bfk92

Introduction

The shipping industry is no stranger to volatility with essentially countless booms and busts over the centuries, something Navios Maritime Partners (NYSE:NMM) endured during their more than decade-long run as a listed partnership. Whilst the booming operating conditions of 2022 have produced a massive cash windfall that few investors ever expected, their outlook is softening as economic conditions weaken heading into 2023. Despite this headwind, they are pushing ahead with a debt-funded capital-intensive strategy that in my eyes, effectively is like loading up on the wrong cargo, metaphorically speaking.

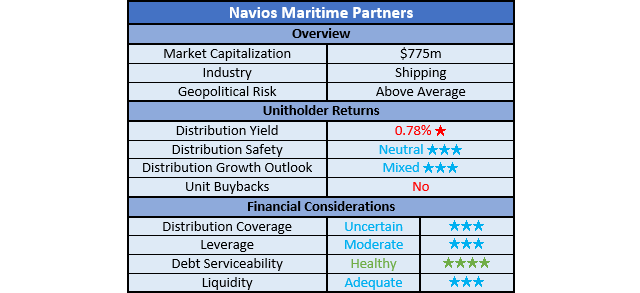

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

Author

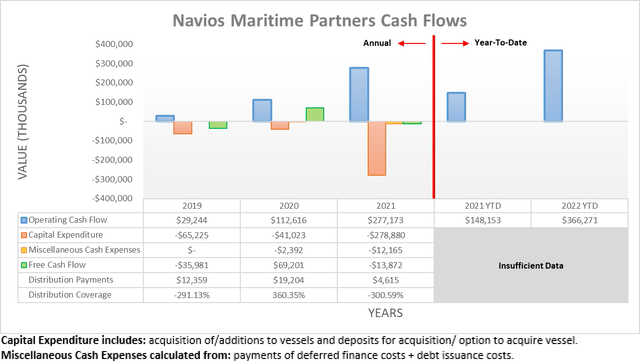

After enduring the Covid-19 pandemic far better than most would have initially expected, their operating cash flow during 2021 surged to $277.2m as operating conditions for their container and dry bulk vessels enjoyed a very strong resurgence. Whilst already positive, it proved a mere fraction of what 2022 had waiting ahead with the first nine months already seeing their operating cash flow reach $366.3m, driven by record-setting charter rates for these same two vessel types, despite their oil tankers still remaining a drag.

Unfortunately, their quarterly results do not include a complete cash flow statement and even though this does not infer anything illegal or underhanded, it nevertheless leaves less data than virtually every other partnership and company routinely provide each quarter. As a result, their exact capital expenditure and various miscellaneous cash expenses during the first nine months of 2022 remain a mystery until their full-year results are released in early 2023, although if nothing else, at least the massive cash windfall is still visible via their operating cash flow.

Author

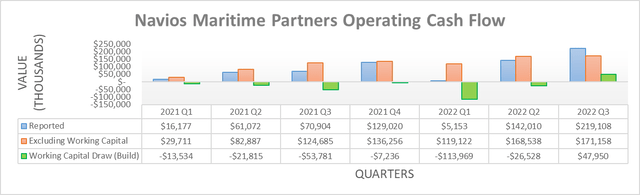

When viewed on a quarterly basis, their record-setting results are even more easily apparent with the third quarter of 2022 see a massive operating cash flow of $219.1m that comes fairly close to their full-year result of $277.2m during 2021, despite being merely one quarter the length of time. This is wonderful, although as always, booming operating conditions cannot last forever and thus one day or another, softer financial performance awaits on the horizon. In fact, the tide is seemingly already turning as the container and dry bulk markets turn south given the gloomy economic outlook and as such the container shipping juggernaut, Maersk (OTCPK:AMKBY), who is warning of “dark clouds” on the horizon. Meanwhile, the dry bulk index is not sending positive signs after dropping by around two-thirds from its peak earlier in 2022.

At least the outlook for their oil tanker vessels is better heading into 2023, although as these only comprise 51 of their total 185 vessels, they are unlikely to offset their headwinds for their container and dry bulk vessels. This raises the prospects for a severe downturn or if not, it still imposes a headwind that makes softer financial performance far more likely than seeing these record-setting results continue well into 2023. At the end of the day, their cash flow performance will continue fluctuating across time, often unpredictably and thus the bigger topic for this analysis relates to their financial position and their capital-intensive strategy going forwards.

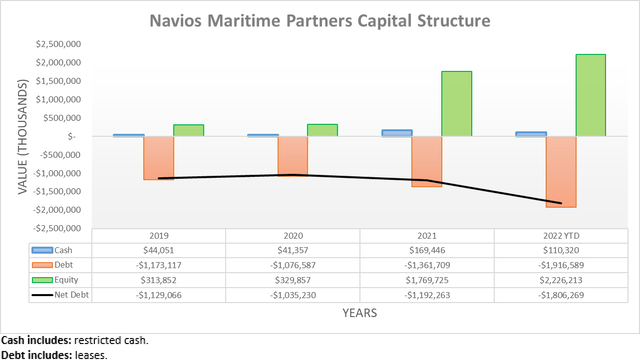

Author

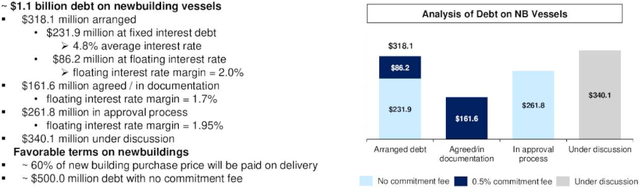

Despite their massive cash windfall during the first nine months of 2022, their net debt continued climbing higher. If anything, it actually accelerated to now land at $1.806b and thus a very large increase versus its previous level of $1.192b at the end of 2021. Unsurprisingly given the capital-intensive nature of the shipping industry, this stems from acquisitions of further vessels with their fleet growing from 146 at the end of 2021 to 185 following the third quarter of 2022. This growth does not appear to be slowing down because when looking ahead, they have outlined a $1.1b debt-funded program to acquire new vessels.

Navios Maritime Partners Third Quarter Of 2022 Results Presentation

This capital-intensive strategy will see their net debt march even higher in the coming quarters, as they are unlikely to generate sufficient cash to offset such a large sum whilst operating conditions soften. If adding a further $1.1b of debt into their capital structure, it would see their net debt increase by circa 56% compared to its latest level of $1.806b.

Author

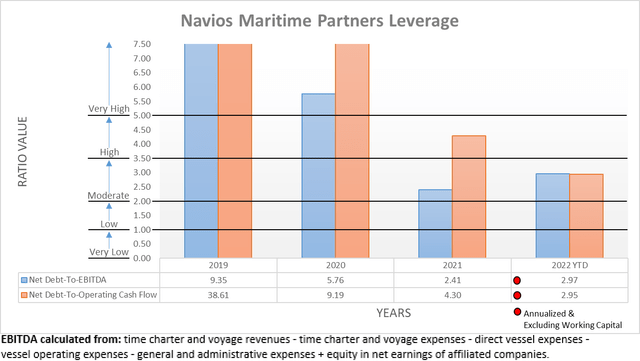

Initially, concerns over their debt-funded capital-intensive strategy may seem completely unwarranted considering their leverage is only moderate, as primarily evidenced by their net debt-to-EBITDA and net debt-to-operating cash flow of 2.97 and 2.95 sitting within the applicable range of between 2.01 and 3.50. Similar to many aspects in life, context is required and thus investors should remember this leverage is dependent upon their record-setting financial performance during the first nine months of 2022. If their financial performance softens in the future, it will translate into higher leverage and as already discussed, the charter rates for dry bulk and container vessels are weakening in tandem with the economic outlook heading into 2023.

Even more importantly, they are acquiring a further 23 new vessels under their $1.1b capital-intensive debt-funded program, thereby boosting their existing fleet of 185 vessels by about 12.50%. Whilst there are obviously various moving parts affecting their financial performance per vessel, it nevertheless is difficult to imagine that increasing their fleet by about 12.50% could possibly boost their financial performance sufficiently to offset the circa 56% net debt increase, assuming like-for-like operating conditions.

If applying these increases to their latest net debt and EBITDA from the first nine months of 2022, it sees a net debt-to-EBITDA jumping to 4.12 and thus well into the high territory of between 3.51 and 5.00. Once again, high leverage requires context because if resulting from a severe downturn, it is not necessarily concerning as their financial performance is likely to strengthen and thus resolve the issue itself. Whereas, this situation results from record-setting financial performance, thereby highlighting that even a modest downturn could see them overleveraged, let alone what would transpire from a severe downturn.

Even if we ignore this troubling comparison and assume the new vessels are somehow leverage-neutral, it still raises the risks posed by a downturn. Since their financial performance obviously fluctuates, such an event could easily tip this balance whereby the additional earnings from their new vessels fail to even match, let alone exceed the increase to their debt, once again, ignoring the already troubling comparison.

Author

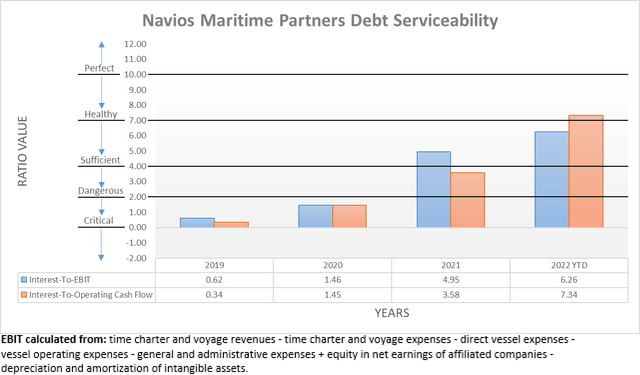

Apart from posing risks to their leverage, the outlook for dramatically more debt also increases the risks for their debt serviceability, which is becoming increasingly important to consider as interest rates climb rapidly. As things stand right now, their debt serviceability is healthy with their interest coverage of 6.26 when compared against their accrual-based EBIT, whilst the comparison against their cash-based operating cash flow yields a modestly higher result of 7.34.

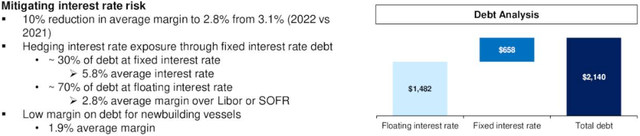

Similar to their leverage, their debt serviceability clearly presents no issues right now but alas, it could turn sour heading into 2023. Obviously, it also rests upon their record-setting financial performance during the first nine months of 2022 and because these incredible results will likely soften, their debt serviceability should deteriorate, especially as interest rates rise. To their credit, management started taking steps to help mitigate this risk but rather disappointingly, so far, they only see around 30% of their debt with fixed interest rates.

Navios Maritime Partners Third Quarter Of 2022 Results Presentation

Whilst this helps, it does not need a mathematician to know that 70% represents the majority of their debt, which sees a variable interest rate of 2.80% over Libor or SOFR. As a result, they are still significantly exposed to higher interest rates and with the United States Federal Reserve increasing rates at 75bpts in October alone, this is not an ideal position with further rate hikes almost guaranteed heading into 2023. Since a material portion of their incoming debt is yet to be approved, its additional interest burden remains to be seen but as subsequently discussed, they are trying to source this capital at some of the worst and thus more costly times, thereby further increasing risks posed by a downturn.

Author

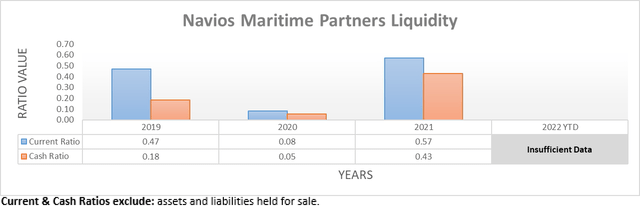

Unfortunately, their lack of a complete quarterly cash flow statement is accompanied by a lack of a complete balance sheet and as such, their latest current and cash ratios remain a mystery. Thankfully these ended 2021 at 0.57 and 0.43, the latter of which being particularly good. Whilst their latest cash balance of $110.3m is lower than where it ended 2021 at $169.4m, it nevertheless seems reasonable to rate their liquidity as adequate but this may change following their full-year results when more data comes to light.

When looking back earlier, they were still seeking $340.1m of debt that is not currently even in the approval process for their new vessels, not to mention another $261.8m that is only in the approval process. Together, these represent a sizeable $601.9m of demand for capital from debt markets on top of what they have already lined up. In my eyes, seeking to dramatically increase their debt at the same time that central banks are rapidly tightening monetary policy runs contrary to prevailing operating conditions and leaves them exposed to onerous terms on this unfinalized debt, thereby further lifting my concerns already outlined. Plus, the combination of high inflation and weak economic conditions will test financial markets in ways not seen in decades, thereby opening the door for possibly unexpected black swan events that add another layer of uncertainty and thus risks.

Unsurprisingly at this stage, their quarterly results do not provide a breakdown of their lease maturities, which are included within their debt, both by myself and management. Although they did see fit to provide a breakdown of the maturity profile for their traditional debt, as per slide sixteen of their previously linked third quarter of 2022 results presentation. This sees a further $104m during 2023 and $81m of debt maturity during 2024 and despite not being particularly massive, they still represent further demands for capital at inopportune times, through a combination of drawing down cash or quite likely, refinancing.

Conclusion

On one hand, more vessels are good but on the other hand, more debt is bad. Whilst the two can balance each other out, it nevertheless increases risks from a downturn because the additional earnings from the new vessels can evaporate quickly in this notoriously volatile industry. Since it appears they are increasing their net debt quicker than vessels, I feel they are loading up on the wrong cargo, metaphorically speaking. These risks are further enhanced as central banks rapidly tighten monetary policy, thereby pulling money out of the system whilst the economic outlook worsens heading into 2023. When combined, I believe that a sell rating is appropriate because even if they avoid a severe downturn, their best days appear in the rearview mirror, which should place downward pressure on their unit price.

Notes: Unless specified otherwise, all figures in this article were taken from Navios Maritime Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment