Dzmitry Dzemidovich

Thesis

New Residential Investment Corp. (NYSE:NRZ) stock was battered in June, coinciding with its management internalization in mid-June. Notably, the panic sell-off also formed a bear trap (significant rejection of selling momentum) on its long-term chart.

As a result, buying momentum returned remarkably to support the steep selldown. Notwithstanding, NRZ remains mired in a long-term downtrend. Also, it had faced significant selling pressure at its intermediate resistance ($11.8) since early 2021. It then formed a bull trap (significant rejection of buying momentum) in May, preceding the June sell-off, which has likely been resolved.

We believe that NRZ stock remains reasonably well-balanced now. However, its price structures on its medium-term chart remain tentative, as it has moved into a bearish flow. Therefore, it’s possible that NRZ could retrace further to re-test support levels closer to its June lows.

As a result, we rate NRZ as a Hold for now. We urge investors to be patient if they missed the June bottom and wait for a re-test to assess the resilience of its buying support.

New Residential Stock – Panic Sell-off In June Was Rejected Resolutely

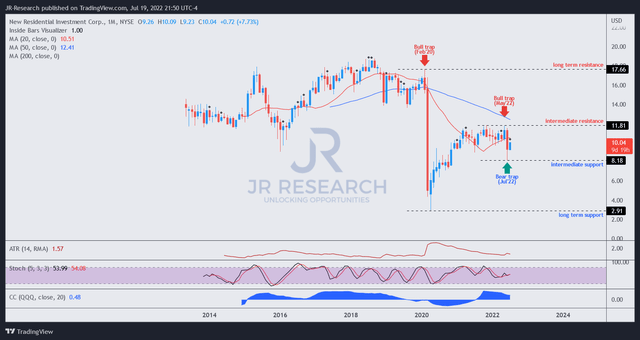

NRZ price chart (monthly) (TradingView)

As seen in its long-term chart, NRZ remains embedded in a long-term bearish bias, despite its recovery from its March 2020 lows. As a result, some investors could interpret the price action as a “bear market rally,” which faced consistent selling pressure at its intermediate resistance ($11.8).

Note that the intermediate resistance has rejected further buying upside since March 2021 before forming a bull trap in May 2022. Therefore, we believe the market has used the consolidation zone over the past year as an astute distribution phase (“quiet” selling to minimize sharp drawdowns).

Subsequently, the bull trap preceded its steep sell-off, culminating in a bear trap in June.

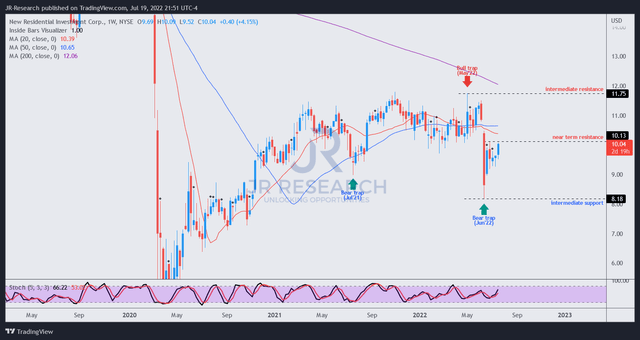

NRZ price chart (weekly) (TradingView)

As seen in its medium-term chart, NRZ has also moved into a bearish bias that resulted from June’s steep sell-off. As a result, its medium-term flow could realign with its long-term bearish momentum subsequently if the buying upside keeps getting rejected.

However, we believe that NRZ’s price action is likely underpinned by June’s lows at its intermediate support ($8.2). However, the NRZ has already moved discernibly above that support zone, which reduces the appeal of a directionally bullish risk/reward set-up predicated on its June bottom.

We see its intermediate resistance as a critical zone that NRZ needs to retake to invalidate its long-term bearish bias. Meanwhile, NRZ appears close to its near-term resistance ($10.15), which could offer some selling pressure. However, the resistance zone has not been validated.

Notwithstanding, given the relatively well-balanced risk/reward profile, we don’t see an attractive set-up from either the long/short side.

For investors looking to add exposure, we encourage some patience. Investors can consider waiting for a re-test of support zones closer to its intermediate support or await another bear trap. That should indicate that the market is willing to lend further buying upside and not send it into a steeper sell-off.

The Market Is Pricing In A Recession, Amid Rising Interest Rates

Investors in New Residential Investment should be aware that a recessionary scenario could markedly impact the company. Moreover, the added headwinds from rising interest rates have resulted in a “double whammy” situation that the company needs to navigate. As a result, we believe the market has attempted to price in these headwinds and determine the appropriate level of dividend yields to compensate for such risks.

NRZ also cautioned in its filings about the likely impact of these risks. It added (edited):

We believe the risks associated with our business are more severe during periods in which an economic slowdown or recession is accompanied by declining real estate values. Declining real estate values generally reduce the level of new mortgage loan originations. Further, declining real estate values significantly increase the likelihood that we will incur losses on our investments in the event of default. In the event of a significant rising interest rate environment and/or economic downturn, however, loan and collateral defaults may increase and result in credit losses that would adversely affect our liquidity and operating results. (New Residential Investment 10-Q)

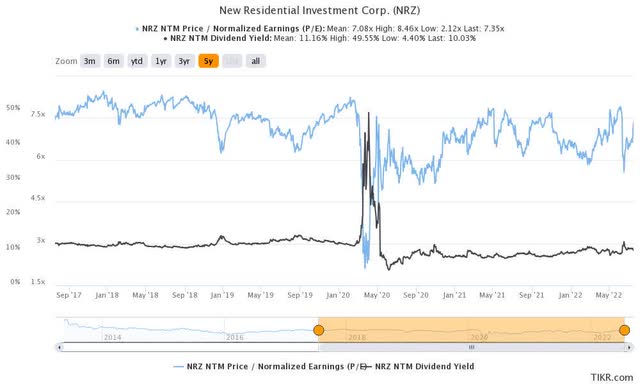

In addition, NRZ’s valuation metrics seem relatively well-balanced now. For example, its NTM dividend yield of 10.03% is slightly below its 5Y mean of 11.16%. Also, it last traded at an NTM normalized P/E of 7.35x, in line with its 5Y mean of 7.08x.

Therefore, some long-term investors could have used the recent mean reversion to add exposure at its June bottom, which we think is astute.

Is NRZ Stock A Buy, Sell, Or Hold?

We rate NRZ as a Hold for now.

Its price action is at a critical juncture and should provide clues on whether NRZ can emerge from its newly-formed bearish bias on its medium-term chart. Also, we would prefer to wait for a re-test of support zones closer to its June lows before reassessing an opportunity to enter directionally-bullish positions.

We believe the market is attempting to price in the macro headwinds likely to impact NRZ. Therefore, investors should assess its price action closely to ascertain the market’s expected behavior moving forward.

Be the first to comment