jittawit.21

Thesis

Investors in National Retail Properties, Inc. (NYSE:NNN) stock got out in a hurry recently, as the market battered the leading retail REIT despite having a strong record of execution, supported by relatively low dividend payout ratios.

However, the market has been pricing in the risks of worsening macros with a likely recession over the horizon. Coupled with an increasingly aggressive Fed, the market is also pricing in the impact of interest rate risks on its AFFO per share estimates. Notwithstanding, with occupancy reaching 99.1% in Q2 and an average remaining lease term of 10.6 years, NNN seems well-positioned to ride through the coming recession from a position of strength.

However, the inventory adjustments going on with even the leading retailers in the US suggest that the market has refrained from re-rating NNN currently, seeing further risks to its AFFO per share growth.

The company’s revised AFFO per share guidance for FY22 indicates that its growth is expected to slow markedly from FY21’s metrics, impacted by the repayments of the rental deferrals.

Notwithstanding, we assess that the massive selloff over the past four weeks, which sent NNN declining close to its January 2021 lows, could subside moving ahead. Coupled with a more attractive valuation and a robust dividend yield, we believe it’s appropriate for investors to consider adding exposure at the current levels.

However, NNN also appears to have lost its medium-term bullish bias. Hence, the market could de-rate it further, anticipating more significant risks to its AFFO outlook in 2023. In that case, investors should look for a decline toward its intermediate support zone ($31), which would improve the reward-to-risk profile significantly for adding at those levels.

Accordingly, we rate NNN as a Buy.

NNN’s Valuation Looks More Attractive Now

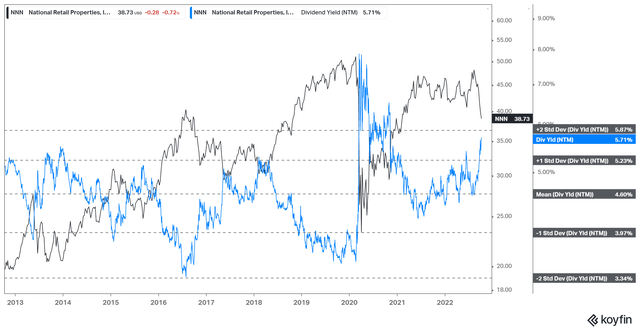

NNN NTM Dividend yields % valuation trend (koyfin)

The recent collapse from its August highs sent NNN’s NTM dividend yield of 5.71% surging toward the two standard deviation zone over its 10Y mean.

Therefore, we postulate that the market de-rated NNN further in anticipation of worsening macros that could impact the resilience of its rental base. Furthermore, management also alluded to the impact of variable interest risks on its tenant base. Management highlighted that one-third of its tenant base is affected by floating rate debt in its capital structure, as CFO Kevin B. Habicht articulated:

About 1/3 of our tenant roster is private equity backed and they tend to operate under kind of debt terms that are variable rates. To date, we have not seen a lot of stress, if you will, at the property level and not too much really at the corporate level at this point in time. [But,] I think it can get a little more challenging if you’ve got some near-term debt maturities that you have to refinance. (NNN FQ2’22 earnings call)

Given yesterday’s (October 7) nonfarm payrolls report, the market has priced in an 81.1% probability of a 75 bps rate hike in the November FOMC. Coupled with the steadfastly hawkish commentary by Fed Chair Jerome Powell and his committee, we believe the market is anticipating further refinancing stress on NNN’s tenant base, impacting its rental obligations toward 2023.

Given an increasingly hawkish Fed engineering a weaker consumer demand backdrop moving ahead, we believe the de-rating is justified. We assess that the market needs to account for these headwinds to reflect NNN’s valuations appropriately.

However, we deduce that the de-rating has also significantly damaged NNN’s valuations, as seen above. But, investors should expect more downside volatility if the market prices in a worse-than-expected economic downturn, which we believe is not the base case, for now, based on the S&P 500’s forward P/E of about 15x.

Is NNN Stock A Buy, Sell, Or Hold?

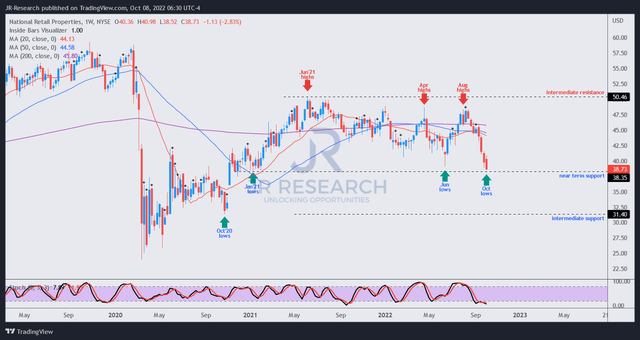

NNN price chart (weekly) (TradingView)

As seen above, the selloff in NNN from its August highs is emblematic of a rapid capitulation move that digested gains all the way back to January 2021.

Hence, we believe the market forced the selling to de-risk NNN’s execution risks in a more unaccommodating environment for its tenant base.

Given the speed and extent of the selldown, we are leaning bullish as it closes in on its near-term support ($38). Hence, we expect a consolidation zone to form at the current levels, offering investors less aggressive entry levels to add more positions.

But, if the recession is worse-than-expected, we see a decline toward the intermediate support zone as appropriate, sending its NTM dividend yields above the two standard deviation zone over its 10Y mean. Hence, investors are urged to layer in accordingly.

We rate NNN as a Buy.

Be the first to comment