Rawf8/iStock via Getty Images

We are currently in an uncertain economic situation where we don’t know whether we will continue to have high levels of inflation, a recession that will stop the growth of the economy, or even both, no economic growth and high levels of inflation. This current market status puts investors in a very uncomfortable situation. Recession fears make investors want to stay away from most securities and high inflation levels make investors want to stay away from cash or bonds since their real returns are negative.

In this article, I will talk about an interesting company that, given its business resilient nature and growth potential, offers investors an interesting investment alternative for this uncertain era. The company is NeoGames (NASDAQ:NGMS), a leading iLottery provider in North America and Europe.

NeoGames: A leading iLottery provider in North America and Europe

NeoGames was born from Aspire, a leading iGaming provider in Europe. In 2014, they decided to spin off their iLottery division with the objective of focusing on capturing the new and very promising market of iLottery in the United States. To do so, they partnered with Pollard Banknote (OTCPK:PBKOF), a leading traditional lottery manufacturer. In this partnership, Pollard will provide the regulatory expertise as well as the relationships with the state lotteries and NeoGames would provide the specialized technology necessary to provide the best service available in the market.

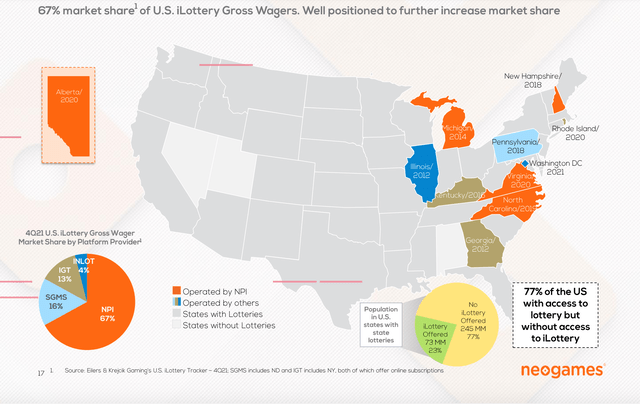

This partnership worked very well and they currently dominate the sector with a market share of 67%. Also, the states where they operate have the best performance measured by market penetration. Even they have recently won the EGR B2B award of the lottery supplier of the year for the second consecutive year. As NeoGames pointed out in their annual report:

“We believe that our focus on iLottery solutions, building upon years of expertise and deep exposure to U.S. customers, has given us a superior understanding of iLottery customers and players that allows us to continue to outperform our competitors in iLottery solutions and games”

Currently, the growth potential in the US is still huge since 77% of the population doesn’t have access to iLottery (because of the lack of regulations in their states). Also, most of the states that currently have iLotteries are reporting higher revenues year over year.

NeoGames growth potential (NeoGames investors presentation)

Besides this growth potential, this industry has very attractive characteristics:

- A substantial upfront investment is needed to open a new lottery, but the investment needed to maintain operations is minimal.

- There is only one iLottery provider for each US state. The iLottery provider selected gets a multi-year revenue-share contract with the state government and they usually don’t change their supplier due to high switching costs.

- Lotteries play a very important role in local governments’ budgets, thus they select iLottery providers with a good reputation rather than the provider with the lowest fees.

- There are economies of scale in the industry; The development of new games and platforms as a percentage of revenues is reduced as they get new contracts.

Acquisition of Aspire

Probably the most important aspect of this investment thesis is the acquisition of the parent company, Aspire. They acquired Aspire for a total consideration of approximately $480 million (SEK 111 per share), $264 million will be paid in cash, and 7.6 million with newly issued shares.

The founders of Aspire (and also founders of NeoGames) decided to accept all the equity part of the offer with an exchange ratio of 0.32 shares in NeoGames for each share of Aspire. This translates into an exchange ratio of $38 dollars per share.

Because of the sink in the share price of NeoGames, the price paid for Aspire, net of cash, is $323 million. With this price, NeoGames is acquiring a leading iGaming provider for Sports Betting and Casinos in Europe that has an ROIC of +15% and is growing revenues and earnings at double digits at a PE of 18X. Besides, the synergies that may exist between these two companies are huge.

| Equity part | $114 million (7.6*$15) |

| Cash part | $264 million |

| Net cash position of Aspire | -$55 million |

| Total | $323 million |

Author, with data from NeoGames Investor Relations news section. The equity part is calculated at a $15 per share price. Also, it is worth mentioning that the strengthening of the dollar prejudice the acquisition since their profits are reported in euros and the takeover was in USD.

The bottom line

Taking into consideration this acquisition, we will end up with 2 great businesses that have great growth potential, high returns on invested capital, and a dominant market position in their niches that can create synergies between both of them.

Making the pro forma financial statements for the year 2022 of NeoGames (even when their whole revenues will be recorded until 2023), we will end up with the following:

| 2021 | 2022 | |

| Sales | 82 | 270 |

| NeoGames | 50 | 56 |

| NeoPollard interactive | 32 | 40 |

| Aspire | 0 | 174 |

| EBITDA | 29.8 | 97.5 |

| EBIT | 15 | 54 |

| EBIT margin | 18.4% | 20% |

| Interest expense | 6 | 20 |

| Taxes | 0.5 | 9 |

| Net income | 8.5 | 24.8 |

| Net debt | -20 | 244 |

| Fully diluted number of shares | 26.6 | 34.2 |

| Enterprise value | 390 | 771 |

Author, with data from NeoGames’ 2021 annual report, Investor Relations news section, and Q1 2022 results. Total Revenues include 50% of NeoPollard Interactive revenues; Enterprise value is calculated based on a $15 per share price.

As we can see, it is expected that we will end up with a business that will be producing around $95 million in EBITDA and $24.8 million of net income. This translates into a multiple of 8X EV/EBITDA and a P/E ratio of 21X. These are very attractive multiples to pay for a business that is expected to grow revenues at double digits and that will grow income and cash flows at a higher rate due to the operating leverage previously mentioned.

Why it exists the opportunity

The main reason is probably the complexity of their numbers:

Currently, NeoGames’ financial statements don’t reflect the current status of the business. The most important part of their revenues, NeoPollard Interactive (the joint venture with Pollard to provide iLottery solutions in North America with the exception of the MSL), doesn’t appear on their income statement properly.

According to IFRS, the company should only record as an income on equity investment, the profit or loss from the operations of a joint venture. This means, that the revenues reported by the company aren’t a good reflection of the business development. Besides this accounting complexity, NeoGames recently acquired Aspire, which is a business that has double the size of NeoGames, so there is more complexity and risk to valuate this business.

Finally, this is a small cap business with limited float, this means that not so many experienced analysts or institutional investors will be attracted to take the time necessary to analyze this company.

Risks

The main risk of this investment thesis is the leverage ratio that the company would have after the acquisition of Aspire. This would be of approximately 2.5X EBITDA and it mainly consists of a credit with Blackstone which has an interest rate of 6.25% plus EURIBOR. In my opinion, this is a high-interest rate to pay for that debt, and rising interest rates would be prejudicial for the company. Even so, the company generates enough cash to pay down that debt in very few years due to the asset-light nature of its business. Also, something that is important to mention is that more than 60% of the shares of NeoGames are owned by the founders so this probably means that they are completely sure that they can pay that debt without any problem, otherwise most of their fortune will be at risk.

Also, another risk is in their joint venture. Currently, all the business from iLottery in North America is done through NeoPollard Interactive, a 50/50 joint venture with Pollard Banknote and NeoGames. The business opportunity for iLottery in North America is huge and there isn’t any restriction preventing Pollard Banknote or NeoGames to try to capture this opportunity by themselves. If any of these companies tries to pursue this growth opportunity by themselves, there is the chance that both companies will get hurt.

In my opinion, NeoGames is better positioned to try to capture this business opportunity by themselves because of the superior technology and their award as being the best iLottery supplier. This is probably the reason why Pollard has recently acquired a small iLottery developer in Europe, in order to prevent NeoGames to try to capture the iLottery market by themselves. Even so, Pollard and NeoGames have always said that they would exclusively capture the iLottery market in North America through NeoPollard Interactive and I think this is the best option since both parts win and their value proposal is way better than any other available in the market.

Conclusion

Given the complexity of analyzing this company, NeoGames offers an asymmetrical investment opportunity that promises above-average returns with below-average risk. As time passes and the numbers from the acquisition of Aspire begin to show, NeoPollard Interactive continues capturing the growth potential of their market and operating leverage occurs, I think the market will recognize the value of this company.

Even so, there are certain risks that we need to take into consideration like the leverage ratio that the company will have after the acquisition of Aspire. Besides, the market sentiment is very negative toward technology stocks so it might take time to materialize this potential return.

Be the first to comment