typhoonski/iStock Editorial via Getty Images

REIT Rankings: Net Lease

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on September 12th.

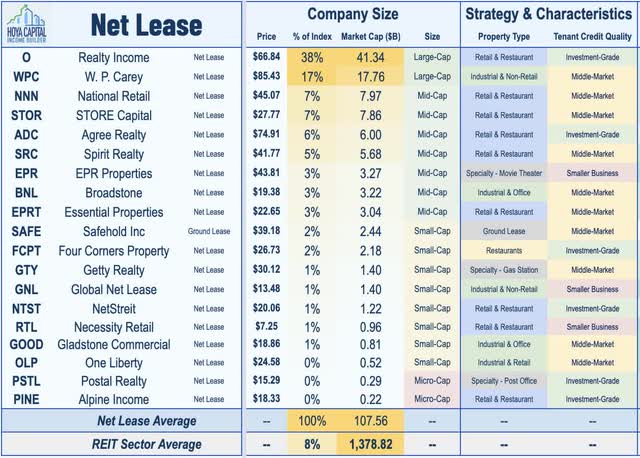

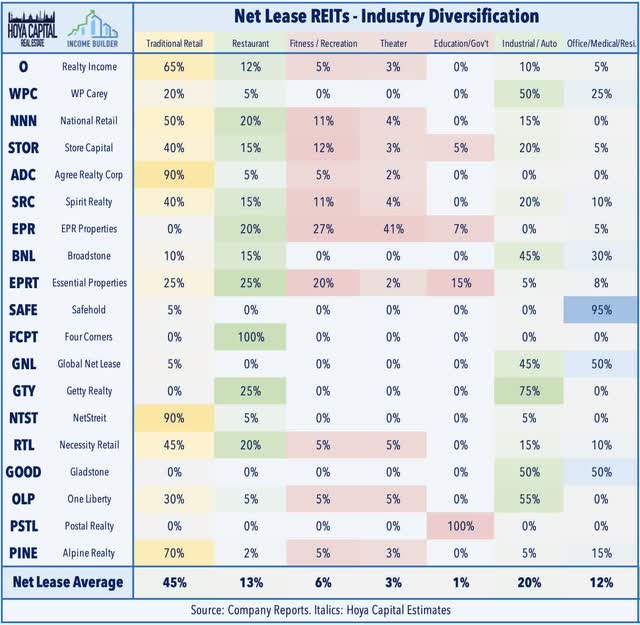

Understood to be one of the more “bond-like” and rate-sensitive REIT sectors, net lease REITs have surprisingly been among the best-performing property sectors this year despite the challenging macroeconomic environment. Even with rent growth significantly lagging inflation, net lease REITs are still on-pace for double-digit earnings growth as robust accretive external growth has – so far – more than offset the drag from muted property-level growth. Within the Hoya Capital Net Lease Index, we track the eighteen net lease REITs and one ground lease REIT, which account for roughly $110 billion in market value. These net lease REITs generally own single-tenant properties leased to high credit-quality tenants under long-term leases, focused primarily on retail, restaurant, and industrial properties.

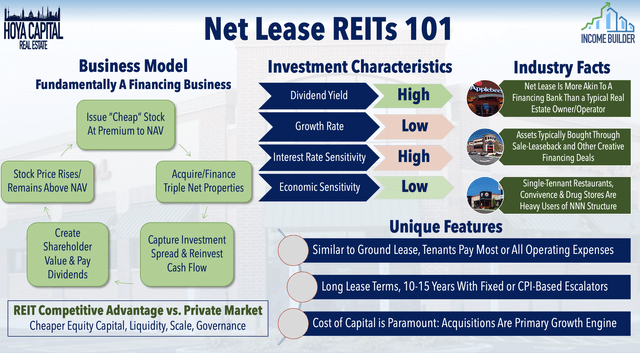

“Net lease” refers to the triple-net lease structure, whereby tenants pay all expenses related to property management: property taxes, insurance, and maintenance. One of the more “bond-like” property sectors, net lease REITs tend to operate more like a financing company than a property manager and have investment characteristics similar to corporate bonds – including high levels of inflation sensitivity – due to the long-term nature of net leases and the underlying “credit” exposure through their tenants’ ability to pay rent. Unlike corporate bonds, however, net lease REITs have the ability to grow distributions through a combination of organic (same-store rent increases) and accretive external growth (acquisitions). Triple net leases – which are used to varying degrees across the REIT universe including the Casino and Healthcare REIT sectors – proved to be particularly durable throughout the pandemic-related turmoil regardless of the headwinds endured by their tenants.

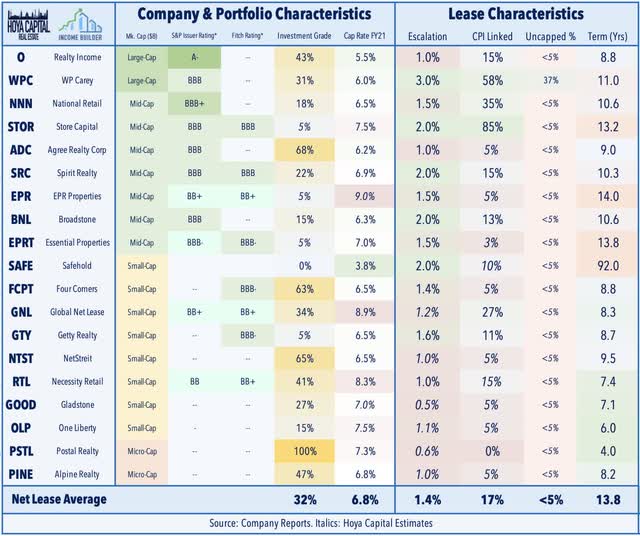

Some net lease REITs focus their strategy on investment-grade tenants with near-zero credit risk, while others focus on “middle-market” or smaller tenants that have some credit risk, but leases to smaller tenants tend to be more favorable to the property owner – particularly when it comes to inflation protection. Within the net lease sector, inflation risk isn’t always efficiently-priced and currently, we see complacency in REITs with higher inflation risk and undervaluation among REITs that are better-hedged if inflation does prove to be less “transitory” than expected. Inflation sensitivity is driven by several interacting factors including external growth potential, lease structure and term, tenant credit quality, and the cyclicality of the underlying property type.

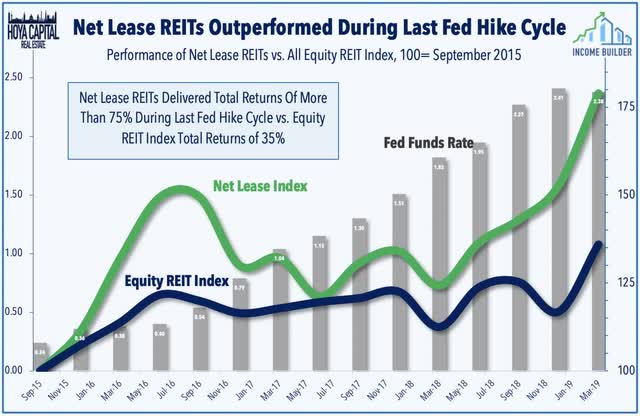

The counterintuitive outperformance for net lease REITs this year is consistent with the phenomenon discussed earlier this year in which net lease REITs actually outperformed the REIT sector during the prior Fed rate hike cycle from 2015-2019 after significantly underperforming in the 18-month lead-up to the first hike. From Q4 2015 through Q2 2019, net lease REITs delivered total returns of nearly 80% – more than double the 35% total returns of the NAREIT All Equity REIT Index during that time. Of note, the 10 Year Treasury Yield began the Fed tightening cycle in late 2015 at 2.25% and ended the cycle in early 2019 barely higher at just 2.39%, underscoring that Fed tightening cycles usually occur after longer-term rates (which are those that matter for net lease REITs) have already reflected much of the future tightening.

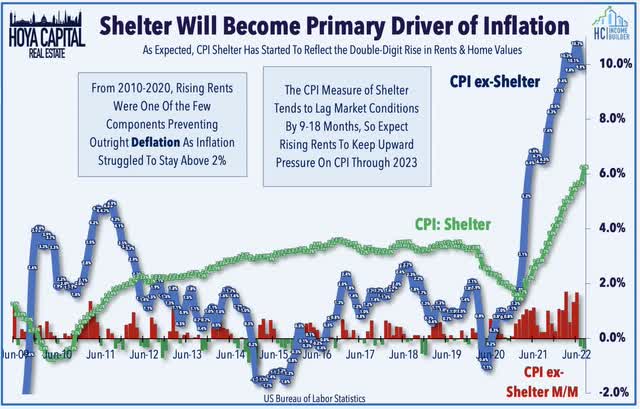

Critically, net lease valuations tend to respond primarily to long-term interest rates and inflation expectations – not short-term rates or realized inflation – and net lease investors aren’t buying the “new normal” of permanently elevated inflation. While we do believe that the worst of the inflationary pressures are behind us, we expect the headline CPI metric to remain elevated due to the lagged impact from the Shelter component of the CPI basket – the largest component of the index – which has been significantly understated since mid-2021 due to the 12-18 month lag in the metric relative to real-time market rents. We expect CPI: Shelter to contribute an additional 0.5%-1.0% to the headline CPI over the next year even as rents and home prices cool down back towards the broader inflation rate – providing an extra benefit to the handful of REITs with explicit CPI-linkages in their lease structure.

Net Lease REIT Earnings Results

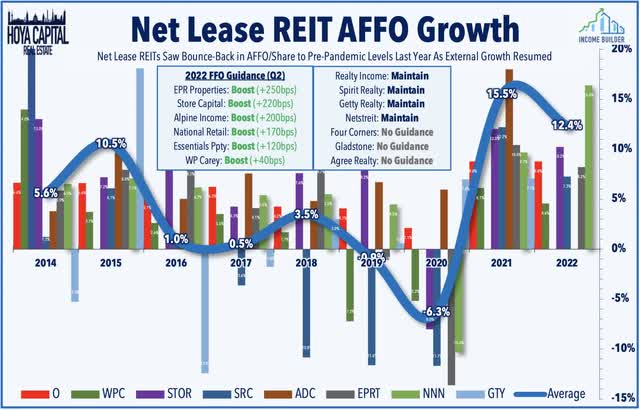

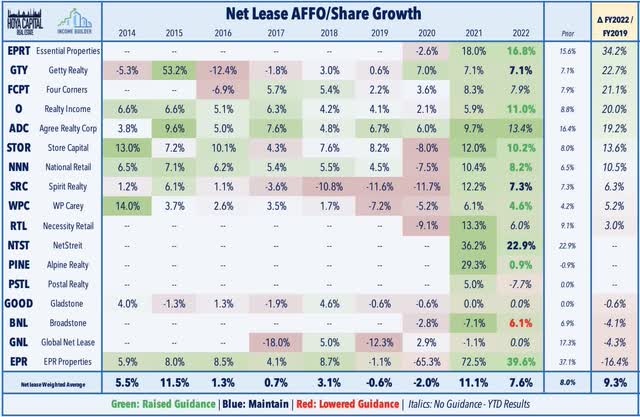

The “Rates Up, REITs Down” concerns are nothing new for these REITs, and despite their reputation as merely bond-substitutes, net lease REITs have delivered above-average earnings and dividend growth over the past decade as accretive external growth has more than offset the drag from muted property-level growth. As discussed in our REIT Earnings Recap, recent earnings results have been quite solid across the net lease sector in recent quarters with six of the eleven REITs that provide guidance raising their full-year FFO outlook in Q2. Accretive acquisitions helped to drive average full-year FFO growth of nearly 15% last year, bringing the sector well above its pre-pandemic level.

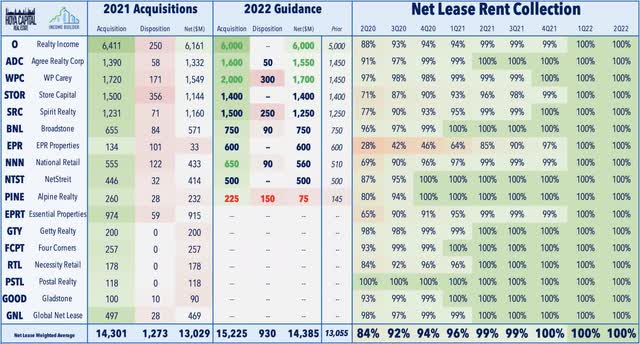

Upside standouts included STORE Capital (STOR), which reported very strong results and raised its full-year FFO growth target to 10.2% – up 220 basis points from last quarter. W. P. Carey (WPC) boosted its outlook, benefiting from its sector-leading upside exposure to inflation through its CPI-linked lease structure. Realty Income (O) was also among the upside standouts after raising its full-year normalized FFO guidance by 220 basis points and reporting its highest occupancy rate in over 10 years. National Retail (NNN) boosted its FFO growth target to 8.2% – up 170 basis points from its prior outlook. The most significant FFO boost came from EPR Properties (EPR), which now sees FFO growth of 39.6% for the year – up 250 basis points from its prior outlook. Elsewhere, Spirit Realty (SRC) maintained its full-year outlook which calls for FFO growth of 7.3 while Broadstone (BNL) lowered the midpoint of its range – the lone net lease REIT with a downward revision.

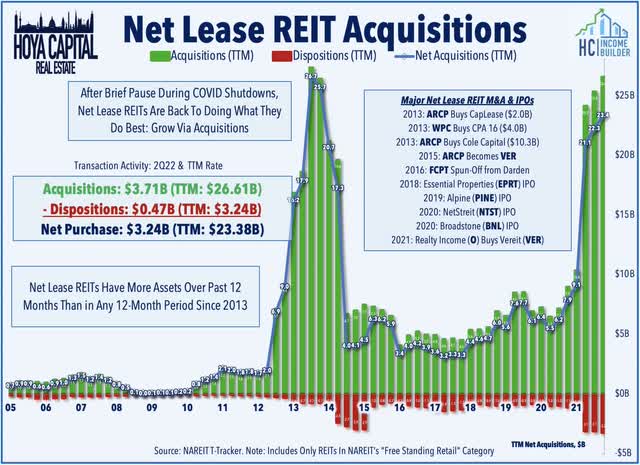

Among the ten REITs that provided acquisitions guidance, three REITs raised their full-year outlook, bringing the sector which, if achieved, would lift the net lease sector total to over $15B this year in net acquisitions – their highest full-year acquisition volume ever. Nearly all net lease REITs are now back on the offensive as rent collection fully normalized by mid-2021 aside from EPR Properties (EPR) – which owns an “experience-heavy” portfolio including movie theaters, theme parks, and gyms. EPR – and was among the hardest-hit REITs by the pandemic and the recent bankruptcy filing from U.K.-based Cineworld underscores that’s that it’s not quite out of the woods.

Cineworld – the global No. 2 movie-theater chain and owner of Regal Cinemas – officially filed for bankruptcy in the United States which comes after reports last month that the operator was struggling financially as recent box office revenues have slowed following an early summer rebound. Cineworld noted that it anticipates emerging from bankruptcy protection in early 2023, and is “confident that a comprehensive financial restructuring is in the best interests of the Group and its stakeholders, taken as a whole, in the long term.” Cineworld accounted for roughly 13% of EPR’s rents through the first half of 2022, but analysts expect the operator to continue paying rent during the proceedings, but negotiate a “haircut” of between 10-25%. A handful of other net lease REITs have between 1.5-5% of their rents coming from movie theater tenants, as outlined in the chart below.

Acquisition-fueled external growth – which has explained the vast majority of the sector’s FFO (“Funds From Operations”) growth over the last two decades – kicked back into gear late last year and is the fuel behind the double-digit percentage point AFFO growth expected in 2022. Given an extra boost from the closing of Realty Income’s $11B deal to acquire VEREIT, net lease REITs – which account for just 7% of the Equity REIT Index – accounted for over a third of total REIT acquisitions over the past twelve months with more than $22B in net acquisitions in 2021, the highest full-year total since 2013.

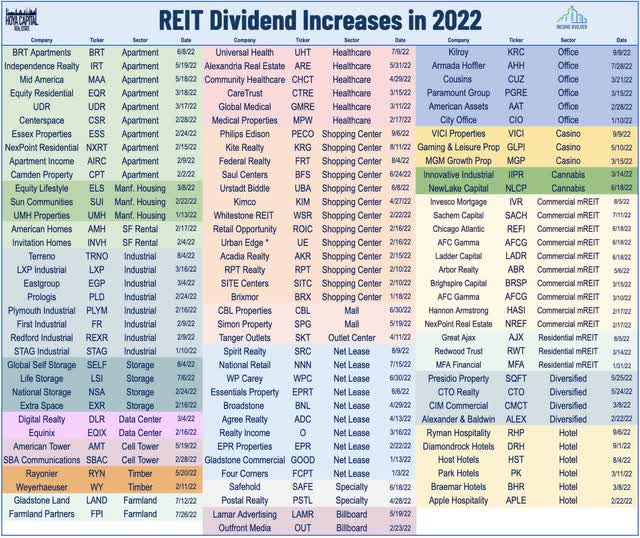

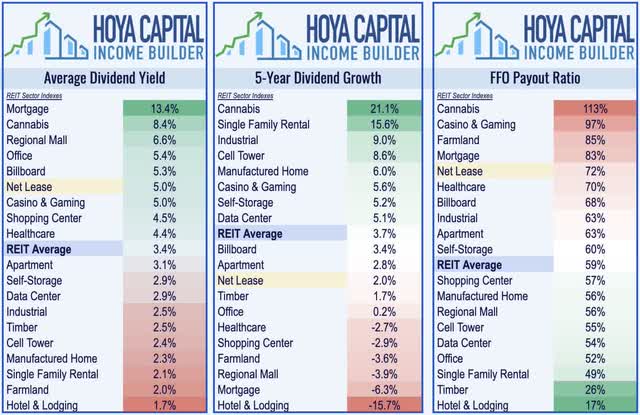

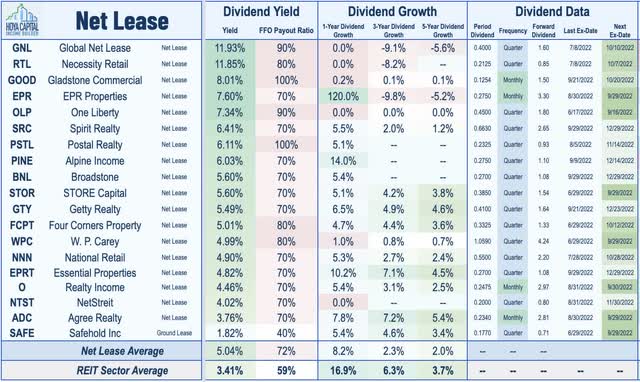

Fueled by improved operating performance, fourteen of the nineteen net lease REITs boosted their payouts in 2021 and we’ve seen another twelve net lease REIT dividend hikes this year, joining a total of more than 105 REITs that hiked their dividends this year. Net lease REITs were largely unfazed by the wave of dividend cuts that swept through the REIT sector in 2020 and with the wave of increases over the past 24 months, the sector is now on pace to achieve cumulative dividend growth of roughly 7% over the baseline 2019-levels. Net lease REITs are now among the highest-yielding REIT sectors with average dividend yields above 5% compared to the roughly 3% average dividend yield on the market-cap-weighted REIT indexes.

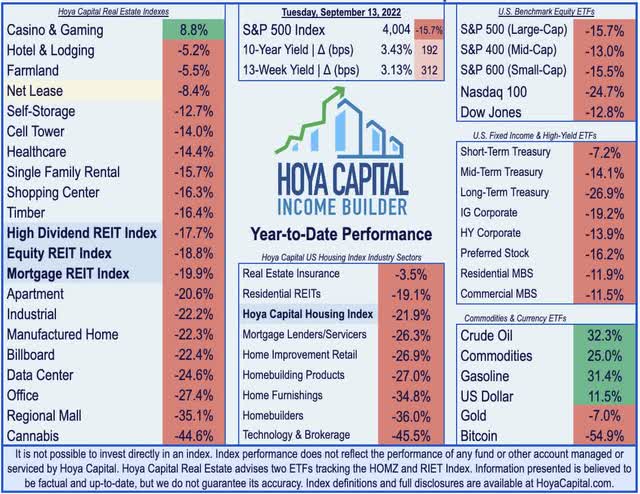

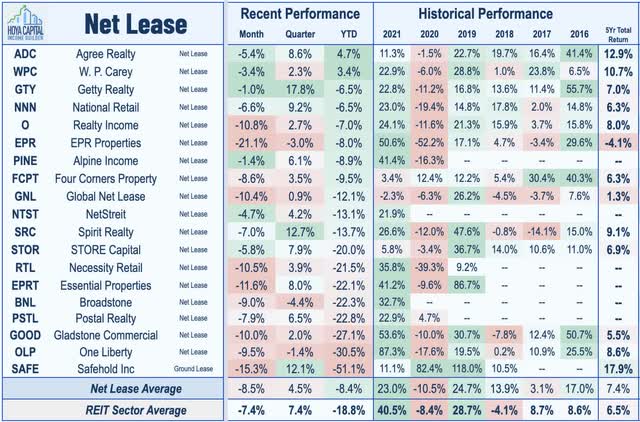

Net Lease REIT Stock Performance

Net lease REITs were slammed early in the pandemic – plunging more than 50% at their lows in March 2020 – but began a rebound in mid-2020 and have delivered notable outperformance over the REIT Index in recent months despite concerns over rising rates and inflation, a similar dynamic to outperformance that we saw in the prior rate hike cycle from 2015-2019. The Hoya Capital Net Lease Index – a market-cap weighted index of these 18 REITs – is lower by 8.4% so far in 2022, significantly outperforming the 18.8% decline from the broad-based Vanguard Real Estate ETF (VNQ) and the 15.7% decline from the S&P 500 ETF (SPY).

The relatively muted performance of the market-cap-weighted net lease index over the past few years, however, does mask some of the bifurcations in the performance between sub-segments of the sector. Notably, many of the smaller-cap REITs that outperformed in 2021 have been laggards this year, characteristic of a “flight to balance sheet quality” within the sector. Net lease REITs focused on investment-grade tenants – notably Realty Income, Four Corners, and Agree Realty – have also delivered outperformance this year over their peers focused primarily on middle-market tenants but we believe this does reflect some complacency in the pricing of inflation risk as discussed previously. Safehold Properties – the lone REIT focused specifically on ground leases – has dipped more than 50% this year – containing a stretch of underperformance since its strong gains in 2019 and 2020.

Deeper Dive into Net Lease REITs

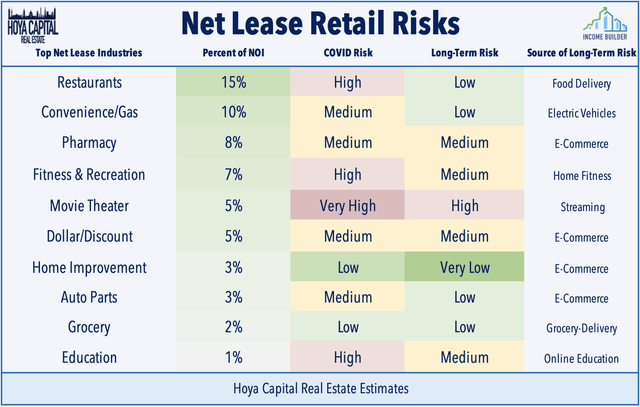

At the outset of the pandemic, investors were reminded that many net lease sectors, through their underlying tenant base, have heavy exposure to industries that bore the brunt of the “social distancing” impact of the virus outbreak including restaurants and experience-based categories such as movie theaters, fitness, and education. While the triple-net lease structure has provided a strong degree of protection for most segments, some tenants in several heavily impacted categories – such as movie theater chain AMC Entertainment (AMC) and Planet Fitness (PLNT) – still face an uncertain future from longer-term secular risks from potential disintermediation.

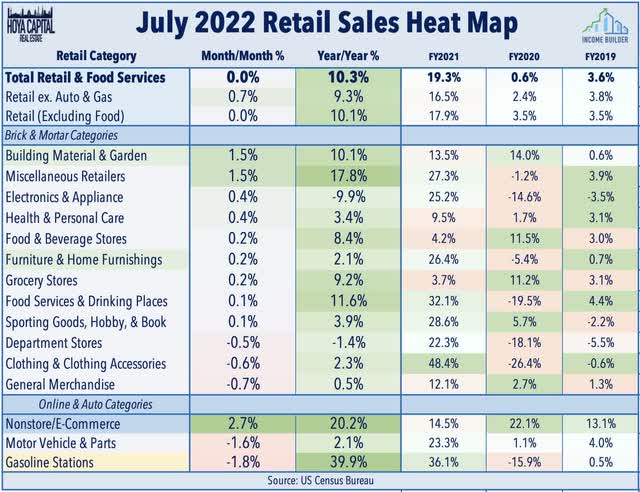

We can’t talk about net lease REITs without also discussing broader trends in retail. After all, in many ways, the underlying leases that these companies hold can be viewed as an inflation-hedged, long-duration corporate bond backed by brick-and-mortar retailers. Aided by the WWII levels of fiscal stimulus in 2021, retail sales jumped to all-time record highs last year, rising more than 19%. While several net-lease-heavy categories including home improvement, pharmacies, and auto parts performed well throughout the pandemic, other key at-risk retail categories including movie theaters, and fitness centers are just starting to get back on their feet, just as the stimulus-fueled spending spree has shown some signs of moderation in 2022.

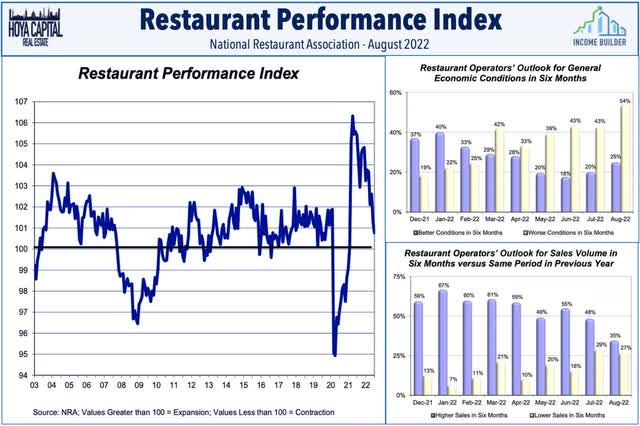

For restaurants, the single-largest net lease category, we note that the National Restaurant Association’s Restaurant Performance Index (“RPI”) – a monthly composite index that tracks the health of the U.S. restaurant industry – has also shown signs of moderation in recent months with the RPI Index declining in the most recent report, as both the current situation and expectations indicators registered broad-based declines. The RPI stood at 108.8 in July – still in “expansion” territory above 100 – but down 0.5% from a level of 101.3 in June and well below the 106.5 peak in early 2021. Notably, for the first time in 17 months, a majority of restaurant operators did not report higher same-store sales compared to year-ago levels as just 45% of operators said their same-store sales rose between July 2021 and July 2022.

The recovery is significantly less certain for movie theaters, which represent roughly 5% of overall net lease NOI – but are the primary property type for EPR Properties, as discussed above. Box Office Mojo data shows that box office revenue plunged 80% in 2020 and remained 60% below 2019-levels in 2021. Fueled by a strong slate of long-delayed movie releases including Top Gun – which set several new revenue records – the outlook has brightened a bit with ticket sales back within roughly 35% of pre-pandemic levels but the previously-discussed bankruptcy from Cineworld again calls into question the longer-term outlook for movie theater facilities.

Net Lease REIT Dividend Yields

Relatively high dividend yields are one of the key investment features of the net lease REIT sector, and the resilience in maintaining or increasing dividends has helped to push dividend yields towards the top of the REIT sector. Net lease REITs now pay an average dividend yield of 5.0%, a premium of 160 basis points over the broader market-cap-weighted REIT average of 3.4%. Net lease REITs pay out roughly 75% of their free cash flow, also towards the top end of the REIT sector average, but typically make heavy use of secondary equity offerings to raise capital to fund accretive external growth.

Within the sector, we note the dividend yields and historic dividend growth of each of the eighteen net lease REITs. Of note, a half-dozen of these REITs have delivered consistent dividend growth over the past half-decade, led by Getty Realty, Four Corners, STORE Capital, Agree Realty, and Realty Income. Twelve net lease REITs are currently paying a dividend yield above 5%, led on the upside by externally-managed Necessity Retail and Global Net Lease which each command a dividend yield above 10%.

Takeaway: Positive Outlook Despite Inflation Risk

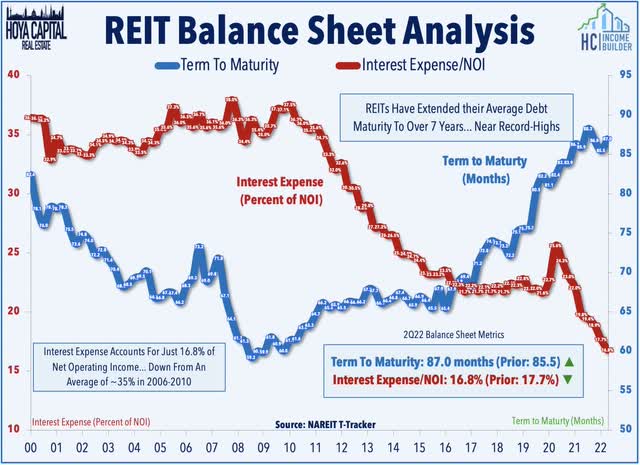

Understood to be one of the more “bond-like” and rate-sensitive REIT sectors, net lease REITs have surprisingly been among the best-performing property sectors this year despite the challenging macroeconomic environment. Even with rent growth significantly lagging inflation, net lease REITs are still on-pace for double-digit earnings growth as robust external growth has more than offset the drag from muted property-level growth. Overall, we remain bullish on net lease REITs, which have taken advantage of the structural competitive advantages of the public REIT model better than any other property sector in our view, utilizing the strength of their balance sheets and unique tax advantages to fuel accretive acquisition-driven growth.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment