tum3123

By Michael Arno

Emerging market (EM) assets have faced a difficult year and a host of challenges, including runaway inflation, a persistently strong U.S. dollar, volatile commodities markets, slowing Chinese growth and demand, and geopolitical risks. Some indicators remain quite challenged, and conditions could still worsen for EM. However, other signals suggest that we may be nearing a bottom, and local EM rates could be set for a rebound. Valuations for select local currency EM bonds appear very attractive with the potential for solid returns as conditions stabilize and improve.

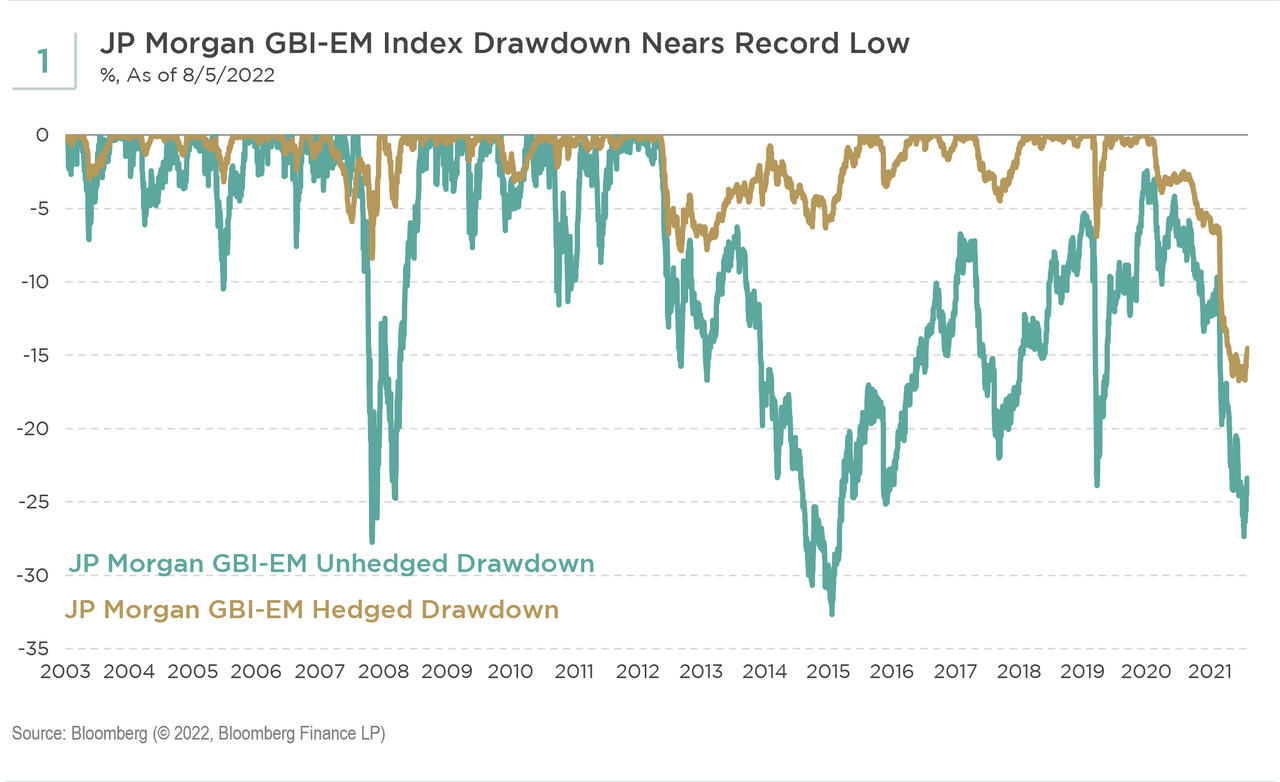

The drawdown in local EM rates has been fierce. For example, the hedged JP Morgan GBI-EM Index drawdown is currently the worst since its inception in 2003, and the unhedged index is nearing the second-worst drawdown (see Figure 1).

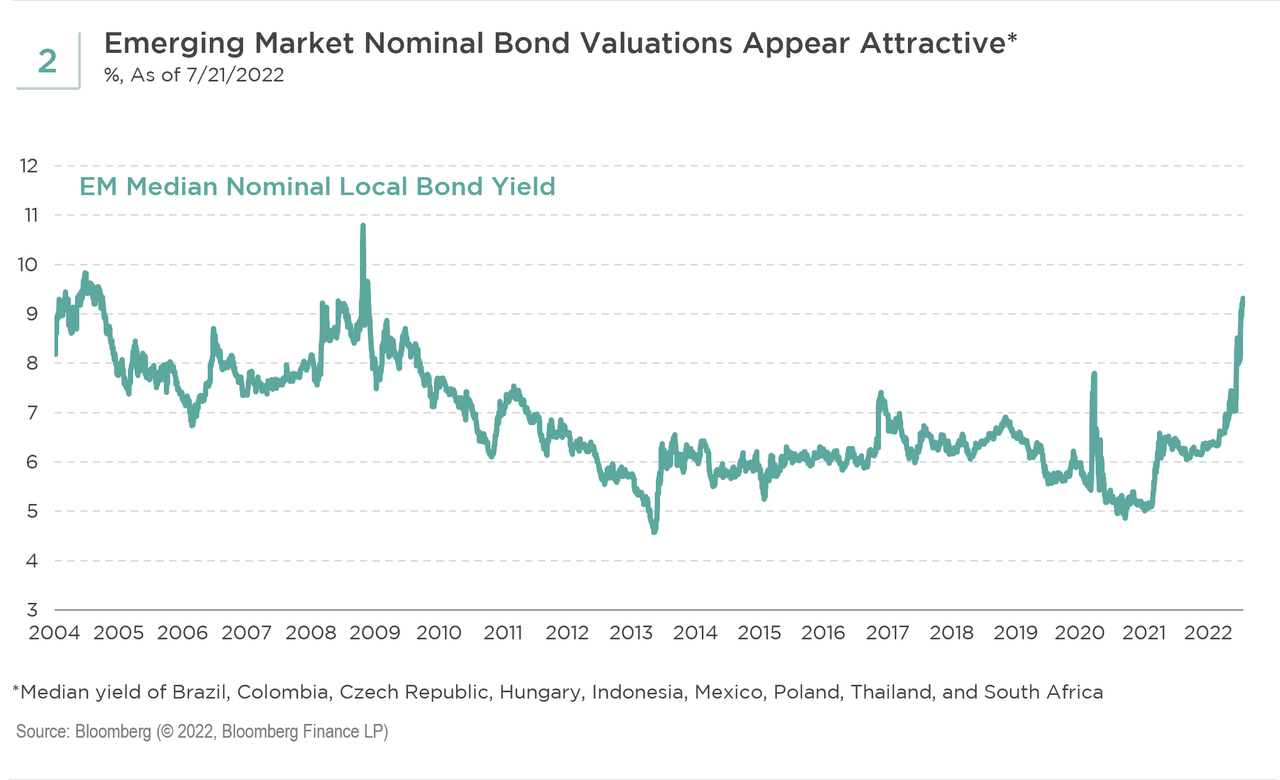

Accordingly, valuations for local currency EM are starting to look attractive as local bond yields have risen to high single digits (see Figure 2).

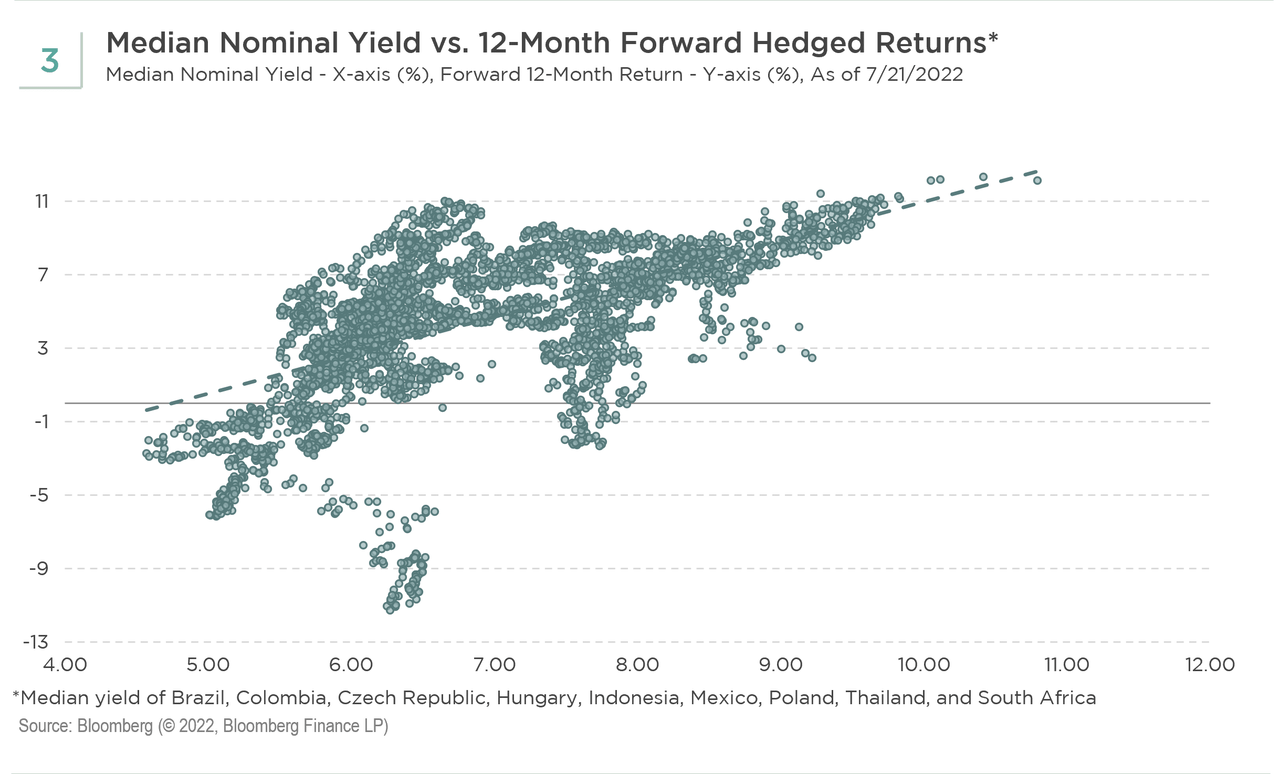

Forward returns for EM bonds have tended to be compelling when valuations are near these extremes (see Figure 3).

Nearing a Turning Point

The risks surrounding emerging markets are still elevated, and conditions could worsen before they improve. The U.S. Federal Reserve (FED) is raising rates aggressively and quantitative tightening (QT) is poised to accelerate. The uncertainty around China continues to linger given the potential for further fallout from the country’s zero-COVID policy and stresses in the property sector, which represents roughly 20% of gross domestic product (GDP). The Russia-Ukraine war has exacerbated the uncertainty around food and energy prices and concerns over global scarcity—and global security.

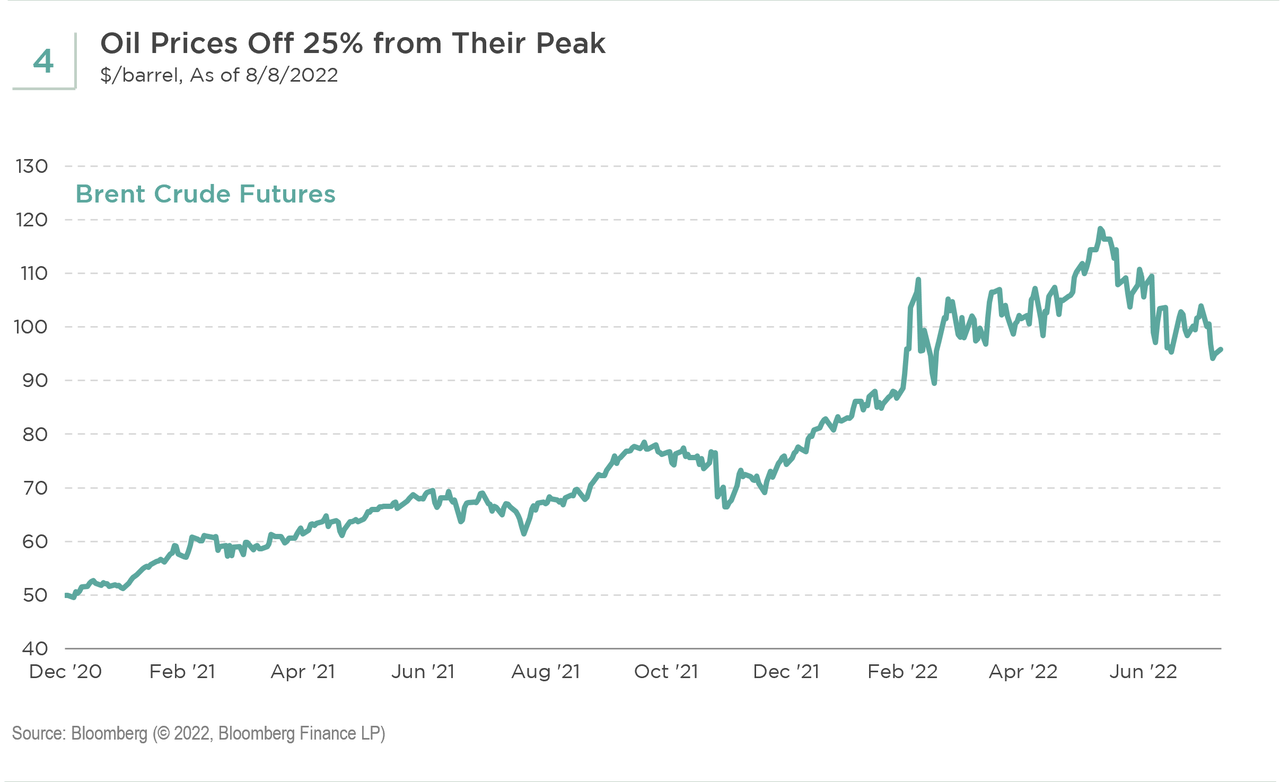

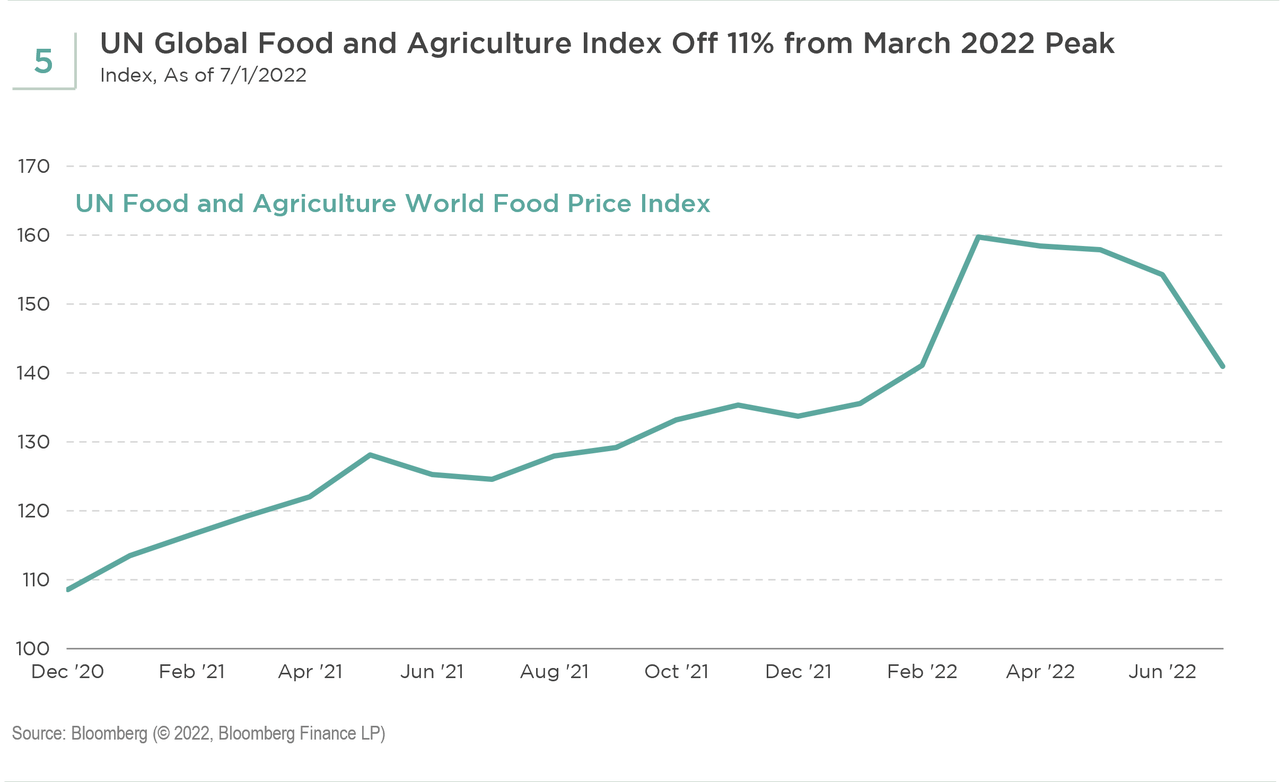

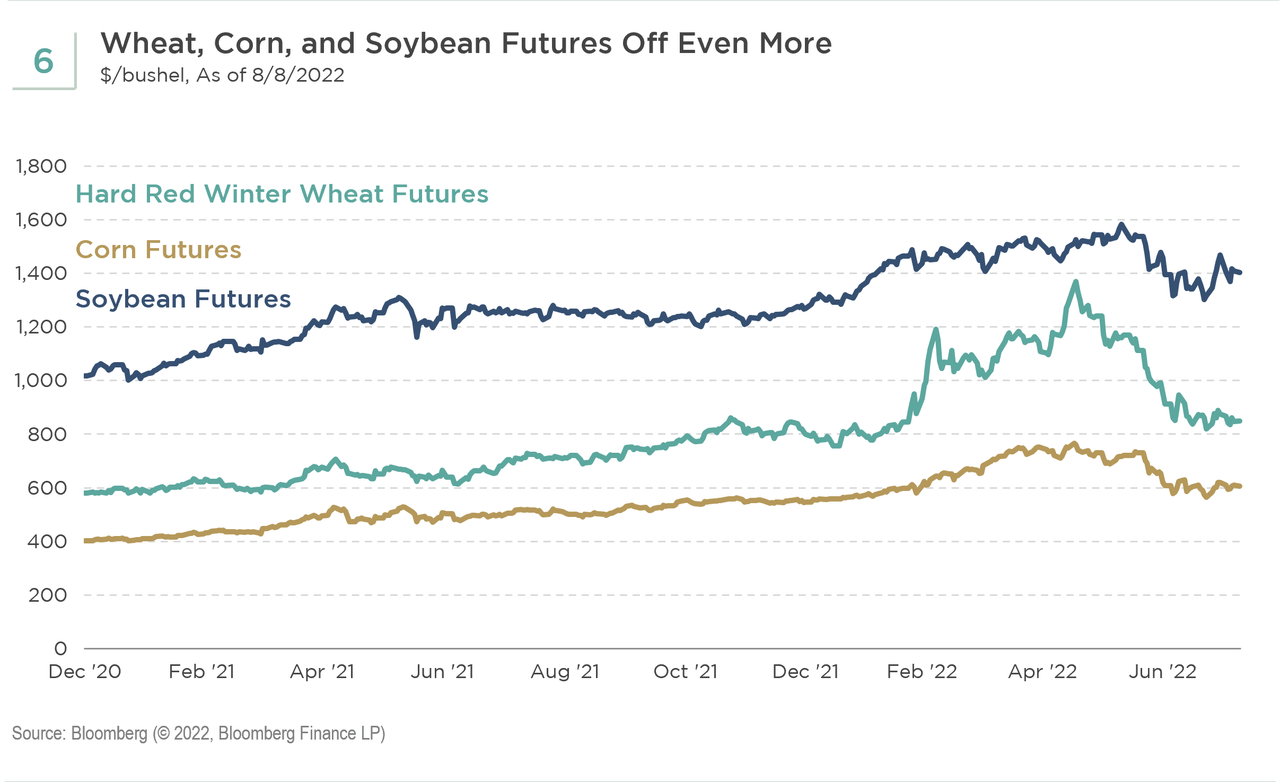

While the outlooks for Fed policy and geopolitics are a bit cloudy, we are seeing signs that headline inflation pressures could be abating in some EM. Food and energy prices have been key drivers of headline inflation in EM. Oil prices (see Figure 4) are off 25% from the highs in early June, and food prices (see Figure 5) as measured by the UN Food and Agriculture Price Index are down 12% from the peak in late March. Some soft commodities, including corn (-20%) and wheat (-38%), are off even more (see Figure 6). A continued deceleration of food and energy prices would be a positive tailwind for headline inflation and local EM duration. Lower headline CPI pressures could also be a positive for the developed market world, meaning we may be close to peak hawkishness for Fed policy. This turning point could be a catalyst for U.S. dollar weakening, which in turn would be supportive of local emerging markets and their currencies.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment