emyerson/E+ via Getty Images

Introduction: Why Is Mowi Stock Down?

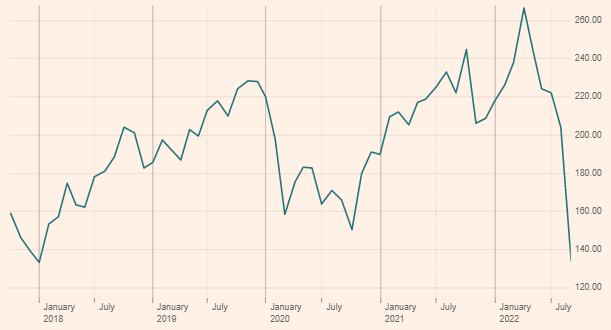

Mowi ASA (OTCPK:MHGVY), the global #1 salmon producer with a $6.4bn market capitalization, saw its stock crashed 22% in the last two days to a 5-year low:

|

Mowi Share Price (Last 5 Years)  Source: Financial Times (29-Sep-22). |

The crash has been caused by a proposed new 40% “resource rent tax” on salmon production in Norway, which can cut Mowi earnings by up to a third.

The salmon industry has favourable characteristics that give it long-term structural growth, and we believe Mowi can grow earnings at high-single-digits over time. However, the industry is also highly cyclical, and Mowi earnings have historically been volatile.

Shares are trading at 11x trailing EPS and a 5.2% Dividend Yield, but not cheap enough once adjusted for the new tax in our view. Avoid.

Mowi Company Overview

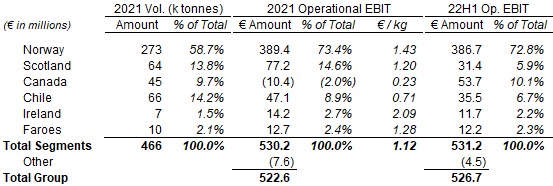

Mowi is an integrated salmon producer involved in salmon farming, feed production and value-add processing. More than 70% of its EBIT comes from Norwegian salmon, but it also has production in Canada, Chile, Scotland, etc.

|

Mowi EBIT & Volume By Salmon Origin (2021)  Source: Mowi company filings. |

Mowi Canada made an operating loss in both 2020-21 due to biological issues (diseases and parasites), but was profitable historically and has returned to a positive EBIT in H1 2022 – we will discuss the region further below.

Salmon’s Positive Industry Characteristics

The salmon industry has favourable characteristics that give it long-term structural growth.

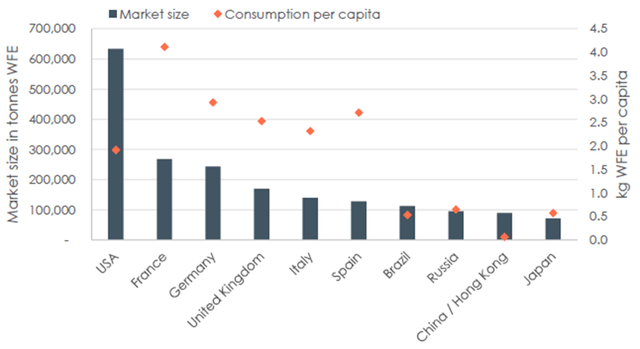

On the demand side, salmon is a high-quality protein that is increasingly desired across the world, due to both rising global affluence and the growing penetration in new markets such as China; per-capita consumption of salmon has remained below levels in Europe, the historical core market, in many countries including the U.S.:

|

Salmon Top 10 Markets By Size (2021E)  Source: Mowi industry handbook (2022). |

In 2019, the last “normal” year before COVID-19, salmon sales volume grew by 6.2% globally, including by 9.7% in China (including Hong Kong) and by 8.2% in the U.S.

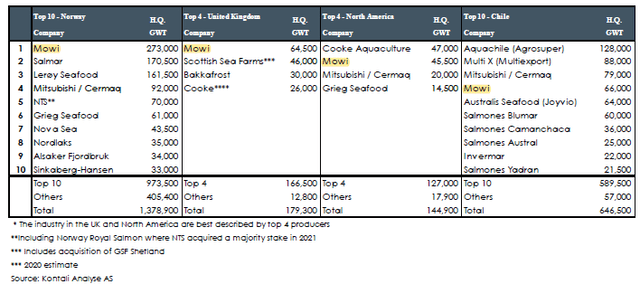

On the supply side, global production volume is growing, but is constrained by a number of factors. Salmon farming requires coastlines with particular water quality and temperature; key producer countries like Norway have regulations (such as license regimes) that limit volume growth; there is also some industry discipline as a result of each country’s production being mostly in the hands of a few producers, for example with the top 10 controlling 70% in Norway:

|

Top 10 Companies in Farmed Atlantic Salmon By Country (2021)  Source: Mowi industry handbook (2022). |

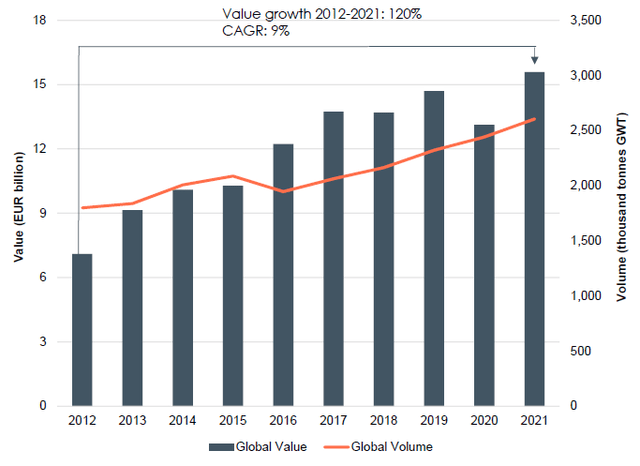

The result of these characteristics is solid, long-term sales growth in the industry, with global volume growing at a CAGR of 4% and global value growing at a CAGR of 9% between 2012 and 2021:

|

Global Salmon Market Volume & Value (2012-21)  Source: Mowi industry handbook (2022). |

However, the industry is cyclical and prices can be volatile in the short term.

Salmon Industry Is Highly Cyclical

Salmon is ultimately a commodity, which means prices can move significantly with small shifts in supply and/or demand.

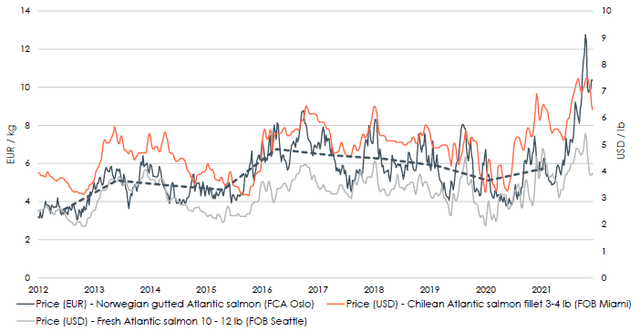

The long-term trend in salmon prices is up. However, past events such as the Russian ban on Norwegian salmon (in 2014), an algae boom in Chile (in 2015) as well as COVID-19 resulted in significant moves in salmon prices:

|

Historic Salmon Prices – Regional Benchmarks (Since 2012)  Source: Mowi industry handbook (2022). |

As salmon is often marketed fresh, transport costs and time means that salmon markets are largely regional, and Norwegian, Canadian and Chilean prices often moved in separate directions.

A number of factors that can affect salmon supply, as well as producer costs, including:

- Smolt stocking volume – harvest volume each year is determined by smolt stocking volumes up to 2 years ago

- Biological issues – diseases, parasites and even water temperate can alter harvest volume, quality and cost

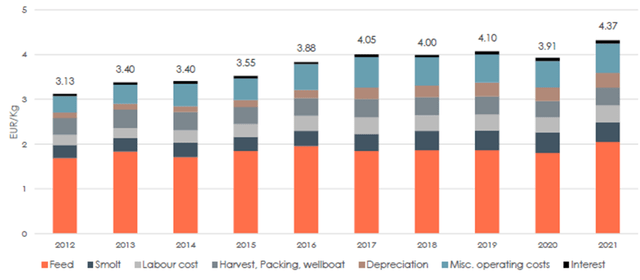

- Feed costs – feed is the largest cost component, and includes fish and agricultural inputs like soy and rapeseed

|

Norway Salmon Industry Cost Profile (2012-21)  Source: Mowi industry handbook (2022). |

(As shown in the chart, cost per kg has grown at a CAGR of 3.8% in 2012-21. We believe cost growth has become more manageable over time, helped by technological advances such as vaccines that help control biological issues.)

In addition to the volatility in salmon prices, producers like Mowi often sell part of their production in advance with forward contracts, deciding the size of contracts subjectively based on their view of price trends.

All of these mean that Mowi earnings have historically been volatile and can be hard to predict short-term.

Earnings Volatile But Growing Long-Term

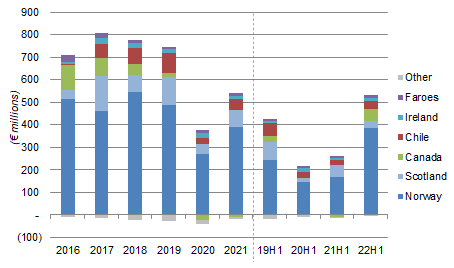

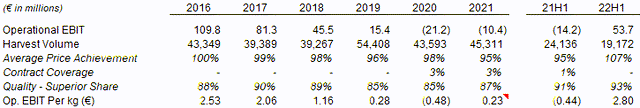

Mowi’s earnings have been volatile in the short term historically. On a group level, Operational EBIT rose 13% in Euros in 2017, then fell back 9% in 2017-19, before collapsing in 2020 as a result of COVID-19 lockdowns:

|

Mowi Operational EBIT By Salmon Origin (2016 to H1 2022)  Source: Mowi company filings. |

Mowi has been experiencing a strong rebound in 2022, generating more Operational EBIT in H1 alone than for the entire 2021 (€527m vs. €523m); H1 2022 Operational EBIT was also 29% larger than in 2019.

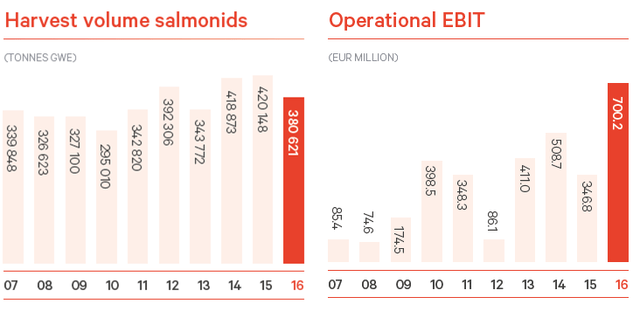

The picture before 2016 is similar, with relatively consistent volume growth but even more volatile Operational EBIT. Regulations and the biological controls were less mature, which meant costs fluctuated more widely.

|

Mowi Volume & Operational EBIT (2007-16)  Source: Mowi company filings. |

We believe that Mowi earnings should grow at high-single-digits over time, driven by volume growing at mid-single-digits, value growing at high-single-digits (with price growing by low-single-digits), and relatively stable margins.

While Mowi’s Operational EBIT fell in 2017-19, this was largely due to one region (Canada), where issues are now largely resolved in our view.

Historic Problems in Canada, Now Resolved

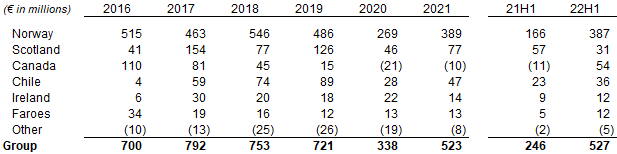

The decline in Mowi’s Operational EBIT in 2017-19 was largely the result of a decline in Canada, where Operational EBIT fell from €110m in 2016 to €15m by 2019, and further into a loss in 2020 (but improving from 2021); Operational EBIT in other regions either fluctuated or even grew in these years before the COVID-19 pandemic intervened:

|

Mowi Operational EBIT By Salmon Origin (2016 to H1 2022)  Source: Mowi company filings. |

The main problem in Canada was biological issues, which mostly affected costs but sometimes volume and harvest quality, as the Key Performance Indicators below help explain:

|

Mowi Canada KPIs (2016-21)  Source: Mowi company filings. |

Harvest volume has been growing steadily in Canada, except in 2017, when it was affected by a lower opening biomass and unfavourable sea conditions, and in 2019, when it grew by 39%. Market prices in fact rose in 2017 and 2018 (by a low-single-digit each year), but fell by around 10% in 2019, partly due to volume growth (which more than offset it).

However, biological issues continued to affect Canada in these years, resulting in both higher costs and a decline in harvest quality (as reflected by “superior share” falling to 85% by 2019), which in turn resulted in a continuing decline in Mowi’s “average price achievement” (relative to market price) (falling to 96% by 2019). With these headwinds, Mowi Canada’s Operational EBIT / kg fell from €2.53 in 2016 to €0.28 by 2019.

2020 was an exceptionally bad year due to COVID-19.

Since 2021, biological issues appear to have been brought under control, with the “superior share” percentage rising. Helped by higher prices, Mowi Canada had an Operational EBIT of €53.7m in H1 2022, the same run-rate as in 2016.

(A new risk has emerged in regulations. The Canadian government has started a consultation on a potential “transition” from open-net pen salmon farming, expected to last into spring 2023, and the outcome is uncertain.)

Proposed New Resource Tax in Norway

A proposed new 40% “resource rent tax” on salmon production in Norway can cut Mowi earnings by up to a third. Mowi’s chairman, Ole-Eirik Leroy, described this as “the most dramatic event the industry has ever experienced”.

Announced on Tuesday, the proposal is part of the Norwegian government’s program to ensure that “profits from natural resources will be better distributed”, including for salmon, trout, rainbow trout, wind and hydro power. For salmon, the tax will have an effective rate of 40%, taking the total effective marginal tax rate on salmon production to 62%. There is a small tax-free allowance of 4,000-5,000 tonnes, equivalent to less than 2% of Mowi’s production in Norway. The new tax needs to be approved by parliament, and is expected to come into effect at the start of 2023.

We believe the proposed tax will likely happen. It had last been proposed by a Conservative government in 2020, but did not pass because the then Labour opposition did not agree. The same Labour party (under the same leader), in government since 2021, is the one now proposing the tax; we expect the Conservative opposition to support it.

The impact of the new tax would likely be devastating. When it was last proposed, Mowi CEO Ivan Vindheim said that:

We think a resource tax on Norwegian salmon farming would be devastating for the Norwegian salmon industry … If you put on 62% resource tax, we are the highest cost performer there is … that will ruin our position”

As Mowi generates 70%+ of its Operational EBIT from Norwegian salmon, we believe the new tax can reduce its earnings by up to a third (depending on what deductions are allowed).

Mowi Valuation & Dividend Yield

Mowi’s valuation multiples are difficult to determine because of the cyclical nature of its earnings.

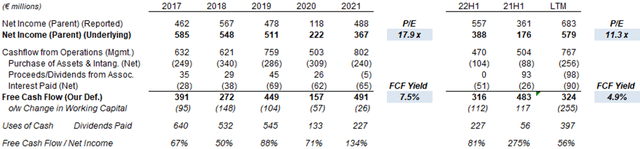

With shares at NOK 133.55, relative to 2021 earnings, Mowi shares are at a 17.9x P/E and a 7.5% Free Cash Flow (“FCF”) Yield. However, earnings grew substantially in H1 2022 and, relative to last-twelve-months (“LTM”) earnings, Mowi shares are at a 11.3x P/E; FCF Yield is, however, lower at 4.9% due to a substantial working capital outflow likely related to timing.

LTM Net Income is similar to that in 2017 and, on balance, likely best represent current earnings. However, adjusting for a one-third decline in earnings as a result of the new tax, LTM P/E rose from 11.3x to 16.9x.

Mowi’s dividend policy is to pay out “at least 50%” of its Underlying EPS as ordinary dividends. Its last 4 quarterly dividends totalled NOK 7.05, implying a Dividend Yield of 5.3%. However, if earnings were to decline with the new tax, so would the dividend, so adjusting for this the real Dividend Yield will fall to 3.0%.

Is Mowi Stock A Buy? Conclusion

We like the characteristics of the salmon industry and believe Mowi can grow earnings at high-single-digits over time.

However, with the cyclical nature of the industry and Mowi’s past earnings volatility, we believe the stock deserves low valuation multiples than others with a similar growth rate.

The new “resource rent tax” may cut earnings by a third, giving Mowi stock effectively a P/E of 16.9x and a Dividend Yield of 3.0% – not cheap enough in our view, especially compared to other bargains currently in the market.

We assign a Hold rating to Mowi stock, meaning investors should avoid it for now.

Be the first to comment