Khosrork/iStock via Getty Images

NewMarket Corporation (NYSE:NYSE:NEU) noted in a recent document that management intends to offer 10% compounded return per year for shareholders. The company is also working on its margins, and recent quarterly figures already showed improvements. In my view, further investments in research and development would likely lead to new innovative products. Even considering the risks from inflation and potential disasters, I believe that NewMarket Corporation stock is cheap at its current valuation.

NEU

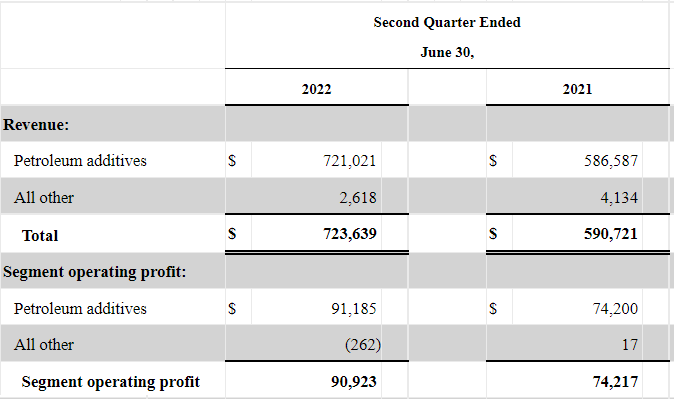

NEU primarily sells petroleum additives along with antiknock compounds, and offers contract manufacturing and services. Petroleum additives represented close to $721 million in revenue in the quarter ended June 30, 2022.

10-Q

Considering the recent commentary from management, I believe that it is a beneficial moment to review NEU’s financial statements. The company appears to make a lot of efforts to recover margins. Even if market participants haven’t recognized the efforts yet, sooner or later I would expect margin improvements. The following words are what seemed most important from the recent quarterly release:

Margin recovery and cost control will remain priorities throughout 2022 so that we can return to our historical profit margin range. In addition, worldwide supply chain disruptions continue to negatively impact our business. Source: Press Release

Let’s also note that NEU already noted significant improvement in its financial figures. Management saw a significant increase in lubricant additives’ shipments. If we take into account that NEU promised 10% returns y/y for shareholders, I believe that NEU’s numbers will most likely trend north:

The drivers for this increase were similar to those affecting the quarterly comparison of operating profit. Shipments increased 2.5% between periods, with increases in lubricant additives shipments partially offset by decreases in fuel additives shipments. Source: Press Release

Our stated goal is to provide a 10% compounded return per year for our shareholders over any five-year period, although we may not necessarily achieve a 10% return each year. Source: 10-Q

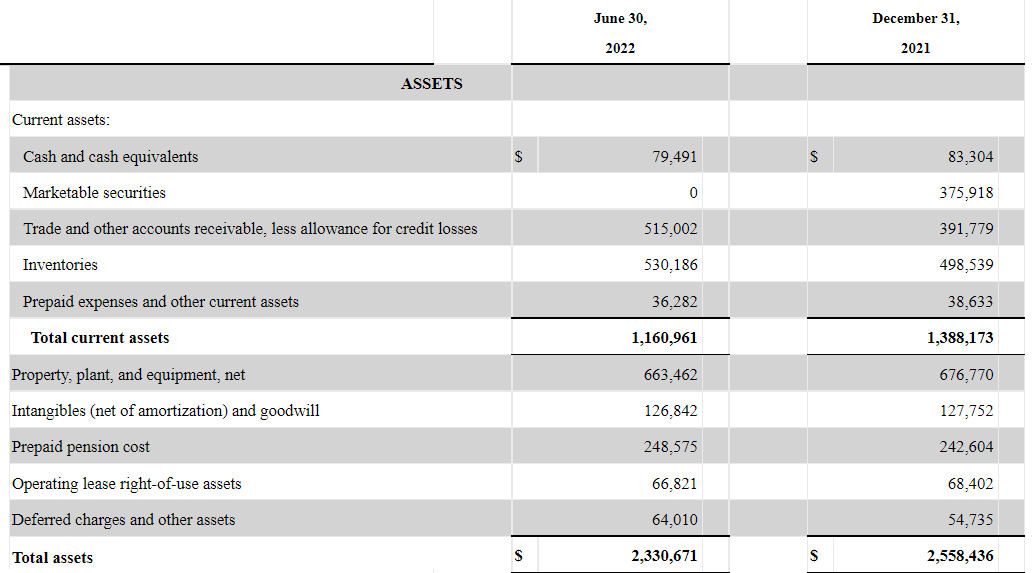

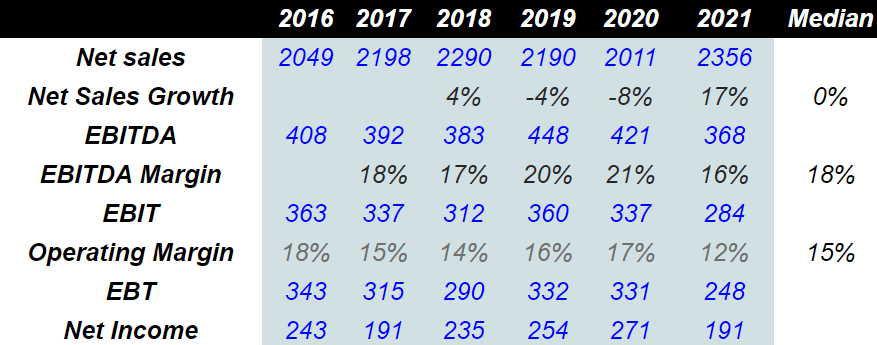

Balance Sheet

As of June 30, 2022, NEU reported $79 million in cash, $2.3 billion in total assets, and $1.6 billion in total liabilities. Thus, I believe that the balance sheet appears in good shape.

10-Q

NEU’s long-term debt may not be appreciated by every investor. Long-term debt stands at $911 million. I am assuming 2023 EBITDA of more than $501 million, so I don’t believe that the total amount of debt is that worrying. If the EBITDA margins continue to remain elevated, and NEU reports sales growth, the amount of leverage appears reasonable.

10-Q

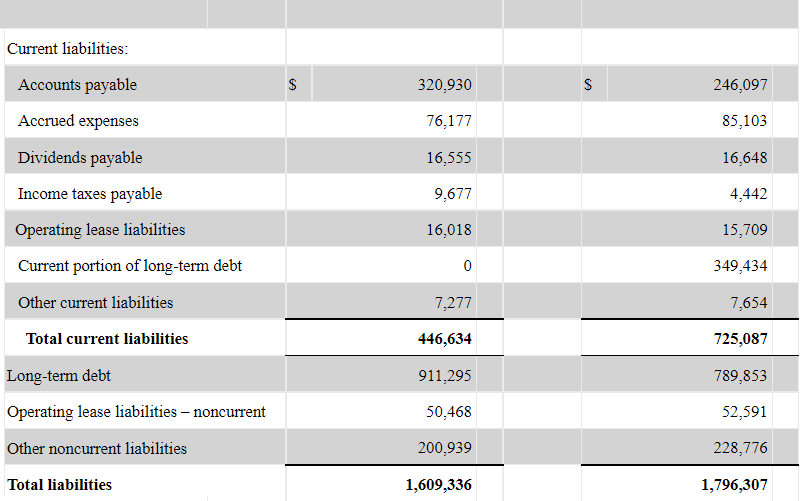

Stable EBITDA Margin And FCF Margin Look Quite Attractive

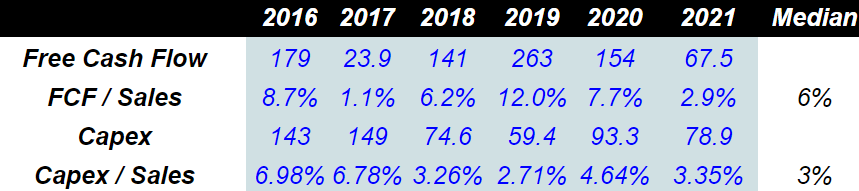

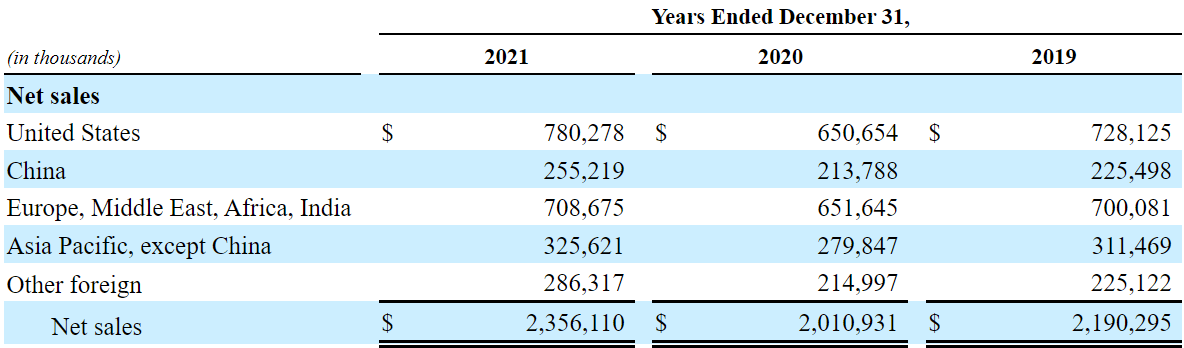

I reviewed some of the figures delivered in the past. My numbers are not far from them. The median sales growth from 2018 to 2021 was close to 0.4%-1%. The median EBITDA margin stands at close to 15%, and net income, from 2016 to 2021, was positive.

Source: Marketscreener.com

Finally, the median FCF/Sales was close to 6%, and FCF was close to $67-$179 million. The company doesn’t invest that amount of dollars in capex. The capex/sales margin was close to 3%.

Source: Marketscreener.com

My Base Case Scenario Implied A Valuation Of $321 Per Share

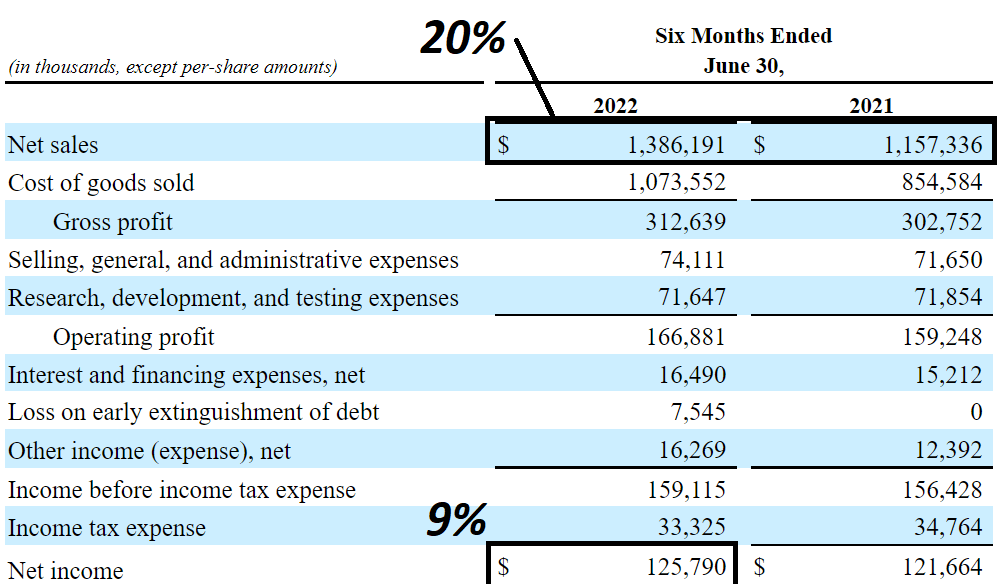

In the six months ended June 30, 2022, net sales were equal to $1.38 billion, showing close to 19%-20% increase as compared to the same period in 2021. The net income was equal to $125 million, which is close to 9% of the total amount of revenue. These numbers are much better than those reported in the past. In this scenario, my numbers are not as good as in 2022, but I tried to depict an optimistic case scenario.

10-Q

Under this case scenario, the oil price would remain relatively stable at the current value. Besides, technology-driven product offerings and further enhancement of the supply chain capability will likely help NEU. The company shared some part of its long-term vision in the last quarterly report:

We believe the fundamentals of how we run our business – a long-term view, safety-first culture, customer-focused solutions, technology-driven product offerings, and world-class supply chain capability – will continue to be beneficial for all of our stakeholders over the long term. Source: 10-Q

Finally, considering the total number of employees working in research and development, I believe that we could expect new formulations. In my view, if there is demand for the new products, revenue growth will likely trend north:

With over 500 employees in research, development, and testing, Afton is dedicated to developing additive formulations that are tailored to our customers’ and the end-users’ specific needs. Source: 10-Q

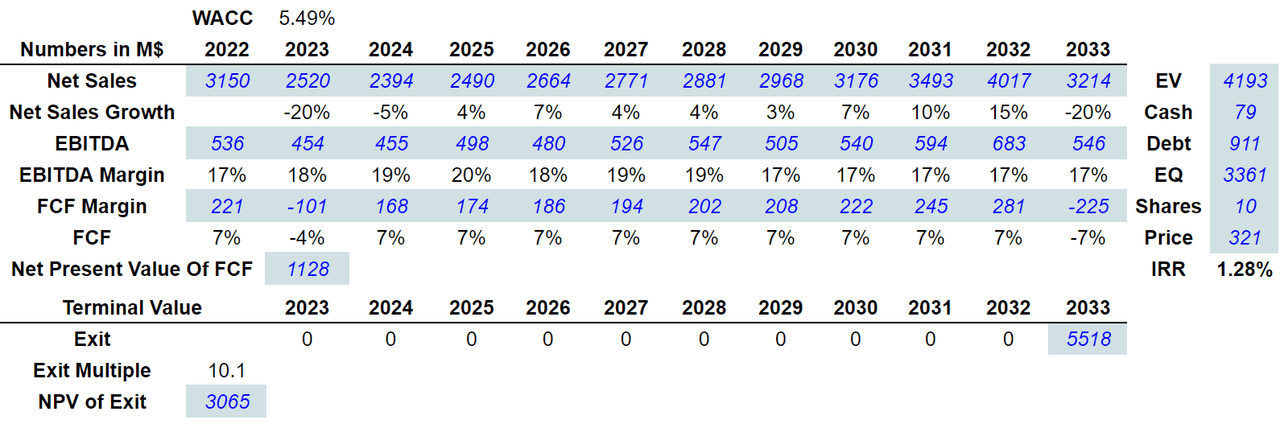

Like other investors out there, I used a WACC of 5.49% and sales growth around 4% and 7% from 2025 to 2030. Let’s also note that I included a decline of close to 19% in sales growth in 2023 because there are many investors talking about a recession in 2023. Also, with a free cash flow margin around 7% from 2024 to 2032, the NPV of future free cash flow would stand at $1.12 billion.

The terminal value included an exit multiple of 10.1x, so the NPV stands at $3 billion. If we sum both the DFCF and the exit multiple, the enterprise value stands at $4 billion. Finally, the equity value would be $3.3 billion, and the fair price may not go higher than $321 per share.

Author’s DCF Model

My Best Case Scenario Includes A Price Of $640 Per Share

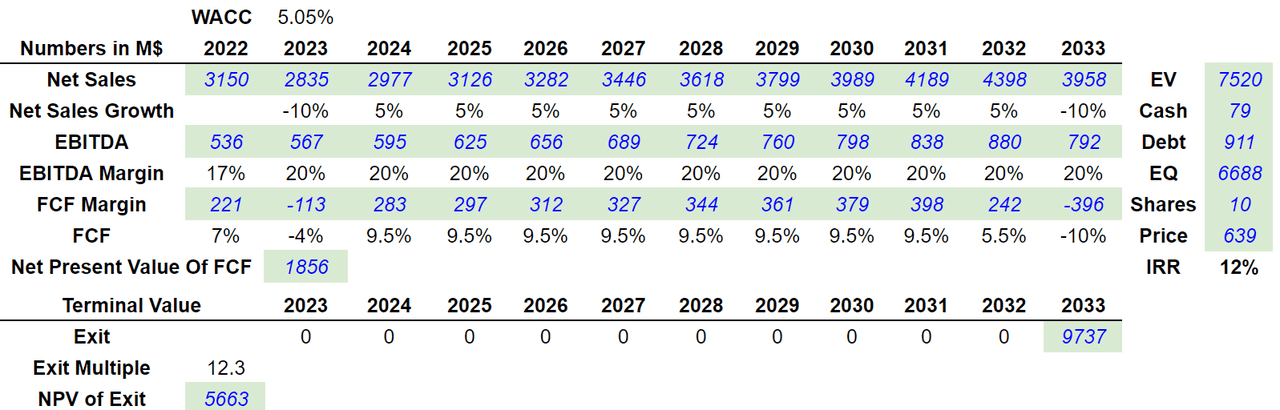

Under my best case scenario, I assumed that NEU will successfully invest a significant amount of dollars in emerging markets. According to market experts, the petroleum additives market size will likely grow at close to 5.2% until 2030.

Petroleum Additives Market Size is projected to be worth USD 8,836 Million by 2030 at a CAGR of 5.2%, Owing to Rising Automotive Manufacturing in Emerging Economies. Source: Petroleum Additives Market Size is projected to be worth…

Let’s note that NEU has already invested in many regions outside the United States. The company already knows markets that will likely grow more than those in the U.S. Hence, I don’t see this scenario to be very unlikely. If management is sufficiently smart, revenue growth could stand at close to 5% y/y.

The regions in which we operate include North America, Latin America , Asia Pacific, and the Europe/Middle East/Africa/India region. North America represents around 35% of our petroleum additives net sales, while EMEAI contributes about 30%, Asia Pacific about 25% and Latin America the remaining amount. Source: 10-Q

I assumed net sales growth of 5% from 2024 to 2032, an EBITDA margin around 20%, and FCF/Sales of 9.5%. I obtained free cash flow around $280 million and $398.5 million. If we sum everything and use a discount of 5.05%, the implied NPV would be $1.85 billion. Now, with an exit multiple of 12.3x, the sum of the exit and the DFCF would be $7.5 billion. If we assume shares outstanding close to 10 million, the fair price would be close to $640 per share, and the IRR would be 12%.

Author’s DCF Model

Worst Case Scenario

In my view, the worst risks come from an eventual increase in the price of raw materials that NEU uses. These are, for example, polyisobutylene, antioxidants, alcohols, solvents, detergents, friction modifiers, olefins, and copolymers. If prices increase, and NEU’s clients don’t accept an increase in products, the company’s net sales may decline. The company discussed these risks in the last annual report:

Our profitability is sensitive to changes in the quantities of raw materials we may need and the costs of those materials which may be caused by changes in supply, demand or other market conditions, over which we have little or no control. Political and economic conditions globally have caused, and may continue to cause, our demand for and the cost of our raw materials to fluctuate. Source: 10-k

NEU’s clients are also large oil companies, and the target markets don’t really include a lot of players. In my view, the concentration of clients may be quite risky for NEU. Keep in mind that the negotiation power of the NEU is not that relevant. Clients may push the EBITDA margin down if management does not find more partners or clients to work with:

Our principal customers are multinational oil companies in the lubricant and fuel industries. These industries are characterized by the concentration of a few large participants. Source: 10-k

Finally, considering the recent purported sabotage of the Nord Stream pipeline, NEU may suffer eventual disruption or disasters in its facilities or facilities of its clients. Keep in mind that the company collects revenue from all over the world. Decreases in production or supply of raw materials could lead to a decrease in revenue growth:

We are dependent upon the continued safe operation of our production facilities. Several of the products we sell are produced only in one location. A prolonged disruption or disaster at one of our facilities could result in our inability to meet production requirements. Source: 10-k

Source: 10-k

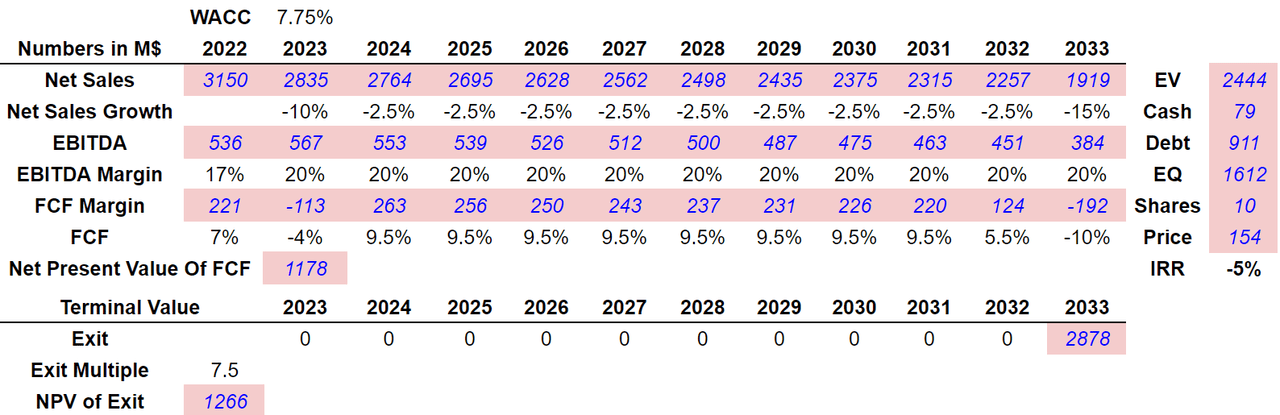

Under a dramatic case scenario, I included sales growth around -25% from 2024 to 2032, an EBITDA margin close to 20%, and FCF/Sales of 9.5%. With a WACC of 7.75% and an exit multiple of 7.5x, the implied enterprise value stands at $2.4 billion. With debt worth $911 million and $79 million in cash, I obtained an equity valuation of $1.65 billion, and a fair price close to $155 per share.

Author’s DCF Model

Conclusion

NEU didn’t only promise 10% returns y/y for shareholders in a recent report, management is also making a lot of efforts to improve EBITDA margins. In my view, with the total number of employees dedicated to research and development, technical innovations will likely lead to new product offerings. In my view, the result of these actions would lead to improvements in the company’s financial figures. Yes, there are risks, but the discount of future free cash flow indicates that the current stock price is too low.

Be the first to comment