da-kuk/E+ via Getty Images

In early 2021, I recommended purchasing National Fuel Gas (NYSE:NFG) for its exciting growth prospects and its extremely cheap valuation. Since my article, the stock has rallied 75% and hence some investors probably think that it is time to take their profits. However, in this article, I will analyze why the stock has further upside potential.

Business overview

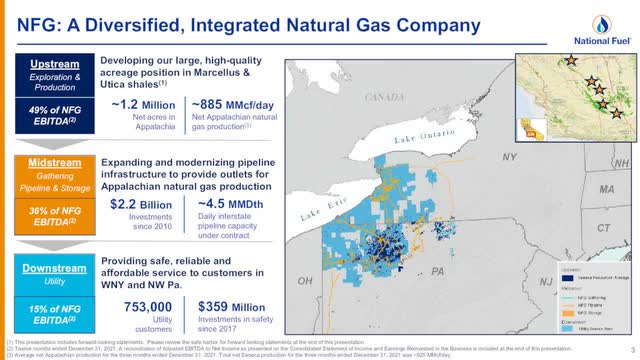

National Fuel Gas is a vertically integrated natural gas company. Its upstream segment (exploration & production) generates 49% of its EBITDA while its midstream segment (gathering, pipeline & storage) and its utility segment generate 36% and 15% of its EBITDA, respectively.

National Fuel Gas Business Overview (National Fuel Gas Presentation)

The energy sector incurred a fierce downturn due to the pandemic in 2020. Due to the social distancing measures implemented in response to the pandemic, the consumption of oil plunged in 2020. However, the natural gas market proved much more resilient than the oil market, as the small decrease in commercial consumption was offset by higher residential demand.

The resilience of the natural gas market was clearly reflected in the performance of National Fuel Gas. While all the oil majors and refiners incurred hefty losses or saw their earnings collapse in 2020, National Fuel Gas incurred just a 15% decrease in its earnings per share.

Even better, National Fuel Gas has accelerated its business momentum in recent quarters thanks to strong production growth and higher prices of natural gas. The company grew its earnings per share by 47% in 2021 and has improved its results even further this year.

In the first quarter of 2022, National Fuel Gas grew its output by 7% over last year’s quarter, mostly thanks to the development of its promising acreage positions in Appalachia. In addition, it benefited from an 18% increase in its average realized price of natural gas. As a result, it grew its earnings per share by 40% over the prior year’s quarter, from $1.06 to $1.48, and exceeded the analysts’ estimates by $0.15. Notably, the company has exceeded the analysts’ estimates for 11 consecutive quarters. This is a testament to the sustained business momentum of the company and its strong business execution.

Moreover, management raised its guidance for the full year for the second quarter in a row. It raised its guidance for the annual earnings per share from $5.05-$5.45 to $5.20-$5.50. At the mid-point, the revised guidance implies 24% growth over the prior year. It is also worth noting that this management has proved conservative in its guidance most of the time and hence it is reasonable to expect the company to exceed its own estimates.

Even better for National Fuel Gas, the price of natural gas has enjoyed a steep rally this year, to a new 13-year high, due to the invasion of Russia in Ukraine. Europe, which generates 31% of its electricity from natural gas provided by Russia, is doing its best to diversify away from Russia in an effort to impose sanctions on the country. As a result, numerous LNG cargos have been exported from the U.S. to Europe and hence the U.S. natural gas market has become exceptionally tight lately.

The prompt price of U.S. natural gas has nearly doubled since early February, from $3.972 to a new 13-year high of $7.612. This creates an ideal business environment for National Fuel Gas. It is also important to note that the aforementioned guidance of the company was based on natural gas prices of around $2.50. It is thus evident that the company is likely to exceed its guidance by a wide margin this year.

Moreover, the sanctions of Europe to Russia are not likely to be withdrawn anytime soon. Therefore, while the price of natural gas may incur a correction from its current level, it is likely to remain much higher than its historical average for at least another 1-2 years. As National Fuel Gas generates 49% of its EBITDA from its upstream segment and about 90% of its output is natural gas, it is obvious that the company will keep thriving for the foreseeable future.

Dividend

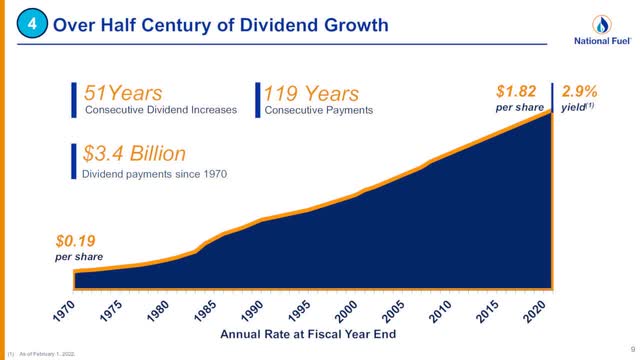

National Fuel Gas has paid uninterrupted dividends for 119 consecutive years and has raised its dividend for 51 consecutive years. It has thus become the first energy company of the best-of-breed group of Dividend Kings.

National Fuel Gas Dividend Growth (National Fuel Gas Presentation)

Given the high cyclicality of the energy market, which is caused by the dramatic swings of the prices of oil and natural gas, the multi-decade dividend growth streak of National Fuel Gas is impressive.

The stock is currently offering a 2.5% dividend yield. It also has a payout ratio of 40% and a healthy balance sheet, with interest expense consuming just 21% of operating income. As a result, the dividend of National Fuel Gas has a wide margin of safety.

Unfortunately, the company has grown its dividend by only 2.5% per year on average over the last decade. This is somewhat disappointing for income-oriented investors. On the other hand, as the payout ratio is too low, it is evident that management has prioritized reinvestment of earnings in growth projects over a higher dividend. As the company is expected to post 10-year high earnings per share in 2022 and 2023, investors should not put too much emphasis on its lackluster dividend growth rate.

Valuation

When I wrote my previous article on National Fuel Gas, the stock was trading at 11.0 times its expected earnings per share of $3.76 back then. Since my article, the stock has rallied 75% but its earnings have been revised upwards thanks to the rally of natural gas prices and strong production growth. As a result, the stock is now trading at a forward price-to-earnings ratio of 13.1.

However, it is important to realize that the analysts’ estimates have not taken into account the latest surge of the price of natural gas. This means that the stock is essentially trading at a lower price-to-earnings ratio.

Moreover, the company is expected to grow its earnings per share by another 17% in 2023 and by another 7% in 2024. It is thus trading at only 10.5 times its expected earnings in 2024. Overall, National Fuel Gas is less attractive than it was in early 2021 but it remains attractively valued.

Risk

Given the aforementioned tailwind from the Ukrainian crisis and its cheap valuation, National Fuel Gas seems to have further upside potential. On the other hand, investors should never forget the high cyclicality of the natural gas business. Experience has taught us that high prices of natural gas lead producers to greatly boost their output and thus supply outpaces demand at some point. There is no reason to believe that this time will be different. Therefore, I advise investors to begin taking their profits whenever National Fuel Gas approaches the level of $85 (20% higher than the current price), which is 13.0 times the expected earnings in 2023. The stock may run even further but it is impossible to predict the absolute top while the downside risk will be significant whenever the next downcycle of natural gas shows up.

Final thoughts

National Fuel Gas is one of the highest-quality energy companies, with an exceptional dividend growth streak. In addition, the company will keep thriving for the foreseeable future thanks to the surge of the natural gas prices to a 13-year high level amid the ongoing war between Russia and Ukraine. Given its impressive business momentum and its cheap valuation, National Fuel Gas seems to have significant upside potential.

Be the first to comment