Md Saiful Islam Khan/iStock via Getty Images

Investment Thesis

Given the present macroeconomic disturbances, one would be inclined to seek safety in defensive healthcare companies, but I don’t think Myriad Genetics, Inc. (NASDAQ:MYGN) is an ideal choice. Indeed, there are a number of problems that have hampered this company’s ability to drive meaningful growth, which has made it very difficult for investors to see much upside from owning the stock. Based on the information available to me, I believe that the company will ultimately struggle to realize its full potential, but its small size and strong financial profile may make it an attractive acquisition target for a larger player in the future. Before I get too far ahead of myself, let me give you a quick background on the company.

Revenue Trends

MYGN is a leading provider of genetic testing services and products. The company’s genetic testing services help individuals access their personal genetic information to better understand their health risks, which can help them make more informed health decisions. For example, the company offers the MyRisk™ genetic testing panel, which helps individuals assess the hereditary risk of developing a set of cancers, including breast, ovarian, prostate, and colorectal cancers. Its GeneSight™ service assesses the chance of responding to specific medications and dose specifications for various mental disorder treatments. Precise Tumor™ is the company’s test service assessing the efficacy of cancer therapies for patients.

We have mentioned three out of eight testing services offered by MYGN, representing roughly 80% of total revenue. More importantly, it sets us in the right direction to assess the company’s revenue drivers. Fundamentally, MYGN sales are a function of tests sold (quantity) multiplied by test price. This might seem simple, but the unique characteristics of the healthcare market render the equation more complex. One would be mistaken to think that the healthcare market is an efficient, free market.

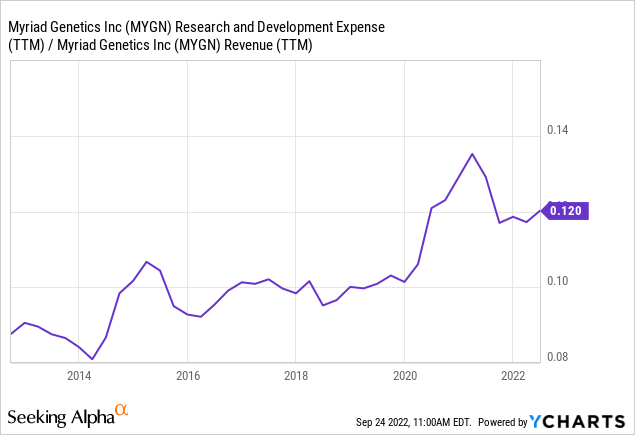

The number of billable units (loosely defined as the number of tests sold) depends on a lot of things, like how many doctors use genetic testing to make a diagnosis and how many patients are seen. This, in turn, is influenced by the standard of care practices and guidelines, which not only affects how often physicians request a genetic test for their patients but also payors’ reimbursement and coverage decisions. To influence the standard of practice, gene testing companies, such as MYGN, run clinical trials and sponsor scientific research, highlighting the connection between genes and health, underpinning a significant portion of their high R&D expense account. Below is a graph showing MYGN R&D expenses as a percentage of total revenue.

A lot of progress has been made in the past five years to enhance guidelines and increase awareness and training of gene testing, but much work remains to be done. For example, a recent study found that despite the medical consensus over the value of genetic testing for children with neuro-developmental disorders, only a fraction have undergone these tests. We see similar trends in other diseases across all ages. Germline mutation screening is essential for MYGN to reach its full potential, but this white paper from the American Association for Clinical Oncology “AACO” reveals that insurance companies place an alarmingly low weight on family history when deciding whether or not to pay for gene testing.

Nonetheless, with every challenge comes an opportunity. Standards of care are not set in stone, and rules and regulations do change. In previous articles, I talked about the emphasis of the Affordable Care Act on preventive care to lower hospitalization as a means to decrease healthcare spending. MYGN’s gene screening for germline mutations can lower costs by allowing individuals with high cancer risk to build health plans to prevent expensive and prolonged treatment courses, for example, through periodic checks and early cancer detection.

MYGN also stands to profit from gene therapy advancements, such as the 2020 Nobel Prize-winning CRISPR/Cas9 and other gene editing technologies. The industry is still nascent, but has the potential to revolutionize healthcare by correcting genetic diseases and providing treatments for various disorders, including cancer. Since the first gene therapy rollout in 2018, more than a dozen gene-editing medicines have entered the market, and hundreds more are in clinical trials.

Lack of Competitive Moat

In 2013, the US Supreme Court declared that patents on human genes are unconstitutional. This ruling, Myriad Genetics v. United States of America, had far-reaching consequences for the gene testing and diagnostic business. Prior to the ruling, companies owned the right to test someone’s DNA and use this data to develop healthcare services, including genetic laboratory testing and screening services. Following the verdict, market competitiveness surged, and prices fell considerably. For patients, this has resulted in better access to genetic testing services. However, it limited the return on investment for gene testing companies not just because of lower revenue per test, but also because of the non-patentability of technology and know-how derived from clinical trials and R&D operations.

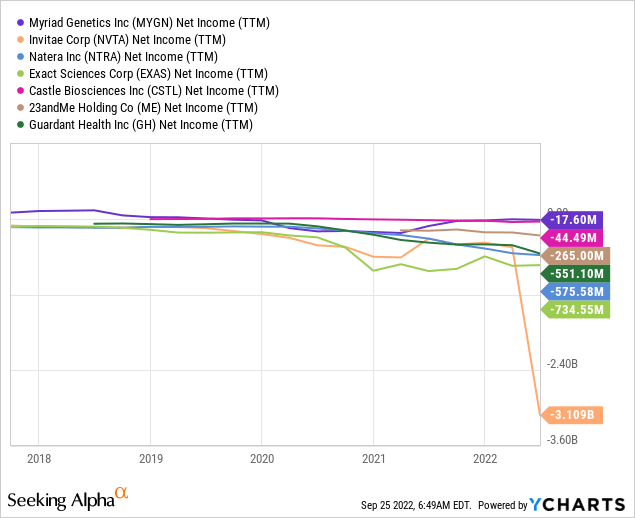

In my opinion, MYGN still hasn’t found its footing since the verdict, which ultimately damaged its competitive moat, rendering gene testing a generic, commodity-like service, as discussed in previous articles. Deep-pocketed long-term, disruptive-tech-focused investors such as Ark Invest and Softbank (OTCPK:SFTBY) gave rein to new market entrants to adopt aggressive pricing strategies and operate on a loss for a prolonged period of time, disrupting MYGN’s market position. These dynamics left most gene testing labs unprofitable, as shown in the graph below.

As the era of free money comes to an end, investors are beginning to focus on opportunities with sustainable businesses, and industry shareholders are now demanding more profitable operations from all market participants. It is still to be seen how each company will perform under the new circumstances. However, one important lesson is that managers will need to revisit their assumptions and conclusions about their capabilities and tech infrastructure. This is manifested in MYGN’s recent tech infrastructure initiative aiming at streamlining operations to enhance margins.

We know our sector is facing significant market pressure and that some of our competitors are struggling to deploy financially sustainable value proposition and growth model. Paul Diaz, CEO, Q2 2022 Earnings Call

We can now intensify our efforts to drive growth and [..] invest further in our commitment to becoming a more consumer-centric technology-enabled company. Paul Diaz, CEO, Q3 2021 Earnings Call

Improving customer service levels, new commercial strategy and our plans for our automated lab of the future, will position us to deliver on our long-term goals. Bryan Riggsbee, CFO, Q3 2021 Earnings Call

Valuation

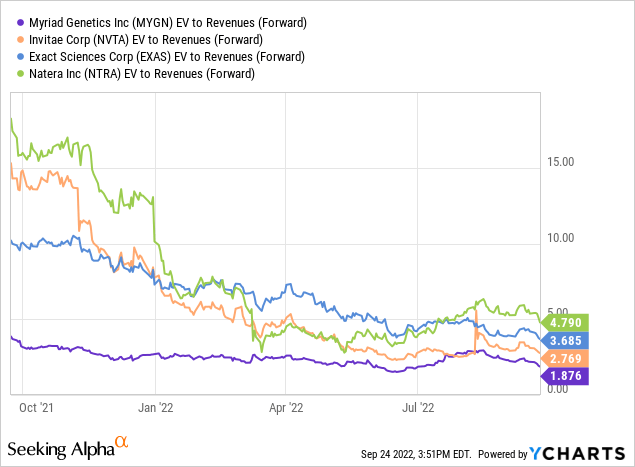

As previously stated, the sector has typically prioritized expansion, spending much on developing reimbursement pathways and growing product portfolios through R&D. The industry is also characterized by rapid consolidation. Many companies are spending extensively on M&A while incurring significant debt. As a result, any valuation comparison should account for this unprofitability and leverage. Given these conditions, I believe the EV/Sales ratio is the optimum ratio for evaluating the industry. The chart below shows that MYGN stock is the least valued in our competitor group, consisting of Exact Sciences (EXAS), Natera (NTRA), and NVTA.

Summary

I believe we are at the cusp of a new dawn for the gene testing industry as the era of free money comes to an end. This is a significant change as it means that companies will now have to start charging more for their services in order to make their research and development possible, but equally important, to generate returns to shareholders.

Still, prudent investors might want to pass on this opportunity until we see how individual companies will perform, such as MYGN, and whether it is likely to be able to sustain themselves over time. As mentioned in the previous article, I believe that investors seeking defensive market positions in the healthcare sector are better off buying into larger companies with more established market positions. Humana (HUM) and UnitedHealth (UNH) are two examples of profitable, market-leading healthcare stocks that I believe present attractive investment opportunities at the moment, given their solid earnings track records and consistent growth outlooks, and high revenue predictability. Investors looking for exposure to the “gene revolution” thematic trade might want to consider the likes of Illumina (ILMN), rather than downstream supply chain operators such as MYGN.

Be the first to comment