gorodenkoff

MSA’s Near-Term Outlook Looks Mixed

My previous article discussed MSA Safety Incorporated’s (NYSE:MSA) challenges and growth prospects. After Q3 2022, the company’s sales prospect is steady in the fire service market and fixed gas and flame detection products. Based on the company’s pricing strategies, I expect the operating margin expansion to continue in the near term.

However, the electric component supply chain issue may not be resolved before 2H 2023 and may negatively affect sales in the first half. The world economy, particularly in the US, faces recessionary risks, which can undermine the company’s margin expansion process. On a more positive note, the company has no near-term debt repayment load, although its leverage is high. Nonetheless, the stock is relatively overvalued at this level. I think investors might want to “sell” it because of the possibility of lower returns at this level.

Many Challenges Remain

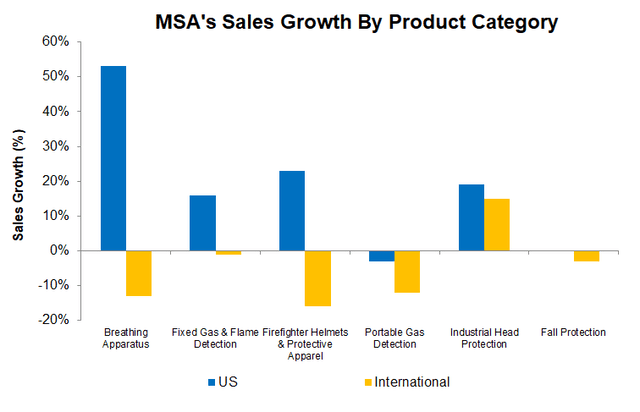

MSA caters to a diversified range of end markets with various products, so a slowdown in some product categories does not affect it unevenly. For example, sales of breathing apparatus in the US grew by 53% year-over-year in the US in Q3 versus a 13% fall in the international territories in this period. Similarly, the sale of fixed gas & flame detection increased by 16% in the US as opposed to a 1% decline internationally. So, the company’s fire service market and longer-cycle fixed gas and flame detection sales remained resilient in the recent quarter. In Q4, the company expects sales to improve based on the total backlog growth.

The supply chain constraint, particularly for the electronic components, remains a critical challenge for MSA, as I discussed in my previous article. The electric component supply chain issue should ease considerably in 2H 2023, as indications show, although it may affect sales negatively in the first half. The portable gas detection business was impacted adversely due to the lack of component availability. The management is remarkably upbeat about the fire service market in 2023. Fixed gas and flame detection is a late-cycle product that should perform well in North America and the Middle East. I think crude oil demand will remain steady in the Middle East and the Americas, which should keep sales of many of MSA’s products robust in 2023.

The Industry Indicators

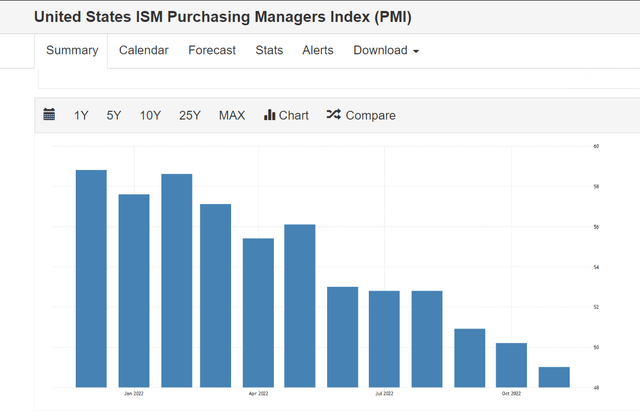

In November, the ISM Manufacturing PMI went down to 49 from above 50 in October. A score below 50 points to a contraction in factory activity. Lower new orders, supplier deliveries, employment, and order backlog contributed to the PMI fall. However, a much smaller base in order backlog and price can gradually induce sellers to refill order books. I expect consumer spending to remain uncertain in the next quarter.

Analyzing The Key Drivers In Q3

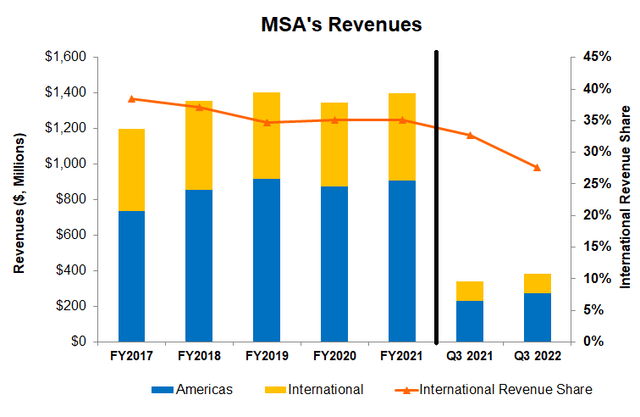

Year-over-year revenues in the Americas increased by 21%, while revenues declined in international territories (5% down). The book-to-bill was more than 1.0x for the quarter, which suggests strong demand, despite the ongoing supply chain challenges. The organic order growth was ~12%. The company initiated various engineering and supply chain solutions to ease the restrictions on supply chain constraints.

As a result, its gross margin advanced by 50 basis points, while the adjusted operating margin improved by 370 basis points in Q3 2022 versus a year ago. Net earnings, too, went up by 45% to $1.45 in Q3. The margin expansion was even more impressive because indirect charges related to inventory and warranty mitigated the company’s cost-reduction initiatives. The company also implemented a price hike in October that positively impacted the margin in Q3.

Dividend And Dividend Yield

MSA’s annual dividend of $1.84 per share amounts to a 1.37% forward dividend yield. In comparison, Brady Corporation (BRC) pays a $0.92, which amounts to a forward dividend yield of 2%.

Cash Flows And Debt Level

In 9M 2022, MSA’s cash flow from operations (or CFO) was $104 million, or nearly 20% lower than a year ago. Despite a 10% revenue rise, working capital deterioration following increased inventory related to increased backlog led to the CFO’s fall in the past year. So, free cash flow (or FCF) decreased by 24% in the past year.

MSA’s leverage is higher (0.9x) than some competitors (GRC and TNC) but higher than BRC. On September 30, it had $160 million in cash & equivalents. Plus, its liquidity included $345.7 million of variable rate borrowings under the revolving credit facility. Approximately 44% of its long-term debt is not due to mature before 2036. So, the short-term financial risks are nearly absent.

Target Price And Relative Valuation

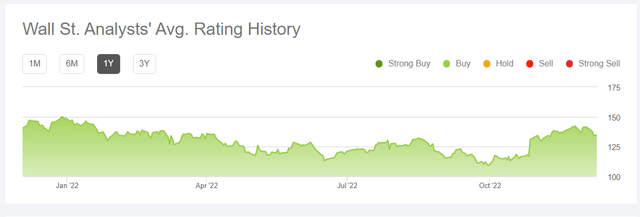

One sell-side analyst rated MSA a “buy” over the past 90 days, while two recommended a “Hold.” None recommended a “Sell.” The stock’s return potential using the sell-side analysts’ expected returns is 8.6% at the current price.

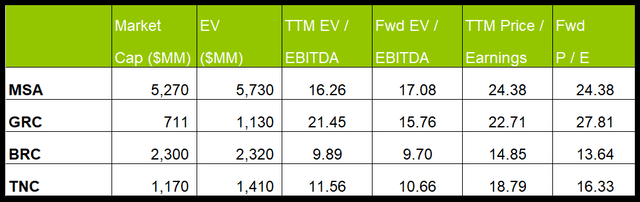

MSA Safety’s forward EV-to-EBITDA multiple expands versus the current EV/EBITDA. This, however, is in contrast to its peers because its EBITDA is expected to decrease versus a rise in EBITDA for its peers. This typically reflects in a much lower EV/EBITDA multiple than peers. However, its EV/EBITDA multiple (16.3x) is higher than its peers’ (GRC, BRC, and TNC) average of 14.3x. So, the stock is relatively overvalued.

What’s The Take On MSA?

In 2023, the MSA’s fire service market and fixed gas and flame detection product sales should pick up because these are late-cycle products. I also expect sales to improve based on the total backlog growth. Based on the company’s strategies, I expect the operating margin expansion to continue in the near term.

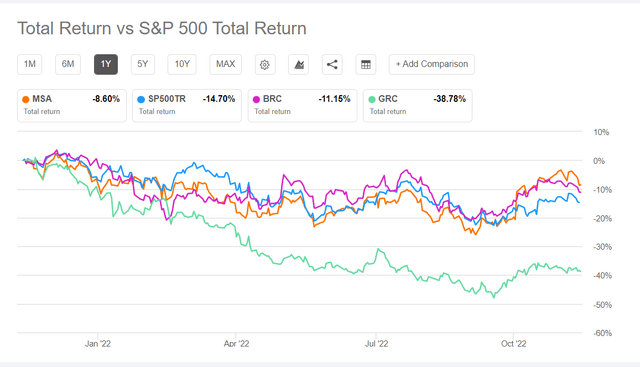

On the other hand, the ISM Manufacturing PMI went down recently, suggesting an industry activity contraction. The specter of the world economic recession looms large over the outlook of the providers of safety products for infrastructure and many industries like MSA. So, the stock price underperformed the SPDR S&P 500 Trust ETF (SPY) during the past year. Cash flows declined in 9M 2022, although there is no near-term debt repayment load. Given the relative valuation multiples, investors might want to “sell” it.

Be the first to comment