Everyone is freaking out about the stock market.

But if you’ve never invested before, or if you’re a millennial, we have a secret to tell you: For you, this is the financial opportunity of a lifetime.

What the stock market crisis means for you is that stocks are now up for grabs, at prices you might never see again, or at least not for another decade or two.

In fact, you just missed what was probably the best day to buy stocks, but it’s probably not too late to get in the game before the market rallies.

So while you’re stocking up on toilet paper, consider that maybe it’s also time to stock up on stocks, if you’ll pardon the pun.

In this article, we’ll walk you through your first steps as an investor, show you how Seeking Alpha can help, and explain how you might turn this bear market from a snarling grizzly into a fuzzy teddy bear.

Invest now? Are you crazy?

Yes, now, when people are panicking, selling stocks, and pulling their retirement savings.

Now is the time to remind ourselves of the golden rule of contrarian investing, a famous quote attributed to Baron Rothschild: “Buy when there’s blood in the streets, even if the blood is your own.”

While we’re hoping this quote doesn’t literally come true, the meaning behind it is definitely applicable to the crisis we’re living through.

Everything looks apocalyptic right now, but the inevitable truth is that eventually, however long it takes, the market will go back up again.

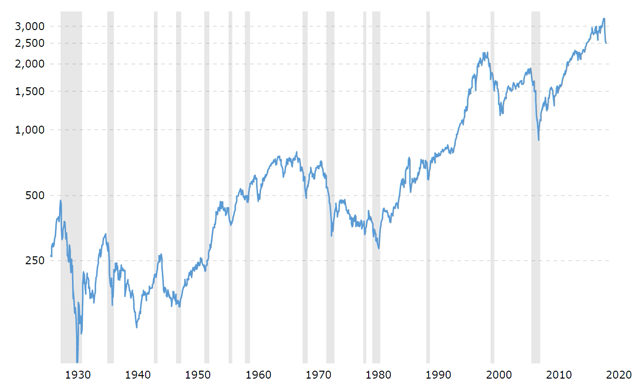

How do we know that? Well, we don’t know 100%, but it’s a safe bet. Here’s a graph showing the S&P 500 throughout the turbulent 20th century:

See? What comes down must eventually come up – even after disasters like 9/11.

So how to find the best stocks to buy before the inevitable recovery? Keep reading, and we’ll help you get started.

Should I go on a stock shopping spree?

No, not at all. But you can definitely start a wish list.

The first piece of advice we can give a beginner investor is: Buy stocks if you want, but s-l-o-w-l-y. If you’ve decided on a certain stock, don’t spend all your money on it, thinking you’ll make a quick buck. Instead, buy a small amount, wait, and if the price is still down and you think it’s a good investment, then consider buying more.

For a young investor, there’s something else that’s on your side: time. As you can see in the above graph, the S&P 500 was on an upward trajectory for most of the past 90 years. If you’re in it for the long haul, your stock portfolio might double, triple, or quadruple in value throughout your life – and possibly a lot more.

OK, I’m ready. How do I get started?

Welcome to the club! Millions of investors use Seeking Alpha to catch up on market news, to discuss ideas (OK, argue) with fellow investors, and to use advanced tools – previously available only on Wall Street – to research stocks. We’re with you all the way!

To actually buy your first stock and start building your portfolio, you’ll need to open a brokerage account. This isn’t at all as intimidating as it sounds – here are some online brokers that are great for beginners.

Newbie investors sometimes choose to invest in index funds, not individual stocks. This means you instantly buy stocks of multiple companies – if it’s the S&P 500, the most commonly known index fund in the United States, that means you’re buying a part of 500 large companies chosen by the fund. This is a great way to get started, but in this article, we’ll talk about doing a little bit more than that with our investing strategies.

Whatever you do, there’s one little word you need to repeat to yourself when starting to build your stock portfolio: diversify, diversify, diversify. This means not investing simply in one stock or even in one industry, because if that company or that industry suffers, your money will be at risk. By investing across multiple industries, you mitigate that risk.

How can Seeking Alpha help you make good investing decisions?

Seeking Alpha offers investors many different features and tools. The first thing we recommend that you do is create an account and start following stocks that interest you. These can be index funds like the S&P 500 or individual companies you find interesting or cool, like Apple (AAPL) or Tesla (TSLA). Follow whatever and however many stocks you want – you can narrow them down later. You’ll start to get email alerts on these stocks: news, articles, and other mentions. You can customize the alerts you receive by clicking on Settings. You might want to choose the daily digest version of one email a day.

For any stock you’re interested in, you’ll be able to drill down and explore different data: not just news and articles, but also financials like the company’s income statements and revenue, earnings reports (where the company reports on the quarter or year it had – a great way to understand the company’s present and future).

If you’re already invested in stocks, you can go ahead and add them to your Seeking Alpha portfolio. This will give you a more detailed and precise look at your investments.

Besides the basic features of Seeking Alpha, we can offer you two methods: the DIY method, and the guided method.

Here’s how we make it easy for you.

DIY stock research: Seeking Alpha Premium

Let’s talk about DIY first.

Many investors prefer to do their own research when it comes to stocks, and for them, investing is a hobby as well as an income stream. If you’re ready to learn more about the stock market and get to know the companies you’re investing in, doing your own research might be the right path for you. And hey, lots of people are trying their hand at DIY everything these days, from baking bread to cutting their own hair.

Investors who do their own research use a variety of tools and methods to make the best possible decisions. Want to take up the challenge of DIY-ing your stock research? Seeking Alpha can simplify that challenge for you. You don’t need to be an analyst to invest, but Seeking Alpha provides you with high-quality products and tools developed and used by Wall Street analysts.

Let’s look at some of the ways you can use Seeking Alpha Premium to make smart, informed investing decisions the easy way.

Ratings: The Pop Charts of Stocks

Just like movies, songs, and video games, stocks have top-10 lists of their own. At Seeking Alpha, we make it easy for you to find the top rated stocks. This way, if you want to invest in top stocks, all you need to do is check out the stocks included in these lists. All the hard work has been done for you by experts and analysts.

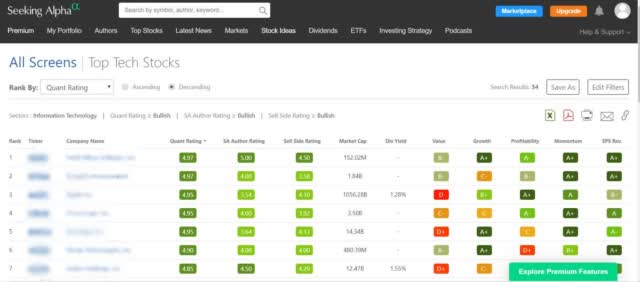

Here’s a screenshot of the Top Tech Stocks. Just by looking at the ratings on this screen you can get a sense of which stocks investors are most bullish on, meaning the ones they think are the best buys at the moment. By looking at this list, you can get a sense of which stocks investors recommend most right now.

If you want to get into the nitty gritty, you can differentiate among three different ratings on Seeking Alpha:

-

Quant Ratings – An overall rating for each stock based on objective data, generated by comparing each stock with the rest based on over 100 metrics.

-

Sell-Side Ratings – Wall Street analysts’ ratings on a particular stock. These ratings are provided by analysts whose job it is to research companies and report on a given stock’s expected performance. Seeking Alpha collects all the analyst data from third-party sources and assigns an aggregated rating from Very Bearish (sell) to Very Bullish (BUY).

-

Author Ratings – Seeking Alpha authors rate the stocks they write about every time they publish a new article, from Very Bullish (BUY) to Very Bearish (sell). We aggregate every author’s rating within the past 90 days and combine it to create the overall Author Rating.

Articles by investors, for investors

If you’re interested in finance, you’re probably already reading articles on various finance publications – and that’s a great first step. Keep doing that!

The bad news is that the stock market is not an exact science: No one knows exactly what will go up or down, nor by how much or when. Everyone writing an article or an opinion about a stock is human, prone to bias and confusion just like you. Of course, a lot of writers are very confident about their analysis, and it’s up to you to know that you’re making the right decision. That’s why it’s important to hear both sides of the argument, and read what the bulls and the bears have to say about a stock before you decide to invest. With all the different talking heads yelling at you to buy this stock and sell the other, it’s really hard to know who to listen to.

The good news, however, is that Seeking Alpha can help you identify trustworthy advice at a glance. On any article on Seeking Alpha, you can see a history of the author’s ratings of the stock, overlaid on that stock’s price chart. Below, for example, you can see how the author’s rating of Apple changes over time: from a long period of bullishness as the stock goes up, and then a lowered rating – a switch to bearishness – just before the stock begins to go down.

News dashboard and stock alerts

Even under normal circumstances, it’s absolutely vital that investors are aware of any sudden changes in their portfolio. BUT – this doesn’t mean you’ll necessarily make decisions based on these changes. In fact, some investors won’t touch their portfolio even when things seem dire – and more often than not, that’s the best decision they can make. But you should still be in the know. After all, it’s your money!

The Seeking Alpha Premium news dashboard comes with powerful filters to find the most actionable news. Some of these are tailored to investing styles and goals, such as dividend investing and value or growth investing. Other filters give you an at-a-glance understanding of the markets: Top News, Trending News, Politics and Market Pulse.

The news dashboard is a great tool for filtering out the noise and focusing only on the news that matter to you and your portfolio.

Notable calls

Notable Calls are actionable investment ideas from fund managers and other Wall Street pros, sourced and summarized by our news analysts. Notable Calls offer subscribers a daily dose of alpha-generating ideas. Combined with contributor articles, Notable Calls makes Seeking Alpha the most comprehensive and valuable source of investing ideas available anywhere.

The Guided Method: Seeking Alpha Marketplace

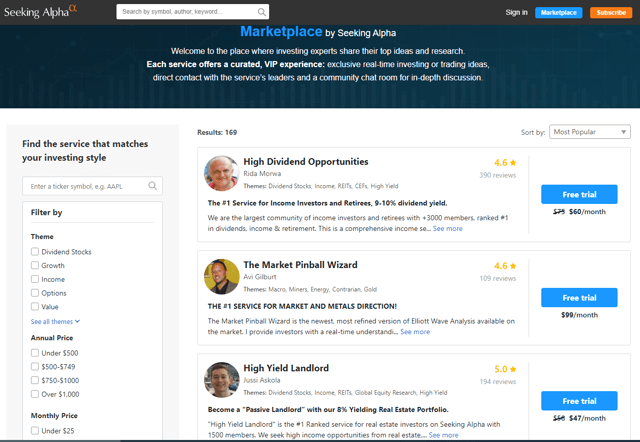

If you want a little extra guidance, Seeking Alpha’s Marketplace is where you can get more specialized help navigating the uncharted waters

What is the Marketplace? It’s where seasoned, expert investors offer their guidance to new investors or those who simply prefer a bit more hand-holding. These investing experts have created their Marketplace service according to their own area of expertise. Some will focus on industries such as real estate, metals, or biotech. Others will focus on a certain investing style or goal: dividend investing, value investing, or various predictive models.

Each Marketplace service offers a curated, VIP experience: exclusive real-time investing ideas, direct contact with the service’s leaders, and a community chat room for in-depth discussion.

Let’s take a little tour of the Marketplace.

You’re looking at the top services currently listed on the Seeking Alpha Marketplace. But there are 168 services to choose from, so how do you find one that suits you?

First, you can sort by popularity or review score to get a sense of which ones Seeking Alpha users like most. Alternatively, you can use the filter to find services according to price or theme (such as dividend investing, tech stocks, ETFs), or narrow down which ones have mentioned a specific stock.

What happens inside the Marketplace service?

Once you’re in, you’ll receive some Getting Started materials, which will introduce you to everything the service includes and how to make the most of it. Then you can start reading the latest reports, previews for the upcoming week, and more exclusive materials. You’ll also gain access to the group chat, where you and your fellow investors can ask the Marketplace leaders any questions you might have – and get answers daily.

Here’s the best part: Most Seeking Alpha Marketplace services offer a free trial that opens access to all of this before you commit – so you can even try several before you settle on one.

TL;DR

For newbie investors, a time of crisis in the markets can be a great time to get started. Prices are down, emotions are up, and the future is uncertain but full of possibilities.

Ever since the market started feeling the effects of the coronavirus, people of all ages and walks in life have been wondering what would happen to their investment portfolios, retirement funds, and bank accounts.

The coronavirus will be defeated, humanity will prevail, and the markets will rally eventually. “It’s always darkest before the dawn.” While everyone else panics, use the opportunity to start treading the waters of the stock market – after all, it waits for no one. And we’re here for you every step of the way.

Want to do your own stock research, the easy way? We’re offering a free trial of Seeking Alpha Premium – no strings attached: click here to start yours.

Prefer a little more hand-holding? Click here to explore the Seeking Alpha Marketplace and find your first investing guide.

Be the first to comment