DanielBendjy

Slow and steady wins the race. It holds true for investing in equities because of reversion to the mean. For instance, the latest group of new tech stocks were trading at bubble valuations and plummeted when the Federal Reserve started tightening. On the other hand, some companies continually generate wealth for investors by slowly and steadily returning cash in the form of dividends and share buybacks. One company that comes to mind is Mondelez International (NASDAQ:NASDAQ:MDLZ). There is much to like with market leadership, rising revenue and earnings, and solid dividend growth. The stock is a Dividend Challenger and trading at a reasonable valuation. I view Mondelez as a long-term buy.

Overview of Mondelez

Mondelez was formed in 2012 after the original Kraft Foods split into two companies, Mondelez International and Kraft Foods Group. 3G Capital eventually acquired Kraft Foods Group and later merged it with Heinz forming Kraft Heinz Company (KHC).

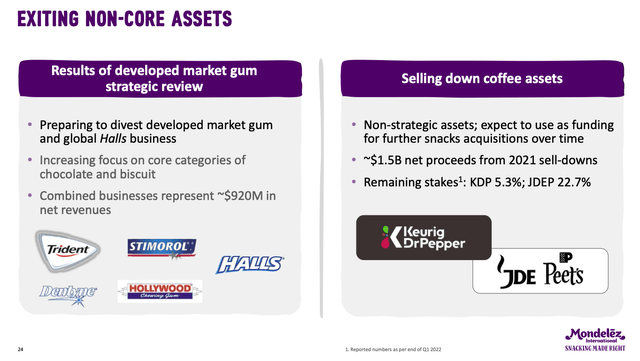

Subsequently, Mondelez underwent a reorganization. First, the company placed its coffee business into a joint venture with Douwe Egberts, eventually becoming JDE Peet’s (JDEP) (OTCPK:JDEPF), listed on the Amsterdam exchange. Also, the firm owned shares of Keurig Green Mountain, which ultimately became ownership of Keurig Dr. Pepper (KDP) after the merger with Dr. Pepper Snapple Group. As a result, Mondelez still has some ownership of coffee stocks, including ~22.7% of JDE Peet’s and ~5.3% of Keurig Dr. Pepper.

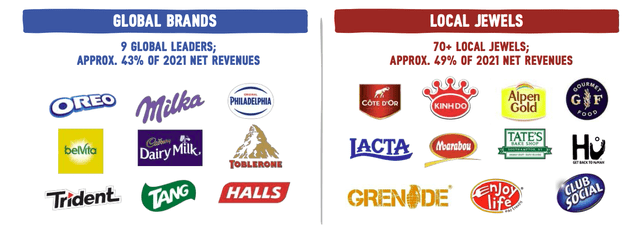

Mondelez owns brands from the original Nabisco, Cadbury, and LU Biscuits companies, making it one of the largest snack foods companies in the world. They have the number one global position in biscuits and the number two in chocolate and gum. Mondelez’s global brands are Nabisco, Oreo, Milka, Philadelphia, belVita, Cadbury, Toblerone, Trident, Tang, and Halls. Other essential brands are Ritz, Tate’s, Lacta, LU, What Thins, Swedish Fish, Triscuit, and Chips Ahoy. Many of the brands are No. 1 in their market segment or geography.

Total revenue was $28,720 million in 2021 and $29,878 million in the last twelve months.

Growth and Restructuring Strategy for Mondelez

Mondelez plans to grow organic revenue by about 3 to 5% per annum. The company generally follows the playbook of most packaged food companies by introducing product extensions, expanding distribution, and marketing.

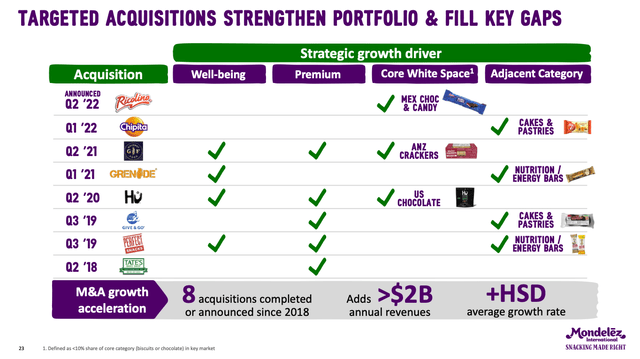

However, Mondelez is an acquisitive company adding growth through bolt-on acquisitions. The company has acquired eight companies since 2018, adding $2+ billion in revenue. The strategy is seemingly to buy promising brands as a platform where the company is underrepresented in a segment, price point, or geographically. Subsequently, the firm expands the new brand. The eight acquired brands are Tate’s Bake Shop, Perfect Snacks, Give & Go, Hu, Grenade, Gourmet Foods, Chipita, and Ricolino.

Along these lines, Mondelez announced the acquisition of Clif Bar for $2.9 billion, which has the No. 1 position in protein and energy bars. The new brand will add about $800 million in sales.

Besides top-line growth, Mondelez is expanding margins through cost cutting. As a result, the company has reduced emissions, food waste, and water usage compared to 2018. It has also reduced packaging waste, moving to 100% recyclable packaging by 2025.

Mondelez is exiting non-core assets after a strategic review. Instead, the company will focus on biscuits and chocolate. Consequently, it will divest the developed market gum and global Halls business representing about $920 million in revenue. The change in focus includes selling the Halls, Stimorol, Hollywood, Dentyne, and Trident brands. In addition, the firm is selling its stakes in JDE Peet’s and Keurig Dr. Pepper. It plans to use the proceeds to add to the snack portfolio.

Competitive Advantages

Mondelez has several competitive advantages. First, the company is far and away the market leader in biscuits, with about 17% global market share in the $104 billion market category. Campbell (CPB) is No. 2 but with only about 3 to 4% market share. In fact, Mondelez has a greater market share and faster growth than several of its largest competitors combined. Besides Campbell’s, other competitors include Kellogg (K), Pladis, Ferrero, PepsiCo (PEP), Britannia, Parle, Barilla, and Nestle (OTCPK:NSRGY). This scale and size allow Mondelez to spread distribution and manufacturing expenses over more brands and greater volume.

Next, the company is a strong No. 2 in the global chocolate market with about 12% global market share in the $112 billion category. Privately held Mars is the No. 1, but Mondelez is growing faster and gaining market share. Only Hershey (HSY) is growing faster. Besides Mars and Hershey, other competitors include Ferrero, Nestle, Lindt, Storck, Pladis, Lotte, and Uniconf.

Moreover, Mondelez has highly recognizable brand names. Consumers know brands like Oreo, Cadbury, and belVita well. The combination of excellent brand name recognition, leading market share, and high sales volumes gives the company an edge for product placement at retailers.

Lastly, Mondelez has excellent and disciplined capital allocation focusing on reinvesting the core business, tuck-in mergers and acquisitions, dividends and share repurchases, and the balance sheet.

Risks for Mondelez

Mondelez faces inflation and input cost risks despite its strength and market leadership. Most inputs are commodities like sugar, flour, cocoa, wheat, and dairy and prices fluctuate. The company is also subject to energy costs, labor, and freight risks. As a result, higher prices can negatively affect margins. In addition, as a US company with global operations, a strong dollar will cause foreign exchange headwinds.

Dividend Analysis

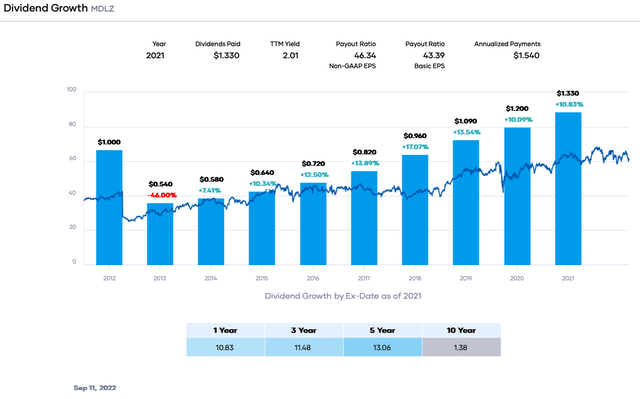

Mondelez is paying a forward annual dividend of $1.54, giving a dividend yield of 2.40%, more than the 5-year average of 2.14%. The dividend yield is also greater than the average yield of the S&P 500 Index. In addition, the company has increased the dividend for nine years, with the streak going back to 2014, making the stock a Dividend Challenger.

The dividend yield and double-digit growth make the stock attractive to many investors.

Mondelez last increased the quarterly dividend in July 2022 to $0.385 from $0.35 per share. The trailing dividend growth rate has been 13.06% CAGR in the past five years. Moreover, the reasonable payout ratio of ~46% combined with rising earnings per share means the dividend will likely be raised in the future.

Mondelez has excellent dividend safety from the context of earnings, free cash flow (FCF), and the balance sheet.

Consensus estimates in fiscal 2022 for Mondelez are $2.91 per share, and the dividend is $1.54 per share. These numbers produce a forward payout ratio of ~48%. Our target payout ratio is 65%, indicating the dividend is safe with a decent buffer and room for growth.

Mondelez had approximately $4,316 million in free cash flow (FCF) in the last 12 months. The dividend needed about $1,907 million, giving a dividend-to-FCF ratio of ~44%. This value is excellent and below our threshold of 70%, suggesting little risk to the dividend based on FCF.

The balance sheet has acceptable liquidity, leverage, and interest coverage.

At the end of Q2 FY 2022, Mondelez had $605 million in short-term debt, $746 million in current long-term debt, and $17,861 million in long-term debt. Total and net debt has been remarkably consistent in the past several years. Total debt was offset by $1,924 million in cash and equivalents and $126 million in short-term investments. As a result, the leverage ratio is ~2.6X, and interest coverage is roughly 14.2X, both solid for a consumer staples company. Cisco has a BBB/Baa1 lower-medium grade investment credit rating from S&P Global and Moody’s. Debt is not troubling from the perspective of dividend safety.

Valuation

Mondelez’s stock price has performed relatively well in 2022. The year-to-date total return is about (-7.0%), and the 1-year return is ~1.2%, much better than the S&P 500 Index and Nasdaq. Moreover, the stock is trading at a price-to-earnings ratio of approximately 21.1X, slightly below its range in the trailing five years and ten years.

The consensus analyst 2022 earnings estimates are now $2.91 per share. Therefore, we will use 21X as a reasonable value for earnings multiple. This number is below the average in the past decade. However, we account for global inflation headwinds and recession fears.

Our fair value estimate is $61.11. The current stock price is ~$61.33, suggesting that the stock is fairly valued based on estimated earnings.

Applying a sensitivity calculation using price-to-earnings (P/E) ratios between 20X and 22X, we obtain a fair value range from $58.20 to $64.02. Thus, the current stock price is ~96% to ~105% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

20 |

21 |

22 |

|

|

Estimated Value |

$58.20 |

$61.11 |

$64.02 |

|

% of Estimated Value at Current Stock Price |

105% |

100% |

96% |

Source: dividendpower.org Calculations

How does this result compare to other valuation models? An EV/EBITDA multiple analysis from Finbox gives a fair value estimate of $71.81 per share. The model assumes a forward multiple of 17.5X. Portfolio Insight’s blended fair value model combining the P/E ratio and dividend yield gives a fair value of $68.39 per share. We don’t use the Gordon Growth Model because of the high dividend growth rate.

The three-model average is ~$67.10, suggesting Mondelez is undervalued at the current price.

Final Thoughts

Mondelez is a stock that should be on every dividend growth investor’s radar. The company is consolidating its position in the biscuits and chocolate space through acquisitions. The company has a wide moat and is growing the top and bottom lines. A growing dividend and stock buybacks are rewarding shareholders. A moderate payout ratio supports the forward dividend yield of 2.4%. The stock is undervalued at the current price. I view Mondelez as a long-term buy.

Be the first to comment