wutwhanfoto

Main thesis

Netflix (NASDAQ:NFLX) has been a fast-growing story for a long time. The company’s capitalization had been growing at a huge pace from 2017 to 2021 at a CAGR of 28.8%.

Everything has changed, however, in 2022. The company’s shares have lost 60% since the beginning of the year. NFLX is no longer a growth stock.

In this article, I will be comparing parallel realities: Netflix as a growth stock and Netflix as a value stock. As the fundamentals have changed completely, it’s like comparing two different companies with similar business models.

Companies rarely die from moving too fast, and they frequently die from moving too slowly.

– Reed Hastings (the co-founder of Netflix)

Netflix as a growth stock

Growth rates

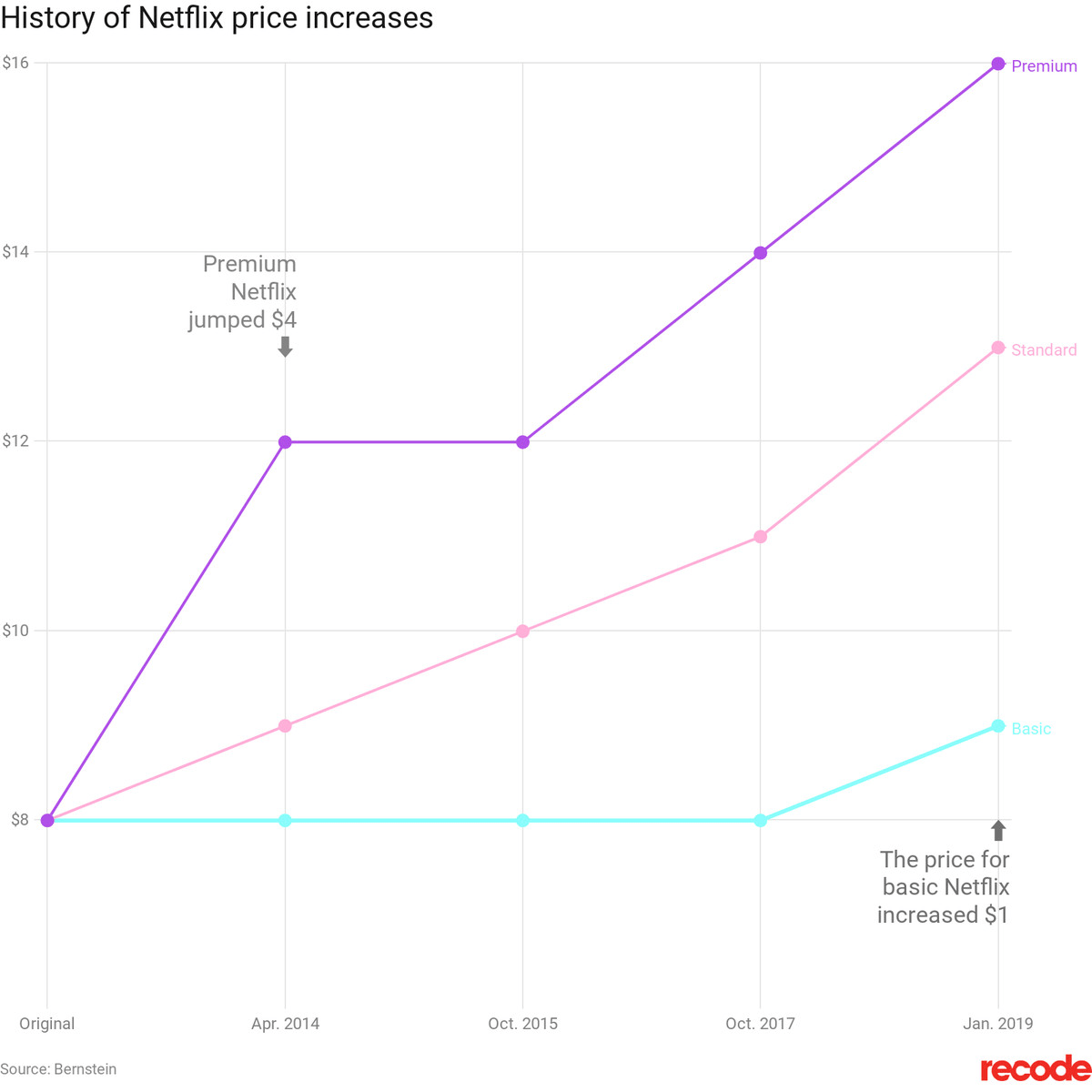

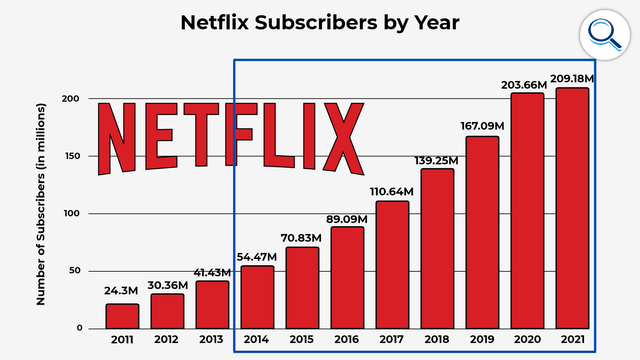

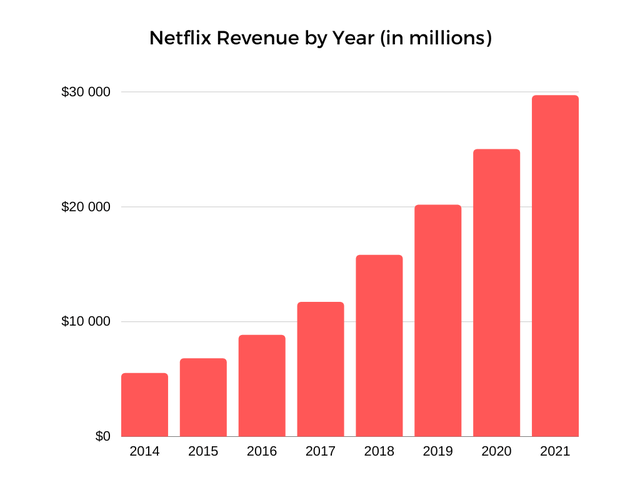

It is difficult to say exactly when the global previous growth cycle began. Over the past decade, the company has experienced incredible growth in terms of both paid subscribers and revenue. I prefer to use 2014 as a starting point, as that was the year the company started raising prices on its premium and standard plans. Thus, subscriber number growth had not been driven by low subscription costs alone.

Vox

From 2014 to 2021, the number of paid subscribers had been growing at a CAGR of 18.3%.

During the same period, the company’s revenue grew 5.4 times and had been growing at a stunning CAGR of 23.4%.

As we can see, Netflix had been growing at an incredible pace, gradually increasing its subscriber base and market share. The company proclaimed itself the king of streaming, and all competitors so far had only been looking up with envy and scratching their heads.

Favorable environment

The main growth driver has always been the transition of the audience from television to streaming. Nielsen’s research shows that in the first half of 2021, Network and Cable accounted for 64% of all time spent on TV while streaming accounted for only 26%. In just a year, approximately 7 million households cord-cut and switched to streaming.

The trend is based on changing consumer preferences. Streaming services are more affordable, offer original content not available anywhere else, no ads, and a wide selection of movies and series that you can watch anytime, regardless of the TV program.

The company operated in a rapidly growing market driven by changing consumer behavior. This, combined with the strong positions of Netflix itself, has resulted in incredible organic growth.

It should be noted that Netflix will continue to operate in a favorable environment, which will certainly be a further driver of operational growth, but the company will no longer see the growth rates of the previous cycle.

Valuation

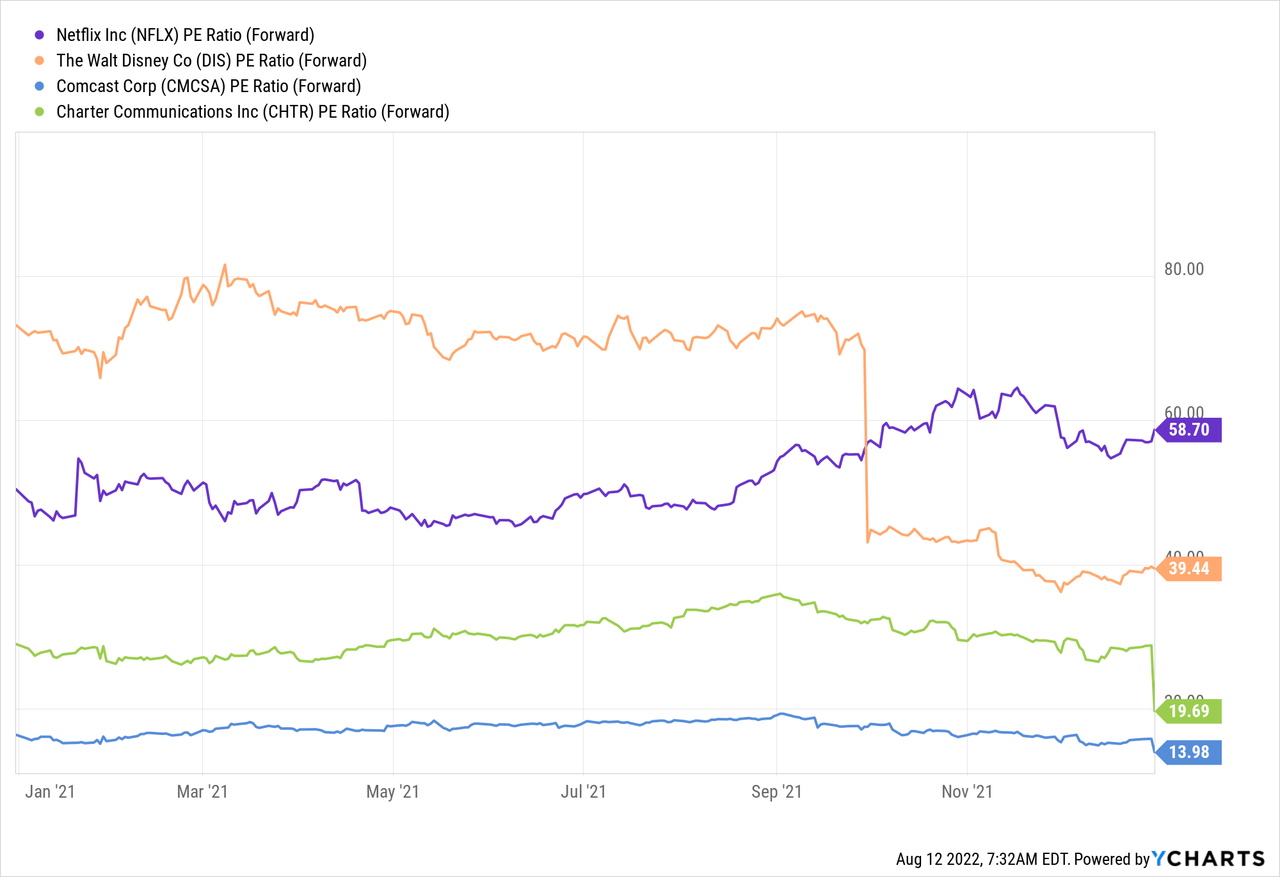

In 2021, which can be considered the end of the previous cycle, multiples had reached close-to-absurd values.

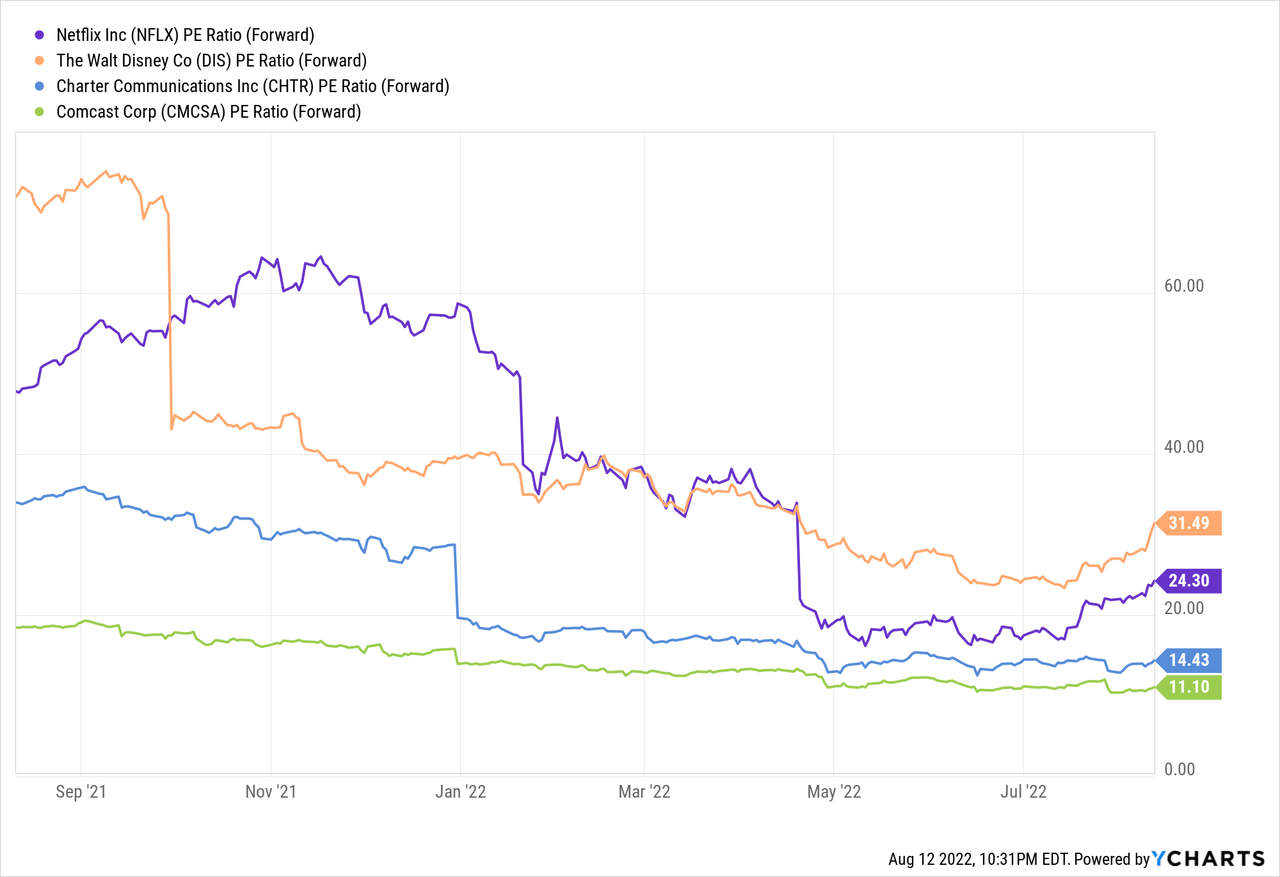

The forward P/E ratio was 58.7x at the end of the year, with an industry average of 20x (author’s estimates).

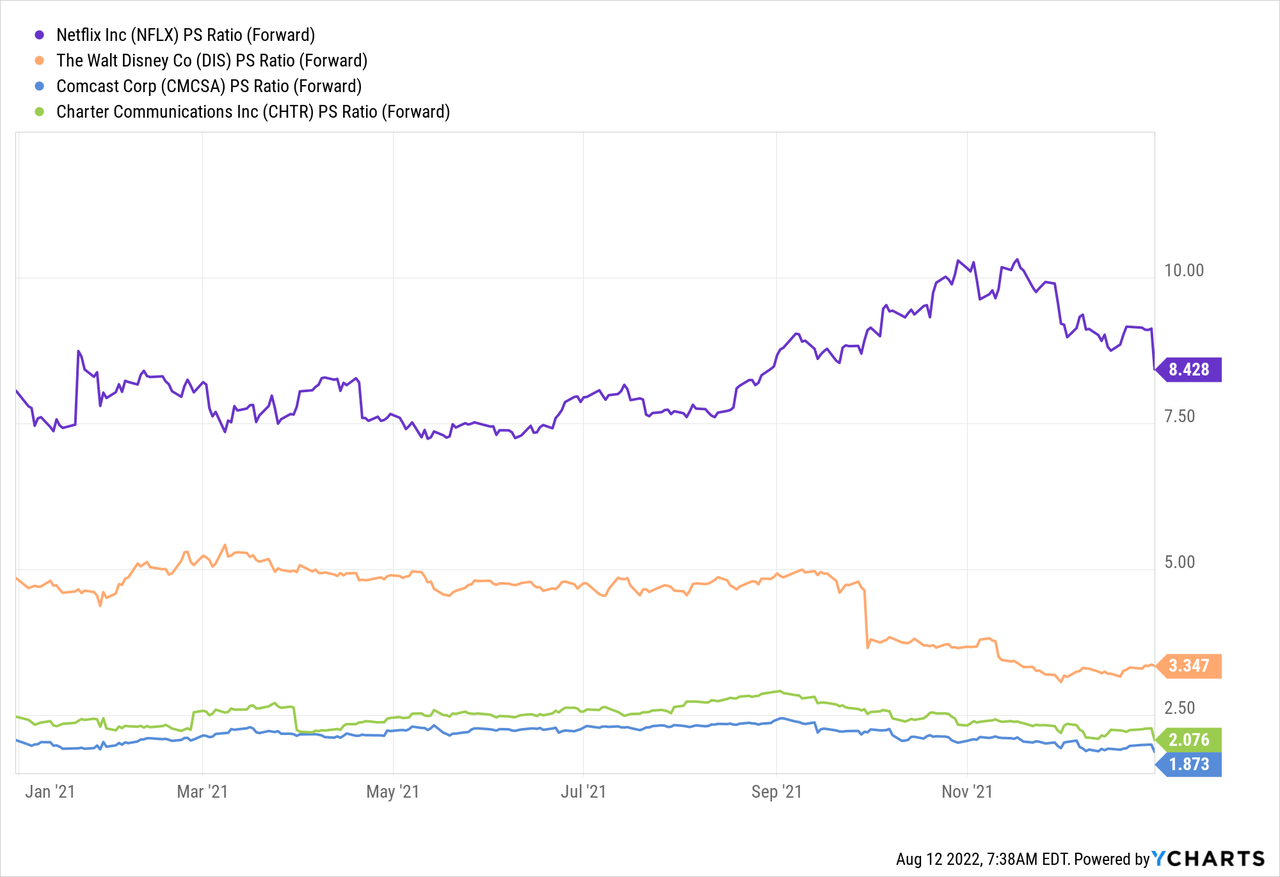

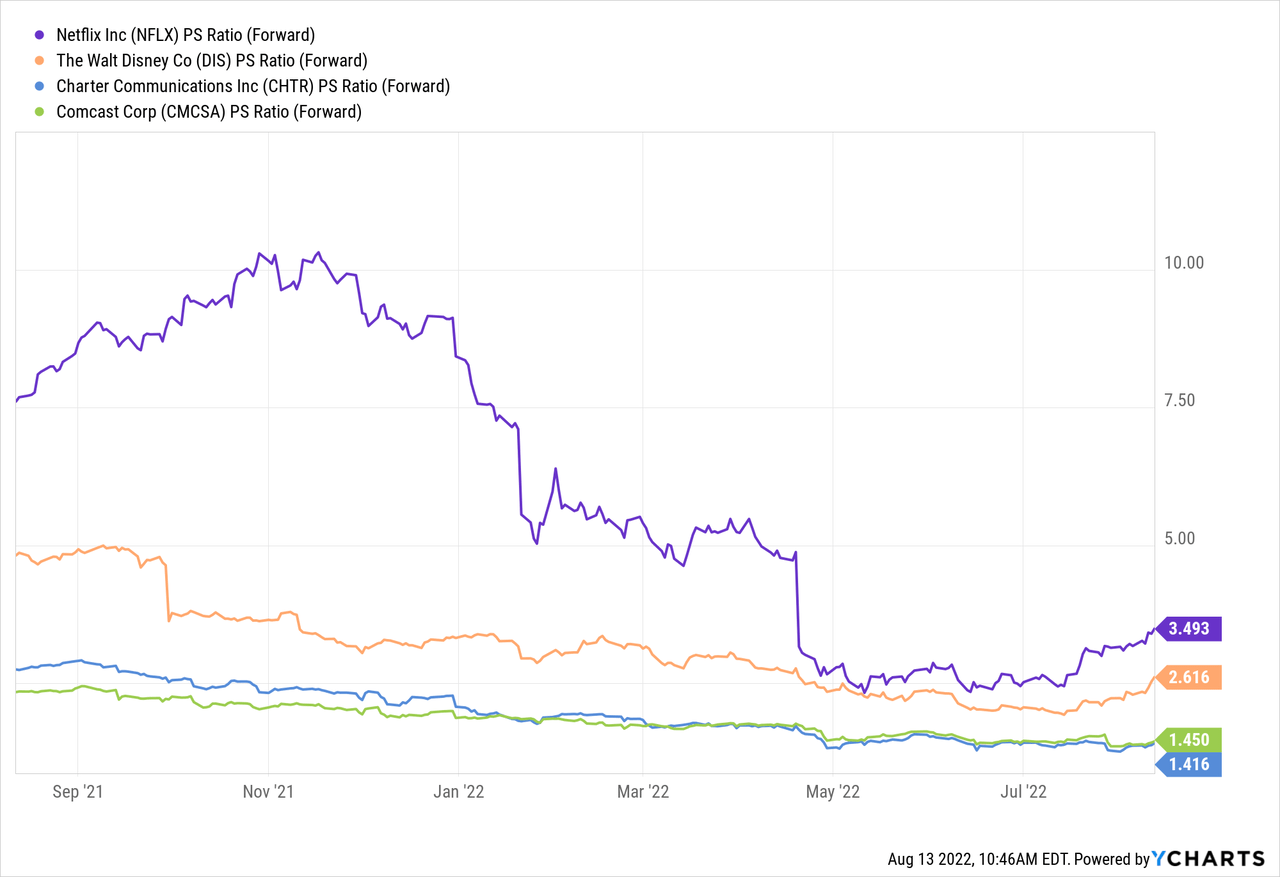

NFLX was trading at a forward P/S of 8.4x, with an industry average of 1.5x.

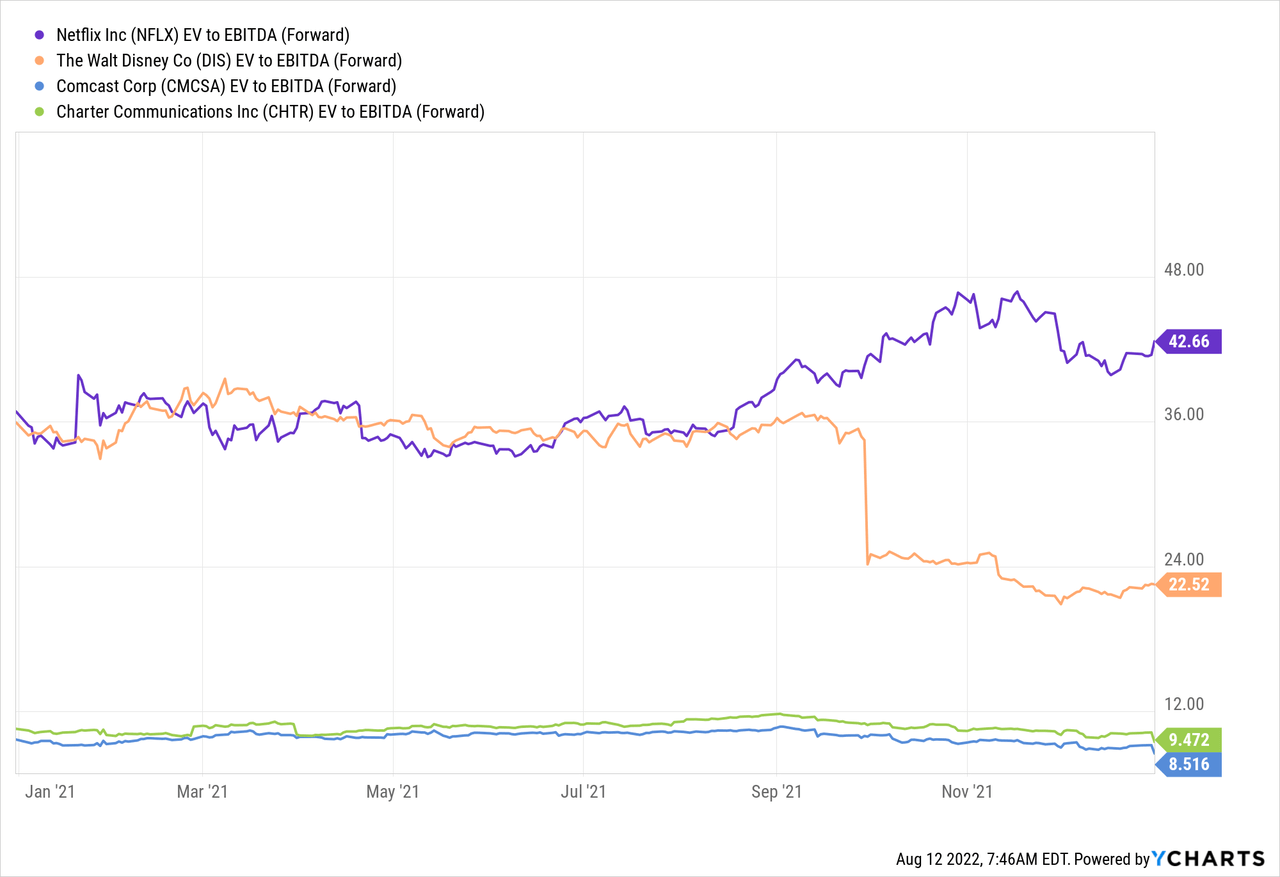

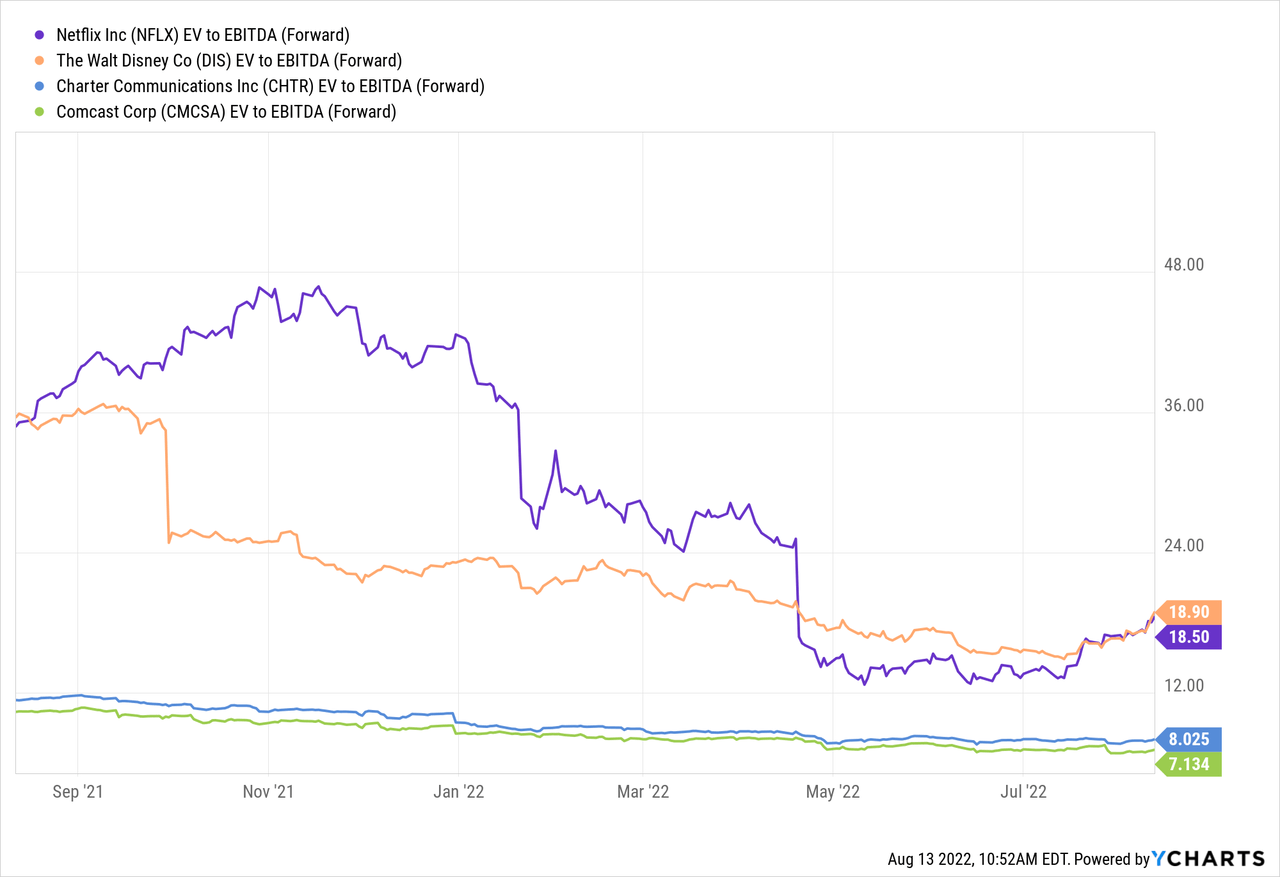

A similar situation was with EV/EBITDA. The forward ratio was 42.6x compared to the industry average of 11x.

The market considered Netflix a growing company, but already at that time, it was a huge corporation, which had difficulties maintaining the former growth rates.

Netflix as a value stock

Netflix kicked off 2022 with a disastrous Q4 2021 report. Investors were disappointed not so much by the report itself, but by the company’s expectations for subscriber growth in the first quarter of 2022. Management expected 2.5 million new subscribers, while Wall Street estimated that 6.93 new users would join the platform.

The final point was the report for the 1st quarter of 2022. It’s not that the company failed to attract new subscribers in line with its forecast. The fact is that the company lost subscribers for the first time in a decade.

This became the point of no return. Netflix shares were down 25% since its Q1 2022 earnings report and 60% down YTD. That’s how, in just 4 months, Netflix went from a growth stock to a value stock.

Growth rates are slowing

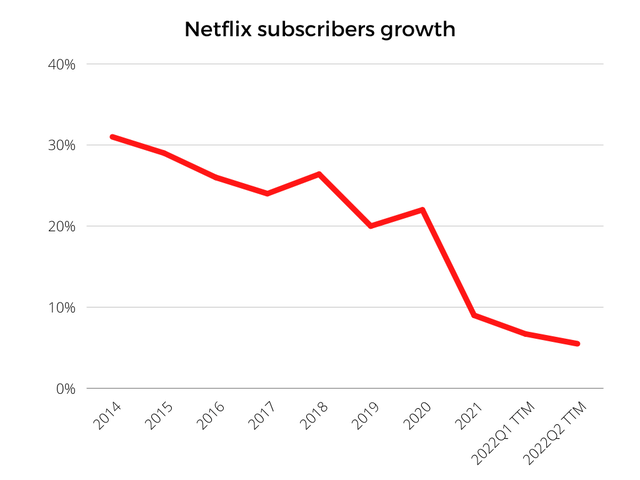

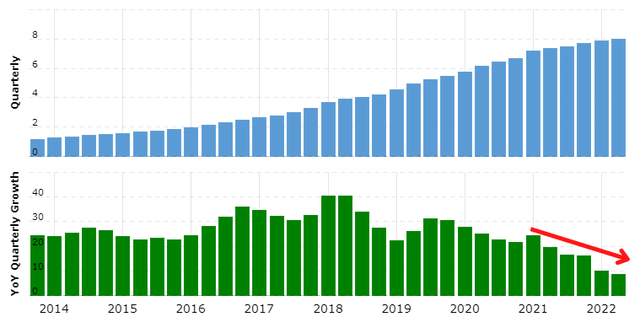

Netflix has definitely entered a new phase with negative net subscriber growth in the first and second quarters of 2022. We are in a new stage in which growth rates are not just slowing down, but not visible at all.

Netflix is now moving at the slowest pace in the decade as the subscriber number growth continues to slide.

The company’s YoY quarterly revenue growth is now at the lowest point since 2012 and continues to fall as well.

The growth company Netflix is gone. The company now has single-digit revenue and profit growth, which is good, but not with record-breaking margins, and quite a reasonable valuation.

Competition

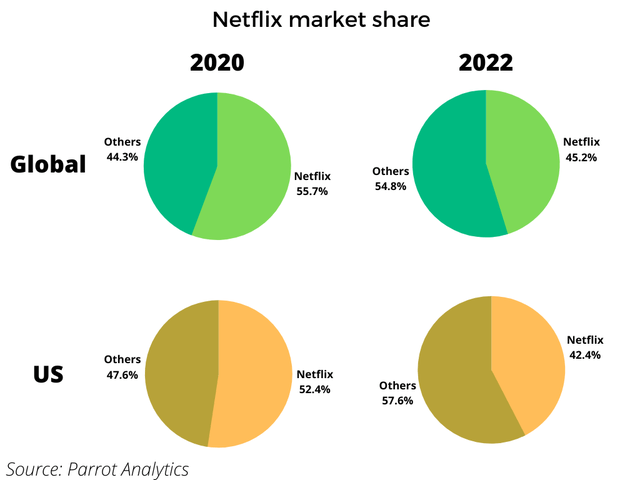

The global streaming services market now is full of competition. Netflix lost double-digit market share in just two years because of the entrance and development of other companies.

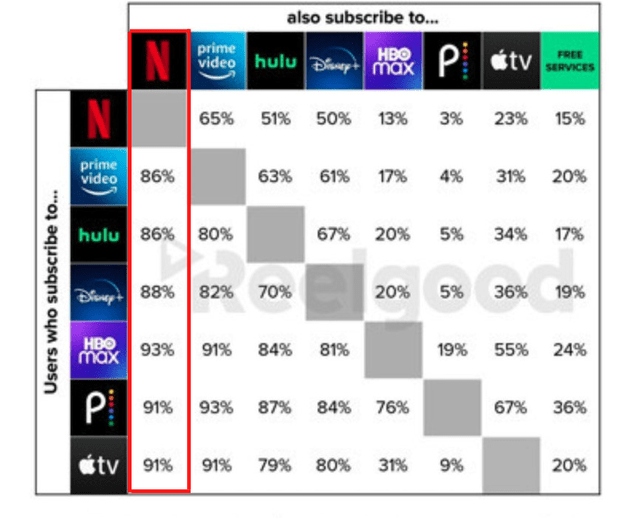

Competition has only recently become a major issue for Netflix. Previously, the relatively small influence of competitors on the company’s business was explained by the uniqueness of the content and the weakness of other players. Most other platform users also had a Netflix subscription.

But I don’t think that’s true now. The company has a fairly large number of competitors with funds comparable to or even greater than Netflix. Given this, the company’s content may no longer be as unique as it used to be, as competitors, with the necessary funds, can create a unique product that is not inferior in quality to Netflix.

Valuation

Netflix’s market capitalization is now at the level of 2018. Along with the market cap, the valuation has also decreased dramatically.

NFLX’s forward P/E ratio is now lower than Disney’s (DIS) (24.3x vs. 31.5x, respectively). That is compared with 58.7x at the end of 2021.

Forward P/S ratio is at the level of 2013, but there is still a premium valuation.

The same thing goes for forward EV/EBITDA.

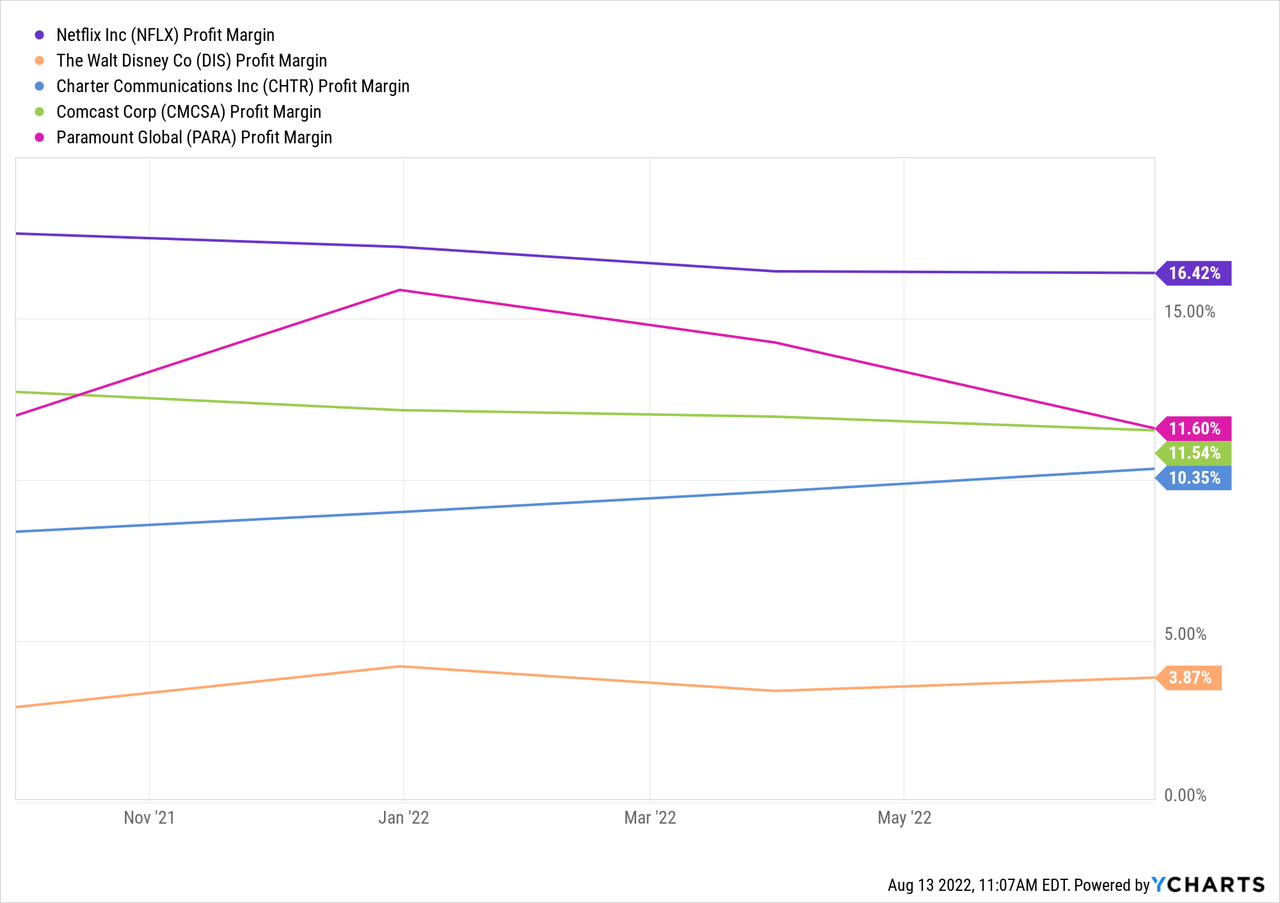

However, it looks like this premium valuation is justified due to the profitability of Netflix. The company’s net profit margin is much higher than its competitors’.

Thus, I think that NFLX is fairly valued.

Conclusion

Netflix has been a growth story over the last decade. In just a couple of months, a multi-year growth cycle for its stock came to an end and was replaced by a new one. The growth premium has evaporated along with unrealistic expectations of further double-digit subscriber growth.

It’s fair to say that Netflix is now being fairly valued for the first time in more than a decade. While the company is facing headwinds, like competition and, as a result, the loss of the uniqueness of the content, Netflix remains a leader in the industry.

NFLX looks much more attractive as a value stock than as a growth stock even with slowing growth rates due to the fair valuation. But it is still a Hold as this value stock doesn’t have a big mid-term catalyst.

Be the first to comment