Co-produced with “Hidden Opportunities”

JamesBrey

Introduction

North American organizations follow several types of payroll schedules. Some issue paychecks once a month, while others choose bi-weekly, semi-monthly, or weekly pay arrangements. The more the monthly payments, the better the deal for employees since it provides tremendous flexibility with their bills and expenses and compensates them for their work quickly. But the organization chooses the schedule for us.

In the world of dividends, we get to choose the payment schedule. Some companies pay only once annually; most U.S. companies (and funds) pay quarterly, while some pay monthly. I love monthly distributions because they give me one additional paycheck (per security) every month and help me grow my portfolio faster with reinvestments.

I also love gifts and surprises during the holiday season, so I am very excited about these two picks discussed in this report. Both are securities managed by one of the best global fixed-income managers, and Santa Claus is bringing home big special distributions from this firm. Time is running out; act fast and sign-up for the 16%* yielding gifts.

Watch History Repeat Itself With Bonds

Interest rates headed sharply higher yesterday as bond prices suffered their biggest setback this year amid heightened worry about inflation, money supply growth, the weak dollar and expanding demand for credit. – NYTimes, published 1978

Although this sounds like news from a few months (weeks) ago, it is actually from March 1978. As bond prices plunged, Wall Street and Main Street were calling for the extinction of the bond market. But just a few months later, they roared back, and the next 40 years saw a record-smashing bond rally that transformed the financial system.

Institutional Investor – Archives

Why am I digging up these old news pieces?

It is because history often repeats itself in exciting ways, and Mr. Market continues to make the same emotional mistakes, and human investors follow suit.

Mortgage bonds are close to the cheapest levels since the Great Financial Crisis, and leading fixed-income fund managers like PIMCO are buying hand over fist. The bond kings – Jeff Gundlach and Bill Gross – have both spoken quite a bit in recent months about the attractive opportunities in the fixed-income sector.

Ever-increasing leverage is the culprit. The U.S. and other economies cannot stand many more rate increases – Bill Gross

Bonds are wickedly cheap to stocks – Jeff Gundlach

Fixed income has been selling off because of “risk-free” alternatives in the form of CDs and iBonds. Investors must note that there is no free lunch. The most significant risk in these alternatives is that their yield can shrink or disappear when the Fed begins to lower the interest rates.

Bonds are among the most boring asset classes for the average impatient investor. Let the markets make their decades-old mistake again; the income investors will have the last laugh. We discuss two discounted high-yield picks to load up amidst market irrationality.

Pick #1: PTY, Yield 12*%

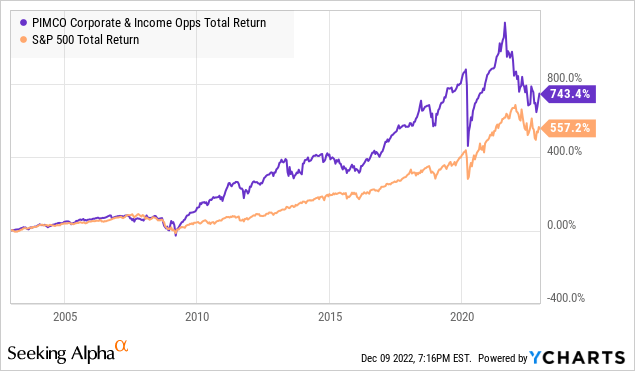

PIMCO Corporate&Income Opportunity Fund (NYSE:PTY) is PIMCO’s flagship CEF (Closed-End Fund) with a track record of market outperformance since its inception in 2003.

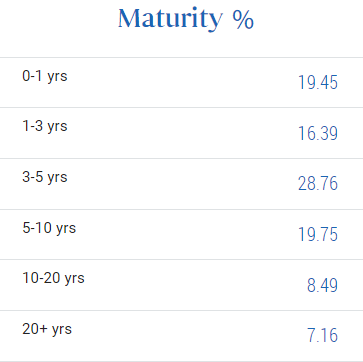

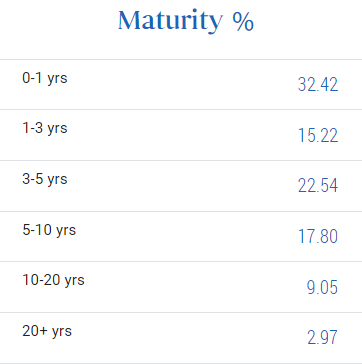

Its total leverage-adjusted maturity duration is 4.3 years, which is short-term by bond standards. Notice how a large percentage of the portfolio comprises 0-3 year term bonds. These will mature at par value in the near term, and PTY can redeploy the proceeds into higher-yielding fixed-income securities.

PIMCO Website

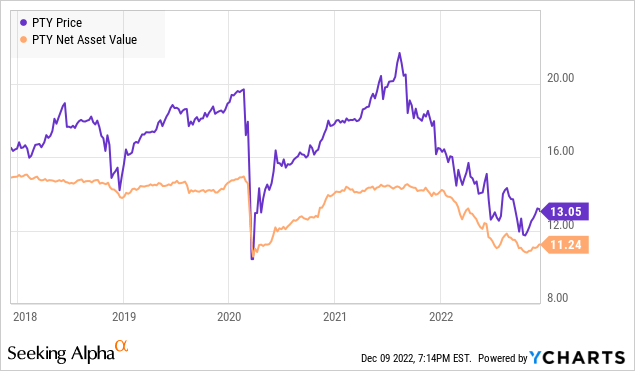

PTY pays a $0.1188 monthly distribution, calculating a healthy 10.9% annualized yield. As mentioned above, PTY is PIMCO’s flagship CEF, and it has a history of trading at significant premiums to NAV with extremely rare (and short-lived) circumstances of discounted pricing.* 12% yield calculation includes a $0.15 special dividend, ex-div Dec. 14th.

This is a bear market induced by rising interest rates, a tailwind factor for PTY; we see the current valuation as a buying opportunity.

Pick #2: PDO, Yield 16*%

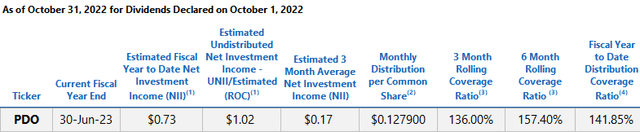

PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) maintains significant exposure to mortgage bonds with an even larger proportion of short-term funds in its portfolio. PDO is among the best performing CEFs YTD in PIMCO’s arsenal, handsomely out-earning its distribution, with almost $1.02 in Undistributed Net Investment Income (‘UNII’) for the year. That is ~8 months’ worth of distributions!

PIMCO CEF UNII Report

* Following suit with its 2021 announcement, Uncle PIMCO has brightened this holiday season yet again. They just declared a $0.96 special distribution for PDO that is worth 7.5 monthly distributions! Factoring this into the yield calculation puts PDO’s distribution at a jaw-dropping 16.6%, ex-div Dec. 14th.

Note that PDO is reporting a 3-month average NII of $0.17, which is in excess of its newly raised $0.1279 monthly distribution. With a large amount of short-term (0-3 year) bonds in its portfolio, this CEF is well-positioned for tailwinds from rate hikes. As the bonds mature at par value, PDO can redeploy the proceeds into higher-yielding securities and continue to boost NII (and our payments) in the mid-long term.

PIMCO Website

PDO issues monthly distributions that calculate a 10.2% annualized yield. PDO carries a termination date of January 2033, which means the fund will wrap up and liquidate its portfolio at NAV on the term date. Hence, buying it close to NAV would be a prudent approach to securing a healthy and sustainable income from this CEF. PDO is still ten years away from that term date. Hence the modest 5% premium to NAV still presents an attractive valuation to buy for sustainable income.

Conclusion

PIMCO brings over five decades of experience managing fixed-income securities and cherishing portfolios with a reliable income stream. We like their management style for its focus on current income and track record of portfolio quality maintenance despite fluctuating market conditions.

PIMCO CEFs are great for dividend reinvestment. PTY and PDO provide a DRIP discount where the shares are reinvested at a 5% discount to NAV (or at NAV if the trading premium is lesser). This provides a sizable boost to your portfolio in the longer term and must not be overlooked. PDO and PTY’s recently declared special distributions are up for grabs and are payable on December 22, 2022, with an ex-dividend date of December 14th. Hurry, time is running out to sign up for the Christmas present from PIMCO.

Remember that sustainability and repeatability are at the core of PIMCO’s strategy. From PDO and PTY, you collect big income now and are well-positioned to have the income prospects repeat in the coming years. PIMCO and other fixed-income funds are loading up on discounted bonds, which is a positive for income investors. History often repeats itself, and we can sit back and collect growing distributions from this market disconnect.

Be the first to comment