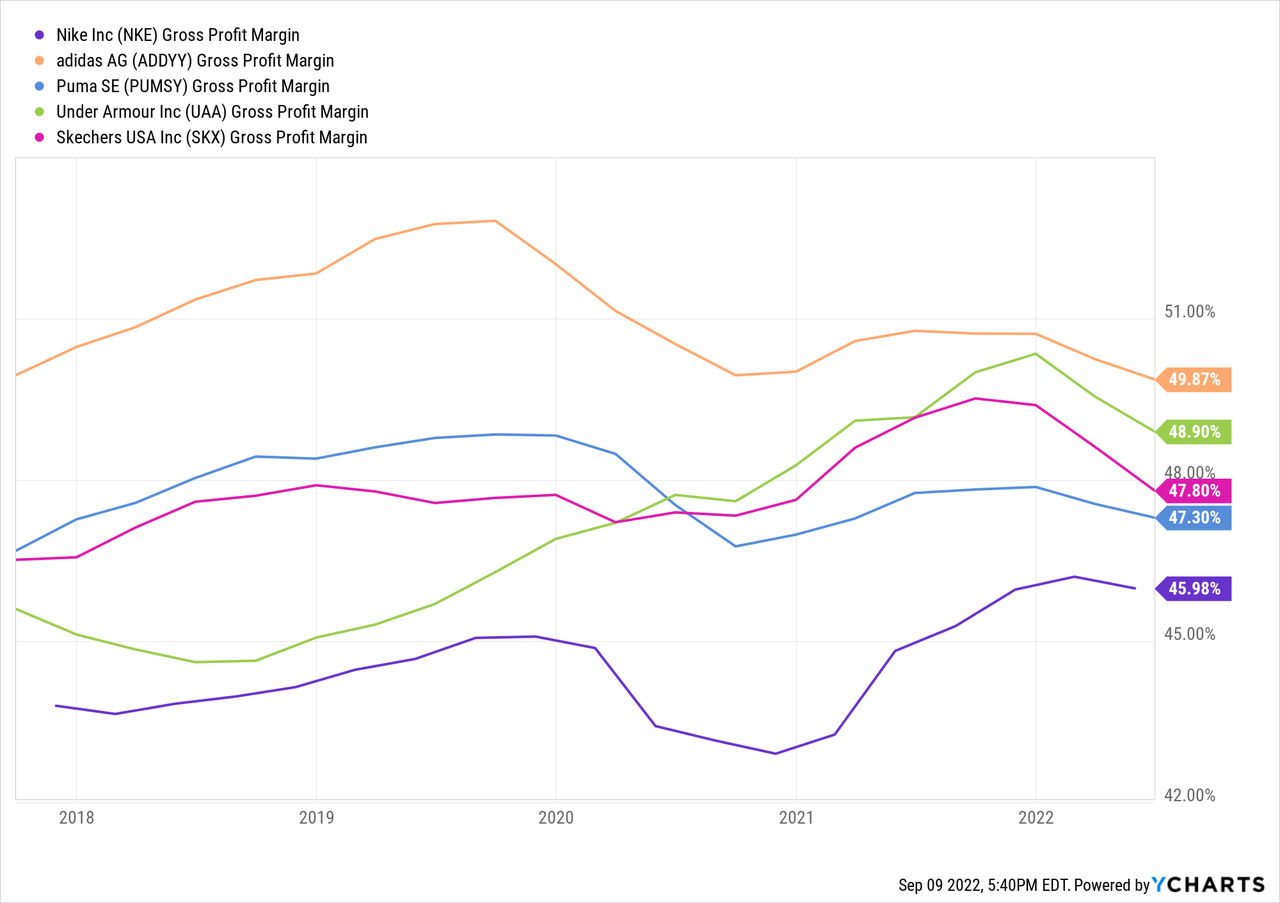

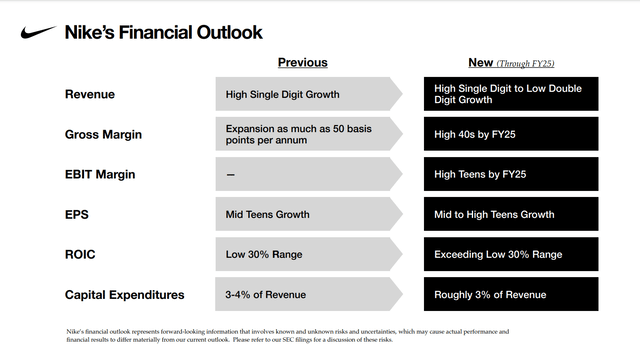

Thus, Nike Direct appears to be a more profitable business than the wholesale one as the company now has more pricing power. In 2018, Merriman estimated that the company’s DTC gross margin is 62% compared with 38% in wholesale. Given Nike’s current target of 60% direct sales by 2025, a high 40s gross margin goal is more than achievable. In this case, the gross margin will hit 52.4%.

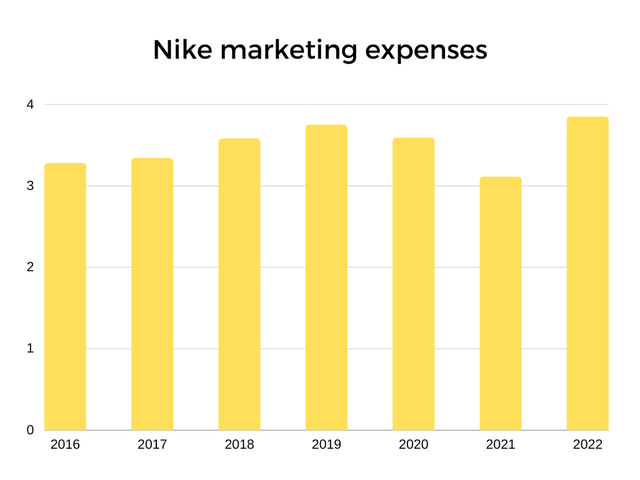

The company can cut wholesale partners so easily for one simple reason – demand remains incredibly high. Nike continues to increase marketing spendings which are now nearing $4 billion.

But the main hype is created not so much by skillful marketing or innovative developments, but by the strongest brand and the special value that sneakers have. Nike is the only true sports brand among the big players. Nike is about something; this brand is something sacred and inviolable with a long history of success. This allows the company to control the resale market by adjusting the supply of drops, creating even more value for the sneaker and the brand respectively. Not a single sports brand in the world has such an opportunity because demand is either not high enough or unstable. It is important to understand that this is not a fleeting success, like Yeezy, behind which there is only a personality, not a brand, but a real long-term trend.

A strong brand will help Nike continue to increase DTC sales at a rapid pace.

FY2022 results

At the end of June, Nike reported the full fiscal year 2022 results.

The company reported an increase in revenue and earnings per share of 5% and 6% YoY, respectively. The brand continues to focus on increasing the share of its own sales. Sales channel Nike Direct brought in $18.7 billion (+14% YoY) driven by the increase in digital sales. The share of direct sales in total revenue increased to 43% compared to 27.5% in 2016. The company continues to steal sales from retailers and lead shoppers to its own platforms Nike.com, the Nike app and SNKRS, and its offline stores.

The earnings call was full of optimism. The management spoke of being confident in its long-term strategy. For FY2023 the company expects low double-digits on a currency-neutral basis.

Nike reported strong results at a time of raging inflation, still-troubled supply chains, and a weakening economy due to the demand, which the company was able to boost with the Direct Consumer Acceleration strategy.

Valuation & margins

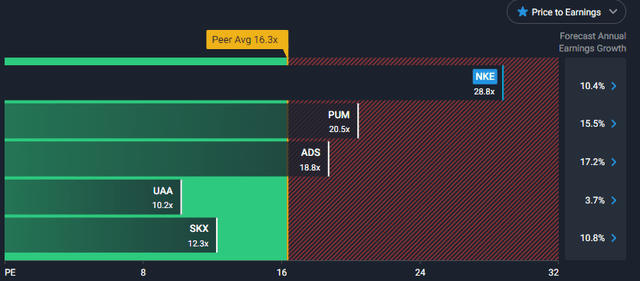

Nike’s gross margin is lower than its competitors. However, peers have greater numbers due to the higher share of apparel in total revenue or simply a smaller share in the global market as their production network is not as large and complex as that of large players.

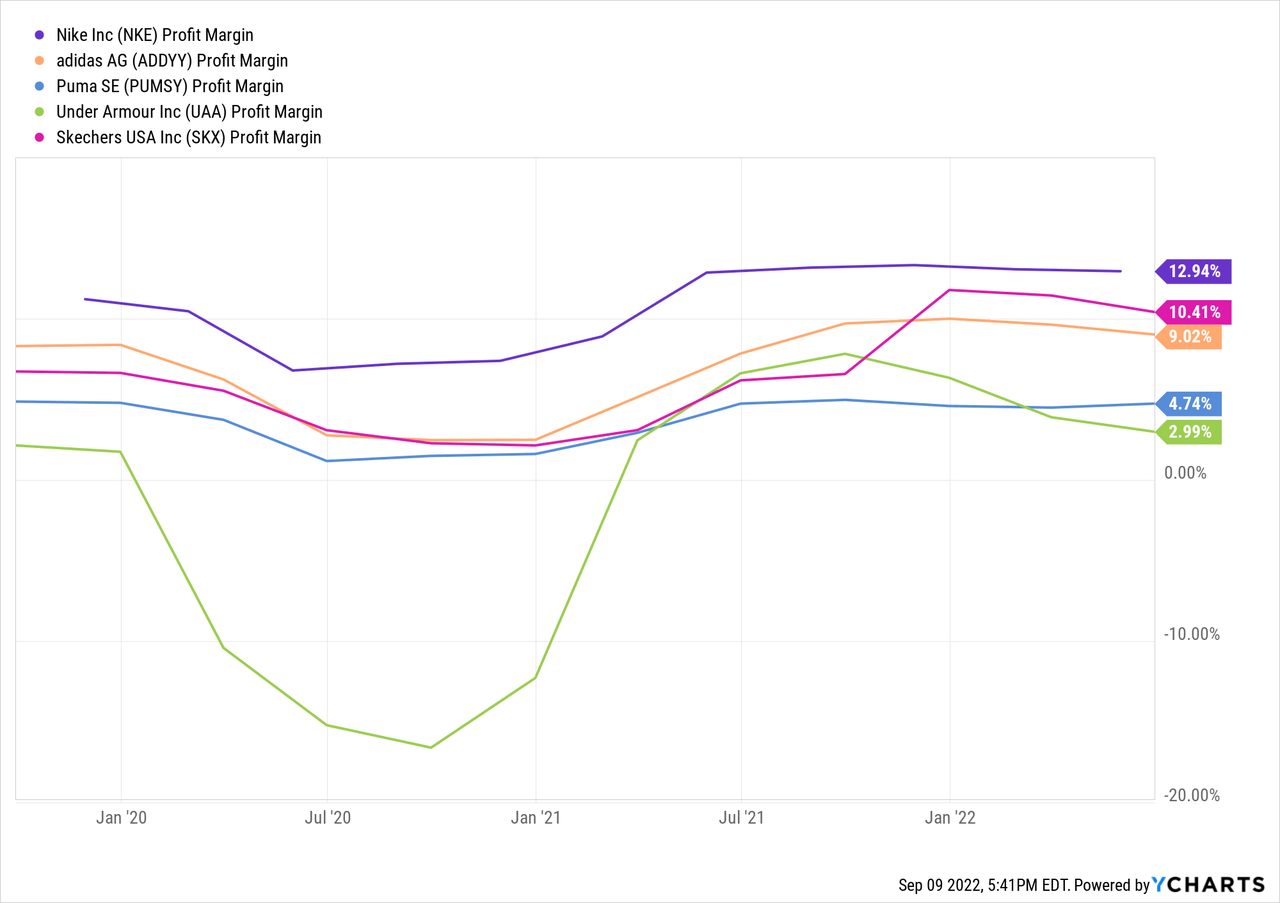

Nike’s advantage is much more visible when it comes to net profit margin. The company has a number of advantages over its competitors. Scale, strong branding, effective marketing, and developed online channels help sell products at a premium price. Thus, Nike’s profit margin is at an unbeatable 13%.

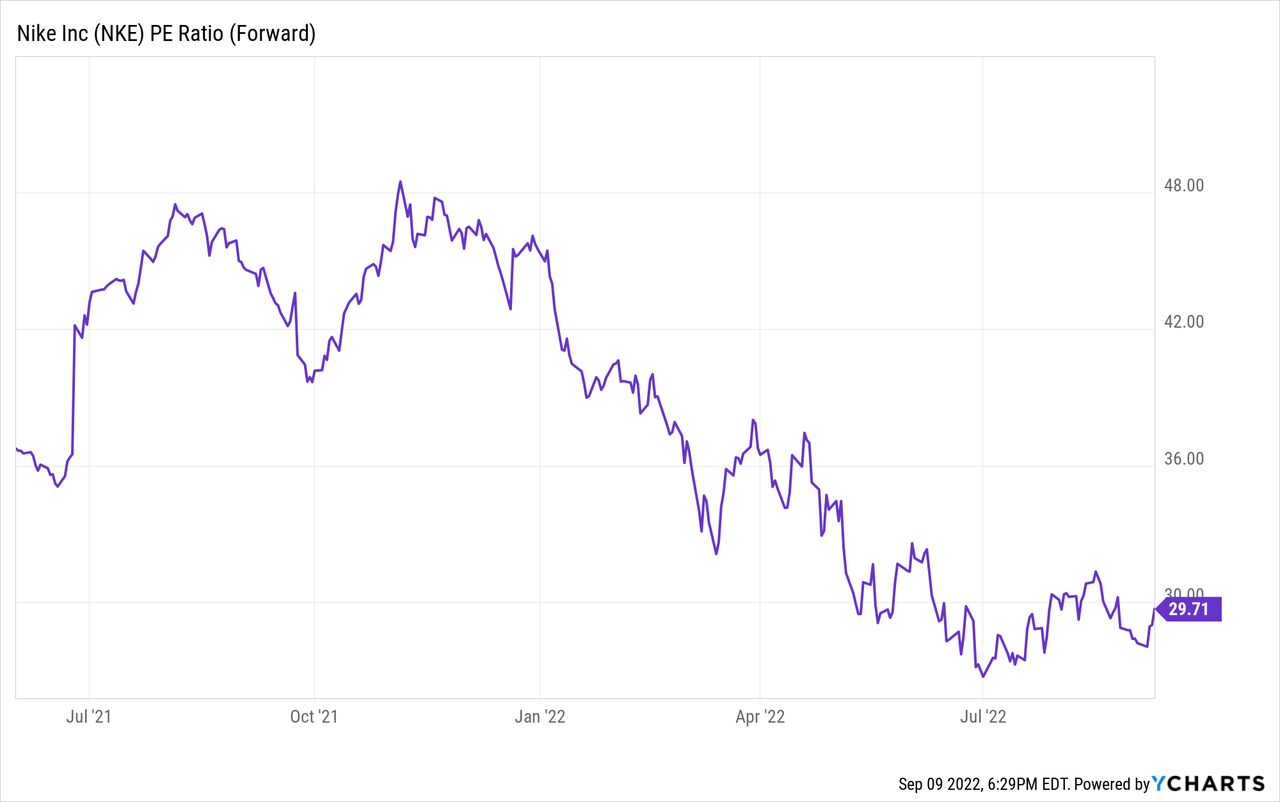

Thus, the company is traditionally valued at a premium to the sector.

Given the shift in focus to direct sales channels and the resulting rise in digital revenue, Nike should be treated more like an e-commerce stock.

Comparing Nike to other footwear companies is like comparing Apple (NASDAQ:AAPL) to other mobile phone makers. The giants are in a league of their own.

Thus, I don’t think Nike is overpriced right now. Competitors are too weak to do anything to such a giant, the company is shifting towards digital sales mainly through its own channels, which opens up the potential for margin growth.

Given the historical valuation, Nike generally looks underpriced. The average 4-year forward P/E ratio is 32.5x from 29.7x currently. The upside potential is about 10%.

Risks

Nike relies on third parties to manufacture its products. China and Vietnam each account for 36% of the total manufactured worldwide, while Indonesia accounts for 22%. In 2021, Nike manufacturer in Vietnam halted production due to coronavirus restrictions, resulting in the company losing three months of production, which continued to affect available merchandise. New disease outbreaks or other force majeure events like geopolitical tensions in countries that produce most of Nike’s products could negatively impact the company’s financial performance.

Second, a slowdown in global economic growth and a change in consumer activity may have a negative impact on wholesale and direct sales. High inflation could cause consumers to shift their budget to essentials and cut back on purchases of items like Nike sneakers. However, here the company has a certain protective barrier in the form of a brand, but the negative macroeconomic environment will clearly affect the company’s results.

Conclusions

Nike, entering a new phase in 2020, intends to accelerate direct sales and strengthen its position in the digital space. With a strong brand and scale, the company continues to bet on DTC, thereby increasing margins. The strategy is clear and fairly simple. The company wants to use a strong brand to drive customers to Nike’s own channels. Thus, the corporation intends to unify the shopping experience and make the brand even stronger.

The results of 2022 and the goals set for the future indicate that the company has chosen an effective approach in its Consumer Direct Acceleration strategy. The increase in DTC sales and the strengthening of the brand will be followed by an increase in gross margin and the company’s capitalization. I would rate Nike as a quality long-term Buy.

Be the first to comment