Teamjackson/iStock Editorial via Getty Images

As I said the first two times I covered it on Seeking Alpha, “two steps forward, one step back” has very much been the story of NatWest Group’s (NYSE:NWG) arduous transition from global banking giant to stodgy, dividend-paying domestic retail outfit. In fairness to the group, whereas most of its woes have previously been self-inflicted, the fallout from the war in Ukraine and the subsequent deterioration of the U.K.’s economic outlook isn’t something you can lay at the door of management past or present. Still, third quarter results released last week won’t do anything to dispel the very mixed sentiment that surrounds the bank.

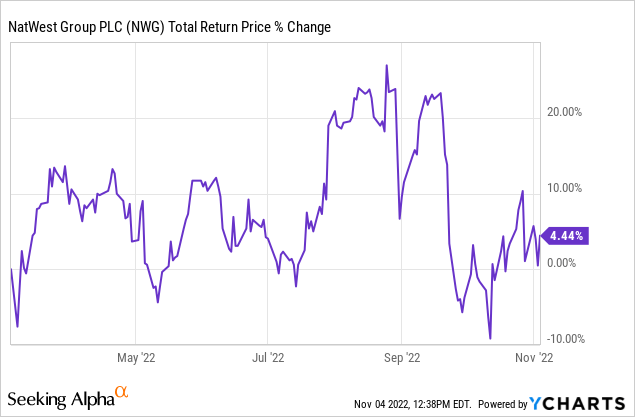

As it happens, the stock has done well since my last piece back in March. The calculation is a bit messier than usual (there was a 13-for-14 share consolidation last quarter on the back of a 16.8p per share special dividend), but by my count NatWest has returned over 20% all said and done since then. That is in GBP terms for the London-listed shares, with the dollar-denominated ADRs having done worse due to sterling’s weakness (or rather, the greenback’s strength).

Looking ahead, these are interesting times for the bank. Getting a handle on potential bad debt isn’t easy given how volatile the economic situation is, while the firm has also delivered a curveball of its own in the form of vague operating cost guidance. At the same time, the bank will be a big winner now that rates in the U.K. are marching higher. With that set to power income growth in the coming quarters, these shares still look cheap to me, notwithstanding the poor U.K. economic landscape. Buy.

Benefiting From Higher Rates

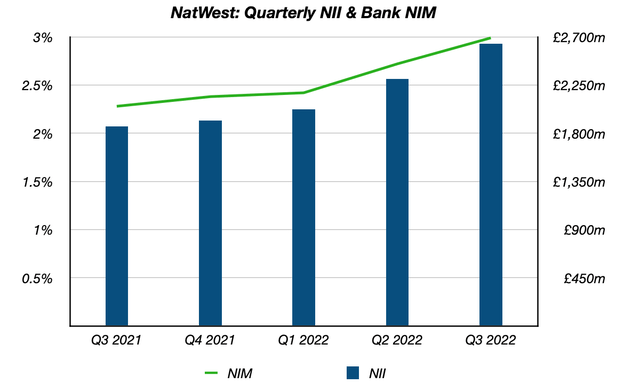

While third quarter results were not well received by the market, one area where NatWest is undeniably doing well is net interest income (“NII”), with the bank finally able to reap the benefits of a concentrated banking market and strong core deposit franchise now that rates are firmly on the up. As a reminder, about 40% of NatWest’s £450bn customer deposits are non-interest bearing.

Data Source: NatWest Quarterly Results Releases

NII in the go-forward group came in at £2,634m in Q3, an increase of over 40% year-on-year and 14% sequentially and above the consensus estimate. That was driven by higher deposit margins, with net interest margin up 27bps sequentially to 2.99%, and higher volumes, with bank interest earning assets up almost £10bn sequentially to £349.9bn. Gross loans to customers in the go-forward group increased 2.7% sequentially to £347bn, with solid growth in both Retail (+2.2%) and Commercial & Institutional (+3.4%).

Focus Turns To Costs

While revenue came in slightly ahead of the consensus estimate, it was expenses that provided the source of the market’s disappointment. Go-forward group operating expenses were £1,782m, down 2% year-on-year but up 5% sequentially. That was higher than expected and led to a miss on pre-provision operating income, though it was forward guidance that provoked the market’s ire, with management pulling its previously flat outlook for 2023 operating expenses. Inflation is obviously putting upward pressure on the cost base, but given the bank affirmed previous guidance as recently as its Q2 results release, this move seems a bit odd. What’s more, the bank declined to offer any fresh guidance on the issue.

The provisioning line also came in higher than expected. The bank booked a net impairment charge of just over £240m for the go-forward group, albeit with that reflecting changes to its economic modeling rather than issues with its own assets. That led to a miss on operating profit, which at £1,242m was 20% higher than a year ago but down the same amount sequentially.

The Outlook

Consumer health and the U.K.’s economic outlook have obviously deteriorated a lot in recent months. NatWest’s lending book is about as run-of-the-mill as it gets, with more than half of loans in fixed rate residential mortgages; it is sitting on a lot of capital (CET1 was 14.3% at the end of Q3); and it generates significant pre-impairment operating income (on track for over £5.5bn this year to absorb potential increases in bad debt. Guidance on that front has been tweaked slightly. Management still expects the full-year 2022 impairment charge to remain sub-10bps, but the 2023 guidance has been upped slightly to 20-30bps, in line with its across-the-cycle figure.

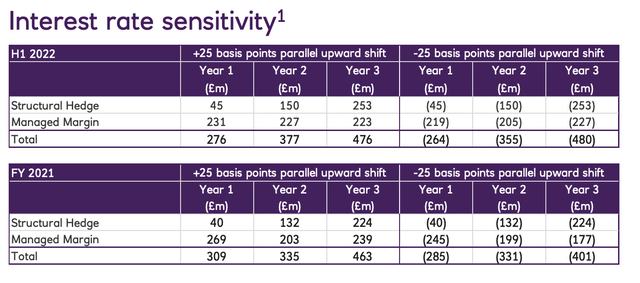

On the plus side, net interest income is going to be a big positive here going into 2023 and beyond. NatWest is very rate sensitive, with management estimating a 25bps parallel upward shift in the yield curve would result in a £276m increase in NII in year one. As a rough guide, I make that around twice the sensitivity of peer Lloyds Banking Group (LYG). With the base rate now at 3% and likely heading higher that is going to be a big tailwind to revenue and earnings over the next few years given NII dominates its revenue. Indeed, even the low-end of analyst estimates has pre-provision earnings rising by 25% out to 2024 versus 2022.

Source: NatWest Q3 2022 Results Presentation

There are risks. The biggest one at the moment is that asset quality deteriorates beyond modeling due to worse than expected economic indicators, while loan growth could come in weaker for the same reason. Open-ended guidance on operating expenses is also not ideal, for obvious reasons. Finally, I think there is a degree of political risk on two fronts. Firstly, government willingness and flexibility to provide stimulus to households and business is now much lower than in recent years. Secondly, and despite U.K. banks already paying much higher rates of corporation tax, an increase in the headline rate may lead to lower profitability if enacted.

Shares Still Cheap

With that said, these shares still look cheap, with the current share price of 238p offering investors a discount to tangible book value. Taking management’s 20-30bps through-the-cycle impairment guidance at face value implies a mid-teens return on tangible equity, though prudently building in higher than expected loan losses still leads me to a double-digit return on tangible equity. On that basis, I do think there is a fair degree of multiple expansion on the table given the current discount to tangible book value and implied single-digit forward PE ratio. In the meantime, these shares also offer a 6%-plus prospective dividend yield, with significant additional capital returns potential via both special dividends and buybacks. Buy.

Be the first to comment