If management can deliver on the ad rollout and monetize the password sharers then NFLX shares could fly. Marvin Samuel Tolentino Pineda

We previously wrote about Netflix (NASDAQ:NFLX) back in June when we laid out a number of steps that the company could take to help stop the bleeding and actually grow both revenues and profits. We saw a lot of low-hanging fruit that was available for management to begin to harvest that would require very little in upfront costs but would deliver revenues that would generate high-margin profits. In short, we saw a number of ways that Netflix was leaving money on the table, billions of dollars annually, and thought that if management would begin to address some of these issues that the stock could not only stabilize but could head higher. At the time of that article, we rated the stock a ‘Hold’ because we believed that the market had overreacted to the negative news and that investors would have to wait to see management begin to implement some of these ideas before the stock was truly a ‘Buy’.

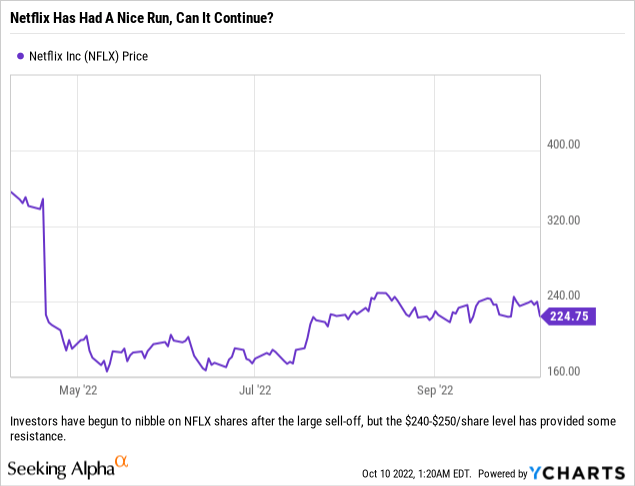

While we were not buyers of the stock during our last article, we did believe it was still a ‘Hold’ – and for those who did hold their shares, they were rewarded handsomely. Since the article, the S&P 500 is up roughly 1.90% and Netflix is up 34.74% – so serious outperformance occurred. Even with that outperformance, we think that management has now either put in place, or started the process to put in place, enough of our wish list for us to begin to be buyers of the stock.

So What Has Changed?

To be clear, we are contrarians when it comes to the company’s business plans. Many think that the company is going to hang on to the past and implement just enough to move forward. We think that Netflix’s management team has finally realized that while they are positioned nicely within the streaming market, they now have competitors eating away at their streaming market share and driving up content costs while enjoying Netflix not competing against them in their other markets for distribution (namely cable/linear, advertising and the box office).

Early on, Netflix competed against DVDs, premium cable channels and cable itself (to an extent) – essentially it was a distribution channel. Now, Netflix is an entertainment company that controls its own distribution and finds itself competing against Hollywood – importantly, this seems to be sinking in with Reed Hastings and Ted Sarandos.

The fact that the company is executing on ads and theatrical releases while still exploring how to effectively monetize password sharing is a major plus in our view. This new open-mindedness from management is refreshing and could lead to a move higher in the company’s share price.

What Recent News Has Us Excited?

In our previous article, we highlighted both the value destruction and money being left on the table by Netflix’s decision to not release their blockbuster movies (or any of their films) to theaters before releasing them to their streaming customers. In any given year in the future, we have estimated that Netflix will leave at least $1 billion in revenues on the table by not doing traditional theatrical releases while also leaving a lot of potential brand equity unclaimed by not allowing their films to garner the Hollywood attention, or “stamp of approval” if you will, that their rivals will be creating. Every Hollywood blockbuster builds word-of-mouth, emotional connections to the audience and consumer awareness which makes the film not only valuable in the present, but can drive future business based on desirability of your film library. For anyone who doubts this, look no further than Disney’s ability to launch Disney+ with their library and Amazon’s (AMZN) decision to purchase the MGM library in order to bolster its streaming offering. Cultural icons drive the business, and that is one area that Netflix heavily trails its competitors in.

Maybe most important, at least from a competitive standpoint, theatrical releases would not only generate revenue for Netflix, but also take the streaming wars to their competitors’ home turf. Every dollar that Netflix can make at the box office is theoretically a dollar they are taking away from one of their competitors which helps weaken their competitors’ advantage when it comes to quickly monetizing blockbuster budget films. Bigger picture, each screen that Netflix can occupy is one that their competitors can no longer monetize. If you are going to make big budget films, you might as well earn some money back but at a minimum you should use that content to take up space where your competitors make their money.

So when we saw the news last week that Netflix will be releasing “Glass Onion: A Knives Out Mystery” in roughly 600 theaters across the United States for an exclusive one-week run starting November 23, 2022, we realized that there is hope that management decides to monetize films via theatrical releases while also building brands through Hollywood releases. This is a baby step to be sure – the release is only about 20% of the size of traditional releases and the one-week window is less than 20% of the length of the new month-and-a-half windows now favored by studios.

While “Knives Out” brought in over $300 million from ticket sales back in 2019, bringing in 10% of that during this release (US and worldwide) would be extremely successful but we suspect that it will be closer to 5% – which will still be a strong showing for sure. While the amount they bring in on this experiment is not important, the “buzz” will be. This is not about economics, but about building up buzz for the streaming release of the film on Netflix on December 23, 2022. The Thanksgiving release in theaters will set the stage for the Christmas release on streaming.

Does The Valuation Scare Us?

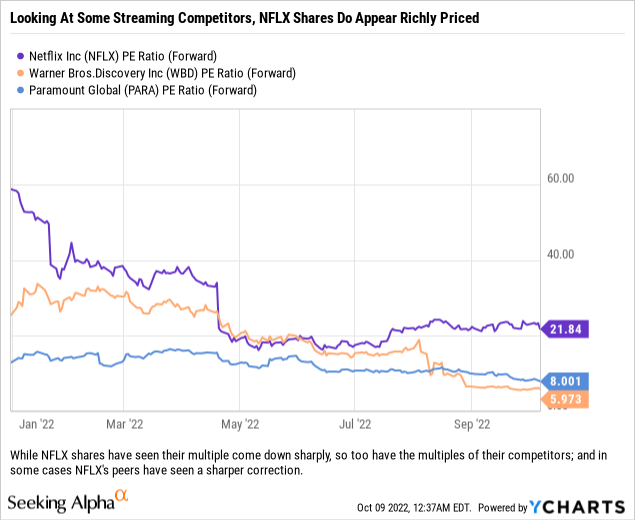

Netflix’s valuation is a bit of a concern when looking at some basic metrics, such as its price-to-earnings ratio, or P/E, but while there are some peers that make Netflix shares look grossly overvalued, one can find comps that show the shares to be in-line.

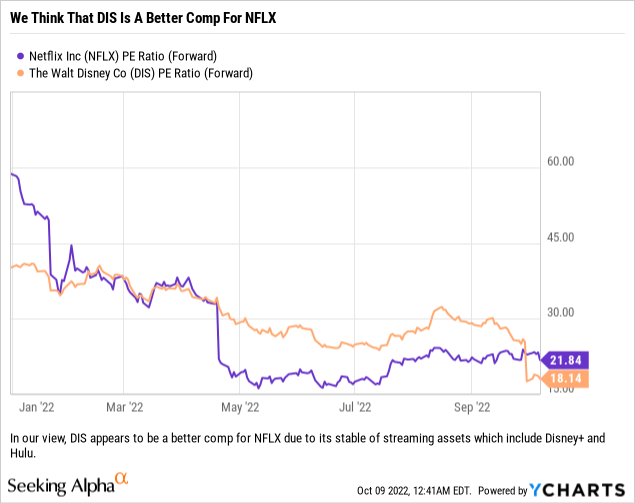

So while it would be easy to look at the above chart and conclude that Netflix is richly priced, we think it might be best to look at a peer that the market also holds in high esteem as it pertains to streaming – The Walt Disney Company (DIS).

Even though Disney faces some of the same cable issues that Paramount (PARA) and Warner Bros. Discovery (WBD) are burdened with, in our opinion the market is deciding to value Disney as if it has figured out streaming whereas it is discounting Paramount and Warner Brothers Discovery’s ability to do so.

Potential Valuation Moving Forward

So, while the shares certainly appear richly valued today, and make our holdings in Paramount and Warner Brothers Discovery look like downright bargains, we think that the valuation is somewhat justified so long as Netflix continues to implement (or at the very least discuss their plans to implement) additional revenue drivers. While the recent talk has been on the company’s plan to integrate ads into the service for various tiers while simultaneously introducing new pricing based upon the tier desired, we think that the crackdown on shared accounts might very well generate the higher margin revenues. There are going to be ongoing expenses running a sales department and additional support for the ads business, but converting a portion of nonpaying customers to paying customers would not only lower costs (driving down nonpaying traffic) but generate revenues that would essentially flow 100% into the profit column.

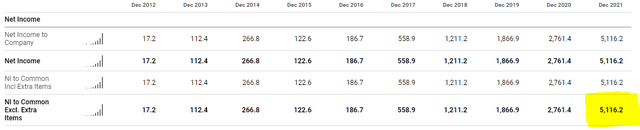

Using NFLX’s 2021 Net Income of $5.12 billion, adding $2 billion in additional net income would provide bulls with a reason to push shares higher so long as the stock can maintain its current multiple. (Seeking Alpha)

We still estimate that ending password sharing would generate $2 billion to $4 billion per year in additional revenues (basically all profits) and ads could generate $500 million to $1 billion annually early on – and this is additional revenue from subscribers who switch down to the ad tier (meaning the ad tier sub + ad revenue would be greater than their old subscription with no ads). If you assume that the company can add $2 billion in profits from adding a baseline of $2.5 billion in revenue ($2 billion from ending password sharing and $500 million from ads) from the above opportunities, at a price-to-earnings ratio of 20, shares in Netflix would trade around $315/share, or over 40% higher than Friday’s close.

Risks To The Thesis

In the current market, there are plenty of risks to this trade actually working out. First is the bear market that we are in – which seems to be dragging down all asset classes with the only place to hide safely being cash. The multiple contraction is also an issue, and to put this in perspective, we would highlight the figures we used in the above example of Netflix realizing $2 billion in additional earnings. If shares were to trade at 15x earnings, then even with the additional $2 billion in earnings, the shares would trade at about $235/share; roughly $10/share, or 4.5% above current prices.

While we only used the conservative base case, we also should point out that our estimate is based on current ad rates. If the economy continues to deteriorate those ad rates (as well as actual number of ads) might very well go down and we could see a shift in tiered plans – meaning subscribers could look to save money by shifting to ad-supported tiers rather than pay the higher monthly bill for no ads. While the current math shows that the ad-supported tier generating about $2.00 more per subscriber than the current average among subscribers, this math could dramatically change if ad rates, or ad demand, head lower.

Also, management has stated their intent to act upon both of these items, but their ability to deliver on those plans will greatly impact when Netflix is able to realize the benefits from these moves. A slow roll-out and/or enforcement of the password sharing initiative would hamper any upside that the stock has, just as a miscalculation by Netflix management on the ad inventory they will have could hit ARPU (average revenue per user), or as Netflix reports the figure ARM (average revenue per member). If they undersell inventory, not realizing the demand for the ad-supported tier, they may not be able to generate the required ARPU to offset the lower monthly Netflix bill to the consumer.

Final Thoughts

We like this trade because even if the economy is heading for a hard landing, Netflix has some very low-hanging fruit available for harvesting that could not only help support the current stock price, but also help elevate it to higher levels. While one of the less desirable outcomes is that the share price is essentially flat if the company can deliver on certain plans, we would imagine that outcome to be favorable to the rest of the market (meaning we believe that in that scenario Netflix would outperform the market).

It appears that analysts believe that the ad business is a multi-billion dollar opportunity, and that paired with our focus on the monetization of nonpaying account users should lead shares higher in the years ahead. The kicker, or cherry on top, could very well be management’s realization that the box office is a tool that can “premiumize” their content – and while that in-and-of-itself is important, we do hope that they will look to monetize the box office in the future to improve their economics, help drive growth and the share price while also taking market share from competitors.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment