miniseries/E+ via Getty Images

Elevator Pitch

I rate Nerdy, Inc.’s (NYSE:NRDY) stock as a Hold. In the company’s press releases, NRDY describes itself as “one of the nation’s largest platforms for live online tutoring and classes” with its “flagship business, Varsity Tutors.”

NRDY is undervalued, taking into account the significant de-rating of its valuation multiples and insider share purchases. In my view, Nerdy’s pivot towards a membership model that boasts subscription-based recurring revenues will be a key re-rating catalyst for the stock. In that respect, I believe that Nerdy deserves a Buy investment rating.

Valuation Multiples And Insider Buys

Nerdy’s recent stock price performance has been very poor. NRDY’s shares fell by -76.5% in the past year, as compared to a much milder -16.8% correction for the S&P 500 over the same period.

The key question is whether Nerdy’s valuations have come down to levels that make it a potential investment candidate. To answer this question, one should consider NRDY’s valuation multiples and insider trades.

Based on valuation data obtained from S&P Capital IQ, NRDY’s consensus forward Enterprise Value-to-Revenue multiple has compressed from a year-to-date peak of 1.73 times recorded on March 30, 2022 to 0.61 times as of October 24, 2022. The historical trailing Enterprise Value-to-Gross Profit ratio for Nerdy also de-rated from its 2022 high of 3.64 times to 0.99 times now.

Nerdy’s current valuation multiples appear to be reasonably appealing, after considering its intermediate-term growth prospects and profitability expectations. The Wall Street analysts expect NRDY to achieve a top line CAGR of +25% for the FY 2022-2024 period, and turn EBITDA-positive by FY 2024 as per S&P Capital IQ’s consensus data.

Separately, it is worth noting that Charles Cohn, Nerdy’s CEO, had previously bought five million of NRDY’s shares at $3.50 apiece in August 2022. NRDY’s last done share price was $1.95 as of October 24, 2022, which is -44% lower than what the company’s CEO paid for in his prior purchases of Nerdy’s shares.

The next critical step in evaluating NRDY as a potential investment is to judge if the company’s short-term financial outlook is aligned with its valuations, a subject that I discuss in the next section.

NRDY Q3 2022 Results Preview

NRDY announced on October 24, 2022 that the company will release its financial results for the third quarter of the current year on November 14, 2022 after trading hours.

Nerdy had previously guided for a top line of $31.5 million and a non-GAAP adjusted EBITDA loss of -$15.5 million in Q3 2022 based on the mid-point of its guidance issued in mid-August as outlined in its Q2 shareholder letter. The management guidance provided by NRDY points to a -25% QoQ revenue decline and a widening of EBITDA losses (Nerdy’s Q2 EBITDA was -$9.6 million) for the third quarter of this year.

The expectations for Nerdy’s Q3 2022 financial performance seem to be realistic. Wall Street’s consensus third-quarter revenue and EBITDA estimates for NRDY are $31.8 million and -$15.6 million respectively, which are largely in line with management guidance. Also, the market’s consensus Q3 2022 top line forecast for Nerdy has already been cut by a substantial -28% in the last three months. As such, my bet is on NRDY delivering in-line revenue and EBITDA when it announces its Q3 2022 results in mid-November.

At the company’s prior Q2 2022 earnings call on August 16, 2022, Nerdy noted that “summer seasonality” and the transition to the new “Learning Membership model” with the “associated revenue J curve (lower initial revenue recognition for new membership model vis-a-vis old package model)” were the key reasons for its weak Q3 2022 guidance. Specifically, the latter factor, the new membership model, should be a key catalyst that re-rates Nerdy’s share price and valuations, as discussed in the next section.

Membership Model Is A Re-Rating Catalyst For NRDY

At Goldman Sachs (GS) Communacopia + Technology Conference on September 15, 2022, Nerdy detailed the company’s pivot from the existing package model to the new membership model.

NRDY highlighted at the GS investor event that it has traditionally relied on “selling packages and classes to consumers in tutoring” to generate one-off product sales and revenues in the past. Looking ahead, Nerdy will place a greater emphasis on its new membership model, which “is a subscription offering that has all-access features” covering as many as “3,000 different subjects” that involves “a low upfront price commitment” as per its comments at the recent GS conference.

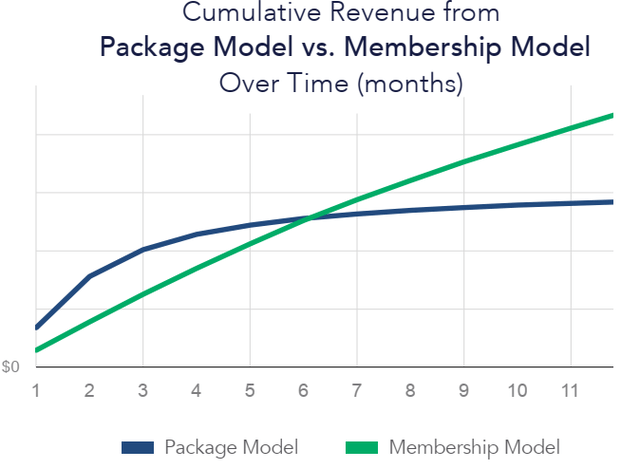

The Difference In The Revenue Cycle For The Package And Membership Models

Nerdy’s Q2 2022 Shareholder Letter

The chart above clearly illustrates the positives associated with the new membership model.

Firstly, NRDY is expected to earn significantly higher revenue from individual customers over the course of their engagement with the company under the membership model.

Secondly, clients will only need to pay a few hundred bucks as the initial payments under the new membership model. This is in sharp contrast with the prepayments in the $1,000-$1,500 range required to be paid out by customers under the old package model. This is reflected in Nerdy’s lower initial revenue for Nerdy with the membership model (vis-a-vis the package model) as shown in the chart.

Thirdly, Nerdy’s recurring membership model revenue is more predictable and less lumpy than the company’s one-off product sales derived from the existing packaging model.

I take the view that NRDY is in a position to command higher valuations with expectations of higher and more recurring revenue for the company under the membership model.

Closing Thoughts

Nerdy is rated as a Buy. The company’s shares are inexpensive, and the new membership model should help to bring about a positive re-rating of its valuations.

Be the first to comment