nimis69

Sometimes, what looks like a value stock may in fact just be a mediocre business that deserves to trade at a low price. One telltale sign of this is that, even though shares are already priced at a low level, the company’s stock will still move more or less in tandem with a broader market. A great example of this can be seen when looking at MRC Global (NYSE:MRC), a global distributor of pipes, valves, and fittings dedicated to the diversified energy, industrial, and gas utility end markets. The company also provides a variety of other offerings like oilfield supplies, valve automation equipment, measurement instrumentation, and more. Over the past few years, financial performance for the company has been rather volatile, even if you ignore the pandemic year of 2020. This helps to explain why shares of the company, despite trading on the cheap from a valuation perspective, are as cheap as they are today. Though shares are starting to look tempting after having declined recently, investors should still demand to see additional stability before considering this anything other than a ‘hold’ prospect.

A solid call

The last time I wrote an article about MRC Global was back in March of this year. In that article, I talked about how the company had struggled over the prior few years, even though it was also true that financial performance in 2021 marked something of a turnaround for the enterprise. I found myself impressed by how cheap shares were. But at the same time, I felt that the instability of the company and likely volatility moving forward made the pricing of the stock appropriate. This led me to rate the firm a ‘hold’, reflecting my belief at that time that the stock should more or less match the returns of what the broader market achieves moving forward. So far, that call has proven to be pretty solid. While the S&P 500 is down by 18.6%, shares of MRC Global have dropped by 18.5%.

Interestingly, this market-matching performance occurred at a time when fundamental performance for the company has been quite strong. Consider results for the first half of the 2022 fiscal year. These two quarters are the only quarters for which new data is available compared to when I last wrote about the business. During that time, sales came in at $1.59 billion. That’s 22.8% higher than the $1.30 billion generated the same time one year earlier. Although revenue in the international operations of the company dropped by 10%, this was made up for with a 28% increase in revenue from the U.S. market and a 34% rise associated with sales from Canada. Although the percentage increase in Canada was far larger, the company generates just 5.2% of its sales from that country. So the real attention should be on the US where the company gets 84% of its revenue from.

This increase, management said, which driven by robust performance in the gas utilities sector driven by the full implementation of a new customer contract, increased activity levels, and the continued execution of the company’s customer integrity upgrade programs. Similar execution of its smart meter programs also aided the firm’s top line growth, as did stronger seasonal demand for its services. The company also benefited from downstream, industrial, and energy transition sector sales rising thanks to increased renewable biofuels projects and additional work associated with the refining and chemicals customers on its books. Upstream production sales, meanwhile, also increased nicely, driven by higher customer spending for additional well completions, while midstream pipeline sales improved thanks to new gathering and processing infrastructure and as a result of increased well completion activities.

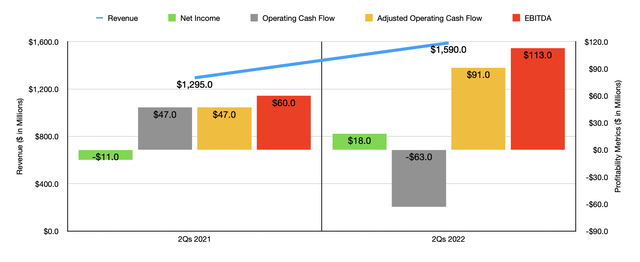

This strong performance brought with it improved profitability. The company went from generating a net loss of $11 million in the first half of 2021 to a net profit of $18 million the same time this year. Yes, operating cash flow did worsen, falling from $47 million to negative $63 million. But if we adjust for changes in working capital, it would have risen from $47 million to $91 million. And over that same window of time, we saw EBITDA nearly double from $60 million to $113 million.

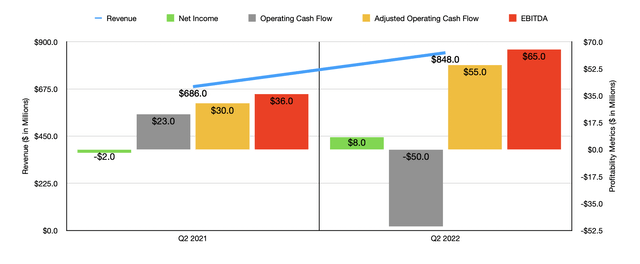

For those wondering about a potential weakening in the space, it’s worth noting that performance in the second quarter was stronger than in the first quarter on a year-over-year basis. Revenue of $848 million came in 23.6% higher than the $686 million generated in the second quarter of 2021. Net income rose from negative $2 million to positive $8 million. We saw operating cash flow drop from $23 million to negative $50 million. But if we adjust for changes in working capital, it would have nearly doubled from $30 million to $55 million. And finally, we saw EBITDA increase from $36 million to $65 million.

When it comes to 2022 is a whole, management has some pretty high hopes. Driven in large part by a surge in investments associated with the oil and gas space, with US well completions already up 26.3% while rig counts have risen by 32.3%, revenue is now forecasted to be $3.3 billion for the year. In addition to being 24% higher than what the company achieved in 2021, it would also represent an improvement over the $3.1 billion in revenue the company previously anticipated. Meanwhile, EBITDA is now forecasted to be around $230 million. This is 58% higher than what the company generated last year and compares favorably to the prior expected guidance of $200 million. No guidance was given when it came to other profitability metrics. But if we assume that adjusted operating cash flow will increase at the same rate that EBITDA is expected to, then we should get a reading of $126.4 million.

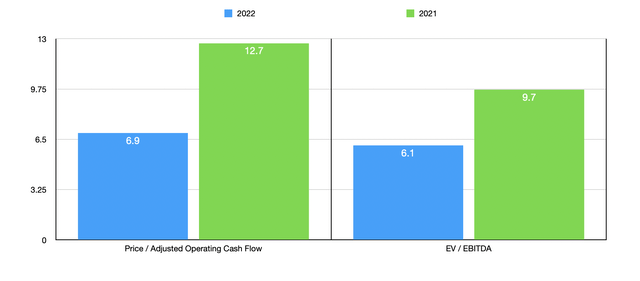

Based on these figures, we can calculate that the company is trading at a forward price to adjusted operating cash flow multiple of 6.9 and at a forward EV to EBITDA multiple of 6.1. These numbers compare to the 12.7 and 9.7 readings that we get using data from the 2021 fiscal year. As part of my analysis, I also compared the firm to five similar businesses. On a price to operating cash flow basis, these companies range from a low of 4.1 to a high of 34.5. In this case, two of the five companies are cheaper than MRC Global. Meanwhile, using the EV to EBITDA approach, the range was between 2.4 and 31.8, with one of the five being cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| MRC Global | 12.7 | 9.7 |

| Titan Machinery (TITN) | 4.1 | 10.0 |

| Transcat (TRNS) | 34.5 | 31.8 |

| BlueLinx Holdings (BXC) | 6.6 | 2.4 |

| DXP Enterprises (DXPE) | 13.7 | 11.1 |

| Global Industrial Company (GIC) | 31.2 | 16.8 |

Takeaway

Based on all the data provided, I must say that MRC Global looks to be a rather attractive prospect from a valuation perspective. Having said that, we need to keep in mind that this is a highly cyclical company that is extremely dependent on factors outside of its control. This alone should warrant some discount compared to what you might otherwise anticipate. And for many investors, the volatility of the enterprise will likely prove unnerving. If shares do get much cheaper from here on a forward basis, I do think my mind could be changed on its prospects. But given the economic uncertainty we are dealing with today and the underlying nature of the enterprise, I do believe that the original ‘hold’ rating I had on MRC stock still is appropriate.

Be the first to comment