MasaoTaira

2022 is quickly coming to a close, and we are getting to the time of year that I look at my investments to decide if there are any trades to be made before the new year. One of the companies I have been going back and forth on in recent weeks is Netstreit (NYSE:NTST), the small cap net lease REIT with a market cap of $1.1B. I have written three articles on Netstreit in the last year and there haven’t been many unexpected changes with the REIT. The main reason I have been considering some of the alternatives is the lack of dividend growth since going public.

Investment Thesis

There are a lot of things I like about Netstreit. The smaller size of the REIT means there is more potential for long-term growth. The company has a solid balance sheet and continues to grow at a solid pace. After the Q3 acquisitions, the portfolio almost carries a 20% weight in pharmacies, but I’m not too worried about an increase in that concentration. At a price/FFO of 17.9x, shares aren’t cheap or expensive today, but I think the downside is limited with the 4.2% dividend.

The biggest thing I’m looking I’m hoping to see in 2023 is some dividend growth, which Netstreit hasn’t provided since the IPO. Below I include some of the alternatives I’m looking at if I do decide to swap out shares of Netstreit. I’m still long Netstreit, but my patience is wearing thin, and I might look to replace it with Agree Realty (ADC), Realty Income (O), or Essential Properties Realty Trust (EPRT) in 2023.

10-Q

Revenues have grown quickly in 2022, but that is somewhat offset by continuing share issuances. They have continued to focus on growing the real estate portfolio with 26 acquisitions worth $131M in Q3. So far they have only sold 4 properties in 2022 versus 9 in 2021. My guess is that the acquisitions will continue at a similar pace with dispositions here or there.

The balance sheet has remained solid even as the company has issued debt in 2022. 93% is fixed debt, and they have been able to borrow at interest rates below 4% except for one mortgage note (4.53%). I like the conservative balance sheet, but I would prefer that the company use debt for acquiring new properties, especially with shares below $20.

Portfolio Concentration

One of the things I would also keep an eye on is Netstreit’s portfolio concentration. The REIT is pretty exposed to pharmacies, with CVS Health (CVS) accounting for 11.4% of rent and Walgreens Boots Alliance (WBA) with another 6.9%.

It was really — we weren’t really planning on increasing our pharmacy exposure as much as we did, but we saw a couple of opportunities specific with CVS and Walgreens that were very attractive pricing. Really strong locations that we felt where the best risk adjusted returns that we could provide investors. I would not expect us to be adding to those names.

– CEO Mark Manheimer on the most recent earnings call

Larger REITs tend to be more diversified than a REIT like Netstreit, but I’m not too worried about Netstreit’s tenant concentration. If management decided they were the best opportunities available to them at the time, then I’m not going to second guess it, especially for a smaller REIT. They also mentioned in the earnings call that they could sell a property or two if the opportunity presents itself. If not, the percent of ABR derived from pharmacies should drop from the current 18.3% as long as the other parts of the portfolio continue to grow.

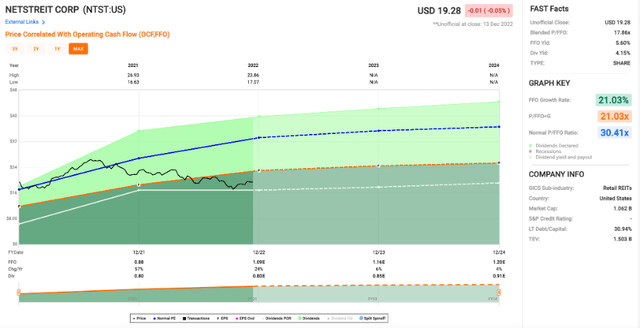

Valuation

Netstreit doesn’t have a long operating history, so the average multiple isn’t that helpful for looking at the valuation. Shares currently trade at a 17.9x price/FFO, which is more expensive than most of the other REITs in the net lease sector. If FFO/share growth hits estimates in the next couple years, buying shares below $20 will likely look pretty cheap by the end of 2024.

My guess is that FFO/share growth will slow a bit in coming years, but I am optimistic that they can beat 6% and 4% growth in the next couple years. In my opinion shares are right are a bit below fair value today. With shares below $20 and yield of 4.2%, I think the downside is limited. However, if they don’t start hiking the dividend, it is hard to argue for any form of multiple expansion to go with the current yield and FFO/share growth.

Still No Dividend Growth

While I like Netstreit’s business, balance sheet, growth, and its valuation, the lack of dividend growth has me considering some alternatives. I said this in my last article and the same logic applies today. I do like the company’s portfolio strategy, but eventually the company’s growth has to show up in the form of dividend increases. If it doesn’t, there are plenty of other net lease REITs out there that pay growing dividends.

Three Potential Alternatives

When it comes to net lease REITs with a focus on investment grade tenants, the closest comparison to Netstreit is probably Agree Realty. Realty Income is the blue chip of the group and Essential Properties Realty Trust is the smallest by market cap and has the largest dividend.

| REIT | Agree Realty | Realty Income | Essential Properties Realty Trust |

| Market Cap | $6.3B | $40.7B | $3.3B |

| Price/FFO | 18.5x | 16.3x | 14.9x |

| Dividend Yield | 4% | 4.6% | 4.7% |

I included some of the basic metrics of each REIT, but each one has pros and cons. Below are links to my most recent articles on each one that discusses each REIT in more detail:

Conclusion

I have held onto shares of Netstreit for a couple years now, and I generally consider myself a patient investor. The valuation looks alright right now at a price/FFO of 17.9x, and the company’s strategy has been solid since the IPO. The real estate portfolio is heavily weighted towards pharmacies like CVS Health and Walgreens, so there is some concentration risk, but I don’t think that will have a material impact on shareholder returns. The downside is limited in my opinion due to the 4.2% yield and growing FFO/share, but I don’t think we will see multiple expansion without dividend growth. I would love to see it in 2023, but if it doesn’t start soon, I will look to swap out my shares for a REIT that is growing its dividend.

Be the first to comment