Larysa Pashkevich/iStock via Getty Images

It has been a couple months since my last update on NewLake Capital Partners, Inc. (OTCQX:NLCP), the small-cap cannabis real estate investment trust (“REIT”). Since that article, the company has reported Q3 earnings along with another dividend hike, its fourth straight quarterly raise. Shares have had a nice 20% run since the end of September, but they still look like a strong buy to me.

Investment Thesis

NewLake is one of the most interesting opportunities on the public markets today. The small-cap cannabis REIT has a bulletproof balance sheet combined with a growing top line on the income statement. Shares have basically gone straight down since going public a year ago, at the same time the dividend has seen quarterly raises. If the raises happen to stop over the next year, that will give you a 9.25% yield on the $16 share price.

While there are plenty of reasons that I’m bullish, the REIT also has a couple reasons to be cautious. The portfolio is very concentrated on the top tenants, and the company’s OTC listing restricts their ability to raise equity capital for now. These two reasons might be enough to scare away risk-averse investors, but there are even more reasons to be bullish.

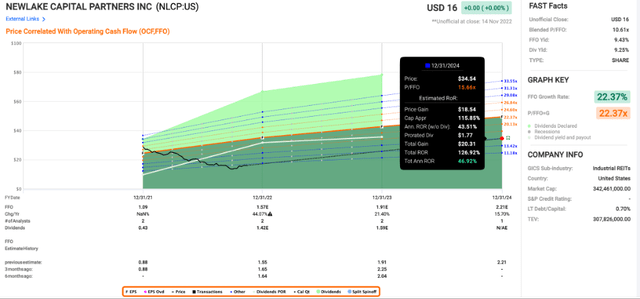

The valuation is dirt cheap, with a price/FFO (funds from operations) of 10.6x today. I’m expecting multiple expansion at some point in the future (up-listing to a major exchange in the coming years could be a catalyst), and returns could be very attractive even if we only get to a 15x multiple. The real estate portfolio has double digit cap rates, complete with rent escalators and an average lease term of almost 15 years. Throw in a $10M buyback for good measure, and I like my chances of making outsized returns with NewLake Capital Partners.

Acquisitions & Portfolio Concentration

NewLake has slowed down with their acquisitions in recent months, but they did have one property convert from a 30-year mortgage loan to a 20-year sale leaseback in August. They also made a small dispensary acquisition in recent weeks in Ohio for $1.6M. I’m curious to see how the company approaches growth opportunities over the next couple years, but they collected 100% of rent in Q3 and showed an impressive growth in revenue. One other factor to consider with a REIT with a smaller portfolio (by value but also number of properties) is the tenant concentration risk.

With a small and highly specialized portfolio, it is only natural that NewLake is going to have most of its rent coming from a few tenants. For the first nine months of 2021, the company had a whopping 97% of its rent coming from the top 6 tenants, with Curaleaf (OTCPK:CURLF) accounting for 34%. Both those have come down slightly for the first nine months of 2022 (89% and 24%, respectively), but to be comfortable with this tenant concentration, you have to believe in the tenant’s ability to pay rent and trust management to continue to diversify the portfolio with new properties and tenants.

One of the reasons that I think the risk/reward is so skewed to the upside is the attractive lease terms NewLake has with their portfolio.

As of September 30th, our portfolio had a weighted average lease term remaining of 14.9 years and an approximately 12.2% current yield with built-in growth through unfunded tenant improvements and lease escalators.

While I’m curious to see if they will be able to continue to get terms like this for years to come, they already have a base of assets with an average of 15 years left at double-digit cap rates. That’s why I like my chances for outsized returns with NewLake. One of the other things that could scare investors away is the lack of liquidity for shares of NewLake due to the OTC listing.

Liquidity Issues

I talked about the liquidity issues in my March article related to the company’s OTC market listing. This is one area where big brother Innovative Industrial Properties (IIPR) has a distinct advantage with their NYSE listing. The company has said they are looking to up-list (which would likely lead to a significant rerating in shares), but I’m not too worried about their OTC listing. As long as the dividend increases keep coming, I plan to add to my position while it is undervalued. If you are looking to buy, I would strongly recommend buying in small lots using limit orders. I have typically bought 100 shares at a time and plan to continue with that approach in the future. Some have speculated that NLCP could be an acquisition target, but I would be extremely disappointed if that happened due to its growth relative to the cheap valuation.

Valuation

The valuation on NewLake doesn’t make much sense to me, but I’m perfectly fine with that as I have been bringing down my cost basis significantly over the last couple months. Shares currently trade at a dirt cheap 10.6x price/FFO. NewLake hasn’t been public for long, so the average multiple isn’t that helpful. While I don’t when we will see multiple expansion, I’m pretty sure it will happen eventually. I try to have a multi-year time horizon with all my investments, so I’m not worried about the short-term price fluctuations.

If we see a 15x multiple in a couple years (assuming the estimates are accurate), shares could double from here. Conservatively, I don’t think there is any reason shares should trade in the teens while the dividend is over 9%. This cheap valuation is the driving factor behind the recently announced $10M buyback. The program is set to expire at the end of 2023, and it could theoretically repurchase over 2% of shares. To be honest, I have mixed feelings about the buyback.

Shares are obviously cheap, and with an illiquid stock like NewLake, the buyback could nudge shares closer to fair value. I would love to see management scooping up shares at a discount, but only if that is the best place to put money. Over the long term, I would rather see portfolio growth because the top line growth is going to be key to the returns over the next couple years. CEO Anthony Coniglio said this on the earnings call:

I would think of it a little bit more as a backstop. The phrase I heard the other day is, you can’t shrink a company to greatness. So shrinking an already small REIT isn’t the first choice. But at the same time, given the price volatility, we felt that we just had to have a program that could act as a backstop if things continue to deteriorate in the markets. And because we throw off so much free cash flow, we’re very comfortable with that. We have basically no leverage today. And then obviously, we’re always thinking about where can we put out money versus where can we buy back the stock. But it’s not I would think of it more as sort of a backstop and as we’re still trying to grow this business.

While there are pros and cons to the buyback program, one thing I don’t have mixed feelings on is NewLake’s dividend.

The Dividend

NewLake has hiked the dividend every quarter since going public a year ago. Meanwhile, the share price has consistently gone in the opposite direction, which is why I think the REIT is such an interesting opportunity. If the dividend growth stops for the next year and the quarterly payout remains at $0.37, that pencils out to a 9.25% yield. If the quarterly hikes continue, I think we are easily looking at a double-digit yield at the current $16 share price. As long as the hikes continue, I plan to continue to add to my position.

Conclusion

NewLake has a complex risk profile with a lot of different factors to consider. The tenant concentration is very high, but I think management will be able to handle that as they grow the portfolio. The OTC listing could be the biggest issue for some investors, and I won’t sugarcoat it. The liquidity is awful for shares of NewLake. I will reiterate again that investors should use limit orders and buy shares in small chunks if they are building a position like I am.

One of the things I try to do as an investor is value the business without getting too caught up in the price action. With NewLake, there are three main things that make me think the REIT is materially undervalued. The first is the lease terms. There aren’t many ways to get double-digit cap rates with built in escalators and a 15-year average lease term. The second reason is the dirt-cheap valuation at 10.6x price/FFO. It’s hard to see when or why we will see multiple expansion, but I want to own as many shares as I feel comfortable with when it happens. Management seems to agree with me on the valuation as they authorized a $10M buyback until the end of 2023.

The dividend is the last, and possibly most compelling reason, to own NewLake. You get a yield over 9% that also has grown every quarter since the IPO. It’s not a long track record of dividend hikes, but the combination of current income and growth should get most income investors excited. NewLake Capital Partners might not be right for every investor, but I still think investors willing to dig in to understand the business should consider a position. If IIPR’s first 5 years on public markets are any indication, NewLake Capital Partners, Inc. could have impressive returns moving forward.

Be the first to comment