Jean-philippe WALLET/iStock via Getty Images

Investment thesis

Naked Wines (OTCQX:NWINF) has been focused on investing in growth but is currently experiencing a business slowdown, compounded by inventory build-up. Management has reacted, focusing on cutting costs to improve profitability and destocking, and has access to sufficient liquidity. Our asset-based valuation analysis points to the upside, and we rate the shares a buy.

Quick primer

Founded in 2008, Naked Wines is a direct-to-consumer retailer of wine operating in the US (45% of total sales in FY3/2022), the UK (42% of total sales in FY3/2022), and Australia. Naked Wines customers commit to a fixed subscription each month (starting at GBP25.00 in the UK) which goes towards their next purchase. The company funds the production costs for independent winemakers (266 in FY3/2022), generating savings that are passed back to its customers (called Angels). There were more than 960,000 Angels (+9% YoY) (page 12) served in FY3/2022.

Naked Wine caters to a relatively affluent customer base, in a market that is traditionally seen as being robust in an economic downturn. The user retention sales rate (existing customers from a year ago purchasing in the following year) was 80% in FY3/2022, down from 88% in the previous year. Its listed UK-based peer is Virgin Wines. We view Naked Wines as positioned in the mid-tier wine market, not catering to high-net-worth individuals like LVMH (OTCPK:LVMHF) with robust trading in their latest results for their Wines and Spirits division.

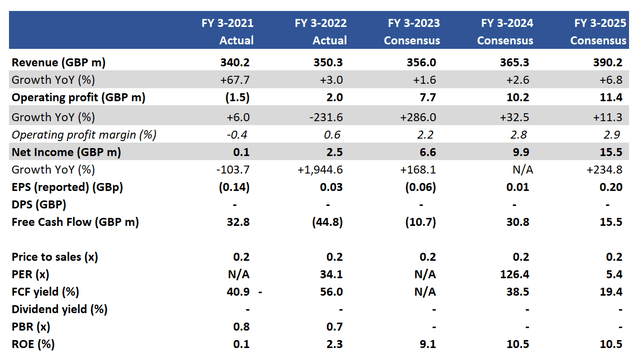

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

During the pandemic, Naked Wines pursued a rapid growth strategy, which saw FY3/2021 sales grow 67% YoY driven by new ‘Angel’ subscriber growth. Management positioned the company to sustain growth into FY3/2022, with a major inventory build and relatively high investment in customer acquisition costs. Unfortunately, the business experienced flattish revenue growth with increasing fulfillment and general & admin costs, culminating in cash burn and requiring a major change in strategic direction. In October 2022, the company announced a re-focus on reducing costs, lowering inventory, and a new renegotiated credit facility of GBP64 million, on top of its net cash balance of GBP22 million.

With short-term liquidity issues seemingly under control, we want to assess how durable the company’s business model will be in a recessionary environment. The shares have corrected by 85% YTD. Our biggest concern is the UK market, where we are witnessing business confidence hit a 13-year low, with the retail sector under significant pressure with the likes of furniture maker Made.com in administration, as well as apparel retailer Joules. High-end grocer Marks and Spencer (OTCQX:MAKSF) has warned over its outlook, commenting that ‘it is highly likely that conditions will become more challenging in FY24’.

Recent trading and revised guidance for FY3/2023

H1 FY3/2023 trading was said to be profitable and in line with revised company guidance issued in October 2022. Sales growth was 4% YoY but under constant currencies fell 3% YoY. Adjusted EBIT reached GBP4 million, which was a major recovery from GBP1.2 million in H1 FY3/2022 but implies a low adjusted EBIT margin of 2.4%. The company’s historical 10-year average reported operating margin is only 1.7%, highlighting that the business model is not inherently high return – it did reach a peak of 8.7% in FY3/2013, the last 5 years have been a struggle as it aimed to scale.

Guidance for FY3/2023 has been lowered to reflect the company’s ‘pivot’ towards profitability and access to liquidity. FY revenues are now expected to decline mid-single digits YoY, and costs will be reduced for customer acquisitions as well as general operating expenses. The implication here is a slowdown in sales growth into H2 FY3/2023, but profitability to improve.

Destocking will take some time to accomplish, with inventory expected to peak in October 2022 followed by a slow decline into FY3/2024 – the pace will be dependent on customer activity as well as the company’s ability to renegotiate with winemakers and the potential penalties it will involve. Cash burn is expected to continue until H2 FY3/2024, and consequently, the company has its new debt facility in place.

In the short term, the company’s efforts to maximize profitability and improve working capital will be viewed positively by the market. However, the longer-term picture of whether the company can return to value generation will depend on customer activity and maintaining access to financing. On a positive note, we believe ‘Angels’ tend to be fairly sticky, and although actual purchases may decline, subscription prepayments should continue which should provide some indication of a backlog of business.

Asset-based valuation

We would like to conduct a simple asset-based valuation of the company, using the following estimated figures – cash, inventory, and customer advances.

The company has managed to renegotiate its credit facility, and in October 2022 had access to GBP86 million cash (net cash of GBP22 million and credit facility of GBP64 million). If we take consensus forecasts (see Key financials table above) as a simple guide, 2-year free cash generation by the end of FY3/2024 will total GB20.1 billion, which will result in GBP 42.1 billion net cash.

The planned inventory balance at the end of FY3/2024 is GBP145 million. If we add the estimated inventory to the forecast net cash, the balance comes to GBP187.1 million. The company owed customer advances (from Angel subscriptions) of GBP76 million in FY3/2022 – when we subtract this debt, the net balance falls to GBP111.1 million.

When we compare this to the current market capitalization of GBP77.4 million, there is an asset-based upside to the shares of over 40%. This is a very simplistic way to assess valuation but wish to highlight that if consensus is pointing in the right direction, there is scope for the shares to recover.

Valuation

Trading on PBR 0.7x, Naked Wines is currently in a net cash position with a large inventory balance. Despite the current cash burn, liquidity is available and management’s focus on profitability, as opposed to volume increases, should result in free cash flow generation into FY3/2024. The shares look undervalued.

Risks

Upside risk comes from Naked Wines beating company guidance into H2 FY3/2023 despite concerns over consumer sentiment. Destocking levels dropping faster than expected will also improve working capital requirements, helping to generate more cash and placing the company in a stronger financial position.

Downside risk comes from major churn in Angels, resulting in falling revenues and customer advances. A major writedown of inventory could place any asset-based valuation at risk – there have been bulk wine sales that point to future discounting.

Conclusion

Naked Wines was caught out in the current economic slowdown, but management has reacted and downside risk now appears limited. Execution needs to be solid but based on our asset-based analysis, there appears to be an upside to the shares given that the company should return to positive free cash flow generation in FY3/2024. Our thesis is dependent on a realistic valuation of inventory.

Be the first to comment