Editor’s note: Seeking Alpha is proud to welcome Mayank N. Sharma as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Robert Way/iStock Editorial via Getty Images

Investment Thesis

Nike (NYSE:NKE) is a global leader in the sports footwear and apparel industry with a strong brand image and high cash reserves to combat the economic headwinds. The increasing inflation, high cost of material and global supply chain difficulties pose a big challenge for Nike. While growth in the direct-to-consumer (DTC) segment provides an impetus to revenue growth, the wholesale channel is still a worry for the management. Celebrity collaborations and endorsements provide another dimension, helping the company create unbeatable brand value. Given the current valuation of the company and fundamental standing, I believe the company is fairly priced and I assign a Hold rating on the NKE stock.

About Nike

Nike is a multinational organization involved in the design, manufacture, and sales of footwear, apparel, and fitness equipment and accessories with its headquarters in Beaverton, Oregon. The company is a global leader in the athletic footwear and apparel industry. It serves men, women, and children with apparel, footwear, equipment, and accessories for sporting, casual wear, and recreational activities. Brand deals are one of the strategies of the firm to stay ahead of its competitors and maintain a strong brand image.

Nike’s Business Model and Strategies

Nike has two main channels of product sales: DTC and wholesale. Under the DTC route, the company sells its products through factory retail outlets and various online platforms including Amazon, whereas the digital store and the wholesale channel includes the company selling through distributor stores across the globe. The product categories break down as 60% footwear, 30% apparel, and 10% accessories and equipment. Nike primarily operates under 3 brand names: Nike, Jordan, and Converse. Nike’s geographical revenue distribution is 40% North America, 25% EMEA, 20% Greater China, and 15% APLA. The wholesale channel of the company accounts for 60% of the total sales and 40% is from DTC channel. Nike has expressed a keen interest in increasing its digital footprints from the current 26% to 40% by FY24.

Nike has managed to outperform its competitors by investing heavily in research & development and endorsements. Due to innovations, the company has managed to stand out vs. rivals like Adidas and Puma. Nike spent upwards of $2.2 billion in sponsorships in 2021, a whopping $450 million more than the next biggest spender Adidas and $1.2 billion more than Puma. These brand deals and endorsements are in the form of kit supply partnerships with teams from different sports and different leagues like NFL, NBA, Premier League, and also individual athlete endorsements.

Sports Kit Supply: Kit sponsorship accounts for over 80% of the brand’s total sponsorship spending. These kit supply deals help Nike to reach wide and diverse consumers having different tastes in sports. It provides kits to teams in the NFL, MLB, and NBA each of these deals is estimated to be over $120 million. Nike signed an 8-year deal with NFL to supply kit, the deal is estimated to be over $125 million each year, for the period 2020-2028.

Nike has a global approach toward sponsorships where it wants to reach mass markets across the world. What would be better than football to make that happen? Nike has kit supply deals with football giants like FC Barcelona, with the deal estimated to be worth $175 million per year, Chelsea, Tottenham Hotspur, PSG, and many more. All these sports kit supply deals are estimated to be worth $1.58 billion, helping the company maintain a dominant 38% market share and an unbeaten brand value over the past 5 years. I think the spending will increase in the coming years but the market share will remain stagnant given the strong competition from the local brand across different geographical markets.

Along with traditional sports, Nike is also venturing into the E-sports space, with a large number of youths being inspired, influenced, and affected it is a great move by Nike to explore E-sports. With a huge craze in the Asian markets, especially China and South Korea, Nike has signed apparel deals with E-sports leagues like League of legends with the 4-year deal estimated to be around $7.80 million.

Athlete Sponsorships: Nike is famous for its brand endorsements when it comes to individual athletes. One of the biggest examples of this is Nike’s brand deal with basketball player Michael Jordan, which led to the start of Brand Jordan under Nike. It has proved to be one of the most successful deals in the company’s history. In FY 2021, revenue from the Jordan brand was estimated at $4.7 billion.

Nike Investor Presentation 2021:Slide 19

To replicate the success that Nike has achieved with Jordan, it has signed lifetime agreements with basketball superstar LeBron James and football celebrity Cristiano Ronaldo with both contracts estimated to be around $1 billion. Apart from these athletes, there are many other players with whom Nike has signed endorsement deals. Nike is estimated to be spending $400 million on athlete endorsements. I believe this endorsement will not only help increase Nike’s sales but also improve and expand its digital reach. Athletes like Cristiano Ronaldo have over 500 million followers on Instagram, Facebook, and Twitter, enabling the company reach a global audience through social media. These proactive deals help Nike maintain its relevance amid changing fashion trends and adapt to them through consumer feedback and continuous research & development.

Online Campaigns: Nike has proven itself when it comes to marketing and using emotional campaigns to provoke consumer attention. Nike is proactive and bold in its stance on many social issues, a stance which helps the company to connect directly with the masses on an emotional level. For instance, during the Black Lives Matter movement, Nike openly came out in support of the victim and launched the campaign #UntillWeAllWin. Also, they pledged $40 million to contribute to the development of the black community in the United States. Such campaigns have psychological effects on consumers, leading them to build an emotional connect with the brand. Nike also launched the #PlayForTheWorld campaign to promote the fitness from the living room concept during COVID lockdowns. These types of campaigns will help increase consumer engagement even in the worst of situations. The company also enlists social media influencers to help reach its target audience.

These strategies have help Nike stand apart from its competitors and become a market leader in the sports apparel and footwear industry. Nike became the first and the only company to breach the $100 billion market cap, which now stands at $173.6 billion, while its closest competitor Adidas, at $32.65 billion, is nowhere close. Though these brand deals and endorsements help Nike to maintain its market share, they are a big expenditure for the firm; in the current economic slowdown, these expenditures can seriously affect its profitability.

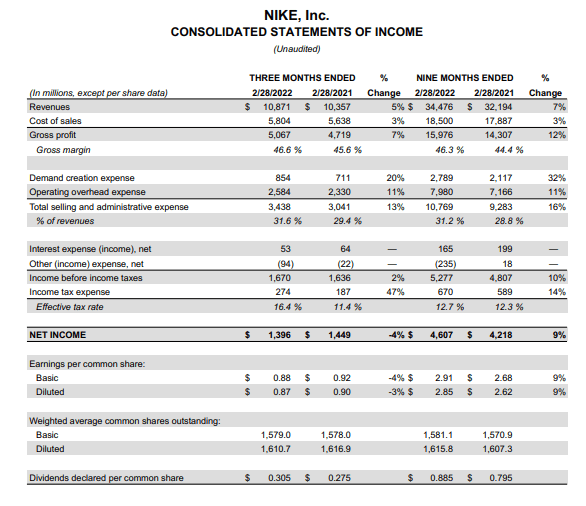

Nike Q3 2022 Financials

I am going to only mention about the current quarter in this article because we are already in the fourth quarter of the company and that’s why the annual data of FY2021 will be very old for the analysis. I will write another article once the company releases the annual data of FY2022. The company reported revenue of $10.87 billion for Q3 2022 (February), up 5% from Q3 2021, driven by a 13% revenue growth in the EMEA market. Gross profit stood at $5 billion, a 7% increase from the same quarter last year. The gross margin was a stellar 46.6% as compared to 45% in Q3 2021. The increase in the gross margins can be attributed to improved margins in Nike’s direct business and a rise in dollar prices but it was offset by the increased transportation and logistics costs. Selling and Administrative expenses were $3.4 billion, up 13% from Q3 2021. The main reason for the steep rise in operating expenses was the wage hike and higher spending on digital marketing. Net income stood at $1.4 billion, a 4% decline from Q3 2021 on the backdrop of higher operating expenses incurred in this quarter. The diluted EPS was $0.87, a 3% decline from $0.9 in Q3 2021.

Nike Investor Relations: Q3 2022 Press Release

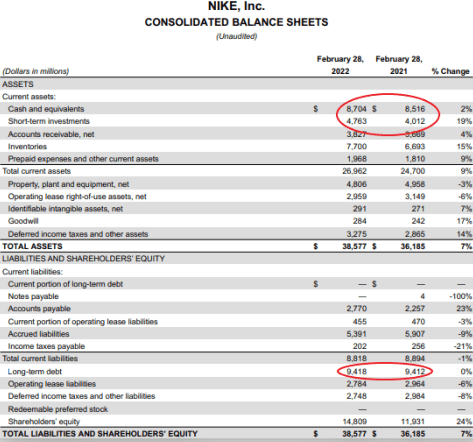

This was all about the income statement, now let’s analyze the balance sheet. The company reported cash and cash equivalent of $8.7 billion as of February 28, 2022, up 2% from last year. The short-term investments were valued at $4.7 billion, a 19% increase from last year. The liquidity of the firm looks quite stable with enough confidence and resources to tackle inflation pressure in the coming quarters. Nike reported long-term debt of $9.8 billion which everyone thinks to be a matter of concern that needs to be managed. But I believe that no one has to worry about this debt as the company has cash of $8.7 billion and $4.7 billion as short-term investments, implying a strong liquidity of $13.4 billion which is enough to manage the long-term debt of $9.8 billion.

Nike Investor Relations: Q3 2022 Press Release

Nike returned to its shareholders a total of $1.7 billion in the form of dividends and share repurchases. This year Nike completed 20 straight years of dividend payments, with $484 million paid out in Q3 2022, up 12% from last year. This works out to a dividend of $0.308 per common share. Nike also repurchased 8.1 million shares at a cost of $1.2 billion. The dividend payout has seen a drop after COVID-19 but an increase in QoQ terms indicates a positive sign for investors.

Inventory as of Feb 28, 2022, was $7.7 billion, up 15% from the prior year. The increase in inventory is due to a rise in the in-transit inventory due to supply chain difficulties leading to higher time in inventory turnout. With inventory expected to increase even further in the coming quarters, I believe it is a big task at hand for the company to deal with inventory management. Increased inventory leads to low inventory turnout which eventually results in narrow profit margins.

The steep rise in operating expenses and average revenue growth suggests that the future quarters will not see high growth rates, which aligns with my investment thesis of limited upside potential from the current price levels.

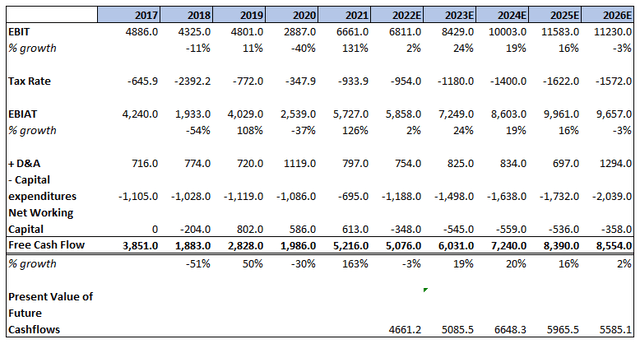

NKE Stock Valuation

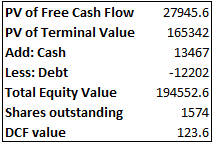

With my discounted cash flow analysis for 5 years, I have considered a perpetuity growth rate at a 5.4% CAGR for the next five years because I think the company will grow at a slower rate as strong brand value and multiple endorsement deal plans of the company are countered by rising inflation, supply chain issues, and the probability of recession. I have kept the WACC at 8.9%. After projecting the year-on-year growth of free cash flow at an average rate of 10.8% and discounting all cash flows and terminal value at 8.9%, the intrinsic value of stock comes out at $123.6 per share. Nike is currently trading at a share price of $111.14 and it has a market cap of $173.6 billion. It is trading at a P/E ratio of 29.08x. As per my analysis, the stock is fairly valued at the current price.

DCF Model by Author

DCF Model by Author

The intrinsic value of the company according to my DCF Model is $123.6, which is an 11.2% premium to the current market price. However, after considering the current economic scenario and all the risk factors, I believe the 11.2% upside doesn’t offset potential downside risks. That’s why I will recommend abstaining from making any new positions at current price levels.

Nike Vs. Competitors

Nike is a global market leader in the sports footwear and apparel industry. Nike has several global as well as local competitors across markets. Some of Nike’s global competitors are Adidas, Puma, New Balance, and Under Armour. Even with the competition in the industry, Nike has been able to capture a big chunk of the market by building a strong and reliable brand globally. Out of other players in the market, Adidas is the closest competitor to Nike. Nike reported an annual turnover of $44.5 billion in FY21, followed by Adidas with a turnover of $25 billion. Nike and Adidas can be considered two heavyweights in the industry with a market cap of $173.6 billion and $32.65 billion. Nike has managed to stay ahead of its competitors by investing heavily in design, campaigning, and research and development. This has enabled Nike to mark its products at a premium price to its competitors.

Nike is the market leader in North America with primary competition from Adidas and New Balance. In the EMEA market, Adidas has the lion’s share followed by Nike and Puma. In Greater China, Nike is at the top followed by Adidas and Anta. Nike has performed as per estimates in North American and EMEA markets but it is facing fierce competition in the Greater China market from local brands like Anta and Li Ning. However, Nike has plans to revive its pre-pandemic revenue growth rate with steep discounts in June for China’s second-largest online sales festival – 618 mid-year sales. However, these discounts could trim the profit margins for Nike.

In terms of valuation, Nike is very expensive, trading at a P/E of 29.08x as against the industry average of 17.6x. The reason for premium valuation is good management, high cash reserves, and a strong brand image. On the other hand, Adidas has a P/E ratio of 16.06x and Puma at 30.91x. Nike is trading at a premium of 13.02x P/E when compared to its biggest rival Adidas. Though the company has a better brand and reach than Adidas, the difference is significant. I believe Adidas has an attractive valuation as compared to Nike in the short term, but from a long-term perspective, Nike has the necessary resources to maintain its growth rate and market dominance.

Risks

Supply chain disruption: One of the biggest risks for Nike since COVID-19 has been the disruption of the supply chain. With the COVID curbs in China due to lockdowns and transit issues in Europe due to the Ukraine-Russia war, the supply chain has not been smooth. Increasing oil prices and labor costs have resulted in increased transportation costs which add to the problem. The disrupted supply chain has resulted in a pile-up of inventory for Nike which has impacted the profit margins. With inflation on the rise, the recovery seems slow and distant but the ease in COVID-19 restrictions in China and other Asian countries provides hope for smooth transit of goods. I believe if the company wants to maintain its profit margin growth, then it has to solve the supply chain issue on priority.

Inflation: Inflation is at an all-time high in most parts of the world and the United States is no exception. Inflation in the country has increased to a concerning level of 8.6% according to the May CPI data, which is a new 40-year high. The increase in oil prices has resulted in increased freight costs and has also led to a strain on household spending, as people are more cautious with their spending. Inflation has also resulted in a rise in the cost of materials, resulting in an increased cost of production. To revive the sales in Greater China, Nike is planning on providing steep discounts; these coupled with increased production costs will restrict the company’s profit margins.

Catalyst

Digital sales growth: Nike’s focus on digital sales is paying off as 26% of its total revenue is now being generated through e-commerce platforms. Nike intends to increase its digital sales share by upwards of 40% by the year 2024. After COVID-19, things have not been the same for retail businesses. No other sector was as adversely affected by COVID-19 as the companies are reliant on brick-and-mortar stores. Traditional retail businesses are exposed to the woes of high lessee payments and store management expenses. Nike has invested heavily in what they term as ‘Consumer Direct Acceleration’ strategy. Through this strategy, the company has managed to pivot from traditional retail and wholesale sales to more efficient digital sales. Digital sales in the US showed a 33% growth in Q3 2022 as compared to 8% of the total sales growth.

Nike has been heavily investing in technology to stay ahead of its competitors and connect more efficiently with the consumer. Nike CFO Matt Friend stated:

Consumers continue to shift toward digital to find the products they love, and NIKE’s digital experience continues to build deep consumer connections and capture digital market share… Over the past 4 years, we have reduced the number of wholesale accounts worldwide by more than 50% while delivering strong revenue growth through NIKE Direct and our remaining wholesale partners.

Nike has a competitive advantage over its peers in the digital space, with its digital platform and its presence being far superior in terms of technology and consumer engagement. I believe if Nike can continue its digital expansion as planned, it would help the firm improve gross margins to a great extent, resulting in better returns over the next 5 years. Nike’s competitive edge in the digital space is the main reason for me to recommend a Hold for the long term.

Conclusion

My final thoughts on Nike are that it has limited upside potential from the current price levels. I think a downside is probable from current price levels given the global economic situation and a possibility of a recession in the United States that many economists have been warning about. I assign a Hold rating on the NKE stock given the high P/E multiples, average revenue growth rate, and $123.6 per share valuation as per my DCF model, which indicates to me that the stock is fairly priced. Unless the economy takes a turn for the better and inflation is controlled, the upside for the stock appears to be capped. Supply chain disruption continues to put a stress on operating margins but with the easing of COVID-19 curbs in most countries, there is hope for recovery in coming quarters. There are better investment opportunities in the market both in terms of cheaper valuation and higher dividend payout. I would recommend to avoid making any new positions in Nike for now.

Be the first to comment