cyano66/iStock via Getty Images

Netflix, Inc.’s (NASDAQ: NFLX) share price has been in a steep decline since mid-November. Macroeconomic changes and market saturation put downward pressure on its movement. At only $374-$376 today, it has already plummeted by 37% from its start price this year. But, it still appears to be slightly overvalued. Plus, a lot of investors are apprehensive of the increased competition.

Meanwhile, it still boasts impressive fundamentals despite the emergence of competitors. Revenue growth slowed down, but margins continued to widen. The company may penetrate more markets, especially in the Asia-Pacific region, so it can fight back, given its innovative business and investment model. Brand loyalty and a good reputation will help keep its strong market position.

Company Performance

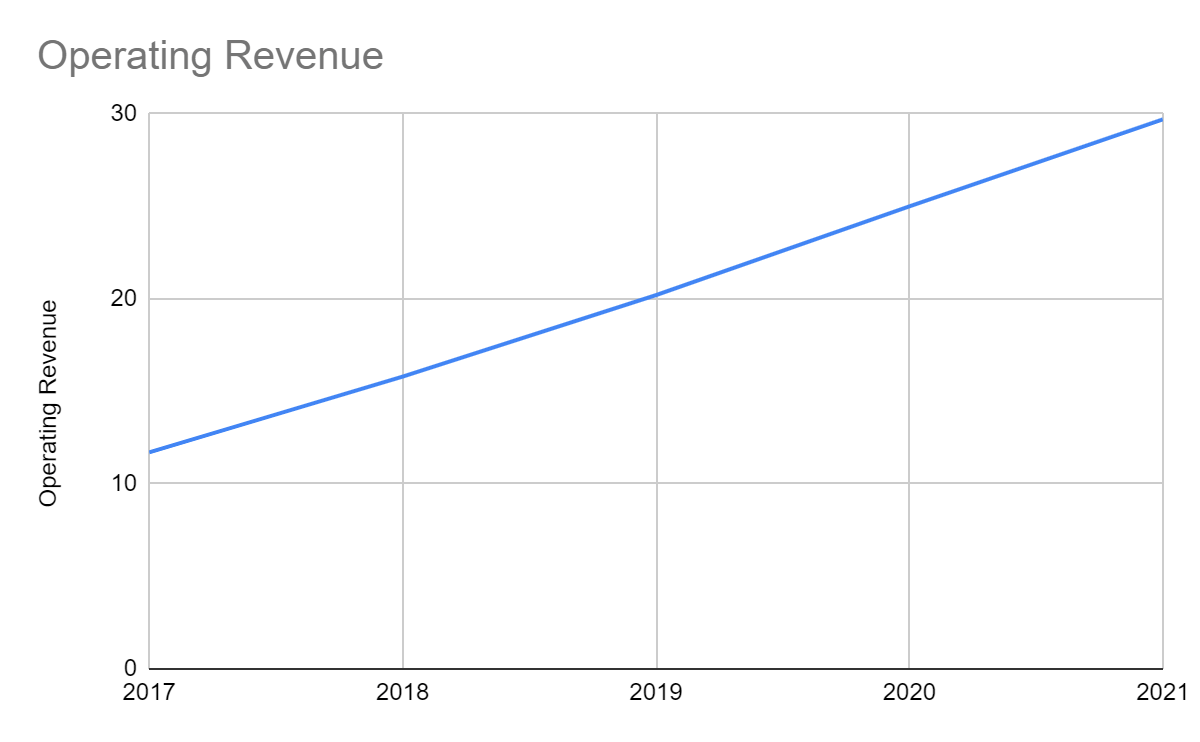

In recent years, Netflix has shown sound financial performance. Its continued revenue increased from $11.7 billion in 2017 to $29.7 billion in 2021. In only five years, its sales have already more than doubled. Yet, its revenue growth has continuously declined as more competitors entered the market. From 35%, it slowed down to 18%. This could have been a warning sign that it lost its appeal to some audiences.

Operating Revenue (MarketWatch)

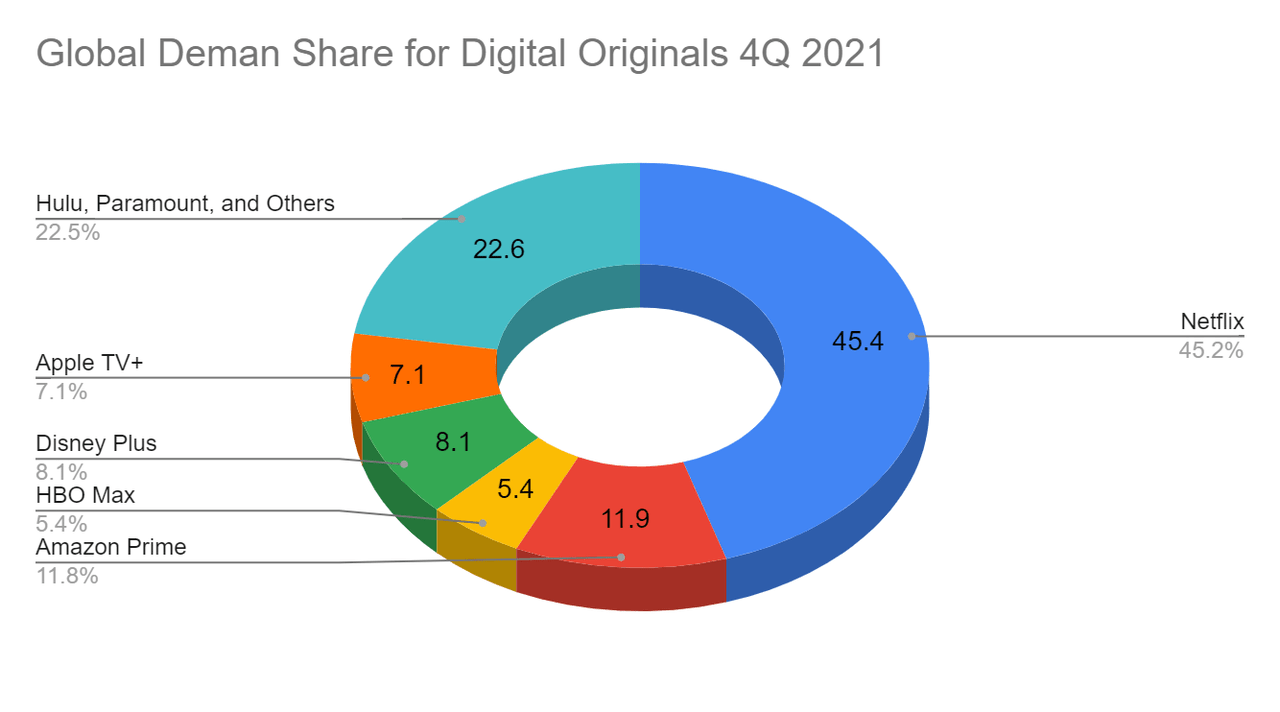

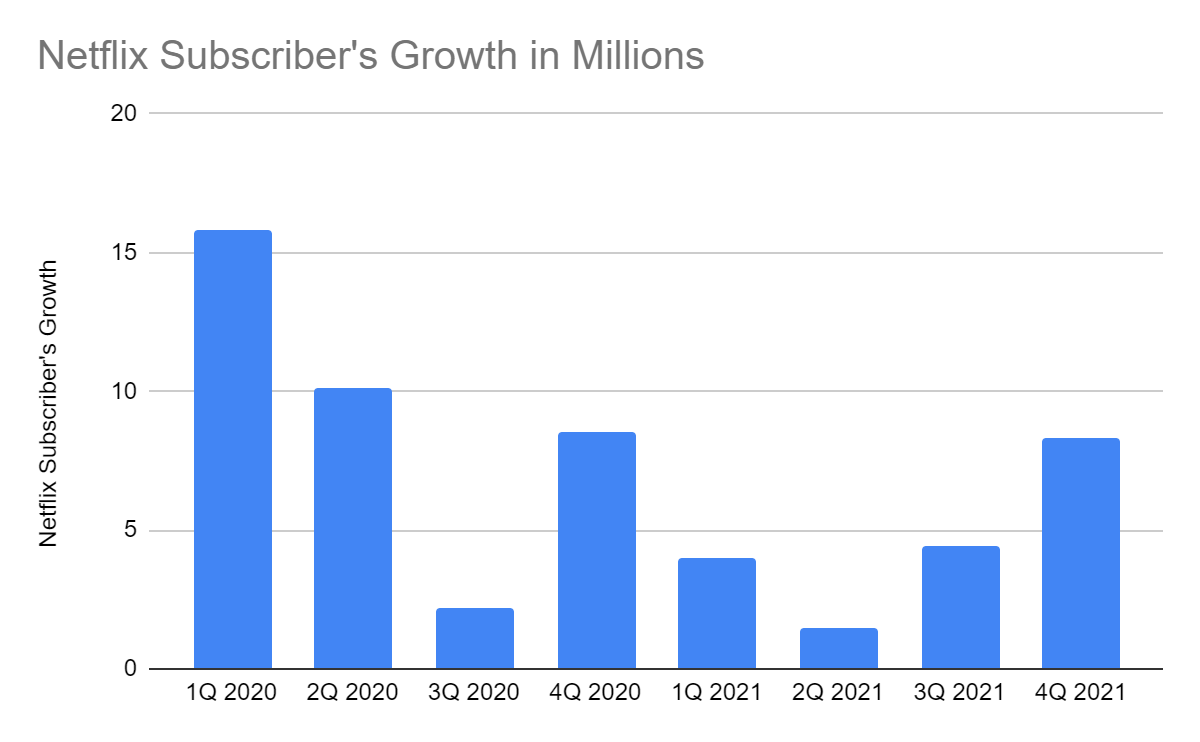

The core businesses’ year-over-year growth in subscribers decreased from 22% to 9% in 4Q 2020-2021. This was primarily due to HBO Max, Disney Plus, and Apple TV Plus, which cut into it. Although it sped up in 4Q, growth was inadequate to make up for the lost subscribers in the three quarters. Netflix continued to dominate the global market, but its demand share shrank to 45% in one year. The decrease was most evident in the US.

So, it is no surprise that many investors think that the combined force of its competitors can churn it out. They may only need to build the same connections and loyalty and finance its content to go head to head with it. Worse, they may find ways to emulate the business and investment style of Netflix. The well-loved Marvel and Star Wars franchises were other growth drivers. Nevertheless, Netflix had an additional 8.3 million globally, 1.2 million from the US and Canada in 4Q 2021. This also marked the strongest quarter of member growth in the last two years.

Demand Share of Streaming Services (Parrot Analytics)

Subscribers Growth (Bloomberg)

But what we must remember is that there are other, smaller competitors in other regions. HBO Max and Disney Plus cannot easily penetrate them. Netflix can easily fight them back there because it already has a local scale. Unlike those two, Netflix can penetrate more countries with lower ARPU because of its great local content slate. It provides foreign streamers with an avenue to share their content. In turn, Netflix benefits as more subscribers are drawn to it.

Moreover, Netflix takes advantage of the fact that there is no local market. The thing is, no streamer is present in all markets, and no channel can monopolize creativity. Keep in mind that other competitors rely on acquisition more than their organic growth, especially Disney. What sets Netflix apart from its peers is the quality of series and movies it streams. In fact, it dominates the top-ten most searched series on Google. It is becoming visible in movie content. Also, it continues to produce local content before making it a global hit. Given this, it has more chances of penetrating other regions.

Solid and Intact Fundamentals

Despite the steady decline in revenue growth, the actual value has consistently increased. Many are still bothered with the decrease, which appears normal as more rivals enter the market. The thing is, Netflix still protected its market position.

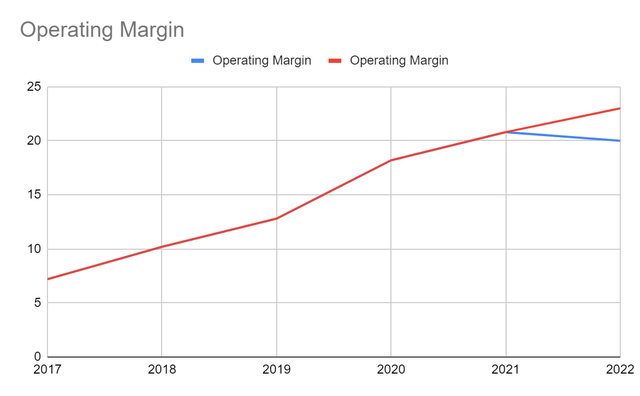

Moreover, Netflix’s capitalization on growth through prudent expansion remains successful. Its well-maintained profitability proves it. Its operating profit amounted to $6.2 billion, a year-over-year growth of 32%. The operating margin rose from 18% to 20%, showing that revenue growth was higher than costs. The 2% increase in the margin means a lot, given its size and scalability. Netflix had higher efficiency. It was able to keep its costs and expenses lower amidst the competitive market environment. Net income jumped by 86% and reached $5.12 billion. Its growth was almost twice as much as the growth in 2020. Indeed, it becomes more profitable, proving its increased capacity to sustain its growth and expansion.

Its Return on Asset (ROA) improvement can further explain this. From 2020 to 2021, its ROA rose from 7% to 11% on earnings of $11 per $100 assets. The growth in the size of assets and the ROA can verify its asset management efficiency. Meanwhile, its Free Cash Flow (FCF) decreased to -$150 million. But, it was still in line with its expectation of approximately breakeven. This was primarily due to its acquisition of Roald Dahl Story using its cash on hand.

Netflix may have lost a portion of its market control, but its real growth remains impeccable. It remains efficient and careful while booming. Also, it has consistency and stability in all its financial statements, which means that it has ideal profitability and sustainability.

This year may be even better for Netflix. It aims to see paid net adds of 2.5 million this quarter vs 4 million in 1Q 2021. It reflects a back-end weighted content slate with fairly good reviews, such as Bridgerton S2 and The Adam Project. This may be logical since acquisition growth has not rebounded to pre-pandemic levels. Also, macroeconomic changes in other regions may affect the purchasing power of many individuals. Given this, the annual operating margin may be lower at 19-20%. But, the Linear Trend Analysis projects it at 22-23%.

It plans to reinvest in core business while funding new growth opportunities like gaming. This month, it announced its acquisition deal with Next Game for a total equity value of €65 million. The company, with 120 employees, recently reported its revenue at €27.2 million, with 95% from in-game purchases. This may provide more opportunities as Netflix improves further in series and movies. Also, it aims to lower gross borrowings, showing a more stable financial leverage.

Operating Margin (MarketWatch)

How Netflix May Address These Challenges

Netflix remains the leading streaming service with 220 million subscribers. Overall, six out of the ten most-watched TV shows and two of the ten most-watched movies were from Netflix. Amazon Prime takes the second spot with 200 million subscribers. But we have to note that not all of its members are streaming its videos. So, if we focus on video streaming alone, Netflix’s lead may be wider.

Here are some techniques that Netflix may continue and consider to keep up with the competition.

Pay Attention to the Untapped Potential in Other Regions

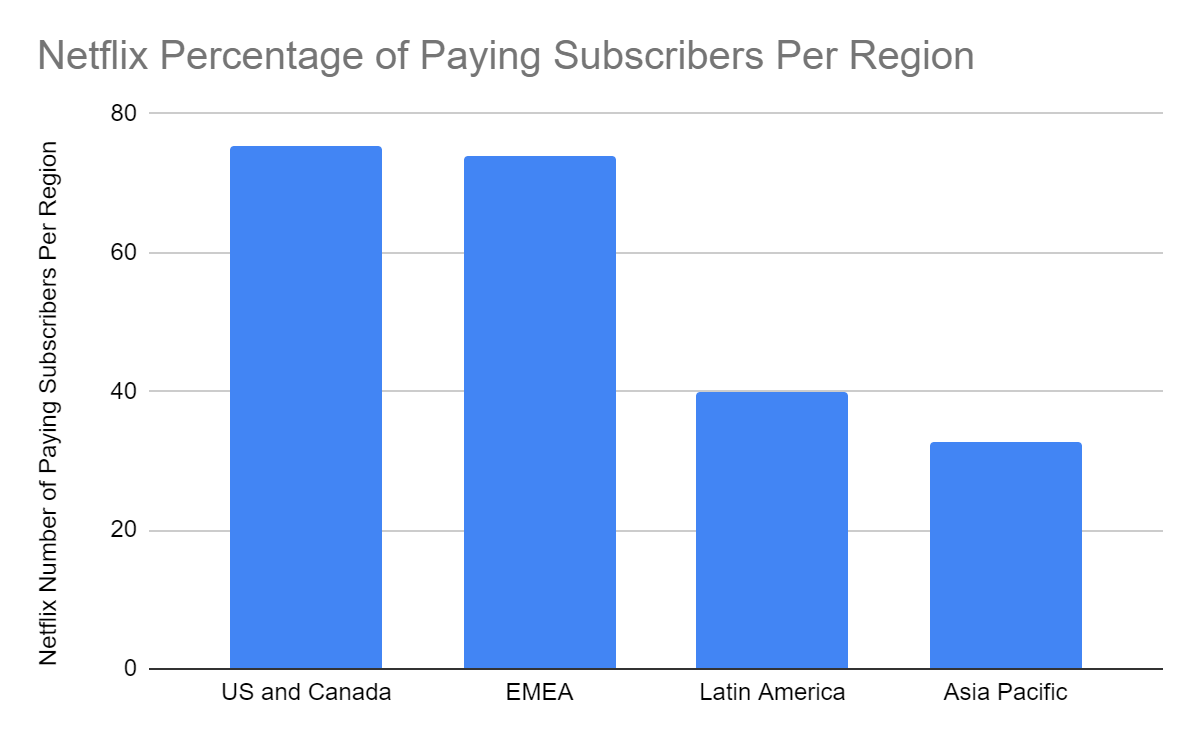

To maintain its strong market position, it may turn its attention to markets with low ARPU. For example, the paying subscribers in Latin America and the Asia Pacific are 40% and 33%, respectively. Currently, it dominates South Korea with the success of Squid Game with 1.65 billion watch hours.

Netflix Percentage of Pad Subscribers (Statista)

These regions are driving the growth in Netflix subscriptions. Since they have the smallest penetration, it has more potential to expand there. Of course, this will challenge Netflix to acquire more members and subscribers. But I believe that it is on its way to further expansion. After the success of Squid Game, it released another Korean hit titled All Of Us Are Dead with more than 100 million watch hours.

It may be a bit presumptuous to measure the capability of Netflix through the South Korean series alone. But, its popularity has become more evident over the years. In a study conducted in 2021, 76% of the respondents worldwide said that the Korean series is popular. Experts estimate that the number will grow to 5.3 million this year.

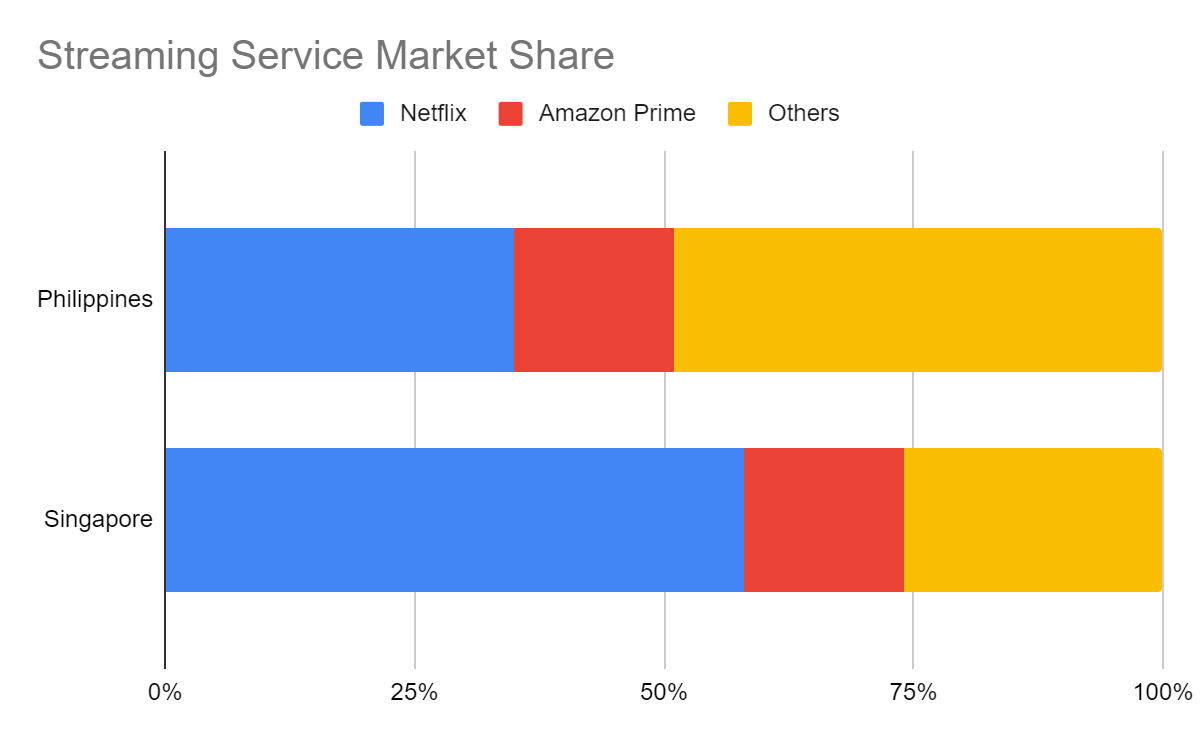

Likewise, other countries in the region are dominated by Netflix. For example, Singapore remains attached to Netflix with a 57.5% market share. YouTube TV and Amazon Prime Video have 22.5% and 15.7%, respectively. The remaining percentage goes to other streaming service platforms. Likewise, the Philippines are geared towards Netflix, with 35% of the total subscribers. It has a more diverse distribution, given the popularity of Asian providers, such as iFlix. The adaptation of Trese, a Filipino comic, further drove its dominance in the country.

Streaming Service Market Share (Statista)

Netflix must take advantage of the current market trend to maintain its position. Its strong reputation and brand loyalty matched with diversity will help it fight back its primary competitors. With more Asian series and movies, it may penetrate other countries in the Asia Pacific. Of course, the biggest challenge is in China, where streaming services are more diverse and abundant. Even so, the other untapped potential will become another primary growth driver.

|

Netflix Rank Market Share Asia Pacific |

|

|

Australia |

1 |

|

China |

Not Included in Top Five |

|

Hong Kong |

1 |

|

India |

1 |

|

Indonesia |

1 |

|

Japan |

2 |

|

Korea |

4 |

|

Malaysia |

1 |

|

Philippines |

1 |

|

Singapore |

1 |

|

Taiwan |

3 |

|

Thailand |

2 |

|

Vietnam |

1 |

Increase the Number of True Subscribers

Password sharing has been a strategy of many viewers to save money. But now, Netflix has started to crack it down with its testing in Chile, Costa Rica, and Peru. The platform won’t ban sharing, but people will have to pay for it. It may increase its revenue, given the high demand and the emergence of more foreign series and movies. Also, it is the longest-running and growing streaming service. It shows that accurate data back its decisions. But, it has to be more careful and watch out for its primary competitors’ pricing strategy and new deals.

Maintain the Quality of its Content

As previously mentioned, Netflix benefited from its foreign series. Indeed, it was able to keep up with the market trends as Korean series and films became more popular. The content and penetration in the smaller market increased its watch hours in 2021.

Aside from its popularity, the quality of content is integral to its capacity to win the battle. Although the other competitors produced global hits, Netflix continued to outdo them. It is no surprise that it had the most series among the ten most searched on Google. Now, it is capturing more movie viewers with its increased visibility. Two of its movies were among the top ten searches.

Netflix remains a hundred steps ahead of its peers by backing its content with data. Algorithms play a vital role, and Netflix is playing with it well. Hence, it must also keep investing in creating great movies and series.

Don’t Forget About the Ads

It was a surprise for many investors to know its recent stand on ads. Netflix has long avoided placing ads in its core market. But at the investor conference, CFO Spencer Neumann said, “never say never.” It can be assumed that Netflix will soon consider it. Its market formidability and popularity give it the right to enter the world of ads. It may try making tier subscriptions with corresponding prices and ad frequencies.

What is more apparent is the management’s sound judgment and careful decision-making. While most of its peers are experimenting with AVOD and sports franchises, Netflix remains unperturbed. It does not have to rush things amidst the fast-paced trend in the market. It has more advantages should it also extend to sports due to its scale. Its stable financials may allow it to expand while reinvesting in its core business. Given the number of its members, the cost of purchasing new content per member is lower than its competitors.

Price Valuation

NFLX stock price has been in a steep decline since mid-November. From $687.40, it was cut by 14% in less than two months. At $374-376, it is already lower by 37%. To estimate the stock price value, I used the DCF model. I started computing for the FFCF of $14.5 billion. Its current WACC of 7.4% is for its discount rate. For its perpetual or perpetuity growth rate, I set it at 1.7%.

The derived value of $526.24 shows a 39.89% upside in share price. It is no surprise that doubts about member adds and revenue growth rate affected the price. Market volatility driven by macroeconomic changes is another aspect to consider. The difference between the price and the derived value is an opportunity to buy the stock. However, its PE Ratio of 33.32 is far higher than the S&P 500 and NASDAQ 100 average of 25.48 and 32.76. So, a decrease in earnings or a value lower than its 1Q 2022 guidance may put downward pressure on the price. Any market disturbances, such as interest rate hikes, may also hit NFLX. But, it is way better than its primary competitors, such as AMZN at 50.26 and DIS at 82.02. What is more evident is that NFLX is back at its pre-pandemic levels.

|

FCFF |

$14.5 billion |

|

Perpetuity Growth |

1.7% |

|

WACC |

7.2% |

|

Cash and Cash Equivalents |

$6.03 billion |

|

Total Debt |

$18.12 billion |

|

Shares Outstanding |

443,964,000 |

|

Stock price |

$374-$376 |

|

Derived Value |

$526.24 |

The derived value of $526.24 shows a 39.89% upside in share price. It is no surprise that doubts about member adds and revenue growth rate affected the price. Market volatility driven by macroeconomic changes is another aspect to consider. The difference between the price and the derived value is an opportunity to buy the stock. However, its PE Ratio of 33.32 is far higher than the S&P 500 and NASDAQ 100 average of 25.48 and 32.76. So, a decrease in earnings or a value lower than its 1Q 2022 guidance may put downward pressure on the price. Any market disturbances, such as interest rate hikes, may also hit NFLX. But, it is way better than its primary competitors, such as AMZN at 50.26 and DIS at 82.02. What is more evident is that NFLX is back at its pre-pandemic levels.

Key Takeaways

Netflix has shown massive growth over the past decade. It has dominated its market for years. But, the emergence of many competitors makes it hard for the company to maintain its market share. Its revenue growth has slowed down in recent years. Nevertheless, its expansion proved fruitful as margins continued to go up. Its ROA showed increased profitability as more assets were added. Hence, Netflix has more capacity to expand.

Given its market position, especially in the Asia-Pacific region, it may penetrate more low-APCU countries. Meanwhile, stock price appears to be lower than the DCF estimation. But, investors must watch out for its PE Ratio. Changes in EPS and actual and projected value differences may affect its trend. I suggest they hold and wait for the 1Q 2022 earnings report before buying or selling NFLX stock.

Be the first to comment