COWZ Pacer US Cash Cows 100 ETF is a solid choice in today’s raising interest rate environment FooTToo

Inflation is high. Interest rates are increasing. Heavily leveraged companies may need additional funds to service their debt. Profitability will likely decrease in such firms along with share prices.

One way to add a layer of protection is to target companies with a healthy amount of free cash flow. Free cash flow is the amount that is left over after paying out operational costs and capital expenditures. Free cash flow can be used to pay down and service debt and even fuel growth while other firms are struggling. Maybe this didn’t matter as much when borrowing cash was so cheap. But I feel that buying companies with a healthy amount of free cash flow is a prudent investment choice right now.

Buying Pacer US Cash Cows 100 ETF (BATS:COWZ) is a simple way to buy a basket of companies that have loads of relative free cash flow.

COWZ Uses Sensible Methodology

A fund can have a great idea but have poor execution. I recall analyzing one dividend ETF (DVY) which weighted stocks based on dividends per share. This made no sense because share price is relative. Weighting based on dividend yield would have made more sense. They had a good idea of making a ‘high dividend’ fund, but the execution was not sensible, and the weighting scheme was later changed. I would like to think it was because of my article – but I know better than that.

After analyzing how COWZ selects stocks, I find it both logical and sensible in today’s environment. How does COWZ select high free cash flow yielding stocks?

Forecasting Free Cash Flow and Earnings

- They start with the Russell 1000 index.

- Next, they remove any companies which have projected earnings or forecasted free cash flows which are negative over the next 2 years.

Removing such firms prevents the fund from accidentally buying companies with high trailing free cash flow but which are expected to have a sharp downturn in profitability or are about to engage in an intensive capital expenditure campaign.

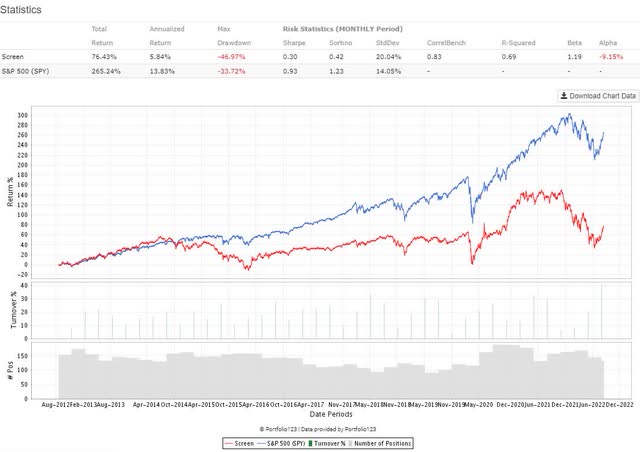

To illustrate the benefit of removing such companies, I ran a backtest in the Russell 1000 over the past 10 years, which only held companies with negative earnings or negative free cash flow forecasts at some point over the next 2 years. I rebalanced and replaced the stocks every 3 months.

Chart compliments of Portfolio123.com

On average, stocks with these negative forecasts underperformed the broad market (SPY) by 8% annually! And the Russell 1000 index contains 10 – 15% of such stocks. It is sensible to remove such companies regardless of their trailing free cash flow yield.

Enterprise Value vs. Market Capitalization

When calculating free cash flow yield, COWZ uses the following formula.

- Free Cash Flow (trailing 12 months) / Enterprise Value

It is good that they use Enterprise Value rather than Market Capitalization. Marketcap is the value of the outstanding shares. Enterprise value starts with marketcap but takes into account debt and cash. Why is it so important that we distinguish the two when calculating free cash flow yield?

Look at the company AGNC Investment Corp. (AGNC). They have generated free cash flow of $1.462 billion (TTM).

- Against a market cap of $6.7 billion that looks like a 22% free cash flow yield.

- But once you factor in debt with an Enterprise Value of $57.5 billion, the free cash flow yield drops to 2.5%.

All of that debt needs to be serviced, so it should not be ignored when calculating free cash flow yield.

This is another thing that COWZ does right.

Free Cash Flow Yield Trailing vs. Expectation

The final step is to rank the remaining stocks in the universe by free cash yield for the trailing 12-month period. The top 100 stocks with the highest FCF yield are kept.

Now, some investors might feel that a better measure would be to rank stocks by their future expected free cash flow yield instead of trailing numbers. Personally, I feel divided on this issue. Using trailing free cash flow yield measures what a company actually did. Using forecasts is an expectation and is subject to the skill of the analyst. It is hope – not reality. Both have their place, but I would not classify one method as right and the other wrong.

One thing to note is that using forecasts will exclude many more stocks than using trailing data. 10 – 15% of the Russell 1000 index doesn’t have forward-looking free cash flow estimates for the next 2 years. We don’t necessarily want to exclude free cash flow kings because they lack analyst coverage.

Furthermore, the historical record for free cash flow forecasts is short. This will limit backtesting of the free cash flow yield forecast strategy. I am not saying that we should never use free cash flow forecasts. But I do understand why COWZ decided to use trailing FCF yields when forming the fund in 2016. Maybe there is room today for a forward-looking free cash flow fund. But COWZ is still great.

Ranking Stocks by Free Cash Flow Yield

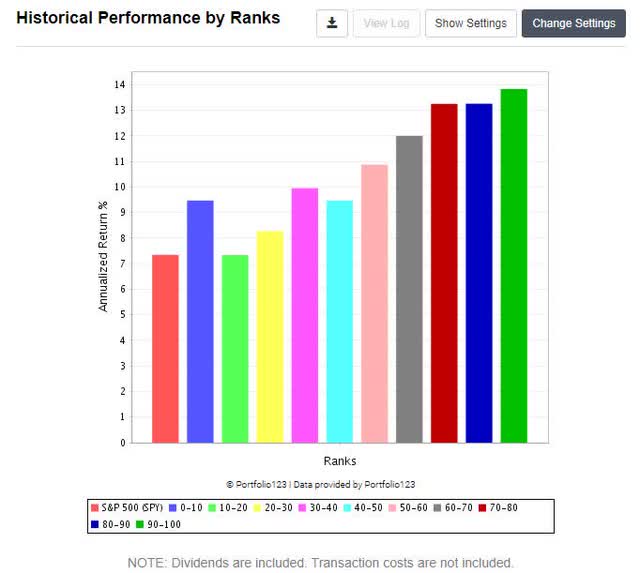

Because I have access to a large historical database of financial data, I decided to rank the stocks in the Russell 1000 index according to free cash flow yield (TTM) using the methodology outlined in this article. I started the test in 1999 and rebalanced every 3 months.

Chart compliments of Portfolio123.com

The red bar on the right represents the S&P 500 ETF. Since 1999 the S&P 500 has returned just over 7% annually. The second bar, which is blue, represents stocks with the lowest free cash flow yield. The last bar on the right, which is green, represents stocks which have the highest free cash flow yield.

This is what you want to see in a factor backtest. The higher the rank, the higher the average annual return over long periods of time. Stocks with high free cash flow yield have been a good strategy in the past and I expect it to be a good strategy going forward. Especially, over the next couple of years.

Final Thoughts On COWZ

The days are numbered for companies making enormous piles of profit with heavy leverage. As interest rates go up, downward pressure continues to be a concern on companies carrying loads of debt and borderline profitability. Sticking to quality funds like COWZ is a sensible choice for investors wanting quick and easy exposure to stocks with high free cash flow yield.

Be the first to comment