fotokostic/iStock via Getty Images

Investment thesis

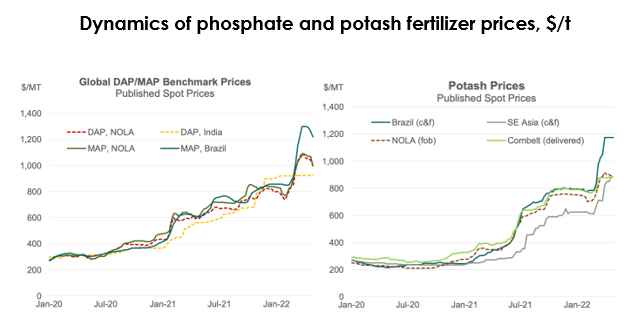

Phosphate, potash, and nitrogen fertilizer prices experienced a rally in the first half of the year amid growing fears of global market disruption of supplies from Russia due to European carriers refusing to provide services to domestic producers because of tensions in Eastern Europe.

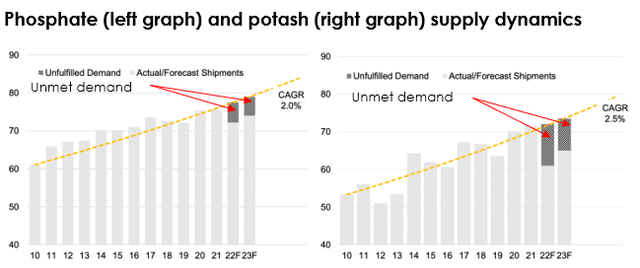

We believe that a reversal in the price of key fertilizers, such as DAP/MAP and MOP, should not be expected in the future due to unmet demand of 4% and 14%, respectively, of total planned global consumption. Therefore, we have decided to figure out what to expect from feedstock prices and who stands to benefit from the situation. We believe that Mosaic (NYSE:MOS) is the best pick for this trend.

The fertilizer market rally is the result of rising costs and farmers’ concerns

Phosphate and potash prices have skyrocketed by 50% since the beginning of the year, exceeding the average of $1,000 per ton. The reason for that are two important factors: growth in the production cost and the consumers’ fear of shortages due to high share of Russia in the global market. More details are provided below.

Mosaic

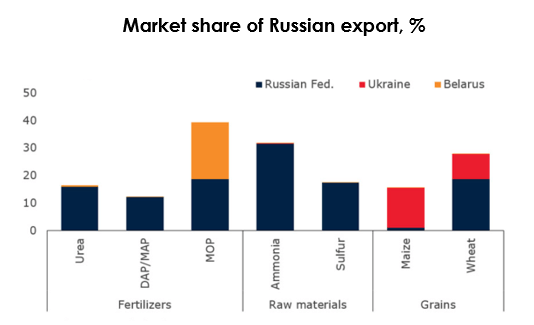

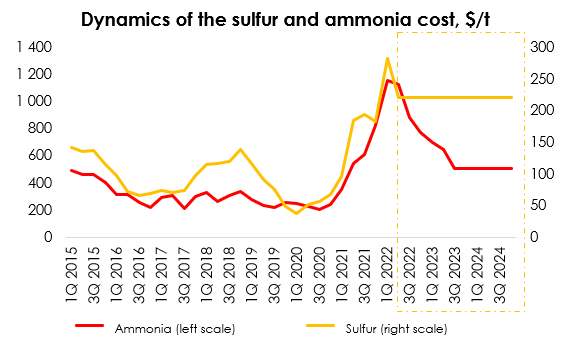

According to the World Bank estimates, Russia holds about 30% of the world ammonia supply and 20% of the world sulfur supply, and together with Belarus, the share of the world potassium market reaches nearly 40%. Concerns about disruption of feedstock supplies to the market were immediately transformed into record-breaking price acceleration. For example, in May the price for ammonia was about $1500 per short ton, and the cost of sulfur climbed over the level of $400 per long ton. In the near term, we do not expect significant correction in the cost of feedstock, since about 75% of the cost of ammonia is gas. European fertilizer producers have already halted production due to record natural gas prices in September-November 2021, which caused a spike in global prices. But what does this have to do with ammonia and sulfur prices? The answer is right there – they are the raw materials for DAP/MAP fertilizer production. For example, about 1.75 tons of apatite ore, 0.4 tons of ammonia and 0.2 tons of sulfur shall be used to produce one ton of fertilizer.

World Bank Calculations by Invest Heroes

We also do not expect fertilizer prices to reverse drastically in the near term due to the phosphate fertilizers supply shortage of 4%, and the 14% supply shortage of potash fertilizers from total global consumption.

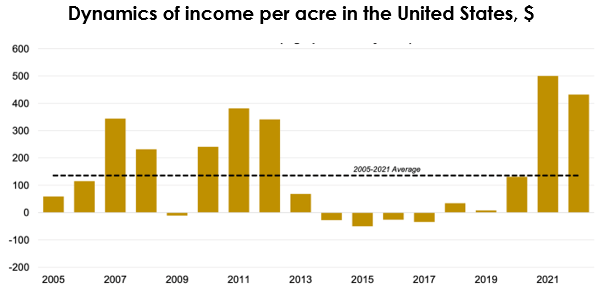

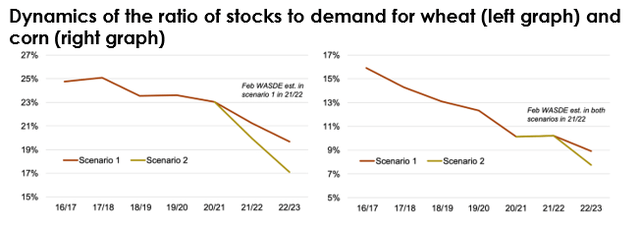

At the same time, we shall not expect decrease in farmers’ demand for fertilizers due to high feedstock prices, primarily caused by depletion of major agricultural feedstock, such as wheat and corn (the ratio of stocks to demand is at multi-year lows and is a factor for maintaining high prices for agricultural feedstock). Low stocks allow farmers to earn record-high margins due to high prices, which offset the cost of fertilizers.

There are companies to focus on

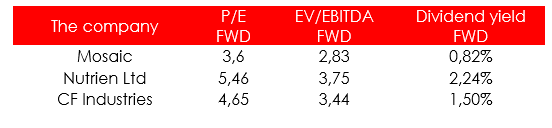

There are three major players in the U.S. market that control more than 90% of the entire fertilizer market with high fertilizer exposure.

Seeking Alpha

Valuation

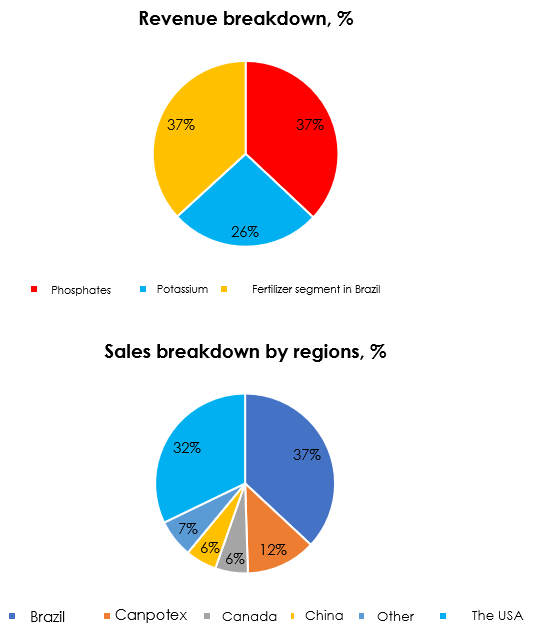

We believe Mosaic is the most attractive in the fertilizer market right now due to its high exposure to potash and phosphates, as well as an almost monopolistic position in the fast-growing Brazilian market, where the company has combined annual sales potential of over 10 million tons and holds 69% of the country’s total phosphate production and over 45% of feed mineral additives.

Mosaic

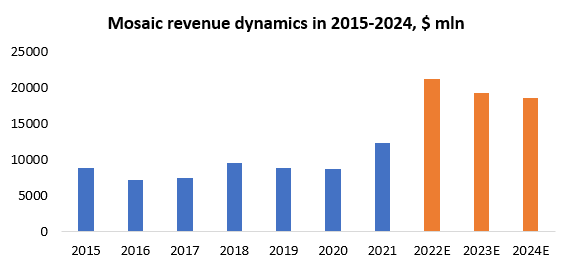

2022 total revenue for Mosaic may grow by 72% y/y to $21,212 million, while 2023 revenue could amount to $19,183 million (-10% y/y), which is in line with our expectations on the macroeconomic situation in the fertilizer market. We note that we do not expect significant reversal of the company’s revenue after 2022, as the global deficit of fertilizer products is persistent.

Company’s data, Invest Heroes’ estimates

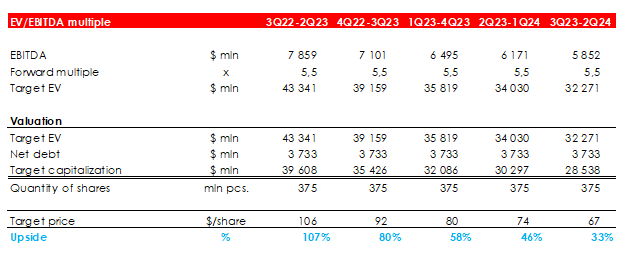

We evaluate the company by averaging estimates from Q3 2022-Q2 2023 to Q3 2023-Q2 2024, thereby including periods of fertilizer price declines in the valuation. The reason is that the FTM valuation reflects the company’s record-high performance and may mislead the investor. The stock status is BUY. The target price is $84, with potential upside of 66%.

Invest Heroes

Factors of company value growth:

- Maintaining high feedstock prices;

- Growth in sales through the establishment of transportation infrastructure in the United States;

- Further expansion in the fast-growing Brazilian market.

Risks

- Stronger reversal in feedstock cost amid global recession.

Conclusion

We believe the fertilizer sector will remain a hotly debated topic over the one-year horizon, due to persistent high feedstock prices caused by volume outflows from Russia, high production costs, gas costs, unmet market demand for phosphate and potash fertilizers at the level of 4% and 14%, respectively.

We believe that Mosaic is a perfect stock to gain extra alpha in a bearish market due to the condition of soaring phosphate and potash prices (the stock market is bearish due to rising interest rates and liquidity outflow). Firstly, Mosaic has exposure to phosphate and potash markets that separates it from its closest peers. Secondly, Mosaic is going to reap the gain of transportation easing that could help the company restore the amount of fertilizer shipments to the most important market – Brazil.

Be the first to comment