roc8jas/iStock via Getty Images

Introduction

In April 2022, I wrote a bearish article on SA about U.S. semiconductor company Netlist (OTCQB:NLST) in which I said that it could be a good time to open a small short position as retail investor interest appeared to be fading off and the short borrow fee rate had dropped to just over 12%

Since then, the company’s market valuation has fallen by over 30% but I think that the bear case is still strong as Q1 2022 results looked underwhelming. In addition, the short borrow fee rate has fallen below 9% and Netlist appears likely to invest millions in the future in its lawsuit against Alphabet (NASDAQ:GOOG) (GOOGL) over memory server patents. Let’s review.

Overview of the recent developments

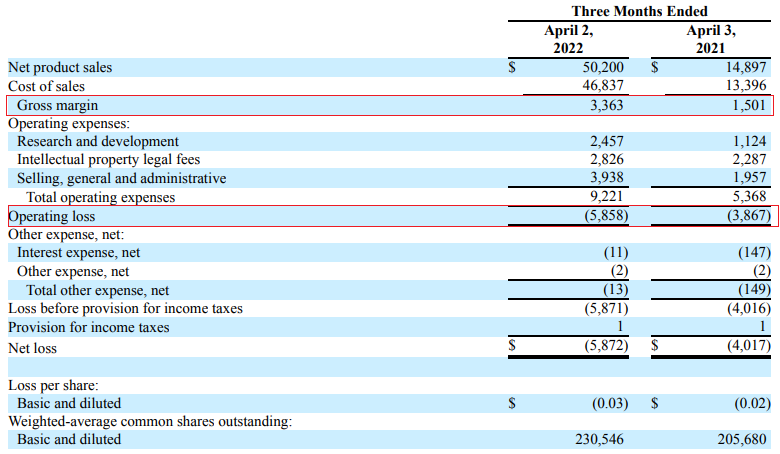

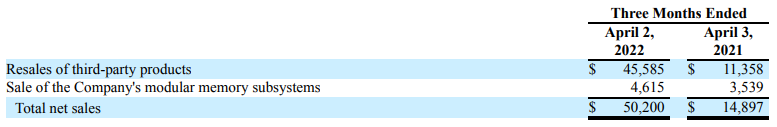

If you haven’t read my previous articles on Netlist, here’s a quick overview of the business. The company is a supplier of modular memory subsystems which specializes in hybrid memory solutions such as NVMe SSDs. Netlist claims that its HybriDIMM is the industry’s first Storage Class Memory product built on commodity DRAM and flash. However, the vast majority of the company’s revenues currently come from the resale of products of South Korean semiconductor giant SK Hynix (OTC:HXSCF). In April 2021, Netlist entered into a 5-year product purchase and supply agreement with SK Hynix after the latter agreed to pay a $40 million license fee following a lengthy lawsuit over patents. The problem is that the new business has very low margins and the operating loss of Netlist soared by just over 50% in Q1 2022 to $5.8 million. The gross margin, in turn, slumped to 6.7% from 10% a year earlier.

Netlist

Netlist

Yes, sales are growing rapidly but is this growth beneficial considering SG&A expenses are growing faster in absolute terms? There don’t appear to be any economies of scale here and my view is that the future of the business looks bad. I think that sales could top $200 million in 2022 but the operating loss seems set to surpass $20 million, wiping out half of the license fee the company received in a single year. In addition, there is no guarantee that the product purchase and supply agreement with SK Hynix will be renewed in 2026.

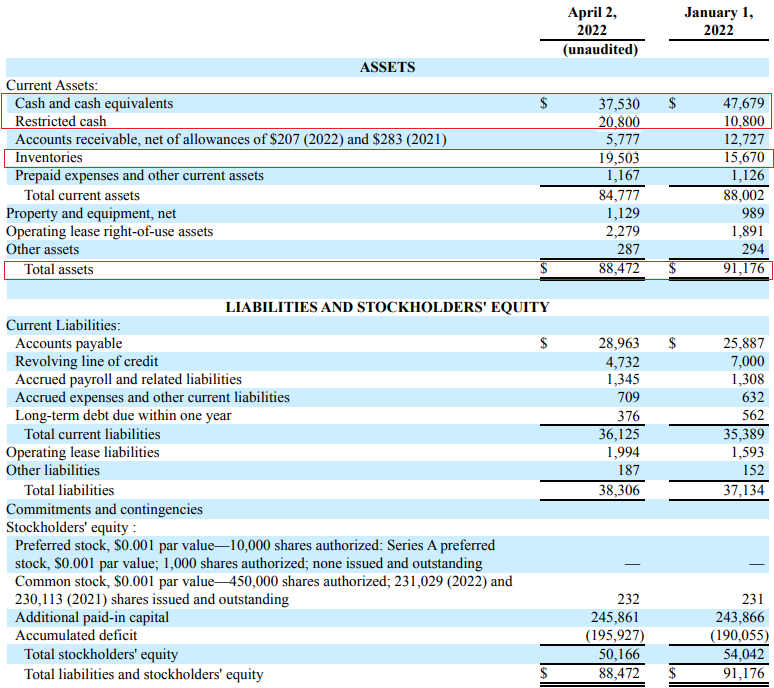

On a positive note, stock dilution risk seems low at the moment as Netlist had $58.3 million in cash as of April 2. The company had only $5.1 million in debt and there are no significant CAPEX plans for the near future. Overall, Netlist has an asset-light business model and cash and inventories account for almost 90% of its asset base.

Netlist

Overall, I think that Netlist looks significantly overvalued based on fundamentals. Shareholders’ equity is just above $50 million, and the business is unprofitable, yet the market valuation stood at over $750 million as of the time of writing. In my view, the share price is at these high levels because investors expect the company to reach several more favorable lawsuit settlements like the one with SK Hynix. At the moment, Netlist is in the midst of lawsuits against Google, Samsung (OTCPK:SSNLF), and Micron Technology (MU). However, I think that there are no indications that any of the lawsuits will go Netlist’s way. In addition, some of these lawsuits have been going on for a long time and they are a drag on the company’s financial results. In Q1 2022 alone, Netlist spent $2.8 million on intellectual property legal fees, which represents a 24% increase year on year. And it looks like these expenses will continue to be high for some time as some of the defendants are not as eager to settle as SK Hynix. For example, the lawsuit against Google has been dragging on since 2009. The most recent development regarding that particular case was in May 2022, when a California federal judge ruled Netlist can continue to pursue allegations that Google’s memory servers infringe its patented memory module technology. You see, Google asked the patent office in 2010 to reexamine Netlist’s patent as the latter has canceled or amended a number of the patent’s claims since then as well as added dozens of new claims. Netlist also amended its infringement contentions in 2021. What Google argued now is that it should be protected under the intervening rights doctrine, but the judge ruled that the patent office determined the claim was patentable as originally issued. I expect this lawsuit to drag on for years.

Overall, I don’t expect any of Netlist’s current lawsuits to be resolved anytime soon and this is bad news for the market valuation of the company because there are no clear catalysts on the horizon. Even if there is a settlement with the likes of Google or Micron, there is no guarantee that Netlist will receive a payment that is higher or equal to the license fee from SK Hynix. In December 2021, Netlist was awarded zero dollars in damages in a breach of contract dispute with Samsung.

I view Netlist as a small semiconductor company whose products have failed to find traction and I think that its license product purchase and supply deal with SK Hynix isn’t a good one considering the operating loss has widened significantly. The $40 million license fee the company received from SK Hynix was a big win, but I doubt that it’s replicable. Keep in mind that Netlist has been suing global semiconductor giants for over a decade now and this is pretty much all it has to show for it. In my view, the business of Netlist isn’t worth much in its current state and this could be a good time to open a small short position as data from Fintel shows that the short borrow fee rate has dropped to 8.65% as of the time of writing.

Looking at the risks for the bear case, I think there are two major ones. First, I could be wrong that any of the remaining lawsuits won’t be resolved soon, and that Netlist won’t receive large license fees. If this happens, the share price could skyrocket. Second, sometimes the share prices of companies on the OTC market can increase for spurious and unknown reasons, and it’s possible that this will happen again here in the future.

Investor takeaway

The revenues of Netlist more than tripled in Q1 2022 but the growth came from the resale of SK Hynix products which is a business that has very low margins. As a result, the operating loss soared by over 50% to $5.8 million for the quarter and it seems that this figure could exceed $20 million by the end of 2022 as Netlist is still involved in several lawsuits. I don’t expect any of them to be resolved anytime soon or result in another large licensing fee.

With no catalysts on the horizon, I think Netlist’s share price will eventually decline to around $2.00 which was the level it had in the months after the SK Hynix license fee announcement. The short borrow fee rate is below 9% but there are no call options available to hedge against risks. In view of this, it could be best for risk-averse investors to avoid Netlist.

Be the first to comment