I have recently added NextEra Energy (NYSE:NEE) to my market-beating All-Equities SRG portfolio. The appeal of the stock begins at the sector level: the utilities space has historically been not much more than loosely correlated with the broad equities market (read: diversification), in great part due to the nature of the services provided and the recurring revenue model. Within the group of largest US-based utilities names, NextEra stands out as one of the best sector picks.

In this article, I will elaborate on the key reasons that led me to include the first utilities name among my “Storm-Resistant Growth” stocks.

Credit: Virginia Mercury

Steady results, strong balance sheet

NextEra is a renewables-heavy provider of energy services to households and businesses, with its large FPL (Florida Power and Light) division serving the Florida market. It is the most valuable company of its kind in the US, measured by market cap, and the largest in the world in energy output from solar and wind.

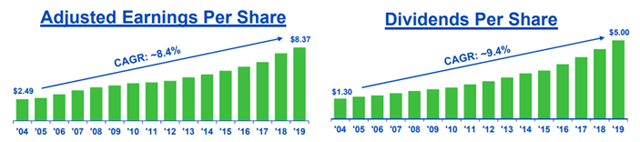

When it comes to assessing the appeal of an investment in NEE, it may help to start from the end. In my opinion, predictability and stability are a couple of characteristics that I value in picking a stock within a sector that is supposed to bring better balance to a generally risky equities portfolio. With this in mind, see charts below.

Source: company’s presentation

When it comes to consistency, it does not get much better than this. NextEra has produced very steady adjusted earnings that have grown at a rate of just over 8% per year since 2004. The rise over time has allowed dividend payments to also increase consistently at a slightly faster pace. As of February 2020 (although we all know that the world has turned upside down since then), NextEra expected the earnings and dividend growth cadence to resume intact through 2023.

At play here is likely the “sticky” nature of the customer base, a feature that I deeply appreciate and pay close attention to when making decisions for my Storm-Resistant Growth portfolio. Bluntly speaking, Florida residents (nearly 90% of FPL’s customers are households) are “not going anywhere”. In fact, the number of residential customers has been increasing consistently at a 1.5% pace over the past several years – the number is slightly better, at nearly 2%, in the commercial vertical.

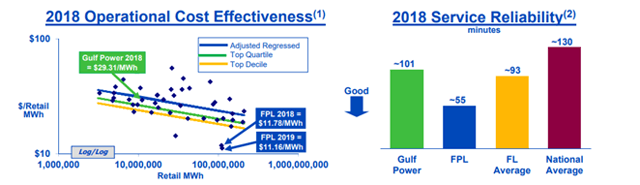

But another likely contributor to NextEra’s consistent bottom-line performance is the company’s efforts to gradually improve operational cost effectiveness. Today, NextEra leads the peer group in all of the following metrics: gross margin, EBITDA margin, return on assets, and income per employee. Part of the profitability gains have been driven by previous investments in storm hardening and smart grid. Now, with the fairly recent acquisition of the less efficient Gulf Power, opportunities for further improvement exist.

See charts below.

Source: company’s presentation

Also worth noting, about 40% of NextEra’s earnings ex-Corporate come from the much more geographically diversified Energy Resources segment. This is the primarily wind (but also solar, nuclear and gas) portfolio of projects deployed across more than 30 US states and Canada. While the division’s financial performance can be more heavily impacted by factors like natural gas prices and local market conditions, Energy Resources can also serve as a diversification source for the company’s results.

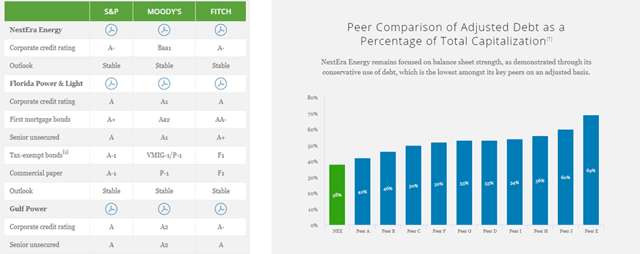

Lastly, it is comforting to know that NextEra seems to be in good financial footing. The table below on the left shows the company’s investment-grade credit quality. On the right, the graph depicts NextEra’s position as the least leveraged among its key peers. The low levels of debt, coupled with bond rates that are lower than industry average, suggest that NextEra’s bottom line should not be as sensitive to its interest obligations.

Source: company’s investor relations page

Final take

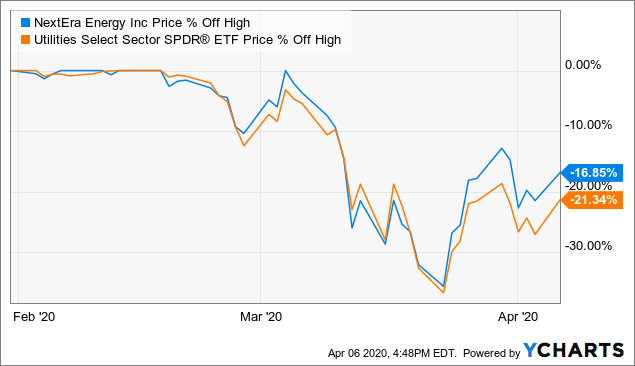

I do not necessarily have a short-term view on NEE, nor do I have convictions that the stock is priced below what I perceive to be its intrinsic value today. Sure, it helps that shares have come off 16% from the all-time high of early March 2020. But my interest in this stock can be much better explained by the diversification characteristics of the utilities space, which I believe should become better appreciated once the market-wide selloff subsides and correlations return to a more normal state.

Data by YCharts

Data by YCharts

As a long-term hold, I think NEE is a buy, even though a trailing P/E of 30x and a fairly low dividend yield of just above 2% may suggest aggressive valuation. In my view, the rich share price merely reflects the benefits of investing in a high-quality, cycle-agnostic company amid an environment of low economic growth and rock-bottom interest rates.

I use an approach that favors predictability of financial results and broad diversification when choosing stocks for my All-Equities Storm-Resistant Growth portfolio. So far, the small $229/year investment to become a member of the SRG community has lavishly paid off, as the chart below depicts. I invite you to click here and take advantage of the 14-day free trial today.

Disclosure: I am/we are long NEE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment