People calculate too much and think too little. – Charlie Munger (Vice Chairman of Berkshire Hathaway)

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on September 24, 2022.

If you’ve been following my research, you’d know that I specialize in small and some mid-cap biotech (i.e., SMID) companies. I didn’t do that arbitrarily. After all, SMID tends to give you the most profits. Provided that you invest for the long term. As you know, I make exceptions on market cap from time to time. The key is whether there are substantial profits to give you multibagger returns in the long run.

That being said, Moderna (NASDAQ:NASDAQ:MRNA) is a large cap stock that I believe has growth tremendous potential. Notably, Moderna is one of the few companies with a mega-blockbuster COVID vaccine on the market. As such, it handsomely rewarded shareholders while saving countless lives. The question remains for Moderna is its long-term prospects. In this research, I’ll feature a fundamental analysis of Moderna and share with you my expectation of this intriguing stock. That is to say, I’ll present arguments as to whether Moderna is trading at a bargain (due to the bear market) or if it’s rightly discounted by the market.

Figure 1: CryoPort chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Operating out of Cambridge, Massachusetts, Moderna was founded for over a decade. Since inception, the company has rapidly advanced from a research-stage innovator to a dominant player in COVID vaccine.

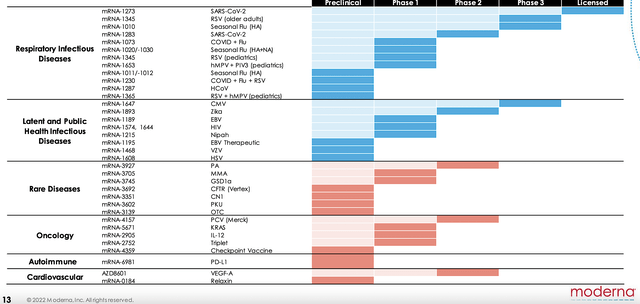

Notably, Moderna leverages the messenger RNA (i.e., mRNA) molecule to develop and advance a broad vaccine/therapeutic portfolio for many conditions. Specifically, Moderna is progressing solutions across areas, including infectious diseases, immuno-oncology, rare diseases, cardiovascular, and autoimmune conditions.

Figure 2: Developmental pipeline

Tracking Moderna Investment Thesis

Before proceeding with the analysis, you should put your stock into the appropriate investment category. That way, you can better track its performance and thereby know when to buy, sell, or hold. Sometimes, it’s best to cut your losses. Other times, it’s far better to average down.

As you can see, Moderna is a “growth biotech” that leverages the mRNA technology to make vaccines and drugs. As such, you’d want to see more product development using its mRNA platform. The more approval/sales as well as more mRNA development, the better. That means your investing thesis (i.e., story) is working out for you.

mRNA Platform

As you analyze Moderna, you should assess the heart of the company (i.e., the MRNA molecule) that is foundational to Moderna’s success. As a “molecular information” agent, mRNA is transcribed from the DNA which is the blueprint of life. Now, between DNA and mRNA, the latter is highly flexible. Hence, you can deliver it inside the cell to make both vaccines/medicine. And, that’s exactly what Moderna is doing.

From the figure below, you can see that Moderna is tinkering with different delivery modalities into various cells. Consequently, that would give the firm tremendous versatility in vaccine/therapeutic applications for a broad range of diseases. As you can appreciate, the early success with the COVID vaccine is only one of the many applications of this stellar mRNA technology.

Figure 3: mRNA molecule is the holy grail to development

Strong Business Foundations – Vaccines And Therapeutics

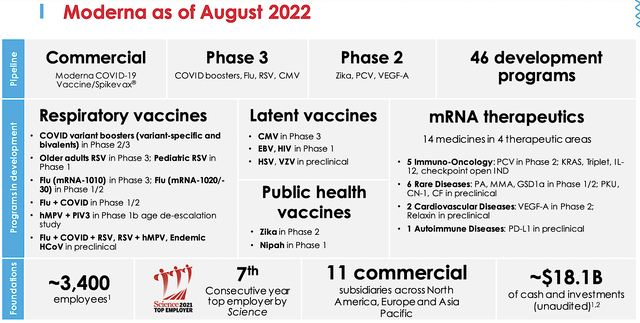

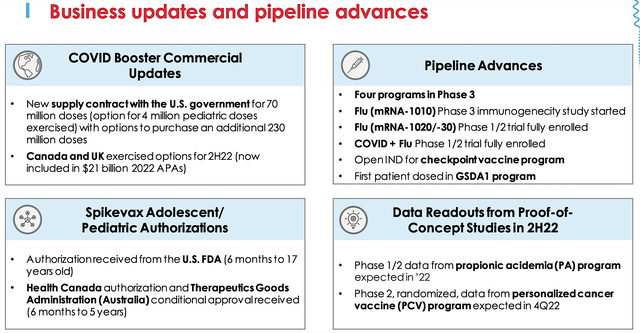

Obviously, Moderna is not another “run of the mill” operator. Already launched and heavily profited from the COVID-19 (Spikevax) vaccine, the company wrapped around its belt 11 commercial subsidiaries and 46 developmental programs. As you can see below, four assets are in the Phase 3 trials — for COVID boosters, flu, RSV, and CMV. The Phase 2 studies debut molecules for Zika, PCV, and VEGF-A developments.

Though Spikevax puts Moderna on the global map, you can see that the company is developing drugs for four lucrative niches. That is to say, Moderna has preclinical and clinical investigations for I/O, rare diseases, heart and autoimmune conditions. As such, you can expect that it’d give the company tremendous depths to boost their future top/bottom lines.

Of those conditions, I strongly believe that their rare diseases portfolio is most promising. Specifically, rare diseases are reimbursed at an average of $150K annually. That is to offset the lengthy and costly developmental process. As I see high promises in this franchise, I forecast with a 65% (i.e., more than favorable) chance that five out of six developments would generate positive future Phase 3 data. Moreover, I believe that they would ultimately gain approval to generate blockbuster sales. I based my forecasting from decades of experience, my intuition, the mRNA molecule and the disease context.

Figure 4: Phenomenal business foundations

Robust Operating Results

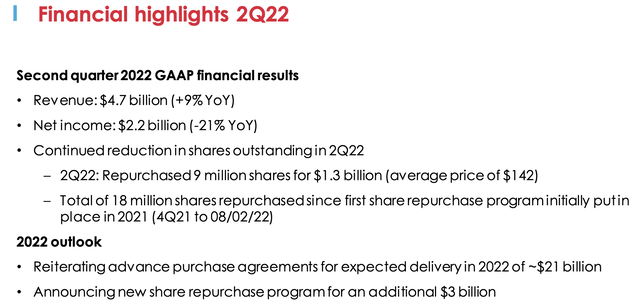

Shifting gears, let us check the latest operational results. After all, it gives clues as to what Moderna is capable of delivering in the future. Viewing the figure below, Moderna’s COVID vaccine franchise is already delivering $4.7B for only one quarter alone. That’s phenomenal operating results for a firm that is in operation only over 10 years.

Interestingly, Fiscal 2021 is expected to garner roughly $21B. Now, the robust sales figure tells you three things. First, Moderna’s Spikevax is a great vaccine that is in high demand. For a drug to register over one billion dollars in sales, the efficacy has to be there. And, it is certainly there for Spikevax. Of all COVID vaccines, Spikevax has one of the best (if not the best) efficacy and safety profile. Precisely speaking, the efficacy rate is over 94.1% for adults.

Second, the sales/marketing team is quite strong. You can also argue that the huge demand for COVID vaccines negates the needs for sales/marketing. Whatever the reasons, it is obvious that Moderna can sell their vaccine.

Third, the management is highly competent in leading their operations. Moreover, they are opportunistic to deliver a solution in special times of high demand. Now, I don’t mean that it is a bad thing. There is nothing wrong with a company banking a profit when it’s able to deliver lifesaving solutions. Noting strong progress, the CEO (Stephane Bancel) remarked,

Today’s earnings represent a strong second quarter performance, with $10.8B in revenue for 1H. We continue to have advance purchase agreements for expected delivery in 2022 of around $21B of sales … Despite the slowing economy and challenges in the biotech industry, Moderna is in a unique position: a platform to drive scale and speed in research of new medicines, a strong balance sheet with $18B of cash and an agile, mission-driven team of over 3.4K people and growing. We will continue to invest and grow as we have never been as optimistic about Moderna’s future. Right now, we have four infectious disease vaccines in Phase 3 trials, and later this year, we expect important data from proof-of-concept studies in rare diseases and immuno-oncology. Our teams are actively working to prepare these new product launches to help patients and drive growth. This is an exciting time for Moderna as we continue to see significant scientific and business momentum.

Figure 5: Stellar quarterly results

Catalysts To Fuel Further Growth

Despite tremendous results, you may question if the company can sustain such growth in the coming years. After all, no one knows for sure if COVID will remain. While there are ongoing debates, I believe that it’ll be like the flu virus that will evolve overtime to remain with us forever.

As you’d need a new flu vaccine every season, it’s likely that COVID will require a new vaccine every two years. After all, the virus causing COVID (i.e, SARS-CoV2) mutates at 1/2 the rate of the influenza virus (i.e., the virus that causes the seasonal flu). If COVID remains, you can anticipate more Spikevax orders in the coming years. Nevertheless, sales won’t be as robust as this year (which I believe is the peak).

Beyond COVID, Moderna also has vaccines for other infectious diseases. You can see that Ebola is recently on the rise in Africa. Given that Moderna can subdue COVID, there is no reason that the firm can’t deliver a treatment and/or vaccine for Ebola.

Additionally, Moderna also has a therapeutic portfolio for various conditions, especially for rare diseases, to boost long-term growth. Furthermore, the company holds so much cash that they can acquire other companies for leaping growth.

Figure 6: Catalysts to power upcoming growth

Competitor Landscape

Regarding competition, Moderna’s COVID vaccine goes toe-to-toe with Pfizer (PFE)/BioNTech as well as Johnson & Johnson (JNJ) and others. Efficacy wise, Moderna’s vaccine is just as competitive as any molecule out there. What enabled Moderna’s to trump Johnson’s is the safety.

Due to the clearcut efficacy/safety and quality of Moderna’s molecule, I believe that it has an edge over competitors. Nevertheless, there is plenty of room for multiple players to thrive in the same space.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 2Q2022 earnings report for the period that ended on June 30.

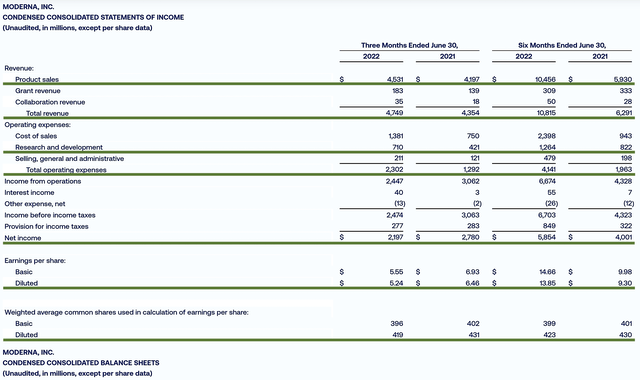

As follows, Moderna procured $4.7B in revenue compared to $4.3B for the same period a year prior. On a year-over-year (YOY) basis, the revenue grew by 9%. The significant increase is due to higher product sales of COVID vaccine.

That aside, the research & development (R&D) registered at $710M and $421M for the same comparison. I viewed the 68.6% R&D increase positively because the money invested today can turn into blockbuster results tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $2.1B (+$5.24 per share) net incomes versus $2.7B (+$6.46 per share) net gains for the respective periods. As you can see, the bottom line narrows by 18.8% which is due to the share repurchase program.

Figure 7: Key financial metrics

About the balance sheet, there were $18.1B in cash, equivalents, and investments. Given that the company already generates a net profit, there should not be any concerns about the cash runway. Simply put, the cash position is extremely robust.

Valuation Analysis

It’s important that you appraise Moderna to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

While Moderna is already a profitable operator with roughly $21B in sales for Fiscal 2022, the sales figures are still uncertain. Moreover, revenue only comes from Spikevax. Therefore, I refer to valuing it similar to a young operator.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 46% margin (I typically use a 25% but based on 2Q results, Moderna logged in a much higher margin) |

PT based on 419M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

COVID franchise with Spikevax |

Estimated $21B for Fiscal 2022 | $9.8B | $233.89 | $140.62 (30% discount because uncertainty in whether COVID will maintain) |

|

Other programs |

Without going into specific programs, they should do $10B (if they’re half as good as the COVID) | $5.0B | $119.32 | $71.59 (40% discount because of their early status in development) |

|

The Sum of The Parts |

$212.21 |

Figure 8: Valuation analysis

Shares Repurchase Program

A “quick and dirty” way to know if a stock is trading at a deep bargain is by looking at the company’s share repurchase program. Unless it’s a deep bargain, a company usually won’t buy back shares. On this front, Moderna has been extremely busy reacquiring their shares.

Back in August 2021, the Board of Directors initiated the $1B shares repurchased program. It was fully utilized at the end of January this year. In February, Moderna announced another $3B shares repurchased program, of which $2B was repurchased with $1B outstanding. Better yet, the company authorized another $3B share repurchase program in August 2022.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this stage in its growth cycle, the biggest risk for Moderna is whether the revenue would sustain.

There is a significant chance that COVID would abate and thereby negates the need for a vaccine. That aside, there is a concern that other developmental franchises might not generate positive data to bear fruits. Nevertheless, the odds are favorable for their positive developments.

Conclusion

In all, I maintain my buy recommendation on Moderna with the 4.8/5 stars rating. Moderna is a story of investment and innovation success. The company delivers the silver bullet (Spikevax) for COVID which is lifesaving for countless patients worldwide. It’s undoubtedly that this company is one of the most profitable pharmaceutical innovators in the world. The question remains if the company can continue to deliver such robust top/bottom lines. All that depends on whether COVID will remain. While there are different camps on that debate, I believe COVID is here with us forever like the seasonal flu. However, it won’t be as deadly as it once was.

Now if COVID is gone, Moderna will encounter years of revenues/earnings setbacks before its other pipeline assets start to generate sales. As such, there is definitely high risk in this investment. If the risks do not materialize, Moderna would be one of the most lucrative investments for you. Currently trading at 2.6X its cash while executing massive share buybacks, it’s a no-brainer that Moderna is trading far below its intrinsic value.

Be the first to comment