filipfoto/iStock via Getty Images

It’s been a while since I last looked at National Health Investors (NYSE:NHI) in February, and a lot has happened since then, not least of which includes rising rates, inflation, and emerging positives in senior living.

NHI’s share price has seen a strong rebound since my last bullish piece, giving a 28% total return over the past seven months, faring far better than the 10% decline of the S&P 500 (SPY) over the same timeframe. This article highlights why the rebound in NHI’s share price is worth a look for income investors, so let’s get started.

Why NHI?

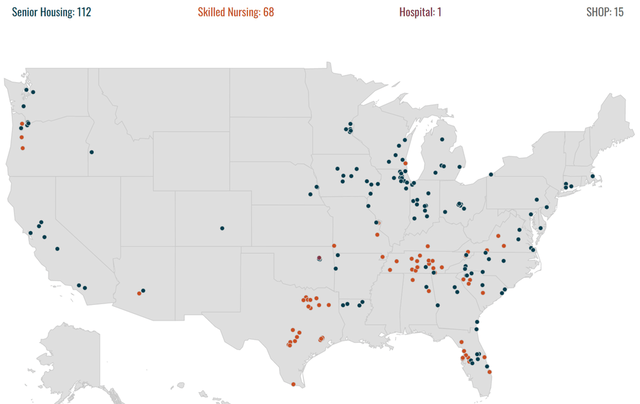

National Health Investors was founded in 1991 and is focused on owning and leasing out healthcare-related properties, including Senior Housing and Skilled Nursing facilities. Its portfolio is generally located in population-dense areas along the East Coast, Sunbelt, Midwest, and West Coast regions of the U.S., across 32 states. As shown below, most of NHI’s assets are lease contracted private pay senior housing (112 properties), with the remainder comprised of 68 skilled nursing and 15 senior housing operating properties.

NHI Property Locations (Investor Presentation)

Like most of the senior housing and skilled nursing segment, NHI has seen its fair share of challenges stemming from tenant labor shortages and suppressed occupancy rates. It appears, however, that some of these challenges are easing as NHI’s normalized FFO per share came in at $1.26 in the second quarter, an 8.6% increase over the prior year period.

Moreover, NHI is working its way through underperforming assets with the disposition of 10 underperforming senior housing properties for net proceeds of $76 million in recent months. Over the past year, NHI has disposed of 31 underperforming properties, with cumulative EBITDARM coverage of just 0.5x for net proceeds of $288 million.

Also encouraging, the troubled Bickford Senior Living assets, which were converted to cash basis accounting for its master lease agreements, are showing positive signs. With the newly reset lease, their EBITDARM coverage is now 1.3x and occupancy further improved subsequent to the end of Q2 by another 100 basis points. Overall senior housing EBITDARM coverage is also moving in the right direction, with the latest report showing 1.11x coverage, up from 0.98x at the end of 2011, and total company coverage improved to 1.68x from 1.54x over the same time period.

Looking forward, what makes NHI stand out among many of its peers is its very strong balance sheet, which comes with a net debt to EBITDA ratio of just 4x, sitting at the low end of management’s targeted range of 4x to 5x. This gives management plenty of flexibility to pursue its pipeline, as noted during the recent conference call:

On a positive note, we have seen several deals that we had previously passed on, come back to the market, which suggests that balance may be tipping back towards buyers.

We continue to prioritize deals with immediate real estate ownership or short-term financing structures with a path to ownership. As I noted on our last conference call, we are seeing more RIDEA type opportunities in the pipeline and believe this is a tool for longer-term external growth, but our focus is now on driving operational improvements in the current ventures before looking to expand the platform.

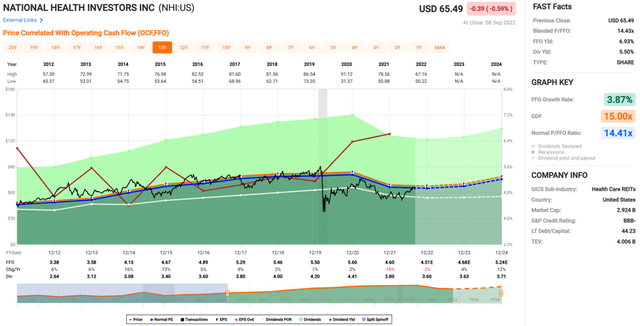

Meanwhile, NHI pays an attractive 5.5% dividend yield that’s well-covered by a 71.4% FAD payout ratio. I also continue to see value in the stock at the current price of $66 with a forward P/FFO of 14.5. While this sits close to the normal P/FFO of 14.4, I believe the market is underestimating the potential turnaround and the very strong balance sheet.

Management also appears to think the stock is undervalued, as it executed $70 million worth of share buybacks in the second quarter alone. Moreover, the Quant system rates NHI as a Strong Buy, by applying a weighted average of predictive values, as shown below.

NHI Quant Rating (Seeking Alpha)

Investor Takeaway

National Health Investors has seen its share of ups and downs over the past couple of years. The trend, however, is looking up for the company, and it maintains one of the best balance sheets in the healthcare REIT sector. This makes NHI well-positioned to capitalize on favorable deals in the senior care segment. Meanwhile, NHI pays a well-covered and attractive dividend yield, and I continue to see value in the stock.

Be the first to comment