bjdlzx

(Note: This article appeared in the newsletter on June 15, 2022, and has been updated as needed.)

Murphy Oil (NYSE:MUR) management recently announced an offshore dry well and really got to the end of the potentially significant exploration wells that could add a lot of reserves for the current fiscal year. Now, for many, the production growth alone is accounted for in the current price. So, there are views that with insider sales, there currently is no reason to own the stock. Long-term buy-and-hold investors may have a different take.

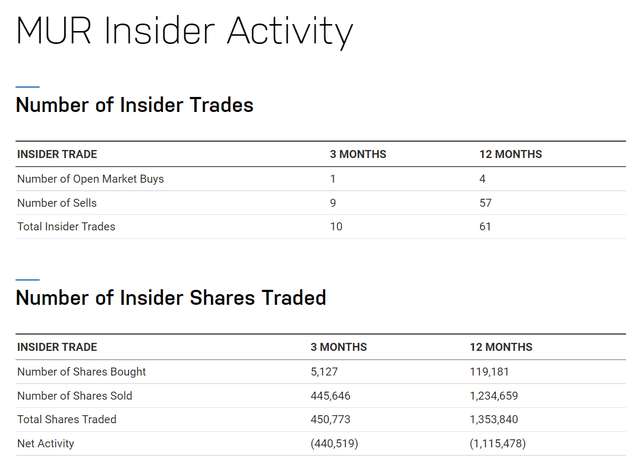

Murphy Oil Insider Activity (NASDAQ Website August 12, 2022.)

This is the kind of activity that can alarm some investors. The insider sales definitely outweigh the insider purchases. But these insiders, like many in the industry, have a significant amount of compensation through stock options. A recovery like the current recovery allows these insiders to sell at prices not seen in years while still retaining sizable holdings.

Oftentimes, there is no allowance made for the fact that key insiders accumulated an inordinate amount of their wealth during the last cyclical downturn. Therefore, a personal rebalancing of their own portfolio is likely indicated as the current recovery proceeds. It may not indicate a lack of faith in company prospects as much as a need to reduce personal risk.

Murphy Oil

The other very common misconception about this company is that “everything exciting for the fiscal year is done”. But this management has been unusually flexible most of the time I have followed it. They have often traded properties at a time when the market least expects it to the benefit of shareholders. Other projects have led to preliminary stock price spurts that may have caught long-term investors by surprise. For that reason, I have often found it a good time to consider investing in this company “when everything is quiet”.

Murphy Oil management has long looked for large projects that provide significant future growth to the company while maintaining a stable of cash flow projects. Because of the emphasis on “significant growth,” the larger growth projects tend to come in lumps that add to any organic growth planned by management.

This fiscal year, there is a lot of offshore growth because a lot of service prices were “rock bottom” until recently. That allowed management to add production and do reworks at costs that will provide a long-term competitive moat.

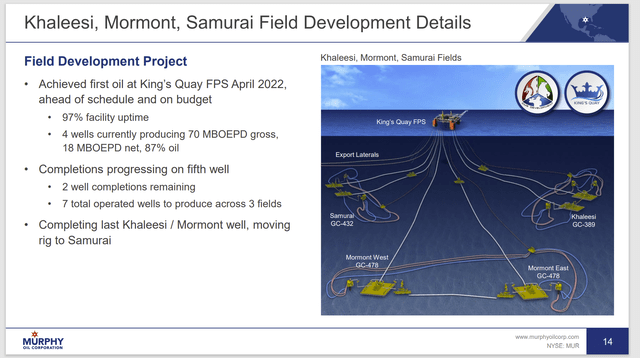

Murphy Oil Major Gulf Production Addition (Murphy Oil Second Quarter 2022, Corporate Earnings Presentation.)

Long-term followers of Murphy will remember that Murphy Oil completely sold all of its Gulf of Mexico projects right around the time of the big oil spill. The company re-entered this area back in 2018. The key was not only the low purchase price for the assets obtained, but it was also the low service costs as the offshore industry suffered through another downturn.

In the current situation, the offshore business is picking up as the interest in Gulf leases finally appears to be reaching some reasonable levels not seen in years. But Murphy used the “lack of interest” time to complete the sizable project shown above. Some of the final costs will suffer from inflation. But much of the projected was completed during a time of sharply depressed pricing.

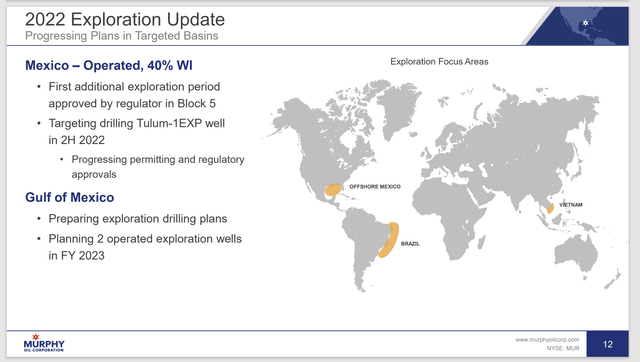

Murphy Oil Exploration Well Guidance (Murphy Oil June 2022, Corporate Presentation)

Management is planning some exploratory wells. It is not unusual for this management to keep a small interest in the higher-risk exploratory wells while retaining a larger interest in potential developmental areas. That minimizes high-risk shareholder expenditures while allowing sizable expenditures of far more reliable development projects.

Every little dollar counts in the commodities business. This management minimizes high-risk expenditures whenever it is reasonably possible. The result is usually steady if unspectacular growth with an unusual exposure to high-impact projects that could be a “game changer” in the future. Gulf Of Mexico wells tends to be large wells with a lot of reserves.

One of these discoveries in the future could materially change the fortunes of investors. I am a firm believer that the companies that “hit a lot of singles and doubles” like this company are the ones that are most likely to hit a home run. So, while patience is definitely required, this is a situation where that patience is likely to be rewarded at some point.

Obvious Exploration Projects

Some projects would be far more obvious to investors in that they are definitely high-impact projects if successful.

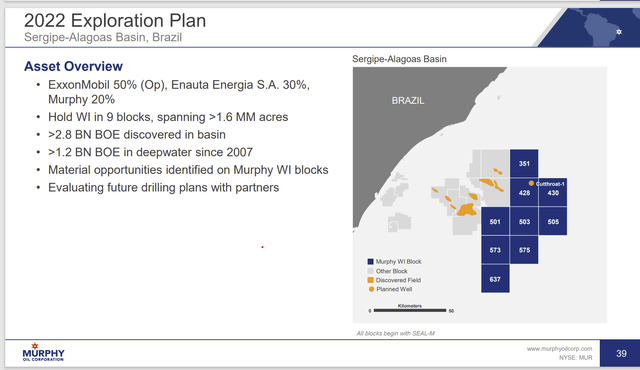

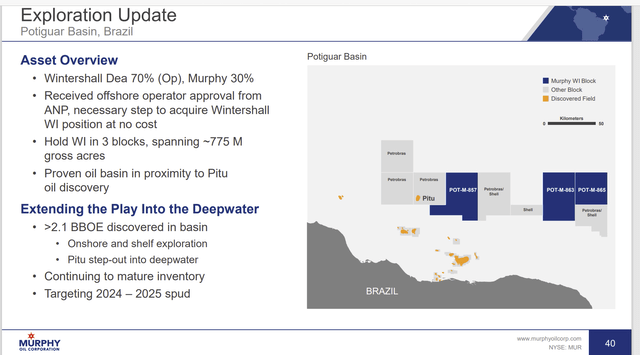

Murphy Oil Partnership With Exxon Mobil Lease Map And Guidance (Murphy Oil August 2022, Corporate Presentation.) Murphy Oil Brazil Offshore Partnership And Plans Fiscal Year 2022. (Murphy Oil August 2022, Corporate Presentation)

Murphy Oil has two partnerships that are exploring offshore Brazil for reserves. Both of these partnerships offer high-impact possibilities of a commercial discovery. Cash flow may be years away. But a large discovery for a company the size of Murphy does offer the possibility of a stock price response.

Since this slide was developed, Wintershall Dea (bottom slide) has decided to abandon the joint venture. Murphy has taken steps to gain operator status in Brazil to be able to acquire the partners’ interest at no cost.

The first well in the Exxon Mobil (XOM) partnership was a dry hole. That is not that uncommon. It sometimes takes a few years before the oil is found on offshore blocks. Therefore, more than a few initial dry holes are a reasonable expectation. It is highly unusual for a company to drill an offshore well that results in a discovery on the first try.

Murphy Oil does have an offshore discovery in Vietnam that is now proceeding to the development phase. That cash flow will likely hit the income and cash flow statements within the next few years.

Summary

The company has a lot of potential growth projects that may materially improve future prospects. There is a joint venture in Canada where both partners are now working to improve the project profitability before they commit to major development expenditures for this unconventional project. There is also an offshore project in Canada that will likely come back online with a significant amount of production to the company.

The company regularly has exploration wells in the Gulf that are lower risk but also have less impact than a pure exploration play like Brazil. For a buy and hold investor, the time to add is when there is “no news” and the stock has settled into a range.

This management is unusually flexible. Therefore, the budget can rapidly adjust and whole projects can be sold or traded with little forward notice. Good management like this one tends to surprise the upside. This stock will have considerable upside improvement if any of the exploration projects result in a commercial discovery or if a project like the joint venture in Canada switches to development. There is a lot to like here for the patient investor.

Be the first to comment