enot-poloskun

NanoXplore Inc. (OTCQX:NNXPF) is a Canadian company that produces and supplies Graphene, an allotrope of carbon and material that is thought to have countless potential applications from faster microchips to greener concrete. In my view, graphene is finally reaching mainstream adoption, and since NanoXplore is a clear leader in the field there is a valuable opportunity to build a position here. The risk averse should steer clear of this play though, as the industry itself is speculative and there are significant risks for the stock, which include the macroeconomic environment and competitive challenges.

Background

Graphene is a 2D material composed of carbon atoms arranged in a hexagonal lattice structure. It was first isolated just 18 years ago in 2004 by two physicists, Andre Geim and Konstantin Novoselov at the University of Manchester. Due to the unique structure of Graphene, it has many desirable properties including superconductivity, flexibility, optical transparency and high tensile strength. These traits mean that it has a vast array of possible applications in areas almost too numerous to count, including biomedical, energy storage and in composite materials. However, the running joke throughout Graphene’s lifetime of development has been that Graphene could do anything-except leave the laboratory. As with any developing technology, the battle to become viable and gain mainstream adoption can be an arduous and lengthy one. Therefore, the main crux of any assessment of NanoXplore is inevitably intertwined with the industry as a whole, as well as the ongoing process of Graphene production technologies and techniques.

Overview

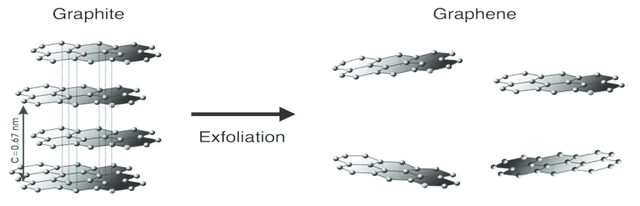

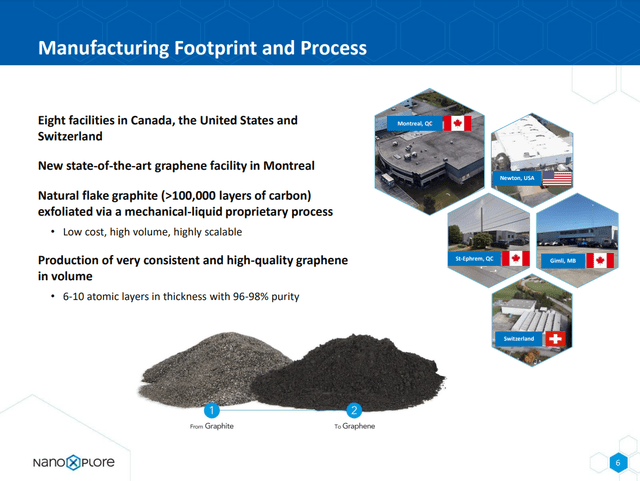

NanoXplore currently owns the largest graphene production plant in the world, capable of producing 4,000 tons per year using a water base exfoliation to convert graphite to graphene. This plant will be crucial to not only the company’s success, but the industry too, because potential customers will not commit without assurance that there is adequate supply for large scale projects. Currently, the company’s main product is GrapheneBlack™ powder, which can be used as an additive in plastics to improve recyclability and protect from thermal and ultraviolet degradation.

The graphene industry, meanwhile, is not some far off technological revolution away, but rather is predicted to exceed $2 billion by 2029, which would translate to a CAGR (Compound Annual Growth Rate) of 30.5%. For context, the wildly popular EV industry is estimated to attain a more modest CAGR of 24.3% by 2028.

Nicklas Blomquist

Q4 2022

NanoXplore does not have any Wall Street analysts covering it and as such, Q4 can’t be said to have beat or missed expectations, however the report was essentially positive. FY revenue of $94.3 million beat the internal forecast while Q4 revenue was up 35.5% YoY. Q4 EBITDA also finally managed to break into the positive at $113,000, although it seems unlikely to stay positive in the coming quarters given that management has indicated increased R&D spending is on the horizon and the current macroeconomic situation could weigh more generally on costs. In terms of liquidity, NanoXplore holds $51.2 million in cash and cash equivalents which is reasonable given they don’t have much debt.

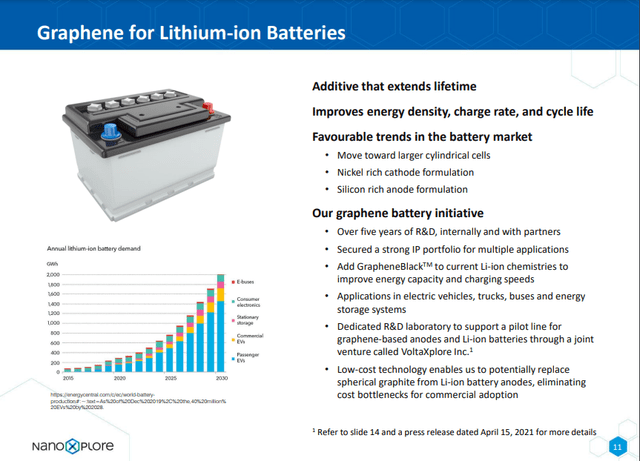

The company has been on somewhat of an acquiring spree, recently acquiring two private companies, XG Sciences Inc and Canuck Compounders Inc. XG Sciences was a competitor as it produced graphene nanoplatelets and held IPs relating to graphene silicon composite anode, a key technology for future battery development. This acquisition is going to expand NanoXplore’s patent portfolio which in my view is a large part of the company’s moat, while also bringing it closer to breaking into the huge battery market, which NanoXplore expects to grow. The EV battery market is estimated to reach almost $560 billion by 2030 so breaking into this market alone could stimulate significant growth. These developments are very encouraging in my view and speak to the company’s growing TAM.

CEO Soroush Nazarpour on battery demand:

The battery ecosystem is a large market and for every gigawatt hour, we will need around 1,000 tons of anode active materials. Based on BMI projections, we could see 700 megawatt hour of battery capacity in North America by 2031. Hence, we expect around 700,000 tons of demand for anode battery materials by 2031. While the current supply of anode material in North America is almost non-existent.

NanoXplore investor presentation

Battery production is only one of three applications management highlighted they expect to form the basis of wide scale graphene adoption. The others are light weight composites and specialty compounds. By using their graphene enhanced composites, the weight of electric vehicles can be reduced by up to 25% according to management, which is crucial in increasing vehicle range. The most potential for growth near term though is almost definitely within the specialty compound area. Cement is particularly promising, with lab tests by partners showing a strength increase between 15% and 70% in cement using a small loading of graphene. Modest applications like this should sustain the company in the shorter term, as selling something that is effectively an additive to an existing product is easier than selling an entirely novel one.

Competition

The competitive landscape in any rapidly developing cutting edge technological industry is usually hard to properly gauge and the fledgling Graphene industry exemplifies this. This is because of the large variation in both Graphene production methods and also intended downstream applications. For instance, Talga Group Ltd (OTCPK:TLGRF) focuses on the mining and use of Graphene in battery anodes, while Zentek Ltd. (ZTEK) produces graphene enhanced pharmaceutical products such as graphene antimicrobial coatings. In addition, many graphene companies in competition with NanoXplore pursue a vertical integration strategy just as NanoXplore does, which muddies the waters somewhat in terms of valuation. A company that primarily mines graphite but has a small graphene product division might justify substantially lower, but grounded valuations, than a graphene company with a huge IP portfolio and large graphene product business.

That leads onto a crucial aspect of evaluating competition in this industry: the methods of graphene production. NanoXplore uses a patented water base graphite exfoliation technique to produce graphene powder, which they claim is low cost, large volume and highly scalable. It is critical to differentiate this powder from companies that instead produce graphene sheets, because they are completely different products with different applications. Graphene powder is useful as an additive in existing industries to do things such as enhance the durability of materials, extend the lifespan and efficiency of products like batteries, and improve the sustainability of plastics.

NanoXplore investor presentation

Graphene sheets on the other hand are generally more costly and difficult to produce, but are required for use in R&D or advanced microchips and are sold by area, not weight. Therefore, it makes sense that most publicly traded companies in this space at the minute produce graphene powder instead, which appears to be the lowest hanging fruit in terms of realising the benefits of graphene as a material. This reality is worth keeping in mind though as a competitive risk to NanoXplore, because there is a possibility that either a private company or a larger public company with deeper pockets comes up with a better method of production and beats them to this market. With that said, I think the potential size of this market means that there is plenty of room for a healthy number of competitors and approaches.

Competitive advantages

NanoXplore holds a few key advantages over the competition in my view. The first is in the areas of R&D and intellectual property. I was surprised to learn that with an annual R&D spend of almost $3 million, NanoXplore leads their competitors by a substantial margin, who mostly spend under $1.5 million. While pure spending power obviously does not translate to research progress let alone profit, it seems likely that the eventual winners in this industry will have to stay at the cutting-edge of research, and so maintain a reasonable R&D spend. A further advantage is the technical expertise of management, the CEO Soroush Nazarpour holds a PhD in nanotechnology and is a published author in the field. Having this insight into the feasibility of different production methods and downstream applications is critical in a new bleeding-edge industry like this.

Valuation

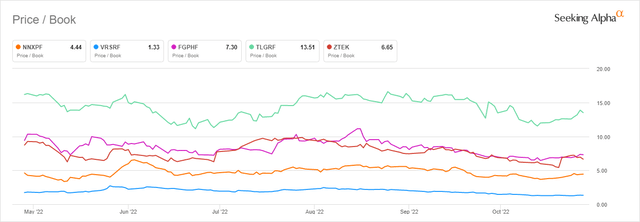

Due to the speculative nature of the market and company, I do not think it is worth coming up with a similarly speculative valuation using discounted cash flows, or anything involving a great number of assumptions. The potential size of the industry, number of applications and varied methods of production are too unpredictable. However, with this type of stock it is worth making a brief comparison to its immediate competition on some basic valuation metrics to get a sense of whether the current price is generally reasonable. To get a sense of this, I compared the Price to Book (P/B) ratio of NanoXplore with some of the competition within the graphene industry.

Although NanoXplore’s P/B ratio does not seem particularly low generally, compared to competition within the industry it looks relatively normal, maybe even on the lower end. This makes sense given that the P/B ratio does not take into account things such as the value of intellectual property which can constitute a large proportion of the value of graphene companies, as well as the fact that the P/B bit higher for tech companies.

Risks

The main risk for this stock is also part of what makes it attractive in the first place, which is the inherently volatile and uncertain nature of the graphene space currently. Although the CEO has impressive technical credentials and the company surely tests production methods and so on thoroughly, I do not think anyone can confidently predict that one production method, or application will sustain the test of time. A superior production method or other technology advance from competitors is always a risk in this industry. Aside from that, like any unprofitable tech company right now, the broader macroeconomic trends are of course also unfavourable, although I do not see any particular warning signs financially.

Conclusion

NanoXplore is a compelling graphene pure play with decisive advantages over the competition. Graphene is finally leaving the lab, albeit seems to be appearing in more straightforward applications as an additive first, with the higher tech possibilities like microchips and even battery anodes remaining longer term growth prospects. Fortunately, NanoXplore has cast a wide net in this sense and is pursuing both currently available applications and more speculative ones, creating a potentially huge TAM.

There are significant risks within the graphene industry as the most efficient production methods are not certain. However, with an experienced engineer style CEO and promising product test results, I think the company has a good chance at becoming a leader of what will eventually be a large industry.

Be the first to comment