Welcome to the demand edition of Natural Gas Daily!

Following more states announcing mandatory isolations, natural gas demand on a real-time basis remains resilient with no total demand drop.

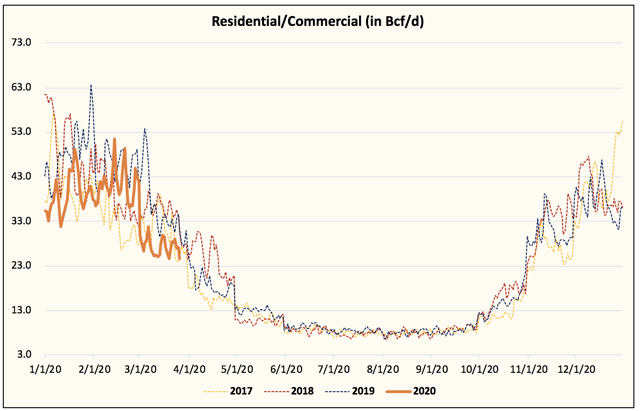

The one area of weakness is coming from residential and commercial demand, which is taking the big part of the demand hit from the shutdowns.

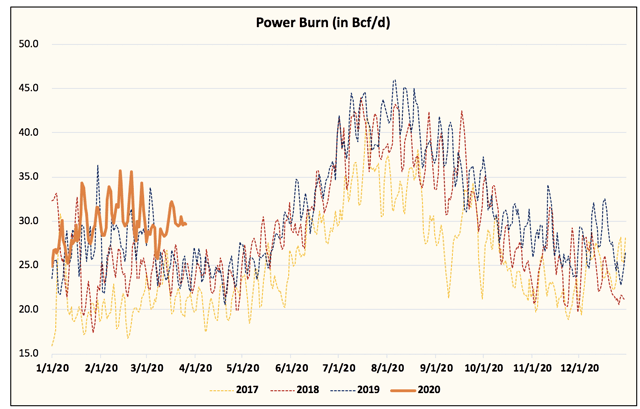

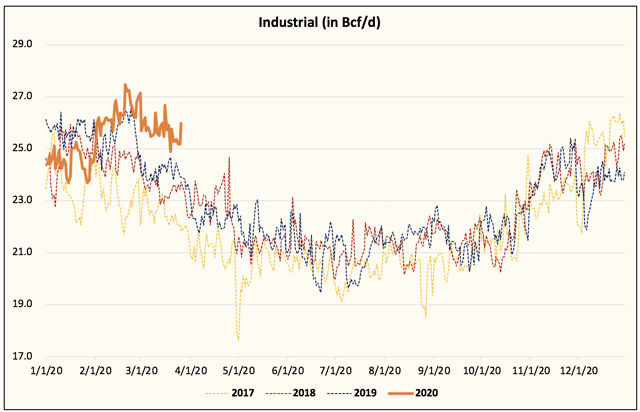

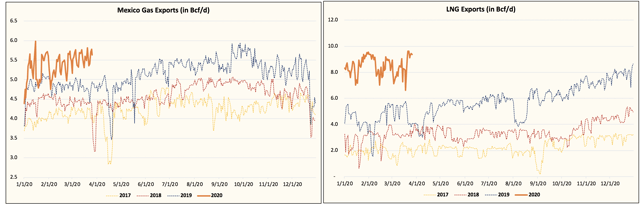

But strong demand in power burn, industrial, and exports continue to offset the demand hit.

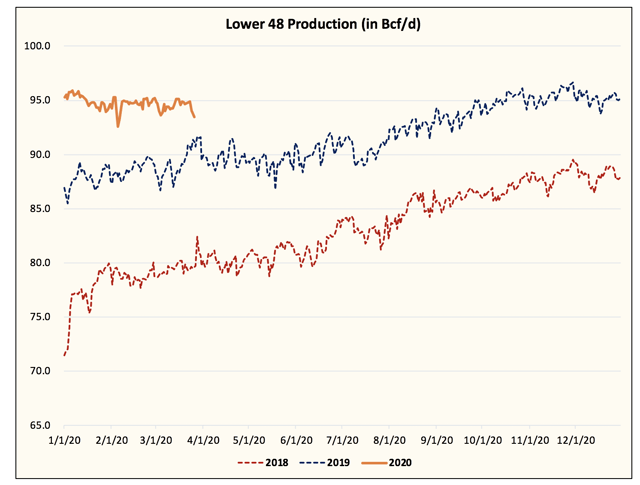

In addition, Lower 48 gas production is falling and will likely accelerate its decline in April as producers shut down well completions and shut-in high variable cost wells.

We could see Lower 48 production dip to ~92 Bcf/d sometime in April.

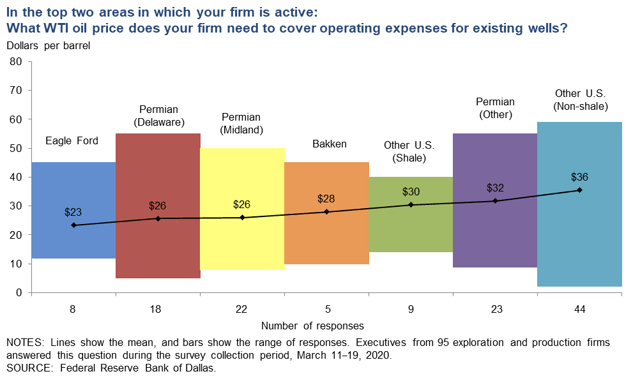

The Dallas Federal Reserve published a survey of producers yesterday asking them for their operating well cost breakevens. The results were as follows:

Notice that WTI is now trading smack at $23/bbl. Production volumes above the $23/bbl mark will start to shut-in as low oil prices are expected to continue. Keep in mind that this is just the average across the shale basins, so the level of shut-in will vary. But one thing is clear, the longer the oil prices stay low, the more production gets shut-in.

In 2016, we only had WTI briefly finish below $30/bbl for 2 weeks. This time, we are seeing WTI now below $25/bbl for a week and likely longer due to the coronavirus demand destruction. This will likely manifest itself into a wider production drop starting in April when contractual obligations subside.

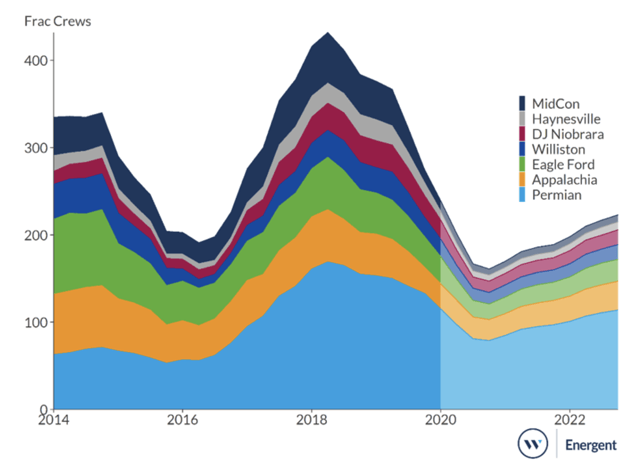

We will also see this first impacted in rig counts and frac spreads. Frac crews are now estimated to drop below 2016 levels:

So, combining the potential of further supply destruction from low oil prices and the resulting impact on associated gas production, natural gas balances will keep trending towards a larger deficit.

Our reasoning for why prices remain stubbornly low is that the fear of demand destruction is far greater than the actual impact. As traders fret over the impact of global LNG reduction potential, the market is unwilling to be bullish on any commodity today (with the exception of gold).

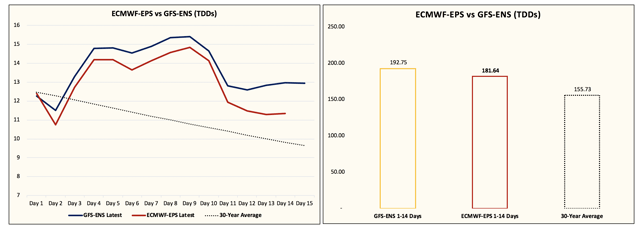

But as supply inevitably declines and demand remains resilient, natural gas prices will be forced to rerate. Interestingly enough, even if a nationwide shutdown occurs, the demand boost from bullish weather projected over the next 15-days will offset this.

For readers that have found our natural gas articles insightful, we think you should give HFI Research Natural Gas a try. We provide the following to subscribers:

Come and see for yourself why we are the largest natural gas community on Seeking Alpha.

Disclosure: I am/we are long UGAZ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment