Torsten Asmus

Article Thesis

MPLX (NYSE:MPLX) and its parent company Marathon Petroleum (MPC) announced their third-quarter results on Tuesday. MPLX continues to execute very well, growing its EBITDA at a solid pace. The company also increased its dividend by another 10%, making its already high dividend yield rise to an even higher level. Between a secure and high dividend, a shareholder-focused parent company, an inexpensive valuation, and buybacks, MPLX looks like one of the best midstream picks available today.

What Happened?

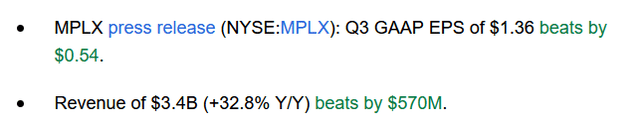

MPLX reported its third-quarter earnings results along with its publicly-traded parent company MPC. Both companies were able to beat estimates on both lines. MPLX’s headline numbers looked like this:

Seeking Alpha

The revenue beat and revenue growth rate were great, but it should be noted that not all of MPLX’s additional revenue flows through to its bottom line. Instead, due to the way the business operates, higher commodity prices do lead to both higher revenues and higher expenses, thus a 30%+ revenue increase does not result in a similar profit or cash flow growth rate.

GAAP earnings per share were very strong, but those aren’t all-important for a pipeline company such as MPLX. Instead, investors usually focus on metrics such as EBITDA or distributable cash flow, which accounts for the high non-cash charges that infrastructure players usually experience due to depreciation (which does not accurately reflect the change of value in those assets). Let’s delve into the details.

MPLX: Strong Execution Continues

MPLX is a high-quality midstream company where management knows what it’s doing and where capital allocation has not been a problem in the past. That has been the case with some other midstream players, such as Energy Transfer (ET), although that company has also improved its capital allocation strategy meaningfully.

MPLX was able to grow its EBITDA, which better reflects its underlying business performance relative to GAAP net profit, by 6% year over year, to $1.47 billion. A 6% growth rate in profits isn’t outstanding in general, but for an infrastructure player that pays a hefty dividend that’s a great result, I believe. After all, even in a no-growth scenario, a company like MPLX could generate attractive returns via its dividend payments alone.

Volumes rose by 5% for the quarter, relative to one year earlier, as MPLX saw its volumes rise in the Permian Basin, while Marcellus volumes were down. Due to the more pronounced increase in MPLX’s Permian Basin business, overall volumes nevertheless increased. It is likely that those volumes will continue to grow, due to strong demand for transportation as the Permian Basin is the hot spot for production growth investments in the US, e.g. by Exxon Mobil (XOM) and Chevron (CVX). MPLX is working on a pipeline expansion, as the Whistler pipeline will increase capacity from 2 billion cubic feet of natural gas per day to 2.5 billion cubic feet of natural gas daily. Whistler is a pipeline that runs from the Permian Basin to the Gulf Coast at Agua Dulce, TX. MPLX is not the sole owner of Whistler, thus the benefit of increased transportation volumes will not entirely flow towards MPLX’s pockets, but the company will nevertheless benefit from higher transportation capacity that should have a positive impact on its future profits and cash generation.

Speaking of cash generation, let’s look at MPLX’s cash flows during the quarter. Operating cash flows came in at $1.04 billion, but those can be impacted by working capital movements. MPLX’s distributable cash flows, which is adjusted cash from operations minus maintenance capital expenditures, and which reflects what the company could pay out sustainably in the long run, totaled $1.26 billion during the third quarter. That was up 6% year over year, in line with the company’s EBITDA growth rate. When we annualize MPLX’s distributable cash flow from the third quarter, we get to $5.04 billion — since MPLX is currently valued at $34 billion, the company is thus trading at just 6.7x its distributable cash flow, which translates into a DCF yield of 14.8%. In other words, MPLX could theoretically pay a dividend yielding more than 14% at current prices if the company would choose not to invest in any growth and if no cash was spent on buybacks or debt reduction.

That’s not what MPLX’s management is opting for, which is a good thing, as some growth spending makes sense when projects offer compelling returns and when the execution risk isn’t high — such as is the case with the expansion of existing assets. Still, the hypothetical scenario shows MPLX’s compelling cash generation relative to how the company is valued, and it also shows that the dividend is pretty safe.

MPLX has increased its dividend by 10% along with the earnings announcement, to a new level of $0.775 per share per quarter. That pencils out to an annual dividend payment of $3.10, which translates into a dividend yield of 9.3% at a share price of $33.50. With MPLX having 1.01 billion shares, the dividend thus consumes $3.1 billion per year, relative to $5 billion in distributable cash flows. The dividend is thus covered at a rate of 1.6, which is very solid for a midstream infrastructure player like MPLX. In other words, distributable cash flows could theoretically pull back by almost 40% and the dividend would still be covered by the cash that the company generates. Combined with the resilient business model that has resulted in strong cash generation even during the pandemic, this high coverage ratio results in a pretty low dividend cut risk, I believe, making MPLX suitable as a sleep-well-at-night income investment stock.

Since MPLX does not pay out all of the distributable cash flows it generates, it has surplus cash that can be used for other purposes. Some of that is spent on growth capital expenditures, such as the aforementioned Whistler pipeline. But MPLX also returns cash to its owners via buybacks. The company has repurchased $300 worth of shares so far this year, which is equal to around 1% of the company’s share count (in nine months). If MPLX keeps that up, it will reduce the number of shares by a little more than 1% per year, thereby giving a small boost to its cash flow per share growth. So if MPLX were to continue to grow its EBITDA by 6% per year, its EBITDA per share could grow 7% to 8% a year thanks to the buybacks, and that would be quite attractive. During the third quarter, MPLX has accelerated its buyback spending pace, as it returned $180 million to its owners this way during Q3. That pencils out to a little more than $700 million annualized, thus MPLX could reduce its share count by a little more than 2% per year. That is, for reference, around half the buyback pace Apple (AAPL) has averaged historically, so quite meaningful although not an absolute gamechanger.

MPLX has not reduced its net debt meaningfully this year, as net debt declined by just $200 million, to $19.8 billion as of the end of the third quarter. Still, thanks to EBITDA growth, its leverage ratio has dropped from 3.7 one year ago to 3.5 today. Midstream companies are generally reasonably financed even with leverage ratios in the low 4s, thus a mid-3s leverage ratio is pretty strong. There is no reason to be concerned about MPLX’s debt, I believe.

Final Thoughts

MPLX continues to execute well and rewards shareholders handsomely. Following the just-announced dividend increase, the dividend yield has risen above 9% again. With the ramped up buyback spending, MPLX could generate meaningful shareholder value in the long run.

The dividend is well-covered, and shares trade at an inexpensive valuation — the distributable cash flow yield is 15%, and the company’s enterprise value to EBITDA multiple of 9 is undemanding as well. MPLX has seen its shares rise by 14% over the last month and by 16% so far this year, while the broad market is down, thus from a timing perspective it may not be optimal to buy today. But nevertheless, MPLX looks well-positioned to deliver compelling total returns in the long run, thanks primarily to its high and well-covered dividend.

Be the first to comment