Justin Sullivan

Thesis

Netflix (NASDAQ:NFLX) stock jumped as much as 15% in after-hours trading, after the company reported better than expected Q3 numbers – adding about 2.4 million of new subscribers. With the help of an ad-supported subscription model, the Netflix is confident that the streaming business may once again find back to growth. And as I have highlighted in a previous article, I agree.

Netflix shares are down by about 59% year to date, but have appreciated by almost 65% from the intra-year lows in April.

For me, Netflix is a buying opportunity. And following the better than expected Q3 results, I am confident to believe that sooner or later (probably later) Netflix stock will make new all-time highs.

Netflix Q3 Results

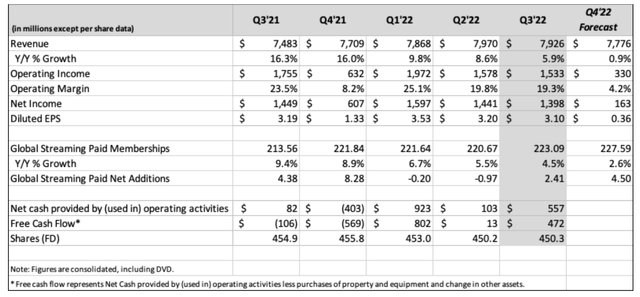

Netflix reported earnings for the September quarter on 18th October after hours, and the market cheered the better than expected results: From July to the end of September, Netflix added 2.4 million new subscriber, which is more than double than what Netflix guided in Q2 (1 million) and what markets expected (0.8 – 1.2 million). Total revenues for the period came in at $7,926 million, which reflects a 6% year over year increase. But the company highlighted that absent any FX impacts, revenues would have jumped 13% year over year – more than double the growth. Moreover, Netflix highlighted strong growth in the Asia pacific region, where the company added the lion share of new subscribers (1.4 million) and a 19% year over year revenue growth (ex-FX).

During the September quarter, Netflix generated operating income of about $1.5 billion, which is lower than the $1.8 billion recorded in Q3 21. Respectively, EPS was $3.10, as compared to $3.19 a year ago.

CEO Reed Hastings commented: (emphasis added)

After a challenging first half, we believe we’re on a path to reaccelerate growth. The key is pleasing members. It’s why we’ve always focused on winning the competition for viewing every day. When our series and movies excite our members, they tell their friends, and then more people watch, join and stay with us

Still A Growth Company

Netflix is increasingly focused on monetization – and rightly so. The company argued that most of Netflix’ streaming competitors are estimated to lose money:

…with combined 2022 operating losses well over $10 billion, vs. Netflix’s $5 to $6 billion annual operating profit.

But despite the profitability focus, Netflix remains a growth story with exciting developments in gaming and advertising.

In gaming, Netflix has only recently started to publish content. But the company said that ‘we’re [already] seeing some encouraging signs of gameplay leading to higher retention‘. As of September, Netflix supports 35 playable titles. This number should jump to 90 titles in 2023, as partnerships with CD Projekt and Ubisoft mature.

I am also excited about Netflix’s ad-supported subscription model, which will launch on the 1st of November in Canada and Mexico, and on the 3rd of November in Australia, Brazil, France, Germany, Italy, Japan, Korea, the UK, and the US. Netflix management has estimated that advertising would open a $140 billion market opportunity (cumulative market value of brand advertising across streaming and TV). Supported by advertising, Netflix will be able to offer potential customers a subscription opportunity for as low $6.99 per month (compared to $9.99 today), in exchange for ‘accepting’ 5 minutes of advertising per hour.

While the impact of the subscription-based advertising model remains to be tested, I am confident to argue that the strategy will be ARPU accreditive – simply based on the observation that other streaming competitors such as Disney+ (DIS) and Hulu are already successfully building on the ad-strategy.

Conclusion

Following a better than expected September quarter with positive subscriber growth, Netflix’ CEO Reed Hastings commented:

Thank God we are done with shrinking quarters … We are back to positivity.

In July, when most market participants were very cautious on NFLX, I argued the stock is a ‘Buy’ and assigned a $250/share target price. With the 15% post-market price surge, my previous target valuation has now been hit. But I still like the risk/reward from investing in NFLX stock. If NFLX would indeed find back to a sustainable growth path, then a x30 EV/EBIT would be adequate, in my opinion. Such a multiple would value NFLX at about $360/share (which would still be almost 50% short from all-time highs). I reiterate my ‘Buy’ rating.

Be the first to comment