VV Shots/iStock Editorial via Getty Images

Investment Thesis: While NatWest (NYSE:NWG) has seen a recovery in the past two years, higher ECL provisions across the Leisure segment and slowing mortgage demand could be potential risk factors.

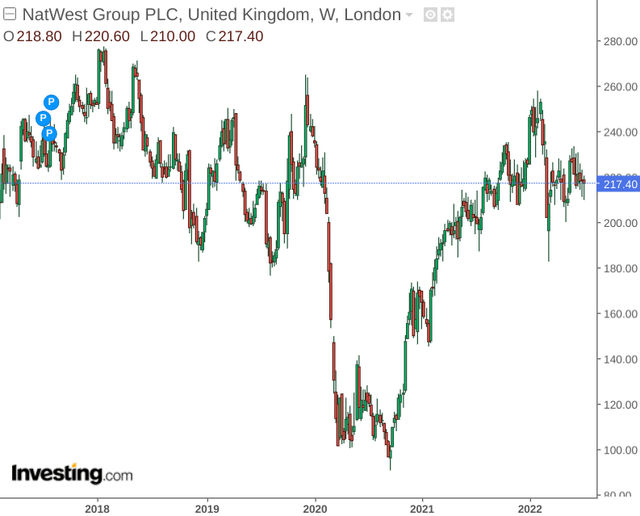

NatWest Group is a leading retail and commercial bank in the United Kingdom. In spite of a sharp drop during the onset of the COVID-19 pandemic, the bank’s share price has seen an impressive recovery.

However, with inflation having become a big macroeconomic concern – there is a risk that NatWest could see a potential decline in growth if there is a significant pullback in overall consumer confidence.

The purpose of this article is to determine whether NatWest could continue to see upside from here in spite of inflation risks.

Performance

One significant gauge of risk for the bank is the company’s expected credit loss (or ECL).

In order to gauge the degree to which this has changed over a longer-term period – I decided to compare expected credit losses in Q1 2019 and Q1 2022 – in order to determine if there are particular business segments that could be more at risk.

The Personal segment (which includes Mortgages, Credit cards and other personal sources) accounted for 55% of ECL provisions in Q1 2019, while the wholesale segment accounted for 45%.

However, Q1 2022 data shows that the split was more even – at 51% ECL provisions for personal and 49% for wholesale.

What is also interesting is that when considering the Wholesale segment, the Corporate segment accounted for 69% of all Wholesale provisions in Q1 2019, whereas this had increased to 75% of all Wholesale provisions by Q1 2022.

To get a better idea of the split by industry, here is a comparison of Q1 2019 and Q1 2022 ECL provisions across the Corporate segment:

Q1 2019

| Industry | Total ECL Provisions (£m) | Percentage (%) |

| Airlines and aerospace | 60 | 7.94% |

| Automotive | 38 | 5.03% |

| Health | 77 | 10.19% |

| Land transport and logistics | 39 | 5.16% |

| Leisure | 227 | 30.03% |

| Oil and gas | 63 | 8.33% |

| Retail | 209 | 27.65% |

| Shipping | 43 | 5.69% |

Source: Figures sourced from Q1 2020 Interim Management Statement. Percentages calculated by author.

Q1 2022

| Industry | Total ECL Provisions (£m) | Percentage (%) |

| Airlines and aerospace | 44 | 5.25% |

| Automotive | 48 | 5.73% |

| Health | 93 | 11.10% |

| Land transport and logistics | 81 | 9.67% |

| Leisure | 401 | 47.85% |

| Oil and gas | 51 | 6.09% |

| Retail | 120 | 14.32% |

Source: Figures sourced from Q1 2022 Interim Management Statement. Percentages calculated by author.

When comparing the two time periods, we can see that ECL provisions for Leisure increased substantially from 30% to 48%, while that of retail fell from 28% to 14%.

Looking Forward

While Leisure spending has seen a rebound following the lockdown phases of the COVID-19 pandemic, it remains to be seen to what degree inflation will be expected to affect spend in this area going forward.

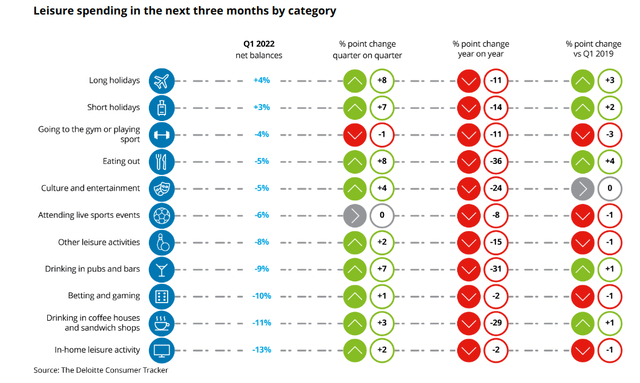

According to the Deloitte Consumer Tracker, we can see that while leisure spending for Q1 2022 saw positive growth across the holiday segment, there was concurrently a significant decline in other leisure activities.

Deloitte Consumer Tracker Q1 2022

Should we see this trend accelerate in an inflationary environment, then the leisure sector as a whole could come under further pressure.

As concerns the Personal segment, while Mortgages accounted for 46% of ECL provisions in Q1 2019, this had reduced to 36% in Q1 2022. Moreover, ECL provisions across Personal customers had reduced from just over £2 billion in Q1 2019 to £1.88 billion in Q1 2022.

With that being said, UK mortgage lenders are currently expecting the biggest fall in mortgage demand since Q2 2020 on the back of higher inflation. Additionally, house prices in the UK are up by 20% since February 2020. Should we see a situation where the drop in mortgage demand remains prolonged due to inflation, then this could mean that we also see a rise in ECL provisions across this segment.

Additionally, investors will be on the lookout for a significant rise in net interest income to accompany higher rates going forward.

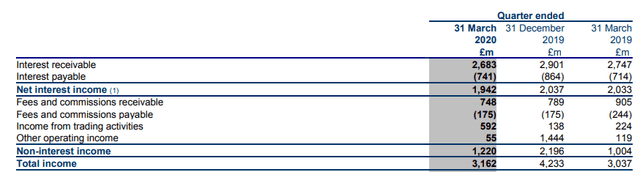

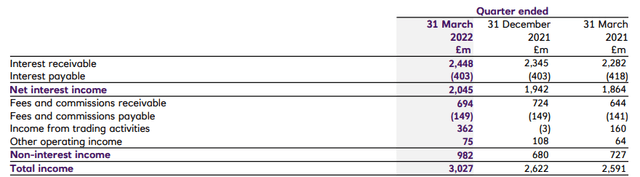

We can see that net interest income in Q1 2022 has only just recovered to levels seen in Q1 2019. Additionally, non-interest income still remains below levels seen in March 2019.

Q1 2019 and Q1 2020 Income

Q1 2020 Interim Management Statement

Q1 2021 and Q1 2022 Income

Q1 2022 Interim Management Statement

From this standpoint, while NatWest may be in a position to benefit from rate rises, it is increasingly dependent on net interest income given the drop in non-interest income. Moreover, should inflation result in a significant drop in business activity, then we could see a situation where growth in net interest income stalls as loan demand starts to fall.

Conclusion

To conclude, while NatWest has seen a recovery in the past two years, higher ECL provisions across the Leisure segment and slowing mortgage demand could be potential risk factors.

Should significant growth in net interest income not materialize going forward, then the stock could see some risk of downside.

Be the first to comment