MarsBars/E+ via Getty Images

Residential mortgage REITs is an asset class that attracts investors for their high yields. However, this asset class can be unpredictable as far as their payouts are concerned, and properly timing entries and exits can be tricky and unrealistic for most retail investors.

That’s why I prefer to stick with well-managed equity REITs, BDCs, and MLPs for their recurring income streams that are more stable. This brings me to New Mountain Finance Corp. (NASDAQ:NMFC), and in this article, I highlight what makes this 10%+ yielding stock a good choice for income investors, so let’s get started.

Why NMFC?

New Mountain Finance Corp. is an externally managed BDC that was founded amidst the Great Recession in 2008 and became publicly traded in 2011. It’s externally managed by New Mountain, which is an alternative investment firm that manages private and public equity, and credit funds with $37 billion in assets under management.

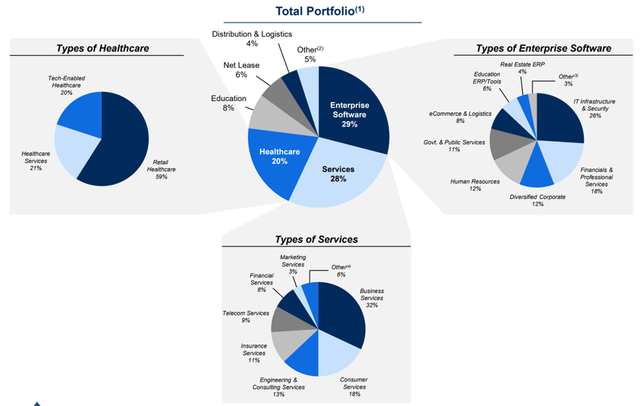

NMFC carries a diverse portfolio with a fair market value of $3.27 billion, spread across defensive and growing sectors, with enterprise software, healthcare, and business services being its top 3 segments. As shown below, NMFC’s remaining segments are comprised of economically essential segments such as education, net lease, and distribution.

NMFC Portfolio Mix (Investor Presentation)

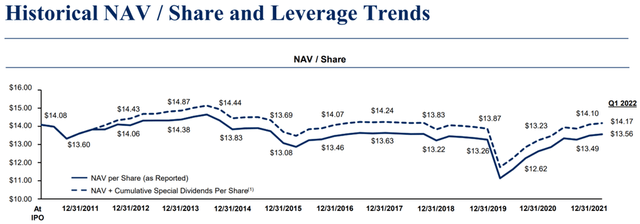

Importantly, NMFC has maintained a rather steady NAV per share throughout its history. This is important for shareholders, as BDCs are primarily regarded as being income vehicles, with capital appreciation being a secondary priority. This can be attributed to sound underwriting policies, which has helped NMFC to see just 2.9% of total investments go on non-accrual status since its inception in 2008.

Moreover, NMFC has now fully recovered its NAV per share to above pre-pandemic levels, and NMFC’s NAV plus special dividends at $14.17 sits above its $14.08 IPO price, as shown below.

NMFC NAV per Share (Investor Presentation)

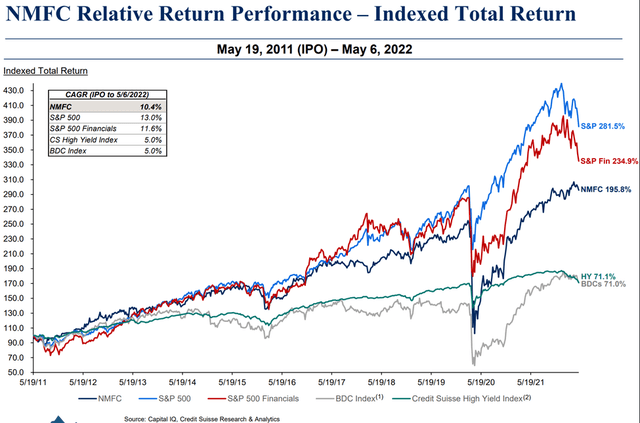

The sound portfolio strategy combined with reinvested cumulative regular dividends has enabled NMFC to achieve industry leading returns, sitting well above the high yield and BDC indices, as shown below.

NMFC Total Return Comparison (Investor Presentation)

Meanwhile, NMFC continues with solid portfolio fundamentals, with NAV per share growing by $0.07 on a sequential QoQ basis, to $13.56 at the end of the first quarter. Importantly, NII per share of $0.30 fully covers NMFC’s quarterly dividend for the same amount. It also maintains a statutory debt to equity ratio of 1.23x, sitting well below the 2.0x regulatory limit.

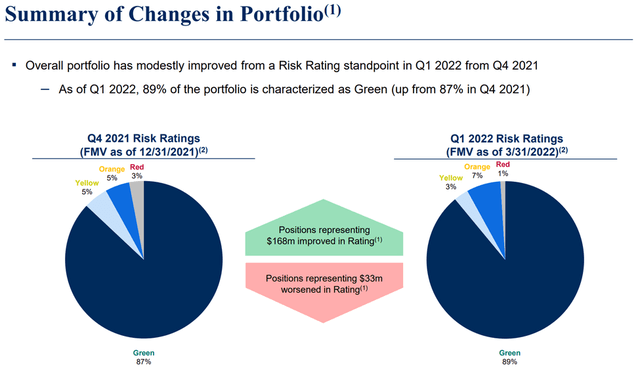

Portfolio credit quality appears to be improving as well, as the percentage of investments in the ‘Red’ category has decreased from 3% to 1%, and the investments in the highest Green category improved by 200 basis points to 89%, as shown below.

NMFC Portfolio Risk Ratings (Investor Presentation)

Risks to NMFC include the external management structure, which may lead to conflicts of interest. However, I’m encouraged to see that management recently agreed to reduce its base management fee to 1.25% of gross assets through the end of 2023, signaling a shareholder friendly move.

Looking forward, deal activity may slow down in the near-term. However, NMFC should benefit from rising rates, as 89% of its debt investments are floating rate, while just 48% of its loans are floating rate. This should enable NMFC to see more attractive investment spreads, as management noted during the recent conference call:

Our market has benefited from continued good credit performance, particularly in defensive industries, floating interest rates and secured debt structures. Loan-to-value ratios in many of our core industry verticals are less than 40% and in some cases under 30%. While deal flow remains materially lower than the latter half of 2021, we have seen increased activity in the large unitranche segment of the market, as equity sponsors have gravitated to the certainty and stability of direct lending versus other financing alternatives.

Yields continue to be very attractive with floating rate spreads of $5.50 to $6.75 on many new unitranche loans. While we remain mindful of the overall economic environment, we continue to have high conviction in our investment strategy of lending to stable and valuable businesses within defensive growth industries that are well researched by the New Mountain platform.

Meanwhile, at the current price of $11.70, NMFC trades at a material discount with a price to book value of 0.86x. This sits well below its trading range over the past 3 years, outside of the early pandemic timeframe. Sell side analysts have a consensus Buy rating on NMFC with an average price target of $12.50, implying a potential one-year 17% total return.

NMFC Price to Book (Seeking Alpha)

Investor Takeaway

Overall, I believe New Mountain Finance is a quality BDC with a shareholder friendly management team, sound investment strategy, and attractive valuation. While deal flow activity may not be as robust in the near-term, higher investment spreads due to higher interest rates should be a strong offset. Lastly, NMFC trades at a material discount to its book value while paying an attractive 10.3% dividend yield.

Be the first to comment