Mindstyle/iStock via Getty Images

Snack food giant Mondelez (NASDAQ:MDLZ) has had a good two years as pandemic induced lockdowns, and consumer panic buying driven by pandemic-induced food shortages boosted packaged food sales. Mondelez reported revenue growth of 8.05% year-over-year (YoY), accelerating from 2020 when revenues rose 2.7%. Net profits jumped 21% YoY to USD 4.3 billion. Heavy marketing, product innovation helped capture market share with the company’s cumulative market share exceeding pre-covid levels.

Short term tailwinds associated with higher pandemic-induced at-home snacking may recede, short term headwinds from cost inflation

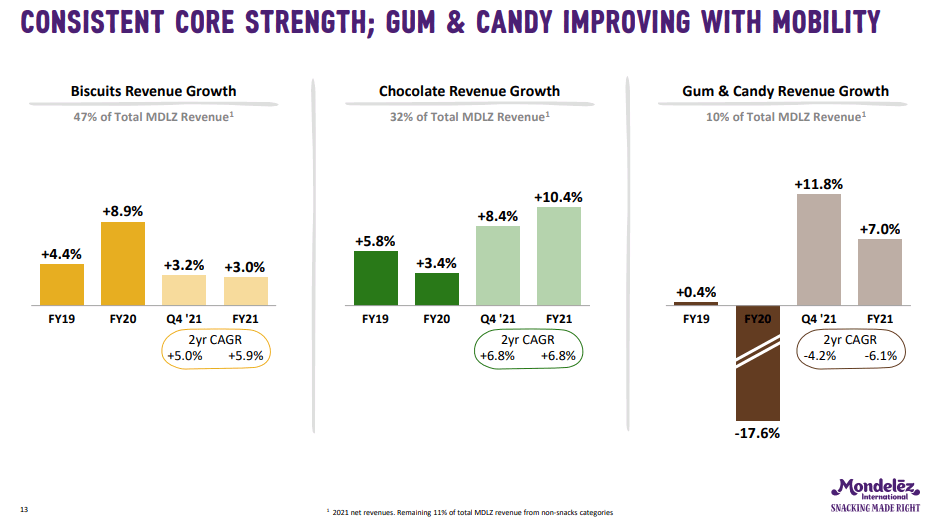

Mondelez has exposure to both at-home consumption and on-the-go products. Mondelez’s core biscuits and chocolates business – which is skewed towards at-home consumption – enjoyed an acceleration in demand during pandemic-induced lockdown periods around the world over the past two years, however with economies gradually opening up and consumer mobility rising, such short term tailwinds may gradually recede in the coming months (the company expects consumer mobility to pick up in H2 2022 but still remain 10%-15% below pre-covid levels). Mondelez’s Gum and Candy business, which has already seen a pick up along with increasing consumer mobility, could benefit from an easing of lockdown restrictions.

Mondelez Investor Presentation

Source: Mondelez Investor Presentation

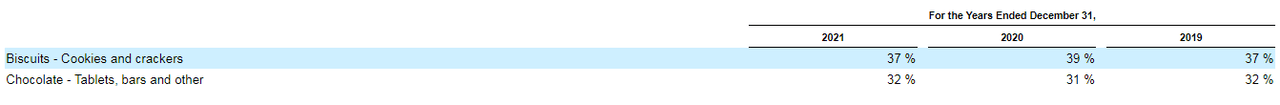

However, Mondelez’s core Biscuits and Chocolates business which accounts for more than 70% of the company’s revenues, could be affected.

Mondelez 10-K 2021

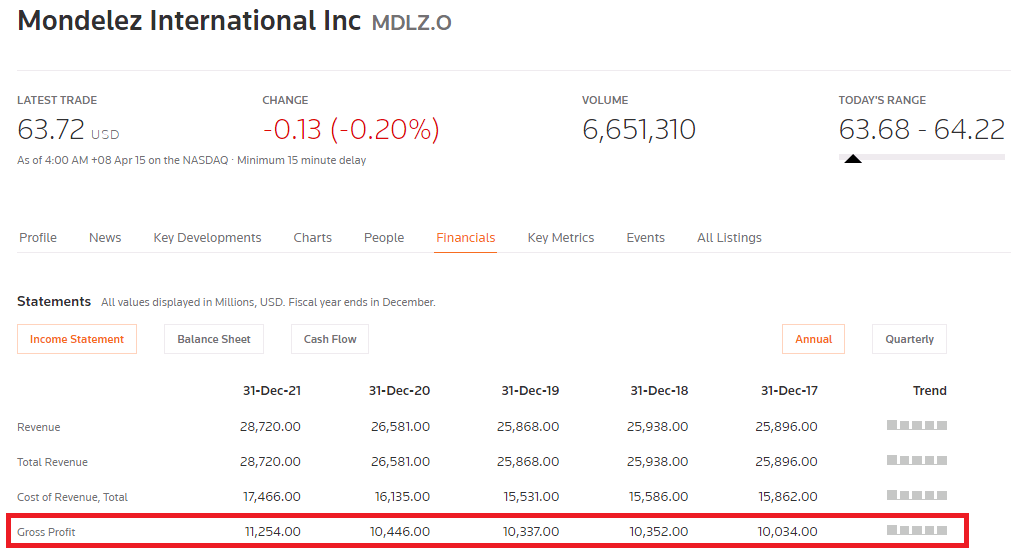

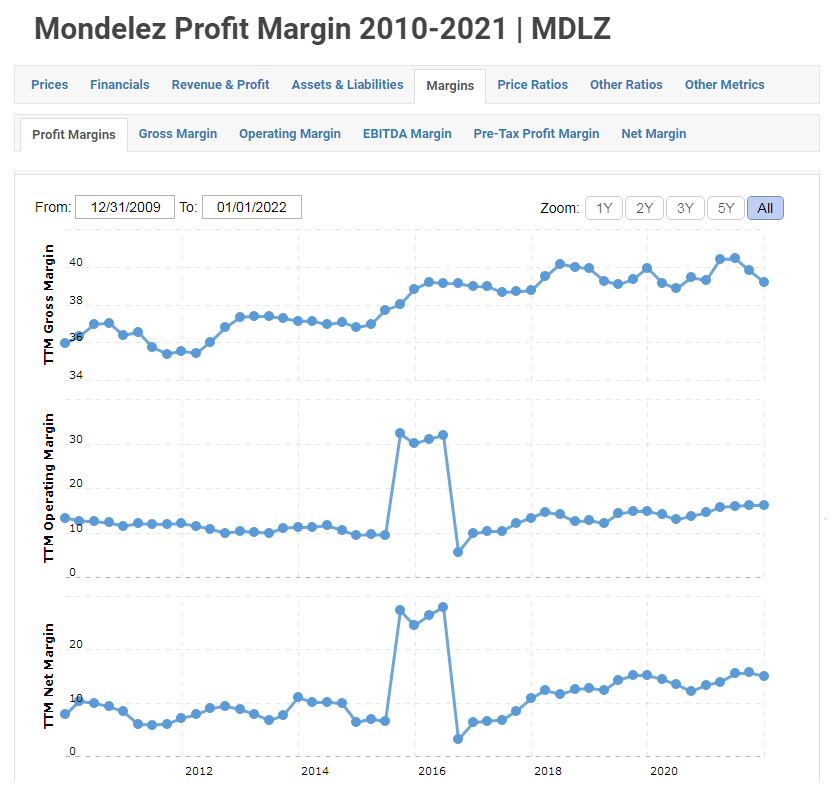

Meanwhile, packaged food makers including Mondelez, have been grappling with supply chain and cost inflation challenges driven by soaring prices for key raw materials, notably wheat, eggs, palm oil, and milk, impacting margins across the sector. Mondelez’s strong brand portfolio and pricing power helped the company pass on those costs to consumers in 2021, with the company’s gross margins seeing just a slight decline compared to the last few years. Mondelez reported a gross margin of 39.2% in FY 2021, a shade less than the 40% reported in 2019 and 2018. 2021 gross profits rose 7.7% YoY to USD 11.2 billion.

Reuters

Going forward, Mondelez expects commodity price challenges to continue in 2022, but with inflationary pressures expected to be high in the first half of the year and pricing actions expected towards the latter part of the year, the company overall expects a sequential improvement in gross profit dollars over the quarters.

Macrotrends

Long term growth supported by continuing investments into brand building and marketing, and strategic expansion into new snack categories and premium snacks, and emerging markets exposure

Mondelez continues to build its legacy brands through heavy marketing and product revitalizations, led by its two USD 1 billion brands – Oreo and Cadbury. Oreo, introduced more than a century ago, is widely recognized as the world’s favorite cookie brand and continuous brand building, witty social media marketing and advertisements, and product innovations (Mondelez continues to roll out new Oreo flavors) have helped the brand stay relevant and win the stomachs of younger snackers as well (surveys indicate young consumers are major Oreo fans).

Cadbury Dairy Milk follows a similar playbook with heavy marketing and product innovations following a localization strategy to increase shelf space and market share. New product launches include Cadbury Dairy Milk Kurma – kurma means “dates” in Malay – launched in 2022 Indonesia and Malaysia during the month of Ramadhan when dates become popular to break fast, Cadbury Dairy Milk Silk Mousse launched in 2021 in India where rich, decadent sweetened milk-based confectionery are extremely popular, and Cadbury Dairy Milk Durian launched in 2019 in durian-loving Malaysia).

Mondelez is also creatively fusing its iconic brands to create fresh new snacks like its Cadbury Dairy Milk Oreo chocolate bar.

Overall, Mondelez’s advertising and promotion expenses have been growing steadily over the years in absolute and relative terms reflecting the company’s aggressive marketing efforts to build its brands and drive sales. Mondelez expects to increase ad spend in 2022 to drive visibility and support higher shelf prices.

Mondelez advertising and promotion expenses

|

US dollars |

A&P spend / total revenues % |

|

|

2021 |

1.6 billion |

5.4% |

|

2020 |

1.4 billion |

5.2% |

|

2019 |

1.2 billion |

4.7% |

|

2018 |

1.17 billion |

4.5% |

While biscuits and chocolate currently make up the bulk of the company’s revenues, the company is actively making strategic acquisitions to expand its product categories and capitalize on emerging trends. Mondelez’s acquisition of Chipita, expands the company’s product portfolio into pastries.

Refrigerated nutrition bars have been a growing trend in the U.S. lately, and Mondelez was quick to scoop up market leader Perfect Snacks in 2019 which expanded Mondelez’s product portfolio into refrigerated nutrition bars. The global refrigerated snacks market is still at early stages and is projected to grow at around 5% through 2027. Mondelez’s global presence, localized snack market knowledge, retail and distribution networks are advantages that could help the company scale the brand worldwide.

The company is also expanding into the premium segment with the company acquiring premium snack companies like premium cookie maker Tate’s Bake Shop.

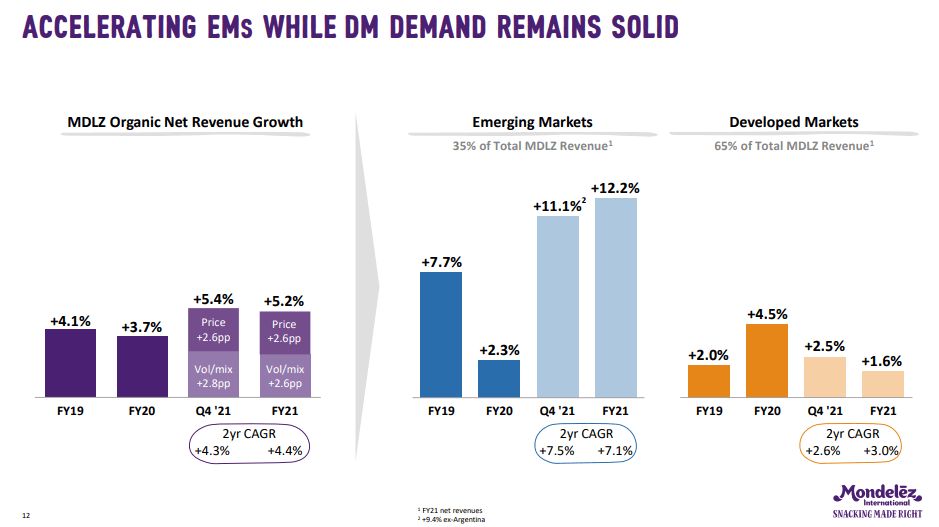

About 35% of Mondelez’s revenue is derived from emerging markets which offers tremendous long term growth potential; Euromonitor expects snack sales to grow four times faster in emerging markets than in developed markets through 2025.

Mondelez Investor Presentation

Portfolio evolving to meet changing consumer habits

Prior to the pandemic, a number of players in the packaged food space saw stagnant revenue growth as consumers increasingly shunned packaged foods and turned to fresh, natural foods or in the case of snacking – healthier “better for you” snacks instead. Packaged snack food giant Mondelez enjoyed robust revenue growth during the height of the pandemic over the last two years, but this was not the case pre-pandemic when revenue growth was relatively lackluster.

|

Year ended December, |

|

|

2021 |

8% |

|

2020 |

2.8% |

|

2019 |

-0.3% |

|

2018 |

0.2% |

Mondelez however has been evolving to meet changing consumer eating habits with the company having in place several strategies to meet this objective. First, the launch of brand extensions centered around well-being, such as Mondelez’s Cadbury Dairy Milk with 30% less sugar launched in the UK and India in 2019, “Oreo Zero” zero-sugar Oreos launched in 2021 in China, and the launch of Philadelphia cream cheese with 100% natural ingredients in Europe. Second, acquisitions of well-being-focused snack brands, such as Mondelez’s acquisitions of Hu Master Holdings in 2021 (the parent company of well-being snack company Hu Products), Grenade (a UK sports nutrition company well known for its protein bars), and Gourmet Food in 2021 (an Australian premium well-being focused biscuit and cracker company). Third, building their own brands, and making investments into emerging, early-stage brands through Mondelez’s dedicated innovation and venture hub – SnackFutures. Brands Mondelez has invested in through its venture hub include Uplift Foods in 2019 (a snack maker focused on prebiotic functional snacks) and brands that have been organically developed through the hub include CaPao (a wellness snack brand offering healthy plant-based snacks with upcycled cacao fruits), NoCoe (crackers made with mostly organic ingredients and zero preservatives and additives), Dirt Kitchen Snacks (healthy air dried vegetable snacks, and pressed snack bars made with vegetables, fruits, nuts and seeds, with no added sugar or artificial ingredients), and Ruckus and Co (ready-to-drink frozen smoothies containing organic milk, fruit puree, and vegetables, a product largely aimed at kids).

It remains to be seen however how successful the company will be in realigning its portfolio towards healthier snacks and building a healthier image. Mondelez’s zero-sugar Oreos for instance received bland interest from Chinese snackers suggesting the company’s portfolio evolution challenge is no easy feat. Meanwhile its low-sugar Cadbury Dairy Milk bar accounts for just a tiny fraction of revenues (1.1% as of 2020 according to this WSJ article).

Risks

Fat taxes and government regulation

Worldwide obesity has tripled since 1975 and governments are increasingly devising methods to counter this growing health problem. Over 50 countries worldwide have already imposed taxes on sugar-sweetened beverages (SSBs) and as obesity rates increase it is possible that these taxes may extend to other “unhealthy”, “junk” foods such as high-sugar snacks like biscuits, cakes, chocolate, and candy as well. A study published by the BMJ revealed that sugary snacks actually account for a bigger proportion of free sugar and energy intake than sugary drinks and that reducing purchases of sugary snacks, for instance through a snack tax, could potentially have a greater impact on addressing obesity. Researchers from the Universities of Oxford, Cambridge, and Exeter and the London School of Hygiene and Tropical Medicine mention that this option is ‘worthy of further research and consideration as part of an integrated approach to tackling obesity’. The Philippines, which reported some success in cutting sugary-drink sales following a sugar tax, is now considering imposing a snack tax in addition to potential advertising restrictions for junk food, candy, soft drinks and fast food as well. This year, India, a key emerging market for Mondelez, announced it will be imposing a tax on snack foods to counter rising obesity in the country.

Financials

There are not many companies directly comparable to Mondelez, however in terms of chocolate Hershey (HSY) could be one of them, and in terms of snacks General Mills (GIS).

Mondelez is not as profitable as chocolate giant Hershey but surpasses General Mills in some profitability metrics, notably in terms of margins, as well as in terms of growth with Mondelez’s revenue and net profit growth being considerably higher than General Mills.

Mondelez however stands out among the trio as having the lowest amount of debt, which better positions the company to make acquisitions – a key part of its growth and portfolio realignment strategy.

Financial metrics for the latest financial year

|

Revenue growth YoY % |

8% |

10% |

3% |

|

Net profit growth YoY % |

21% |

15% |

7% |

|

Gross margin % |

39% |

45% |

35% |

|

Return on assets % |

4.7% |

15% |

7% |

|

Total debt to equity % |

69% |

182% |

133% |

Summary

Riding on the covid-induced snacking trend, Mondelez has been growing market share, helping drive top line and bottom line growth. While short term challenges namely cost inflation and decelerating at-home snacking could dampen financial performance, long term portfolio realignment towards healthy snacks, product innovation, heavy branding, and strategic acquisitions bode well for the company. The snack market however is extremely competitive, and it remains to be seen how successful the company will be in its portfolio evolution effort in the face of consumer snacking behaviors shifting towards healthier snacks. Nevertheless, the company has in place long term strategies to address this as part of its effort to maintain and increase its market share, including a dedicated venture hub to identify and build promising brands, and a relatively low debt burden which leaves the company well prepared to acquire promising brands.

Be the first to comment