piyaset/iStock via Getty Images

Investment Thesis

Mosaic (NYSE:MOS) is priced at approximately 4x this year’s EPS. I want to get the valuation insight out there straight away. But I don’t want to beleaguer this point.

I believe that there’s a lot more to this, honestly weird, story than just a cheap valuation.

There are so many push and pull factors, that it’s no wonder the market is highly suspect of Mosaic.

Top 3 Elements Coming Together

There are 3 key factors at play.

In the first instance, the Fed is raising rates. This has a dramatic impact on all multiples across any equity investment. While this should most significantly impact long-dated, high-growth assets, where the profitability of those companies is a long-time into the future, raising rates is nevertheless impacting all stocks.

Secondly, there’s no doubt that the volumes of fertilizer being sold are coming down in 2022. We can debate all day about why farmers are pushing back, even as crop yields are so high and food inflation is now a global issue. But the facts are the facts, and farmers are pushing back.

Thirdly, fertilizer prices have been coming down.

So, with those drivers at the forefront of our discussion let’s dig further.

Prices of Potash/Phosphate at Retailers

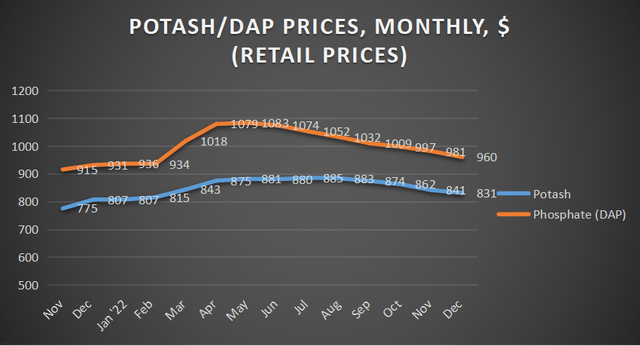

In the graph that follows, I’ve included potash and phosphate (”DAP”) prices from retail.

Recall, as of Q3, about 50% of Mosaic’s EBITDA came from potash, while close to 30% came from its phosphate business. The remainder of Mosaic’s EBITDA comes from its Mosaic Fertilizantes business, which is a vertically integrated phosphate and potash mining business in Brazil.

So, Mosaic’s operations depend on potash and phosphate prices in the market.

dtnpf.com

And the overall trend above is clear, prices have been coming down since early 2022.

I would then be quick to articulate that there’s a significant amount of seasonality in these figures. And then, I would press ahead to remark how for now prices are still higher on a y/y basis for both potash and phosphate.

However, let’s be honest, Mosaic itself is clearly less than bullish on its own potash prospects. Why?

Just a few days ago, Mosaic curtailed its potash production at Colonsay.

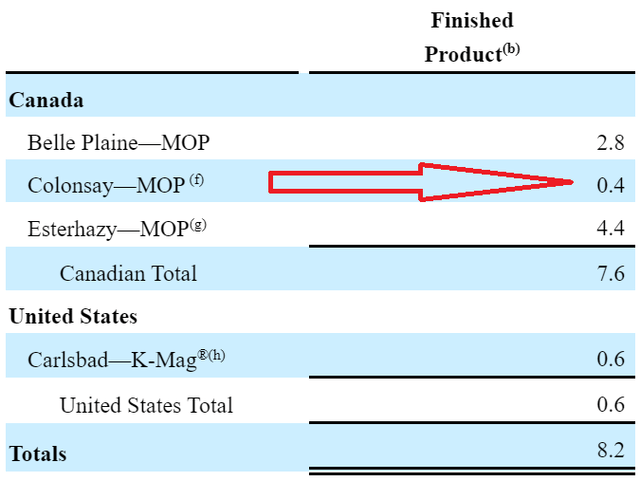

However, I would then counter this by stating that Colonsay’s finished product accounts for approximately 0.4 million tonnes out of Mosaic’s total 7.6 million tonnes.

MOS 10-K

Yes, this only accounts for approximately 5% of its finished product tonnes.

But on the other hand, this insight, together with the fact that Colonsay had been operating at an annual run rate of 1.3 million tonnes, down 13% from 1.5 million tonnes at the end of Q4 2022, goes a long way to reinforce exactly what investors believe when it comes to Mosaic.

Potash volumes are coming down and farmers are simply unwilling to entertain the idea of paying up for fertilizer.

But what about its valuation?

MOS Stock Valuation — 4x 2022 EPS, What Does this mean?

I’ve assumed that Q4 EPS comes in below the current Street estimate of $2.61 by approximately 5%. This is largely guesswork on my part. This would translate into $2.48 of EPS in Q4.

Altogether this would put Mosaic’s EPS at around $11.81 for 2022. Put another way, investors are being asked to pay 4x years’ worth of profits for this company.

Again, to be absolutely clear, to the best of my knowledge nobody is believing that Mosaic in 2023 is going to be unprofitable. And nobody, to the best of my knowledge, seriously argues that Mosaic’s balance sheet is in a perilous state.

So, what we have here is a business that could be seeing its EPS fall in 2023. And on that basis, investors are not willing to pay up for more than 4 years of profits at the current level. It’s as if by the end of this decade, we won’t need potash and phosphate because we’ll replace these fertilizers with something else.

The Bottom Line

Bulls, like myself, can argue as much as we want that farmers should be enticed to purchase fertilizer to maximize yields, but the facts on the ground don’t reflect that narrative.

Yes, the stock is clearly cheap. And yes, the stock is clearly expressing every aspect of possible negativity. And yes, investors honestly believe that the upwards cycle in fertilizer has come and gone.

But I remain resolute that paying 4x this year’s EPS offers investors a very compelling asymmetric bet.

Be the first to comment