jetcityimage

Saratoga Investment (NYSE:SAR) can flex with the rate hikes and improve its earnings, and it also trades at a pretty meaningful NAV discount. At the same time, it is exposed to what we believe are latent macro risks and there are minor duration risks. Bond markets tend to be smarter money, and we think that’s why the NAV discount is here, and Saratoga trades fairly. But despite the yield being attractive in the current markets, there’s no clear angle so we pass.

Saratoga Investment Case

Let’s discuss the key risk factors we see for a bond portfolio. The first is rising rates. The Fed has made its position clear and with unemployment still very low and inflation still high, those rates are high. The other risk is related, and that is macroeconomic risk, perhaps caused by further rate hikes, but likely lying dormant in the value chain.

Rate Risks

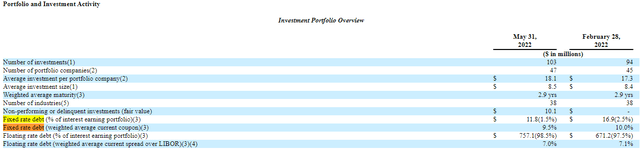

The first issue is rate risks. Saratoga has quite a lot of fixed rate investments.

Fixed Rate Proportion (10-Q May 2022)

It’s come down pretty meaningfully from the last quarter, but it is still relatively high. The durations on their bonds are usually issued at 10 year maturities, with relatively fat coupons. But taking the portfolio together and including the floating rate debt, the duration is around three years, probably due to the very large coupon rates. Still, three years isn’t nothing, and those assets are getting hurt when a point or two in rate increases come. 6% in fair value declines is a sting, assuming the three years in effective duration reflect the fixed rate debt well.

Macro Risks

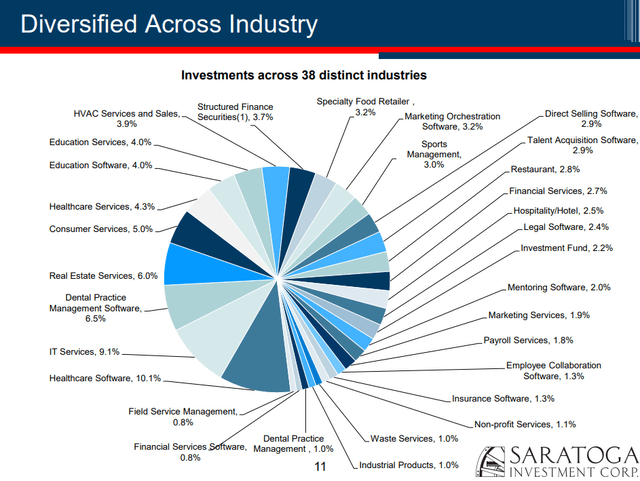

The other risk is macro-related, and Saratoga is somewhat exposed when looking at its sectors.

Sectors (Q1 2022 Pres)

IT services is quite high in allocation. They also have a fair bit of educational software that could see some pullback as people stop caring about the pandemic over economic woes. Both these segments are also corporate facing which are end-customers that have yet to see the reckoning coming from falling consumer confidence. Unemployment could come from both these latent forces as well as further Fed rate hiking.

Conclusions

While there are some risks, the company buys first-lien debt which is not risky in terms of seniority, and currently the performance of loans looks good anyway. Moreover, its conditions on the financing side have been locked in at pretty good rates, and the company is growing its AUM despite a more disciplined market.

The company also trades at a substantial discount to NAV. The NAV per share value is around $28 and the company trades at $23, so at a discount factor of 0.8. There are some possible reasons for this. The first is that securitisers are struggling to package and sell loans, so the liquidity of their portfolio might be declining and therefore their mark-to-market value. Moreover, if they cannot securitise the loans, they may dump them into the market, and this would not be a good supply situation for the debt markets. The other reason might be macroeconomic concerns. Duration risk can explain a little of it, but certainly not much.

SAR outpaces the business development company (BDC) index, which is the closed-end fund-style regulatory structure that Saratoga adheres to. The yields are pretty good across its portfolio around 9%, and a higher rate environment, to the extent that it doesn’t cause performance problems on outstanding loans, should allow for disciplined allocations at better rates than in a low interest environment. The dividend yield is 8% and has been increased for 6 consecutive quarters. The dividend is just about covered, which means that unless they can continue to grow AUM, there are risks to it with performance likely to worsen rather than improve. Also, as rates increase, the amount of willing lenders also decreases. Increasing AUM will not be that easy. Overall, we don’t feel particularly compelled to invest in US middle-market debt.

Be the first to comment