hapabapa/iStock Editorial via Getty Images

I have both written and read a number of articles on Seeking Alpha. It is one thing to write an article offering a strong opinion and suggest that readers should buy stock XYZ for various reasons and it is something entirely different to say I made an investment bet with both courage and conviction. As mostly a small-cap value investor, you might be surprised, shocked even, to learn that:

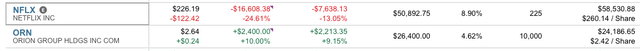

1) I bought shares of Netflix Inc. (NASDAQ:NFLX) for the first time ever, in the afterhours on Tuesday night and more shares, yesterday, during regular trading and 2) this is now my largest sized bet in the portfolio.

Enclosed below, as you can see, Netflix is now my largest sized position. Usually, I try not to size my favorite ideas more than 15%, but I am making a special exception here, as I would argue it is rare to get the chance to buy such a high-quality business at such a good price. As my first attempt to buy shares was done in afterhours trading, this past Tuesday night, my average cost basis is $260.14 per share.

Fidelity Live Portfolio Snapshot

Also, for sizing perspective, as Orion Group Holdings (ORN) happens to be listed in alphabetical order in the portfolio, I decided to include it in the NFLX portfolio snapshot too. As an aside, on March 23, 2022, I shared a free site article on Orion with readers and would argue that it offers tremendous risk/rewards in the mid $2s, but even I am not bold enough to bet more than 10% of the portfolio on Orion.

And before we dive in here, I did see the last night’s news that Bill Ackman liquidated his $1 billion plus sized position in Netflix. From accounts in financial news, it is my understanding that Bill was long shares of Netflix, also for this first time, back in January 2022, establishing a position in the high $300s. For the record, and just to be clear, I think Bill Ackman is a really smart and a very good investor, with a strong track record. That said, it shows you much pressure there is competing in the Tier 1 investment world. The pressure to always be right both in the short term and long term, at least optically, might have influenced Bill’s decision to throw in the towel and reassess on Netflix. I don’t move in the same circles as Bill, so I don’t have the luxury of calling him to find out why he really sold his position. Incidentally, had we not learned of Bill’s decision, I would have guessed Bill would have doubled down, starting at yesterday’s opening bell and been buying throughout the day. We know now that isn’t the case and he decided to take his expensive medicine and move onto what he perceives as greener pastures.

Let’s Talk Netflix

There are 42 sell-side analysts that cover Netflix. As of yesterday, its market capitalization was only slightly north of $100 billion. Incidentally, on November 17, 2021, Netflix shares kissed $700 (then a $315 billion market capitalization) and NFLX shares entered 2022 at $602.44 per share (then a $271 billion market capitalization). So as a value investor, even those I didn’t low tick it, as NFLX shares closed at $226, and NFLX shares very well could trade under $200, at least in the very near term, I would argue, at $260 per share, my average cost, I am buying a great business, at a good price. And for the first time in ages, as of yesterday, Mr. Market was offering investors a proportional equity interest in this great business and at an attractive valuation.

My Thesis Really Simple Thought Process On Netflix

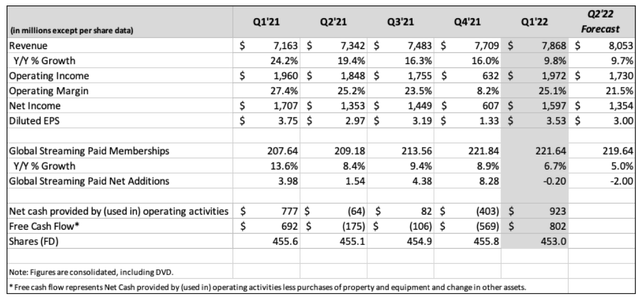

If we take a step back, at the end of Q1 FY 2022, Netflix has 221.64 million global subscribers. Entering 2022, the market was valuing this as a growth business and market participants had to pay a princely multiple to own a piece of this business. In January 2022, Q4 FY 2021 numbers were revealed and net subscriber numbers missed expectations. Given the high valuation, the stock got dinged as growth investors exited stage left and took their medicines at $400 per share.

This past Tuesday night, we learned that excluding the wind down of the Netflix in Russia (700K impact), Netflix’s net subscriber add was only 500K vs. its guidance of 2.5 million subscribers. Adding insult to injury, Netflix guided the Street to a net subscriber loss of 2 million in Q2 FY 2022. No question, at least at the margin, the highest inflation in 40 years, record nominal gas prices, and the war in Ukraine impacted the marginal subscriber. Perhaps, at least at the margin, competition did too.

At this point, the growth story and narrative changed. Growth investors only care about growth (Stevie Nicks’: Players only love you when they’re playing phrase, from the song Dreams, comes to mind) and don’t allocate capital based on valuation. So yesterday’s 35% decline, with NFLX shares losing $122.42 points, turned into a stampede as mitigating growth herd rumbled off in search of greener pastures.

Netflix Q1 FY 2022 Shareholder Letter

If you take a step back, this means thinking independently and ignoring the allure of reacting viscerally. This means ignoring the scary headlines, and the dramatically slashed sell-side price targets. This also means being comfortably contrarian and willing to weather the near-term effects of that migrating herd’s cloud of dust and trail of destruction, the share price in this case, left in its wake. Moreover, baton passes from growth investors to value investors are rarely well executed like Olympians gracefully running 4 x 100 relay races.

At the end of the day, Netflix is an incredible business because of its original content. And the company, like other great businesses, such as Amazon (AMZN) or Apple (AAPL), and a selective number of other businesses, and there aren’t many on the planet of this scale, correctly understood that its moat was to reinvest its robust operating cash flow back into its business. And again, in this business, that reinvestment is the creation of compelling original content. If you read management’s Q1 FY 2022 shareholder letter or listen to its Q1 FY 2022 conference call – that hasn’t changed. At face value, the competition is fierce with the likes of Amazon, HBO Max, Hulu, and many others, but I would argue that Netflix is so far out front and will win the content arms race.

Secondly, and this is really the linchpin to my thesis, besides doing a better job of monetizing the numbers of free riders (the rampant password sharing), and this is a vast pool of would-be subscribers (or incremental revenue per account), I would argue that management needs to stop chasing the last marginal subscriber addition and stop pretending to be a growth company. Growth is good, but not at the expense of profitability. Why let the transient and very marginal customer get to set the price of the service?

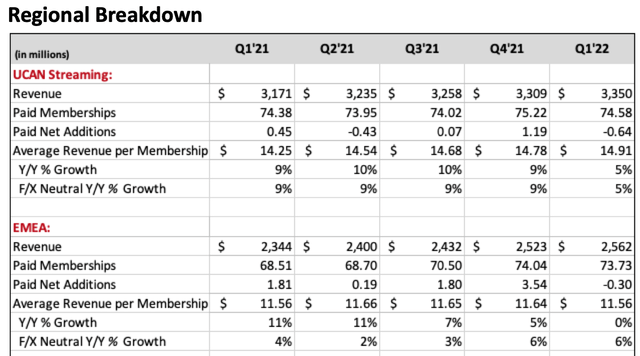

If you run the math, in the UCAN region alone, a $2 per month ARM (average revenue per member) increase translates to a $860 million uplift and that assumes a lower user base, perhaps 70 million members as opposed to 74.58 million now.

Here’s the math:

74.58 million UCAN members x $14.91 per month x 12 months equals $13.344 billion per year in revenue. 70 million UCAN members x $16.91 x $12 months equals $14.2 billion in pro-forma annual revenue. That is an $860 million uplift that drops straight to the bottom line and we are only talking about in UCAN. This exercise can apply to Netflix’s other regions, albeit with a more moderate absolute dollar increase.

If you take a step back, like many other great companies, and again, Amazon and Apple come to mind, these companies are so successful because they create so much value for consumers relative to what they charge for their services. Apple does it through great software and huge economies of scale. Amazon does it through tremendous economies of scale and Prime is its anchor. With Prime as its loss leader, Amazon makes up for these losses in other segments and Prime keeps consumers in Amazon’s orbit.

In United States, as of April 2022, it cost $60+ to fill up your gas tank and going out to grab a fast casual lunch can cost upwards of $10 to even $15 per person. Netflix offers tremendous value for people’s entertainment dollars. And I would argue that this value is so far in excess of what they charge. Therefore, and you have to do this gradually, despite the competition, I would argue that as long as the original content stays strong, Netflix has pricing power and remains a great business. Although Wall Street voting machine might disagree, at least in the short term, as Sir Warren says, in the long run, Wall Street is a weighing machine.

Netflix Q1 FY 2022 Shareholder Letter

Netflix Q1 FY 2022 Shareholder Letter

Valuation

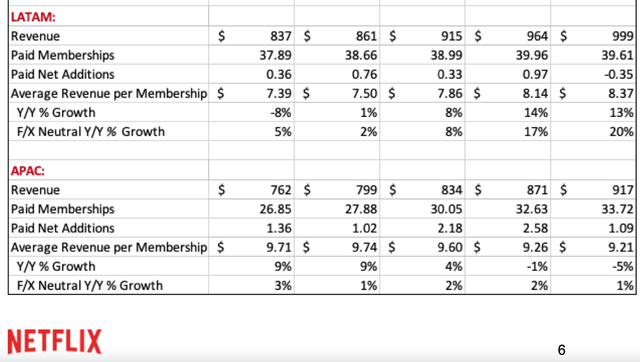

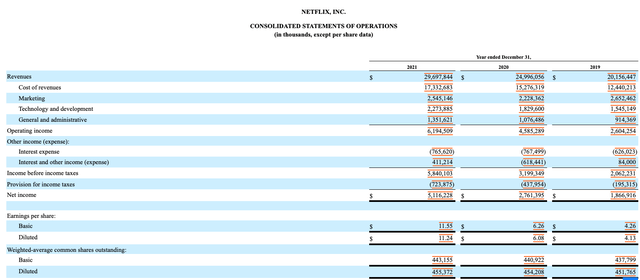

In FY 2021, NFLX earned $11.24 per diluted share. So, at $500 per share, an investor was paying 44.4X earnings. This is a great business, but it has traded like a great business. This was the case for years.

Netflix FY 2021 10-K

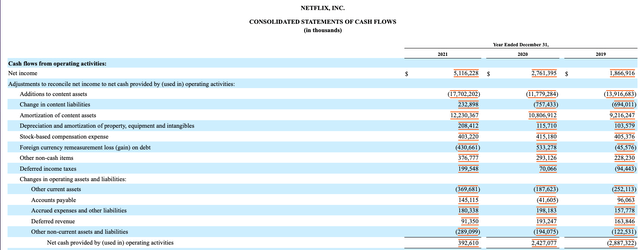

In 2021, NFLX’s operating cash flow before changes to working capital was $18.3 billion. However, and as you can see, the company has aggressively reinvested that cash flow back into content. They spent $17.7 billion on content in 2021, $11.8 billion in 2020, and $13.9 billion in 2019.

Netflix FY 2021 10-K

Netflix has 453 million fully diluted shares outstanding. $226 per share x 453 million shares equals a $102.4 billion market capitalization. At the end of Q1 FY 2022, Netflix’s net debt was $8.6 billion, so we are talking about a $111 billion enterprise value. So, Netflix’s EV / FY 2021 Operating Cash Flow (before content) is only 6.1X ($111 billion / $18.3 billion). I am really happy to buy the stock in this business at this valuation.

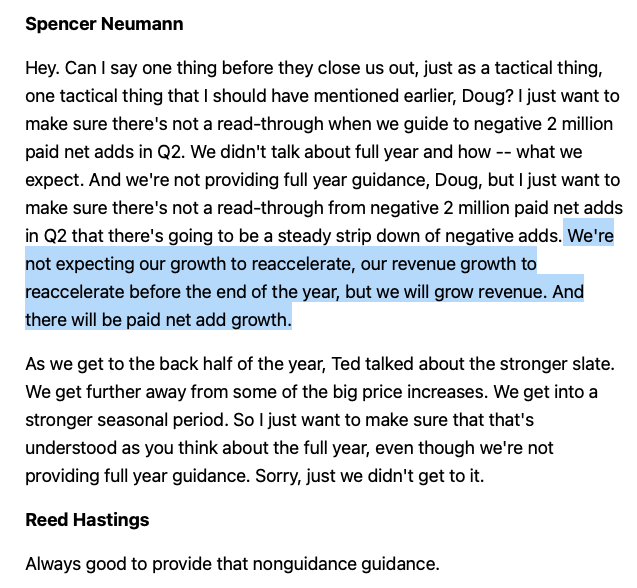

Secondly, if you read or listen to Netflix’s Q1 FY 2022 conference call, Netflix is unofficially guiding the Street to net paid add growth for fully year 2022. So, this coupled with increased pricing means FY 2022 operating cash flow and EPS should be higher than in FY 2021.

Netflix Q1 FY 2022 Conference Call Transcript

Putting It All Together

As I said in the opening paragraph, it is fun to write an article and offer readers a ‘strong buy’ recommendation, but unless there is skin in the game and a person is investing with conviction, I would argue strong buy recommendations are selling for a dime a dozen. Netflix is a fantastic business that is finally selling for a good price, something so rare as great businesses don’t go on sale very often. So as the migrating herd of growth investors ride off into the sunset, in search of their next adventure, value investors can swoop in and pick up the shares of Netflix being offered by a pessimistic Mr. Market, with NFLX shares down 68% from the November 2021 all-time high and offered in the low $200s.

Although it might be scary for many investors to contemplate buying Netflix, as the conventional wisdom and narrative have swung widely in less than six months, this is still a great business that produces compelling original content. As long as Netflix is creating this unique and original content, and they are doing it so well on a global scale, this is the moat despite all the competition.

At the end of the day, I am betting that the value Netflix offers its monthly subscribers is so far in excess of its intrinsic value and relative value from a purchasing power perspective (the cost of other monthly expenses both entertainment and non-entertainment) that this business has pricing power. Moreover, over time, management might work out what I have already worked out, stop chasing the marginal subscribers as gradually rising ARM is better than under-pricing the service to appease Wall Street growth investors. Yesterday, the Wall Street growth posse left the Netflix saloon. Perhaps, Netflix’s management will take notice and court the big pools of value investors and their capital.

And one more point. Let me offer a wild and speculative prediction. I won’t be shocked if later learned that Sir Warren ends up buying some Netflix shares. He has a huge war chest of dry powder and he too is an opportunistic buyer of great businesses. We shall see.

Be the first to comment