ABDESIGN

As 2021 came to a close, I provided my top five picks for the coming year. Four of those five tickers outperformed the market. Not including dividends, the year-to-date average return was minus 2.91% versus a loss of 17.13% for the S&P 500.

The average yield for the 5 stocks was 2.66% when the article debuted and now stands at 3.52%.

I continue to rate two of the stocks as buys.

From Worst To First

Lowe’s Companies, Inc. (LOW)

Lowe’s was my only pick that underperformed the market. Since my article highlighting the five appeared, shares of Lowe’s have fallen 20.2% while the S&P 500 dropped by 17.13% (all measures of stock performance are as of midday 12/12/2022.)

In the past, I’ve highlighted Lowe’s as a prototype for an ideal dividend growth stock.

Lowe’s operates in a near duopoly with Home Depot (HD). This provides the firm with scale advantages, which in turn translates into a cost advantage against competitors. Lowe’s bargaining power with suppliers and advertisers lowers costs, increases margins, and allows the retailer to pass on some of the savings to customers.

The company’s product lines are generally ecommerce resistant and about two-thirds are non-discretionary in nature.

The company owns 84% of its stores, including those on leased land, and Lowe’s debt is rated Baa1/stable from Moody’s, and BBB+/stable with the S&P.

The dividend yields just over 2%. The payout ratio is below 28%, and the dividend has a 5-year average growth rate that is nearly 20%.

While the current economy may be of concern, the broader trends favor investors.

The U.S. has 12 million new household formations, but only a 7 million supply of new homes.

Furthermore, the average home is well over 40 years old, meaning there is a greater demand for updates and repairs. Add to that the trend that has homeowners living in the same home for roughly twice as long as was common at the turn of the century, and you have the makings of enduring tailwinds.

Lowe’s forward PEG ratio of 0.98x is marginally better than the stock’s 5-year average PEG of 1.05x; however, the forward P/E of 19.01x is slightly above the 5-year average P/E of 18.53x. Consequently, I rate LOW as a Hold.

Discover Financial Services (DFS)

Shares of Discover fell less than 12%, beating the S&P 500 by nearly 5.5% since my article debuted.

As the fourth largest credit card network in the U.S., Discover ranks behind American Express (AXP), Mastercard (MA), and Visa (V). However, Visa and Mastercard operate solely as credit card processors while DFS is also a banking operation and therefore a lender.

While this creates greater risk, it also means Discover is benefiting from a rising rate environment. DFS generates over 80% of revenue via net interest income, primarily from interest on credit card balances. While tough economic times can result in increased delinquencies and charge-offs, they also lead to large credit card balances.

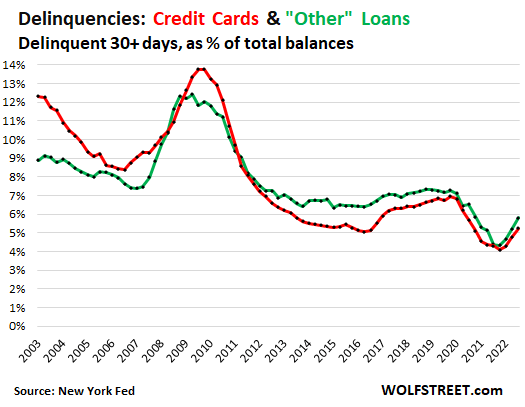

While it is true that loan delinquencies are increasing, they have not yet met pre-pandemic levels.

Wolfstreet.com

It is important to note that Discover’s Common Equity Tier 1 Capital Ratio, under the Basel III transition, was 13.9% as of September 30, 2022, well above its 10.5% target rate. That means the firm is well prepared in the event that charge offs surge.

Average loans have increased for five consecutive quarters, and the company has a very robust share buyback authorization. From 2016 through 2021, the company reduced the share count by 25%. Management recently authorized share repurchases of up to $4.2 billion through June 30, 2023. That is equal to approximately 15% of Discover’s current market cap of roughly $28.3 billion.

Discover’s debt is rated BBB/stable by S&P, Fitch provides a rating of BBB+/stable, and Moody’s has a rating of Baa2/positive.

DFS yields 2.28%, the payout ratio is 14.32%, and the 5-year dividend growth rate is 12.09%.

The stock has a forward PEG of 0.12X. The forward P/E is 6.75x, well below the 5-year average P/E of 11.79x.

I rate DFS as a BUY, and the stock is also ranked among my top ten picks for 2023.

Pfizer Inc. (PFE)

I began pounding the table in favor of Pfizer as an investment back in April of 2021, and I rated the stock as a Strong Buy in July of that year. The shares have outperformed the market by about 38% since then and by 9.5% since I rated it as a top-five pick.

PFE is facing a slew of patent expirations in 2025-2030, but the company expects to bring 19 new products or new indications for existing products to market within the next 18 months. The following is from the last earnings call:

If successful, these 19 launches, of which more than 2/3 have the potential to be blockbusters, will be the most ever in Pfizer’s history. The 15 in-house-developed projects alone could potentially represent approximately $20 billion in 2030 sales, which would more than offset the expected LOE impact.

Albert Bourla, CEO

In an industry that requires a number of costly shots on goal to bring forth new products, Pfizer’s size creates one of the largest economies of scale in the pharmaceutical industry.

Pfizer’s development of a COVID-19 vaccine and related treatments created a surge in revenues: Pfizer generated $32.9 billion in cash flow from operations in 2021, more than triple the $10.5 billion from a year earlier.

At the end of September, Pfizer had $36 billion in cash and equivalents and about$40 billion in total debt.

The current yield of 3.14% is rather robust for this industry. The payout ratio is around 24%, and the 5-year dividend growth rate is 5.70%.

I see Pfizer as trading at a modest discount. Consequently, I rate the stock as a Hold, albeit with a spot near the top of my watch list. I’ll also note that the shares should perform well in a poor economic environment.

Gaming and Leisure Properties, Inc. (GLPI)

GLPI was the second-best performer of my five picks, beating the S&P by a whopping 23%.

With a portfolio of 58 properties in 18 states, GLPI is the most geographically diversified owner of gaming assets in the U.S. The durability of the business model is reflected in the fact that GLPI collected 100% of rents during the COVID crisis.

With the exception of three properties, the next lease renewals do not occur until 2023. All current leases are 15 to 25 years in length. The majority of the properties have master leases and annual rent escalators averaging ~2% per year.

GLPI’s debt is rated BBB- by S&P and Fitch and Ba1 by Moody’s.

The current yield is 5.45%, the 5-year dividend growth rate is 2.58%, and the dividend is well covered with an 80% AFFO payout ratio,

GLPI trades at an AFFO multiple of 14.63x. Compared to their 5-year average of 13x, it appears overvalued.

Consequently, I rate GLPI as a Hold.

Nexstar Media Group, Inc. (NXST)

Of my five picks, Nexstar was my best performer. The stock beat the S&P 500 by roughly 35%.

My first article on this ticker debuted in August of 2020. I rated NXST as a Strong Buy in that piece, and since then, the share price has more than doubled.

With 199 stations in 116 markets, NXST is the largest broadcast group in the U.S. It has stations in 17 of the top 25 markets and reaches 68% of U.S. households. Due to this scale, the company attracts national and local advertisers.

Revenues for local stations were once driven by TV advertising. However, NXST now garners over half of its revenue from distribution rights and a mere third from advertising.

NXST also operates 120 local websites with 239 local mobile apps offering hyper-local content and another source of advertising revenue.

One source of potential growth lies in adoption of ATSC 3.0, also known as NextGen TV. NextGen provides better audio and video quality as well as a strong reception source for fixed and mobile devices.

A study by BIA Advisory Services estimates broadcasters will garner, using a worst case scenario, $6.4 billion in revenue from NextGen by 2030. The best-case scenario projects revenues of $15 billion with the proliferation of NextGen.

Before I provide a rating for NXST, I would like to caution readers regarding the company’s debt profile.

I consistently eschew investments in stock’s with poor debt profiles, and NXST is the only investment I hold with debt that is not investment grade.

Nexstar’s credit is rated Ba3 / BB, a non-investment grade speculative range. However, the company’s debt load is improving: net leverage at the end of the last quarter was 3.18 times. That’s down from 3.32 times in Q2 and 3.7 times at the end of 2021.

Nexstar’s dividend yields 1.95%, with a 13.58% payout ratio and a 5-year dividend growth rate of 24.57%.

I rate NXST as a BUY, and I also rank the stock among my top ten picks for 2023.

Summing It Up

Although Lowe’s, Pfizer and GLPI have fallen off my buy list, I view each as quality investments, and they are near the top of my watch list.

The state of housing in the U.S. should provide enduring tailwinds for Lowe’s, and shares of Pfizer should perform well during a recession.

GLPI’s ability to collect 100% of rents during the COVID crisis proves that the company will also perform well in the event of an economic downturn.

Although I continue to rank Nexstar as a buy, I caution readers that it does not adhere to the safety profile I generally require for my investments. Although the company’s debt burden is improving, it should be watched closely.

I rate Discover as a Buy. Although it is one of my larger holdings, I just added significantly to my position in the name.

LOW, NXST, and PFE all rank among my top ten positions, largely due to the increases in share valuations that occurred after my initial investments.

I have a moderate position in GLPI.

A follow up article will be posted shortly with the remainder of my top ten picks for 2023.

Be the first to comment