Pranita Thorat/iStock via Getty Images

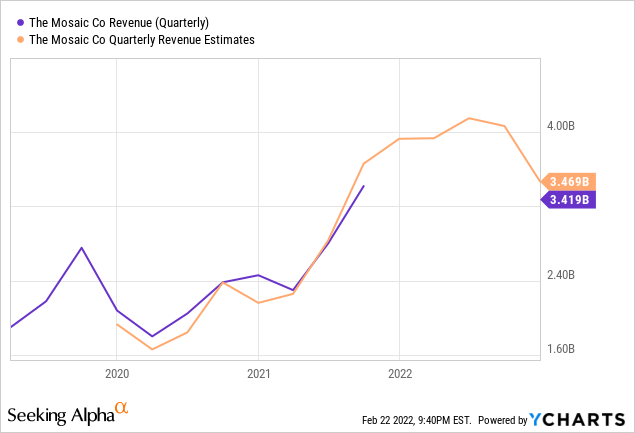

The Mosaic Company (NYSE:MOS) released its Q4 2021 8-K earnings report and the stock took a 6% loss in after hours trading. The company slightly missed quarterly estimates with a 1.5% miss on EPS and a 2.2% miss on revenues. As of close on 2/23, the price had rebounded to $45.20.

The biggest surprise in the report was a decrease in fertilizer sales volume. The decrease is not all that surprising to me. It should be expected that, when prices are high consumers are going to cut back, and that’s what happened. Earlier this month, I wrote about MOS and said that it’s starting to look ripe for the picking. It’s not ripe yet so I increased my long position on this correction.

Lower Sales

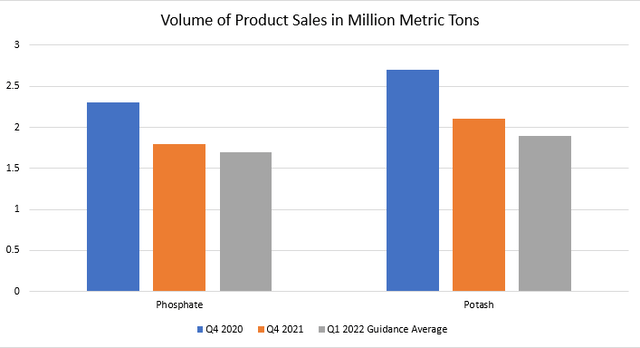

Fourth quarter volume sales of phosphate and potash decreased 22% each YoY. The company has been selling fewer tonnes of fertilizer as the price has climbed and discouraged farmers from applying as much. I discussed this concept in my article because potash and phosphate are not required for crop production every year. Management is guiding for lower sales volume in 2022.

This doesn’t concern me because margins are making up the difference so far. The marketing operating price of phosphate is up 86%, and potash is up 133% YoY. If fertilizer prices decrease, it will encourage more sales, the exact opposite of the current trend. In the perfect world, you would have high prices and high volume, but like much in life, MOS can’t have it both ways.

Chart by author (Data from company Q4 earnings report)

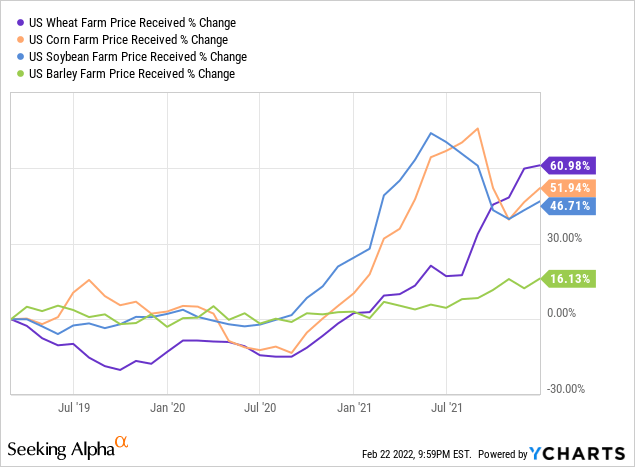

For a company like MOS, I prefer higher margins and lower sales volumes over the opposite. This is because they still own all the fertilizer that they haven’t sold yet. The company will make more profit in the long term by selling at higher margins. The gross margin rate increased in Q4 from 25% to 30%. What is important to me is the price that farmers receive for their crops. Corn, soy, wheat, and barley are some of the top fertilizer-using crops grown in the U.S. Farm price received is still trending up, and the recent conflicts in Ukraine have now spiked wheat futures higher. Sustained higher prices will incentivize farmers to plant wheat instead of other crops, which creates a domino effect where less acres of other crops are planted resulting in higher prices across the board.

As mentioned, revenues are still strong because prices are compensating for lower volume. Revenues estimates are still higher for the rest of 2022, implying higher stock prices for the year.

Company Future

CEO Joc O’Rourke had this to say about the company’s performance and future:

Mosaic delivered record EBITDA in 2021, and we expect strong performance to continue in 2022. As a result of successful investments like our new Esterhazy K3 potash mine, Mosaic Fertilizantes in Brazil, and our cost-structure transformation, we are generating tremendous value in the current environment. This has provided us with the opportunity to return significant capital to shareholders, while still investing efficiently in the business and strengthening the balance sheet.

Of note, the Esterhazy K3 potash mine is expected to begin production by Q2 2022. The company expects 5 million metric tons of potash production from the mine which will average 1.67M metric tons in Q2-4. Joc O-Rourke, during the earnings call, said that K3 “at full capacity will be one of the largest, most efficient and automated potash mines in the world.” Consequently, they expect a $200 million reduction in capex for the year.

The company expects strong demand for fertilizer in 2022, and I think the macro data agrees. In my last article, I discussed trends in planted acreage and fertilizer use worldwide. Also, the ongoing shortfalls in global supply from China and Belarus have not improved.

MOS is planning to raise their annual dividend from $0.45 to $0.60 per share in 2022. This is a forward yield of 1.36%. They are also going to begin a $400 million share buyback program this month and plan to conduct another $1 billion in buybacks following that. Inventories grew 57.6% YoY, and the company is preparing to meet 2022 demands. They already have 85% of Q1 2022 sales committed.

In their quarterly report, the company noted an important development:

Buyers in China and India have recognized the potential shortfall and committed to supply agreements with Canpotex at $590 per tonne for 2022. As a result, the potash market is expected to remain very tight in 2022.

This compares to the MOP selling price that MOS experienced for potash in Q4 of $414 per metric tonne.

During the earnings call, O’Rourke had this to say about the coming year:

As we head into North American spring planting season, we are seeing normal buyer behavior as demand continues to reflect strong underlying crop prices. In Brazil, fertilizer shipments in 2022, appears set to equal last year’s record-setting total. Grower economics are improving, thanks to rising crop prices, credit availability and a favorable exchange rate. In India, while farmer demand remains very strong, availability is still lagging. This month, the Indian government released its initial budget for nutrient subsidies, highlighting the Indian government’s willingness to respond to market condition with revisions. Given depleted Indian inventories, we see India as a source of pent-up demand, which should see phosphate and potash consumption growth in 2022.

These expectations are supported by the macro backdrop. And now, the Russia-Ukraine situation is heating up. Russia is the #2 producer of global potash and #4 producer of phosphate. This conflict, and any sanctions that accompany, is restricting an already tight fertilizer market.

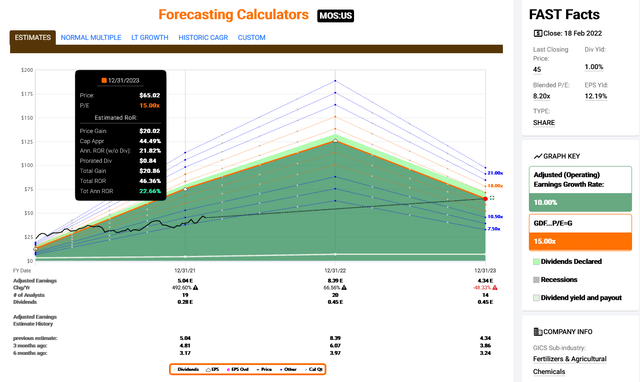

EPS for 2021 finished at $5.04, which is $0.04 short of the annual estimate. The last after hours price quote I received was for $41.70 per share. This results in an 8.27x multiple. Estimates expect EPS to increase by 66% in 2022 but then decline back to 4.3 EPS in 2023. At this point, I’m having a hard time seeing earnings that low unless the bottom drops out of crop prices. Nonetheless, based on these estimates at a 15x multiple in 2023, the stock would return 22.6% CAGR.

A more conservative valuation would use price to cash flow and assume the current multiple of 6.58x maintains through 2023. This results in a projected CAGR of 8.8%.

Summary

The Q4 earnings report is mostly a yawn, despite the small miss. The company already had attractive valuations, providing a margin of safety, and remains equally attractive now. Market demand and prices are set to remain strong in 2022, and I am confident the company will make good profits. After 2022 is yet to be decided. I added to my long position with a cost basis of $41.64. The crop is getting riper, but it’s not time to harvest yet.

Be the first to comment