Editor’s note: Seeking Alpha is proud to welcome James Fox as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Joe Raedle/Getty Images News

The Moderna (NASDAQ:NASDAQ:MRNA) share price has fallen from its pandemic peak amid uncertain demand for its lifesaving mRNA vaccine. But I think it’s got further to fall.

Moderna shares traded for more than $450 last summer. But today the stock is trading at $147 – less than a third of its pandemic peak. The vaccine-maker stock gained massively during the pandemic. Its mRNA vaccine was favoured by governments around the world, including in the US and EU. In fact, its shot was famously touted as the Rolls-Royce of vaccines, although it was also linked with very rare cases of myocarditis that perhaps caused it to be less popular than the Pfizer (NYSE:PFE) vaccine by those being vaccinated. Prior to the pandemic, the Massachusetts-based firm was trading for less than $15 a share.

However, I’m concerned about Moderna’s prospects. Despite soaring profits during the pandemic, long-term demand for its only commercial product, the COVID-19 vaccine, will fall drastically. As a result, I’m not adding Moderna to my portfolio anytime soon and I contend the stock is still overvalued by around 25%.

Why is the share price falling?

Moderna only has one commercial product and that’s its lifesaving COVID-19 vaccine, Spikevax. The shot received emergency approval around the world in 2020 and 2021 and is considered one of the most effective vaccines in the fight against COVID-19. Like other vaccines, Spikevax was developed and approved on an accelerated schedule. While it is normal for vaccine development to take a decade from discovery to rollout, Spikevax was created and rolled out within a year.

These exceptional circumstances propelled Moderna from a company that most people had never heard of, to a household name worldwide. Its shot was one of the first four vaccines approved for use against the virus in the West. The other vaccines included the AstraZeneca (LSE:AZN) shot that was sold for cost-price by the Anglo-Swedish drugs company. However, the Moderna vaccine was sold, and continues to be, for around $20-25 a dose.

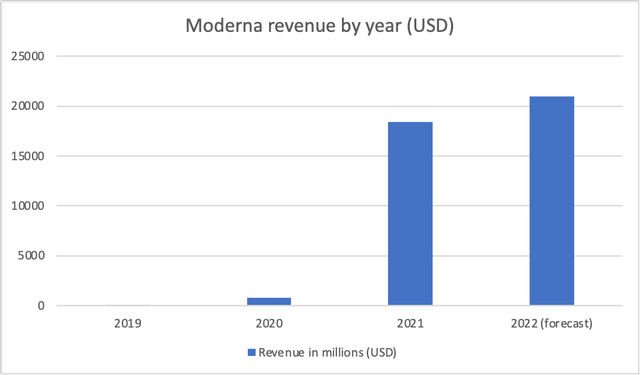

In turn, this saw Moderna generate $18.4 billion in 2021. The figure represents an enormous 2191% jump from 2020. In 2020, the vaccine maker saw revenues of $803 million. This figure also represented a huge 1234% increase from the $60 million generated in 2019. As such, we can see how the pandemic generated revenue growth in a way which is not likely to be repeated.

Moderna – Revenue by quarter

Moderna has strong forecasts for 2022, but the future is uncertain after that. The firm, which currently has a market cap of $58 billion, says it is on track to deliver $21 billion in revenue in 2022. This figure is covered by advanced purchased agreements for its SpikeVax COVID-19 vaccine, amounting to $21 billion and options worth $500 million. These agreements concern vaccines to be delivered in 2022. However, forecasts from then on are mixed. While the general forecast is steeply downwards. Some analysts have predicted that Moderna’s vaccine sales will dip as low as $2 billion in 2024. Moderna says it purchase agreements are in place with United Kingdom, Canada, Taiwan, Kuwait, and Switzerland for 2023 and that it continue negotiations for orders to be delivered later this year and next.

One issue worth noting is that the majority of advance purchase agreements for 2022 were signed in 2021 before the virus mutated into its current and less virulent state. Moderna said on January 10, 2022, that advanced purchase orders for the year stood at $18.5 billion. As such, we can observe that there have been $2.5 billion worth of deals signed in the near three months between January and March – equivalent to around $830 million a month. This is a much lower rate of sales than previously observed. I fear Moderna’s sales per month will continue to fall with COVID becoming less virulent.

Could SpikeVax revenue fall as far as $2 billion in 2024? I definitely think so. At $25 a shot, Moderna would need to sell 80 million vaccine doses to achieve $2 billion in revenue. That’s certainly a lot less than it’s selling now. But I can see how it would fall that low. As we move away from the pandemic, I don’t see poorer nations continuing vaccination programs, and I don’t think multilateral organizations will foot the bill anymore. So that leaves high-wealth nations, like the UK, EU, US, Japan, South Korea etc., and I don’t think they’ll be vaccinating the whole population or giving boosters more than once a year. My calculations suggest there are around 350 million over 65s living in these high-wealth countries. Of course, there are other vulnerable communities, but I believe the market for COVID-19 vaccines will be a lot smaller. Moderna will still have competitors, cheaper competitors too. So, I think $2 billion in revenue for 2024 looks like a solid forecast.

So, investors are clearly concerned about revenue generation in the years to come. And I think as we look around us, we can see that the demand for COVID-19 vaccines is dropping – not only among governments, but among normal citizens. Only elderly members of the British public are being offered fourth jabs right now and I’m not sure whether younger members of the population will be given free COVID-19 shots again.

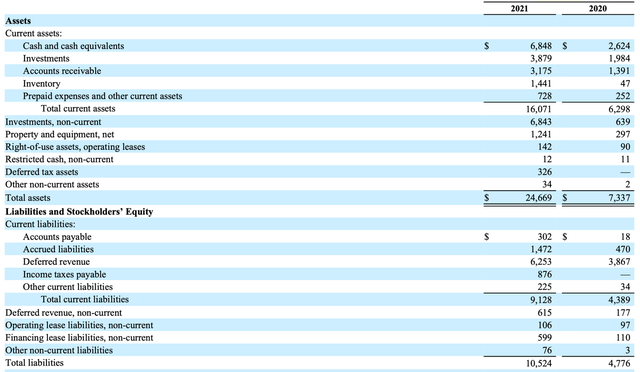

Financials and Balance Sheet

As discussed, Moderna’s financials look strong on the back on exceptional performance during the pandemic. This is also reflected by a healthy balance sheet and cash flow. Total assets ($24.6 billion) far outstrip total liabilities ($10.5 billion). Cash and cash equivalents grew from $2.6 billion in 2020 to $6.8 billion in 2021. The majority of liabilities ($6.2 billion) were deferred revenues – i.e., money received in advance for products.

Moderna – Balance sheet

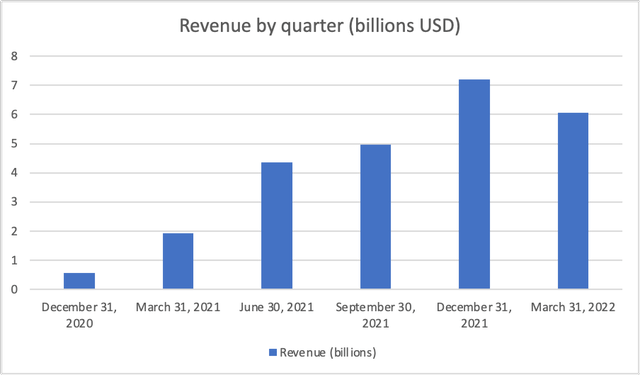

We may also be seeing signs that Moderna’s peak quarterly revenue has been reached. This is demonstrated in the last quarterly results. Last year, revenue grew quarter on quarter to $7.2 billion in Q4. However, revenue fell for Q1 of 2022 to $6 billion – $5.9 billion of which came from SpikeVax sales. That’s 98% of the company’s revenue. The remaining 2% comprised of grant revenue and collaboration revenue.

The below chart demonstrates revenue growth over the past six quarters. Data was sourced from Moderna’s quarterly reports.

Revenue by quarter, Moderna

Earnings per share (EPS) came in at $8.58 in Q1 of 2022, which marks a considerable fall from Q4 of 2021 when EPS came in at $11.29. Although it is worth noting that this was considerably above analysts estimates of $5.83.

However, Moderna’s cash reserves are definitely something to admire. In its Q1 update, Moderna highlighted that it had amassed $19.3 billion in cash, cash equivalents, and short-term investments as of March 31, 2022. As a result, Moderna has more cash than drugmakers which are many times its size.

What could send the share price upwards?

The less virulent nature of the Omicron strain has made vaccinations less vital. While Omicron is considerably more contagious than previous variants, it causes less severe symptoms. One thing that would send the Moderna share price soaring is the emergence of a more virulent strain, which would incentivize more vaccination. However, viruses don’t tend to evolve to become more deadly. The most successful viruses are the ones that spread, not the ones that kill their hosts.

The second thing that could reverse the negative trend in the share price is the development or launch of new products with commercial potential. mRNA technology has been lauded as having the capacity to be more easily manufactured to take on diseases such as cancer. However, the majority of Moderna’s vaccines in development concern COVID-19 and other respiratory viruses.

Moderna has two combined respiratory-virus vaccine candidates in its pipeline. One targets influenza and COVID-19. The other targets flu, COVID-19, and respiratory syncytial virus (RSV). Both candidates are in preclinical development. This sort of product could enhance the firm’s revenue generation capability, but it seems unlikely that such vaccines would be rolled out to whole populations. Instead, it would be targeted at the most vulnerable, probably just in time for the winter months. However, competitor Novavax (NASDAQ:NVAX) is slightly closer to commercializing a similar product.

Moderna also has a Cytomegalovirus (CMV) vaccine in phase three trials. CMV is related to the herpes virus that causes cold sores and chickenpox. However, once you have the virus, you retain it for life. It can cause serious health problems in some babies who get the virus before birth and in adults with weakened immune systems.

The biotech firm is also developing a Zika vaccine and a personalized cancer vaccine (PCV). The PCV is in phase two trials and such vaccines, if successful, are likely to be very lucrative. The disease is one of the biggest killers worldwide and treatment can be very costly. Moderna is also working on a HIV vaccine. However, many of Moderna’s vaccines are still some distance from commercialization. Reaching commercialization can take a decade or longer.

There is obviously great potential for these vaccines. And there is considerable optimism that mRNA technology might be the key to treating and immunizing people against some of the deadliest diseases on the planet. The pandemic has raised awareness to the capabilities and utilities of mRNA treatment. Pipeline projects are well funded, not only because of record profit levels achieve over the past two years, but because of enhanced government interest and funding. However, any product coming out of Moderna’s labs will still need to go through the same rigorous scrutiny as other treatments. Despite this, there clearly is a lot of faith that mRNA technology has the capacity to prevent and treat diseases previous not covered by vaccines. As such, despite Moderna only having one commercial product now, and no sign of another in the immediate future, it’s not surprising that Moderna is trading at a premium to its peers.

Competition and risks

As discussed, Moderna only has one commercialized product. But that product, its COVID-19 vaccine, is very effective. In fact, it is understood to be one of the two most effective vaccines against COVID-19. Initial trials suggested that the mRNA vaccines produced by Moderna and Pfizer were around 95% effective against the original variant of COVID-19. By comparison, AstraZeneca’s vaccine was around 70% effective at preventing symptomatic COVID-19, although studies have inferred that the Anglo-Swedish shot offered greater long-term protection via T-cells. Moderna and Pfizer are considered more effective against the Omicron variant than AstraZeneca, although data is relatively sparse, and studies are not necessarily comparable.

Previous large-scale vaccine rollouts revealed that members of the public were sKeptical of Moderna’s vaccine following reports of negative health outcomes relating to Myocarditis. Because of this, and as the need for vaccines wane, demand for Moderna’s shots may fall quicker than demand for the Pfizer vaccine. Naturally this would be detrimental for Moderna’s revenue.

Moderna may have a flu-COVID combo vaccine ready in the medium term. However, Novavax is likely to get its product to market first. Novavax’s COVID-19 vaccine formula also uses traditional vaccine technology, which may prove more popular with those not won over by the mRNA technology. This could be a big blow for Moderna and sizeable coup for Novavax.

Compared to other pharma and biotech firms, Moderna appears quite vulnerable right now. With only one commercialized product, and stiff competition over a combo shot, Moderna is a much riskier choice than established pharma firms with multiple revenue streams, or even Novavax.

Valuation

Because of the uncertain future, Moderna looks very cheap by some metrics. The biotech firm has a price-to-earnings (P/E) ratio of just 4, based on its profits over the past 12 months. It also has a price-to-sales ratio of just 2.4. Moderna’s valuation is quite unique in many respects. Growth stocks tend to be expensive as they are partially valued on future revenue potential rather than their current earnings. However, Moderna growth appears to have been short-lived, and it seems unlikely that such revenue growth can be repeated in the future.

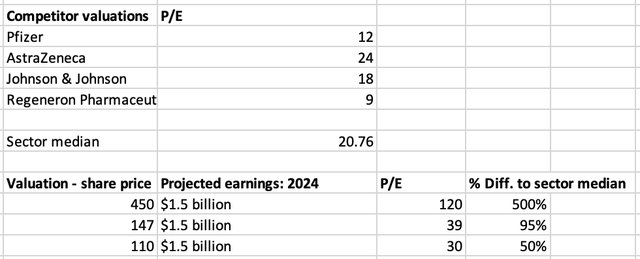

As such, we need to delve deeper to Moderna’s finances. The company has a pre-tax profit margin of 70%. That’s the type of margins you’d expect to see from luxury fashion and not medicine. Using this figure, we can assume that Moderna will generate around $14.7 billion in pre-tax profits in 2022. However, if we assume that Moderna does not successfully commercialize a new product in the next two years, revenue will fall as low as $2 billion in 2024. This means that the biotech’s pre-tax profits could fall below $1.5 billion in 2024. This infers a forwards P/E ratio for 2024 of 39, which is very expensive even though biotech firms tend to trade at a premium given their valuation reflects future earnings potential.

However, predicting the commercial viability of products in development by Moderna, long-term prospects are dependent on trial outcomes. The pandemic has generated a lot of cash for Moderna, and that will give development projects a huge boost. But as it stands, the CMV vaccine is the only non-COVID product in the pipeline to have reached phase three trials.

Taking the above into account, I believe Moderna is still overvalued. I value Moderna at $110 a share, some 25% lower than its current price. I think this takes into account its falling revenue and lack of near-term products for commercialization in its pipeline. This price would take its 2024 P/E ratio – according to my projections – down to around 30. This is still 50% above the sector median but takes into account the potential of mRNA technology and Moderna’s exceptional cash reserves built up during the pandemic. It is these two factors, Moderna’s mRNA technology and its access to cash, which makes valuing this biotech difficult. As such, one would expect it to trade at a premium to its peers, but calculating exactly how much presents difficulties.

The below highlights Moderna’s P/E ratio against projected earnings for 2024 and various share prices.

Valuation

Conclusion

Despite Moderna’s impressive revenue generation during the pandemic, it’s prospects over the next two-four years don’t look great. As a result, I believe Moderna stock is currently overvalued by around 25%.

Moreover, while we can compare Moderna to other pharma and biotech firms, from an investor’s perspective, I’d rather put my money into solid value stocks which pay a dividend, like Lloyds Bank (NYSE:LYG), than take a chance on Moderna right now.

Be the first to comment