Drazen Zigic/iStock via Getty Images

Last week the market received fresh consumer price inflation data. That figure came in at a blistering 8.5% for the month of March 2022. On a year over year basis, consumers have now had to battle four consecutive months of CPI above 7%. As consumers are forced to make changes to their monthly budgets because of inflation, investors need to look at their portfolios and allocate capital to the assets and equities that will hold up in an inflationary environment. If an investor wants equity exposure that offers diversification out of energy or commodities as an inflation trade, there’s a strong case to be made for the macro setup I see for Molson Coors (NYSE:TAP).

Beer Drinker Pivot?

The core thesis behind this idea is one of behavior change. When consumers are faced with higher prices at the grocery store, they often have to change their habits and adjust to lower cost alternatives. For the beer industry, I think high inflation could actually help the more economic, legacy brand owners take back some market share.

It’s no secret that craft beer has exploded in the last few years. Last year, 13.1% of the domestic beer market was produced by small and independent brewers. When we look at the craft market by barrel volume and compare that with the total dollar market, we can see that craft beer is much more expensive than most domestic beer you’ll find from companies like Molson Coors or Anheuser-Busch InBev SA/NV (BUD).

| 2021 (US) | Dollars (billions) | BBLS (millions) |

| Total Beer Market | 100.2 | 187.6 |

| Craft Beer Market | 26.8 | 244.9 |

| Craft Share | 26.7% | 13.1% |

Source: brewersassociation.org

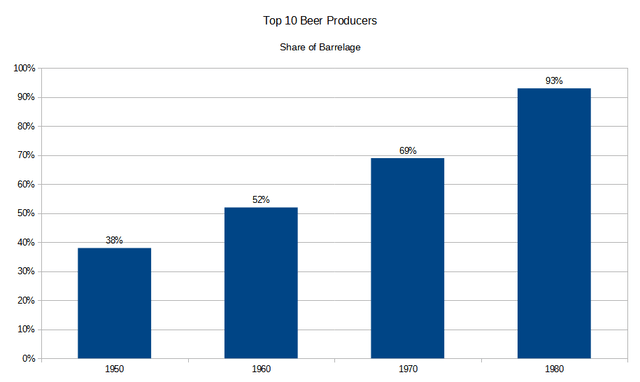

Despite a little over 13% share of the beer market by barrel volume, the craft producers claim just under 27% of the total market revenue. This level of share distribution has not always been the case. In previous years, as much as 93% of total market barrelage has been produced by the top 10 market participants.

Top 10 Beer Producer Market Share (BeerHistory.com)

This chart shows data collected by beerhistory.com. Over a 30-year period, the top ten beer producers by barrelage went from 38% share of market in 1950 to over 90% in 1980. If we are in a sustained era of high consumer price inflation, I think will see consolidation in the beer industry again. It’ll likely be the higher unit-priced craft producers that shed share.

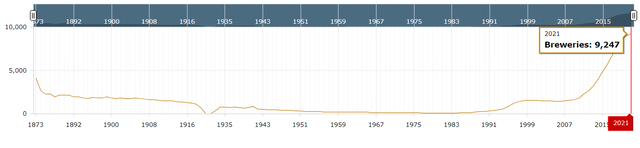

Total Breweries (Brewers Association)

There are now over nine thousand breweries in the United States. While having several thousand domestic breweries isn’t without precedent, a 16% CAGR for over the last decade is very strong when you consider that there were less than 100 breweries in 1980 and we started 2010 with just over 1,600. I like beer, but even I wonder if there are more breweries than needed. From the start of the 1970’s to the end, the number of domestic breweries declined by about 35%.

Alcohol Is Still A Sure Thing

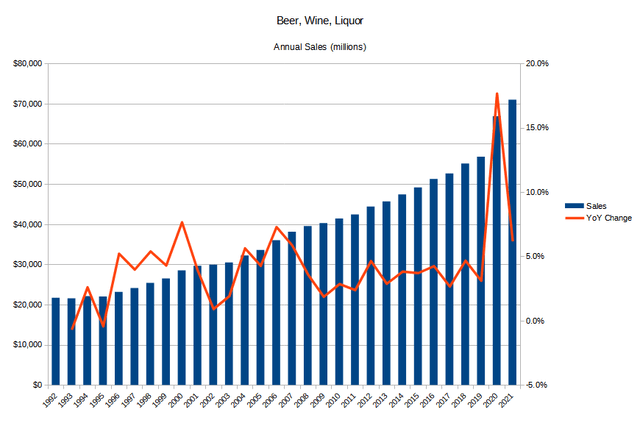

Beer and alcohol are generally recession-proof products. The consumption of alcohol usually goes up every year and to this point the market has supported the level of domestic brewery growth. There have actually been more than 700 breweries added to the market since 2019. While that might seem surprising on the surface, look at the alcohol consumption in retail sales:

Annual Alcohol Sales (Census Bureau)

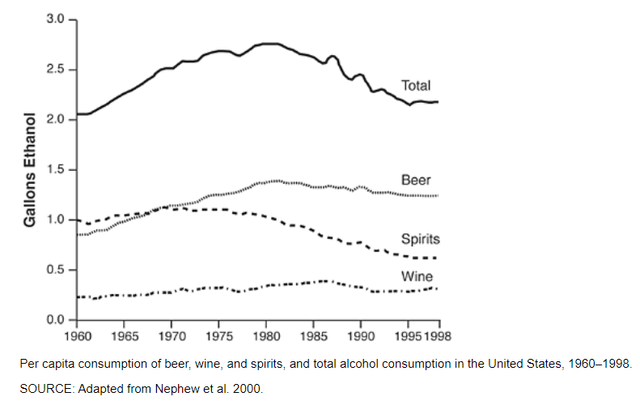

The raw sales figures have almost always been positive year over year. The rate of change is usually higher in times of economic uncertainty. Though the retail trade data from the Census Bureau in the chart above only goes back to 1992, I found an interesting chart from the NIH with data that goes further back. It’s actually better because it breaks out the alcohol consumption by type:

Alcohol Trends by Segment (NIH)

Not only did per capita consumption of alcohol grow during the 1970’s, but it was actually beer that was largely fueling that growth. Spirits and wine were both stagnant through the decade.

Why Molson Coors Over Anheuser-Busch?

The market share story for Molson Coors has not been a pretty one over the last few years. According to the company’s last annual filing, TAP’s share of the North American alcoholic beverage market has given up more to the craft insurgents, seltzers, wine, and spirits producers than BUD has over the last four years.

| Year | TAP | BUD | Other |

| 2017 | 25% | 42% | 33% |

| 2018 | 24% | 42% | 34% |

| 2019 | 23% | 41% | 36% |

| 2020 | 22% | 41% | 37% |

| 2021 | 21% | 40% | 39% |

| 4 yr Change | -16% | -5% | 18% |

Source: Molson Coors, annual estimated share of alcoholic beverage market (US/Canada)

If history is any indication, the Miller/Coors brands could benefit from total brewery market contraction more than Budweiser. Though they were not brands under one corporate umbrella at the time, Miller Brewing and Adolph Coors both saw their share of the domestic beer market grow faster than Anheuser-Busch during the 1970’s.

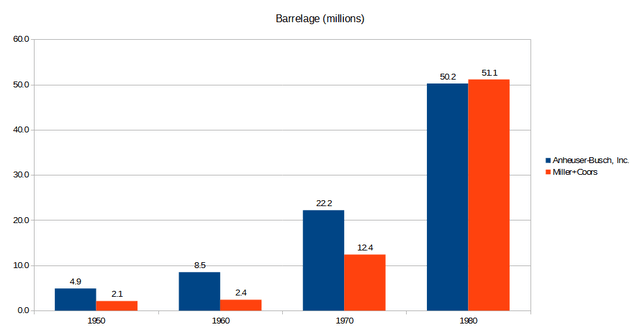

Barrelage by Company (BeerHistory.com)

When we combine the output from Miller and Coors, Anheuser-Busch had nearly double the share of those two brewers in 1970. But that story changed dramatically during a high inflation decade where a theoretically combined Miller/Coors entity would have actually been the top brewer by 1980. Though they were far from new brands, during a time of high consumer price inflation, Miller (founded in 1855) and Coors (founded in 1873) saw bigger growth than Anheuser-Busch (founded in 1852).

Of course, what happened in the past is not destined to repeat. This isn’t to say that Anheuser-Busch can’t work well in an inflationary environment as well. But I think you could argue that TAP has bled market share as a result of craft beer growth to a larger degree than BUD has. So a potential reversal of the craft trend could have the reverse effect and be better for TAP than for BUD. Also, unlike Molson Coors, most of BUD’s revenue comes from outside North America.

| 2021 | North American Share of Total Revenue |

| Molson Coors | 82.5% |

| Anheuser-Busch | 29.9% |

Source: Molson Coors, Anheuser-Busch

If sustained consumer price inflation plays out in the US, I believe Molson Coors is better positioned to benefit from consumer behavior changes as TAP’s exposure to the North American market will potentially be reflected in the top line to a larger degree.

TAP Is The Value Play

Compared to alcohol producing peers and the broad market overall, Molson Coors has massively lagged from a capital performance perspective over the last several years. The company has lagged in large part because of weakness in product innovation and because of savvy marketing agreements by Budweiser.

To address that weakness, Molson Coors has been going through a revitalization plan since 2019 that has focused on updating product, process and corporate structure. The plan has included the development of hard seltzers, has consolidated the company from four corporate segments down to two, and implemented younger customer acquisition strategies like Metaverse Bars during the Super Bowl.

It remains to be seen if trendy digital advertising initiatives by Molson Coors or its peers will turn younger alcohol consumers into legacy product loyalists. But if these new branding strategies work to level the advertising playing field a bit more, TAP has a much more attractive starting point valuation for prospective investors today.

| TAP | (BUD) | (SAM) | (STZ) | |

| P/E GAAP (FWD) | 14.12 | 17.94 | 25.57 | 23.25 |

| P/E GAAP (TTM) | 12.04 | 25.93 | 312.55 | NM |

| Price/Sales (TTM) | 1.17 | 2.19 | 2.18 | 5.43 |

| EV/Sales (FWD) | 1.79 | 3.40 | 2.00 | 6.22 |

| EV/Sales (TTM) | 1.86 | 3.68 | 2.19 | 6.62 |

| EV/EBITDA (FWD) | 9.00 | 9.85 | 13.67 | 16.78 |

| EV/EBITDA (TTM) | 8.27 | 11.21 | 34.88 | 17.81 |

| Price to Book (TTM) | 0.90 | 1.71 | 4.52 | 4.07 |

| Price/Cash Flow (TTM) | 7.67 | 7.91 | 79.41 | 17.43 |

Source: Seeking Alpha, as of 4/18/22

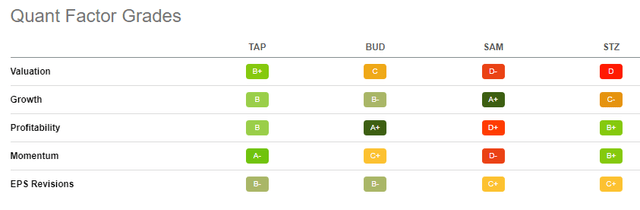

You can see in the table above that TAP trades cheaper than peers from just about any valuation metric you prefer. Seeking Alpha’s Quant Factor Grades also indicate Molson Coors is the best buy out of what I consider to be the more economically priced beer companies with large domestic footprints.

Quant Factor Grades (Seeking Alpha)

Risks

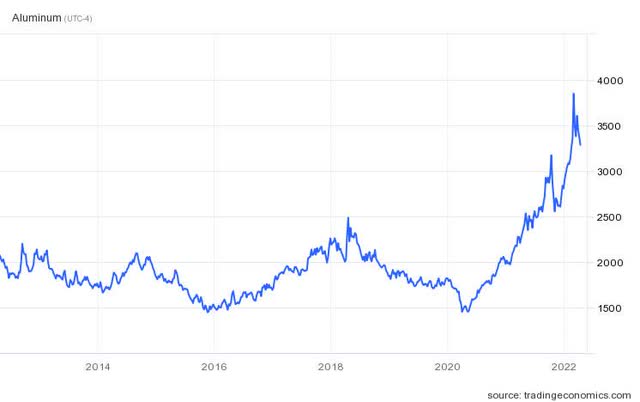

Inflation works two ways, of course. And generally higher prices for the consumer are a result of higher input costs for the producer. That may be the case with Molson Coors as well. Distribution cost increases felt through both higher energy prices and from a shortage in truck drivers will likely continue to be a factor. In addition to that, production costs from materials are definitely a concern. 74% of TAP products serving the American and Canadian markets use aluminum packaging. The cost of aluminum has moved up considerably in the last 24 months.

Aluminum Price (TradingEconomics.com)

An additional concern is the immediate performance of the broad equity markets. Weakness there could hurt TAP and other publicly traded beer names should they get brought down with the indexes. Finally, though there is debt and the cost of refinancing that debt could increase from here, the debt profile for Molson Coors shows maturity probably isn’t a concern until 2026. And at that point, the cashflow from operations should be very robust if my thesis plays out.

Summary

Just as investors look to hedge against inflation in their portfolios, the consumers on the ground feel inflation in a different way. Generally, high consumer price inflation of this nature is met with changing consumption behavior. Given the recent shift to craft beer and the proliferation of new breweries to try, legacy beer producers like TAP have struggled. I think beer fans are going to be forced to make some tough decisions. As a smaller percentage of their paychecks can go toward fun, supporting every local brewery may not be an option much longer.

Whether they actively choose to drink more affordable beer on their own or they do so because the craft breweries that they love can’t continue to operate, I believe there will be a renaissance in more affordable beer offerings from the legacy brands in the MillerCoors portfolio. I think TAP benefits from this macro shift more than peers and I think the stock is worth a look given the affordable valuation to comps.

One More Thing

I’m really excited to share that I’ll be launching a Marketplace service right here on Seeking Alpha called Heretic Speculator PRO in the next couple weeks. As we get closer to the launch, I’ll get into more of the details about the service and the value proposition for subscribers. Make sure you follow me so you don’t miss what’s coming!

Be the first to comment