bjdlzx

Murphy Oil (NYSE:MUR) is a company that is oriented towards growth no matter the market demands. There are some sound businesses here. But there are also some “homerun” possibilities. Those investors looking for a company that is giving into market demands to return capital can look elsewhere. In the meantime, this company has a good base upon which to grow the business in the future with a rock-solid balance sheet aiding the cause.

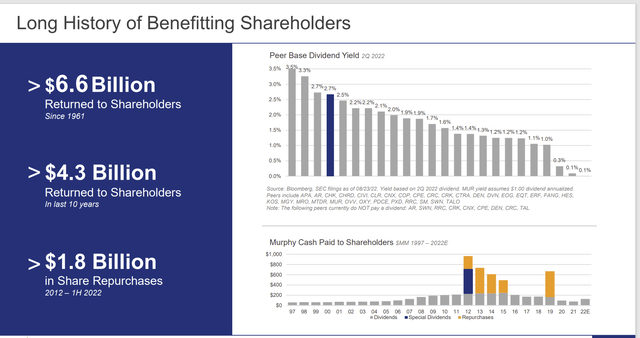

Murphy Dividend and Share Repurchase History (Murphy Oil October 2022, Corporate Presentation)

The company has a long history of paying a base dividend only. Similarly, the only time that dividend was cut was during industry downturns when management became very unsure about future cash flow. Management then would cautiously restore the dividend during recoveries.

There have been occasional share repurchases but only one special dividend. This company is not following the industry trend of giving significant cash flow back to shareholders. Instead, management sees much better use of capital to provide above average returns for shareholders. That has led to a growth year for the company in an industry dedicated to shareholder returns instead of growth.

This actually makes sense as management reports rapid paybacks in the latest corporate presentation. That means that the return on money invested is very attractive in the current environment. Management has also made some minor purchases and divestments to high-grade the portfolio.

The market demand for return of capital resulted from the oil price crash of 2015 followed by an aborted recovery in 2018 and ending with the coronavirus challenges of 2020. But really, the aborted recovery resulted from too much money flowing in at a time when demand for oil was not increasing that much.

The market failed to understand that the boom times of the past were gone. Now, money had to be invested for decent long-term returns. The go-go days of the past were a thing of the permanent past (for the time being). The very institutions screaming for a return of capital were the ones investing in failed projects. This is an industry where due diligence is a constant (ongoing) job. Those failing to note changes can lose a lot of money quickly as happened in the 2019-2020 period.

Murphy Oil management is catering to the fact that the speculative money is now gone. Therefore, a return to a favorable environment to invest in the industry has returned. Management is acting accordingly. The rest of the industry is likely to slowly follow this example once it is realized that a lot of prior unrealistic projects that flooded the market with oil are unlikely to happen currently.

Growth Projects

Management has been emphasizing the Gulf of Mexico for some time. Offshore had been a laggard in enjoying the recovery of the industry. Management used that time to bring on some large-scale projects using the low costs available at the time. Since much of the costs incurred are capitalized, the low costs create a faster payback environment with the strong pricing recovery underway.

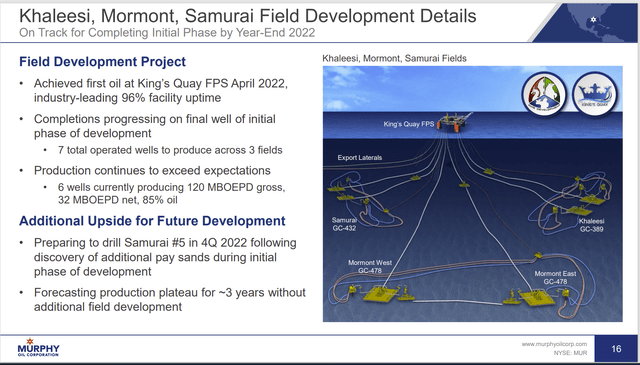

Murphy Oil Summary Of Kings Quay Project (Murphy Oil Third Quarter 2022, Earnings Conference Call Slides)

Shown above is a major contributing reason to the remarkable production growth in the current year. These are long-lived wells with relatively low decline rates. The current environment allows for a payback period that was unimaginable a year or so earlier. Many of the Gulf projects will payback much faster than imagined providing their owners with free cash flow for years to come.

The considerable exposure to the Gulf Of Mexico allows for relatively fast growth due to a lot of projects there were derisked in the past. Instead, the usual “true” exploration projects there are a lot of “add-on” projects and extension type projects that are lower exploration risk type projects. Murphy is a relatively small player and offshore projects tend to be expensive and large. So, taking the time to put the odds in your favor as this management has done can often pay unexpectedly sizable dividends in the future.

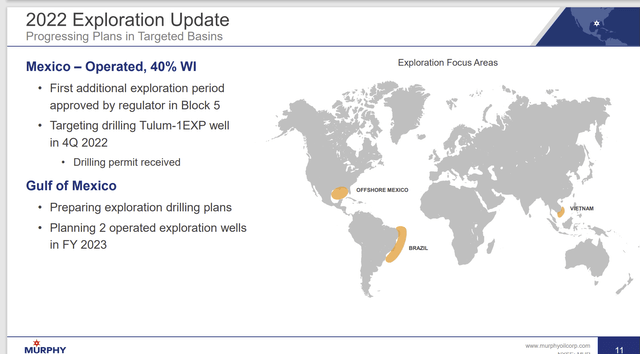

Murphy Oil Map Of Offshore Areas To Explore (Murphy Oil October 2022, Corporate Presentation)

Management has a schedule of higher risk and lower risk offshore exploration. Investors can expect some dry hole write-offs in the future mixed in with some discovery announcements. So quarterly earnings could be on the erratic side.

The more speculative plays like Brazil hold the promise of a large upgrade of reserves should a discovery be made. But even the Gulf Of Mexico exploration (where there is considerable information already available) hold the promise of material production upside should a discovery be made.

The offshore advantage, even with a cost recovery rally underway for service industries, still offers relatively long-lived wells with lower production decline curves. This production does not need the constant high investment level that the onshore unconventional business needs to maintain production.

Nonetheless, management was in a position to raise the level of natural gas production in Canada because they waited for a downturn to free up takeaway capacity.

The Eagle Ford is generally perceived by this company as a cash cow. So, material production growth on those leases is unlikely at the current time.

The Future

This management will continue to grow the base business while looking for ways to materially raise reserves very profitably. The emphasis on a strong balance sheet has served shareholders well in the past as it has enabled management to take advantage of accretive deals almost any time in the industry cycle.

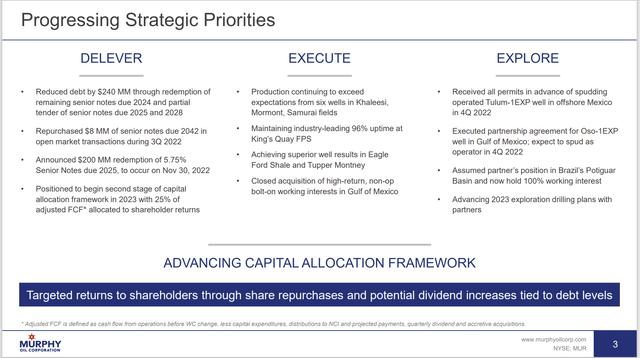

Murphy Oil Summary Of Strategic Business Plan Priorities (Murphy Oil Third Quarter 2022, Earnings Conference Call Slides)

The above makes clear that this company will not be an income vehicle anytime soon. So, income investors need to look elsewhere.

Management has a priority to “reset the balance sheet” as they put it. They view the current robust pricing environment as a time to lower debt to levels previously beyond their reach. That will take some time given that growing the business is also a fairly high priority.

In the meantime, the offshore exploration and development program will likely allow for some significant additions to both cash flow and reserves. The additions will come in lumps because Murphy is a fairly small offshore operator and offshore projects tend to be large.

But Murphy has long known how to reduce some of the offshore risks to the point where this company has a predictable income stream from established production while growing that stream through discoveries. The past history is that successes far exceeded failures. That is likely to continue.

For shareholders that want a management to try for that “homerun” discovery, this is the company to look at. Management is adept at finding those chances without risking the company in the process (as so many competitors do). The strong balance sheet provides considerable downside protection. But the stock can be volatile because dry hole costs are generally expensed as incurred. Those offshore dry hole costs can be a fair amount of money.

Be the first to comment